Sell in May and go away

Many follow this advise and do this for a good reason. Cyclical behavior is statistically proven. It is certainly wise to be more reserved during the so called summer doldrums. But this year seems to have some evidence that early positioning might not be a mistake. We have made our point of confluence in our weekly silver chartbook two weeks ago. In market participation one of the edges to extract some profits is to go against the grain. Being a contrarian can exploit at times great opportunity. Let us point a few reasons on why we are still bullish and why this year we might just not sell in May and go away.

Monthly chart of gold/silver ratio:

Gold-Silver Ratio, monthly chart as of May 30th, 2019

The gold/silver ratio hasn’t been this high for over a quarter of a century. In the past an imbalance this severe has lead to silver move ahead of gold. Extremes in the markets have rarely sustained their position. This is an edge not to be overlooked! So holding out on gold from a risk perspective during the ‘summer doldrums’ and the Sell in May and go away sentiment might be just the course to go, but silver provides a mich better risk/reward ratio here.

Silver, weekly chart as of May 30th 2019:

Silver in US-Dollar, weekly chart as of May 30th, 2019

Trading near annual lows with good support for this longer term monthly time frame play, represents opportunity. Should this reversal candlestick pattern hold until the last candle is set in stone with the completion of this weeks market performance, a break through the yellow upper channel resistance line is pretty likely. This is even more evidence that supports the chance for a good play in silver here.

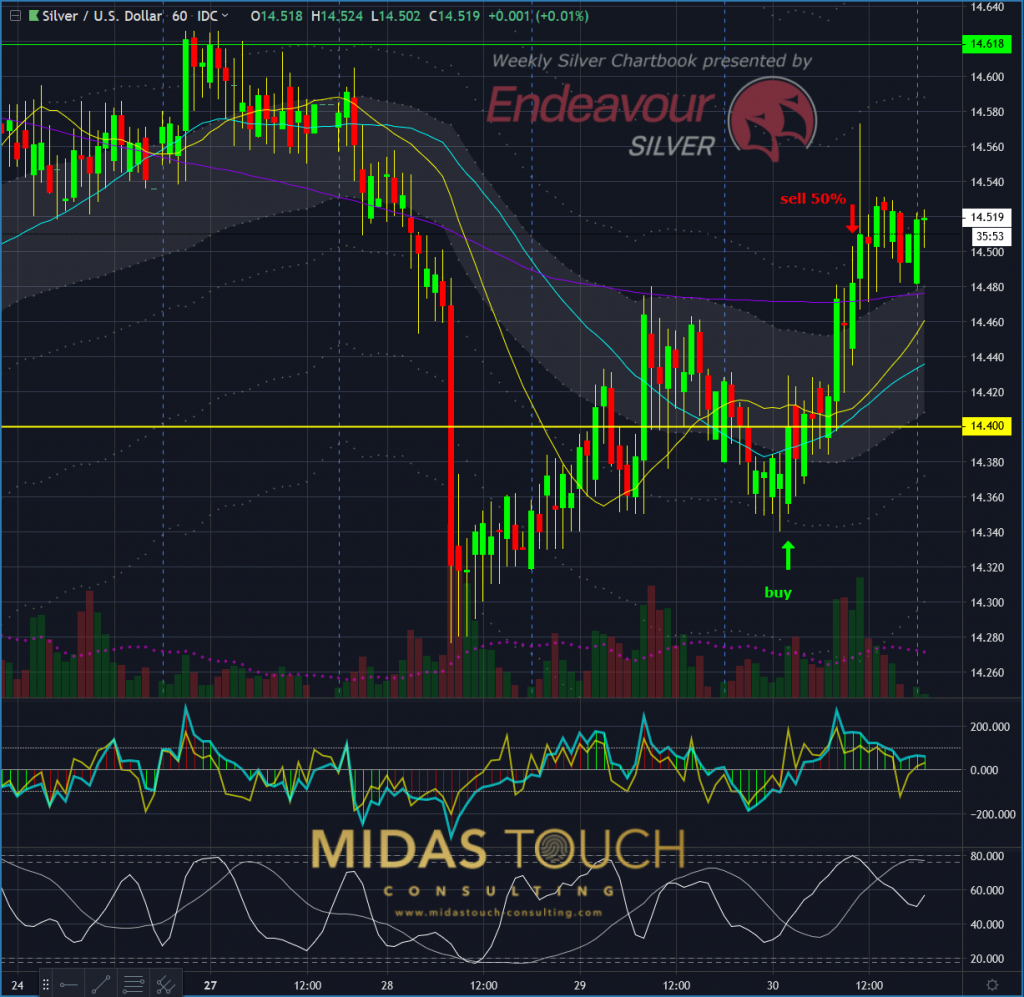

May 30th, silver reload entry on 60 minute chart:

Silver in US-Dollar, 60 minute chart as of May 30th, 2019

We added to our long term play with a live entry posted into our Telegram channel. Reloads like this are very low risk by taking early profits and trailing stops at the beginning tight. If lows aren’t retested and one doesn’t get stopped out, the remainder of the position is added to the long term play and increases profit.

When many factors align to show evidence that might disprove typical market behavior (e.g. “Sell in May and go away”), great opportunity might be in its’ birthing place.

Follow us in our telegram channel.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.