Accountability – consistency – the holy grail

Everyone is in the markets for a reason. Most long for financial independence. That in itself represents more choices, more ways to express oneself. Freedom truly, and that is a feeling. Unfortunately, you will not find that in the markets, but quite the contrary. Only discipline and a steep learning curve lead to consistency. And only consistency assures that weekly check that represents the goal of financial freedom. A difficult to acquire skill needs to be learned and it can only be improved by record keeping. So accountability is an essential ingredient. For most quite the opposite of feeling free. Accountability – consistency – the holy grail.

The market with its endless choices and easy way to participate, only a push of a button truly, can distract and lure for expressing ones desires of freedom instead. A sure route to bankruptcy. So it isn’t a special setting of a customized indicator as many hope for, that represents the holy grail. It is hard work and self reflection.

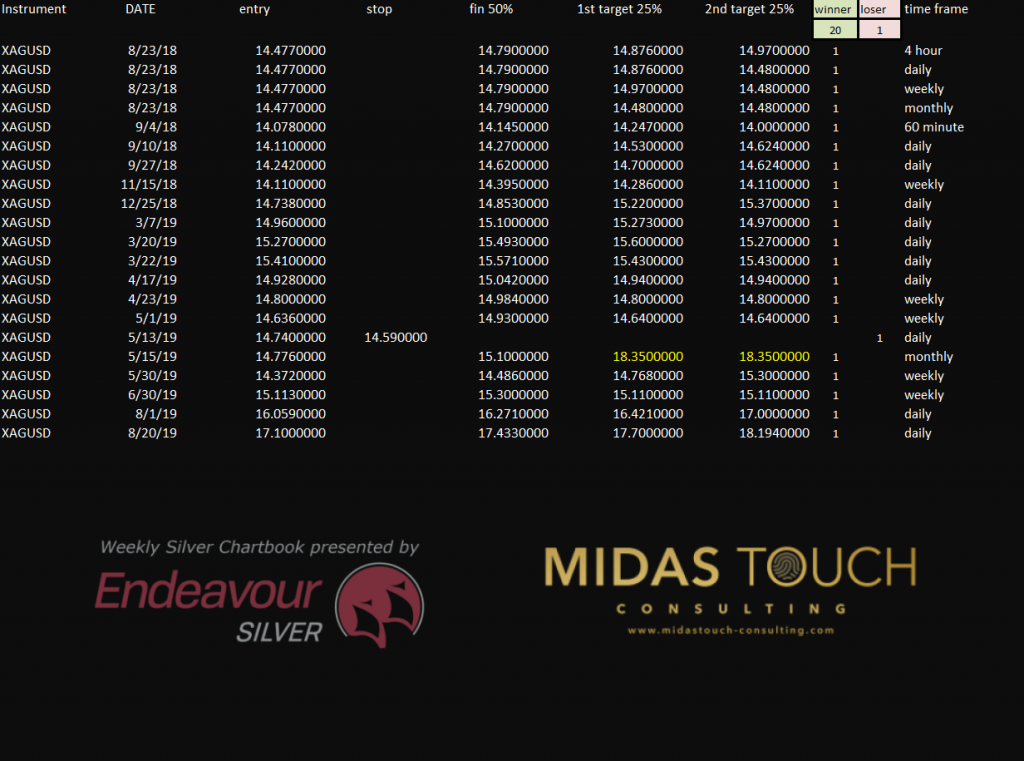

We recently posted annual results of our silver trading performance in a chartbook:

Trades in the silver market from August 2018 to August 2019:

trades in the silver market from August 2018 to August 2019

While a 95% hit rate and additional stats are impressive the sample size is small with 21 trades.

One way to be accountable is to be transparent. We post all our trades live, in real time in our telegram channel, a way helpful to any trader. This eliminates the typical moves of novices who change time frames and markets and execution platforms and any and all ways to reload a wiped out account and give oneself a “fresh start”. This behavior is typical to eliminate feelings of guilt and failure, but only pure facts point out if one improves in ones skill set. This differentiates between the gambler and the trader. Keeping a log of ones trades is by far more important than curve fitting ones trading system.

Next to psychology which accounts for 90% of the game, it is execution skills that pave the way to success. So just because a system looks good on paper in theory, does not mean riches await.

The importance is to measure how did we do, versus what did the market offer us.

BTC/USDT, weekly chart, 2018/2019, investors lost:

Bitcoin in TetherUS, weekly chart as of October 10th 2019

We opened our doors to our free telergam channel in January 2018. At that time bitcoin was trading near US$13,000. With trading levels right now near US$8,500, investors would have lost a bundle.

Accountability – consistency – the holy grail, 2018/2019, BTC/USDT, weekly chart, “accountability”:

Bitcoin in TetherUS, weekly chart as of October 10th 2019 b

Consistency means no large drawdowns and solid statistics over a long period of time and a large sample size. The chart above provides the statistics of our performance, trades posted in real time. A sample size in a range that represents consistency. Exposed in a high variety of market conditions that the bitcoin market provided over the time frame of these 2 years.

While investors experienced quite a substantial loss, the active consistent trader was able to reap substantial profits. Accountability – consistency – the holy grail.

One last word about discipline. Many admire others for this skill. Find it unattainable even for themselves. This is a myth. Discipline is nothing but a resulting focus, after one has made up ones mind.

Once a commitment has been made in ones mind. A belief established to follow through, ideally based on a burning inner desire to do so, makes these consequential steps effortless. A runner runs, a painter paints, a trader trades… You will not find complaints about long hours, muscle aches and consistent failures within those who follow their dreams. They do not struggle with daily disciplined routines that are a part of their route of improvement. They find themselves rather compelled to participate in each and every step that’s necessary to reach their set goals and desires. That being said, discipline is nothing else but simply making up ones mind.

All charts timely posted in our telegram channel.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.