Bitcoins New Year’s resolution

It’s that time of the year when you grab a membership to the gym and promise yourself to be steadfast against temptations of the past. It is also when one lets bygones be bygones and allows oneself a fresh start. For traders, that should not mean staking another new account and forgetting about the losses and mistakes from the past. Improvement comes from learning from one’s mistakes and reviewing those. If you haven’t used a trading journal, start one. This is the time to review or create a business plan. Write down a mission statement why you are participating in the market. Do so in detail, like which beliefs guide your efforts and what goals are in sight. Bitcoins New Year’s resolution.

Goals should entail a detailed plan describing one’s edge with instructions on how to take profits and how to execute that plan. Imperative is also to define “how much?”, meaning the trading size and trading frequency.

BTC in US-Dollar, Quarterly Chart, trending up:

Bitcoin in US-Dollar, quarterly chart as of January 18th, 2022.

Where often the rubber meets the road is accountability. Yes, you technically could trade off a screen the size of your phone and do so in your underwear from home. That doesn’t mean this will lead to profits.

More likely, success will come if you tell your spouse that you will only trade for real money once a significant sample size of paper trading shows consistent returns on your well-defined statistical edge. Holding yourself accountable to a person close to you is critical. This way, you won’t slack on facing your shortcomings. There is a thin line between gambling and being a victim of nourishing scarcity emotions and having a well-defined trading system executed with discipline to extract profits from the markets over larger sample sizes consistently.

The quarterly chart above shows how bitcoin has been trending up over the last five years. As much as last year’s final quarter was profit-taking after all-time new highs, the price seems to stabilize near the regression channel midline (blue line), which typically acts as support. We find these accentuated retracements typical for bitcoin and are looking for a possible turning point towards a new leg up in the larger time frames.

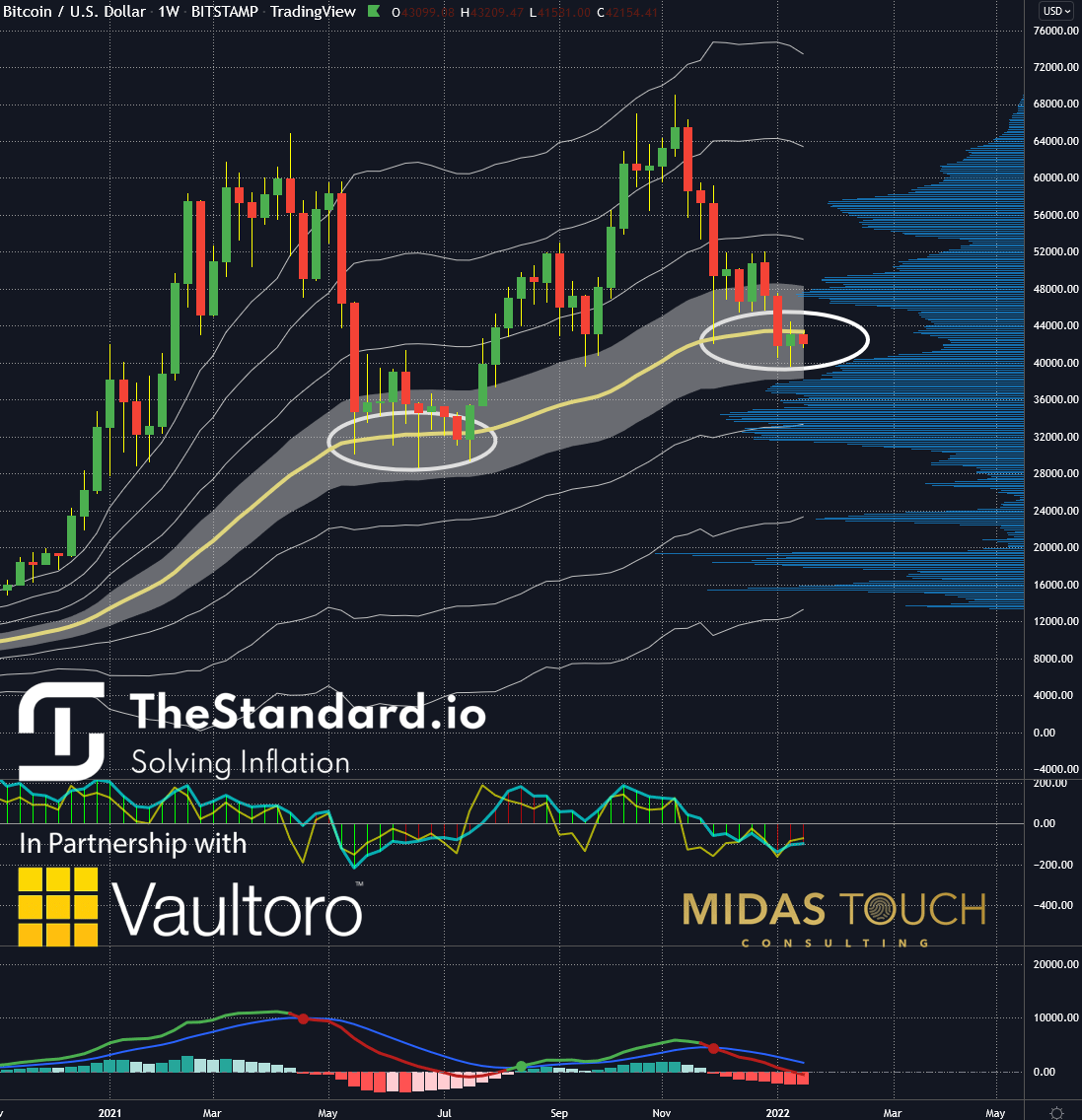

BTC in US-Dollar, Weekly Chart, Bitcoins New Year’s resolution:

Bitcoin in US-Dollar, weekly chart as of January 18th, 2022.

Patience should be a key element in any such system. Patience to wait for the good trades that have the potential to provide upside moves three to five times greater than the necessary risk taken to try out the trade. What also needs to be thoroughly checked is not to be underfunded and that there is no pressure to make a living off trading right away. If these rules are undervalued, ruin is typical, since trading psychology has particular requirements to execute a profitable methodology appropriately. Therefore, this includes that the money at stake lost cannot influence a drastic change in living.

When undertaking a venture like this, it is advisable to not increase pressure by spreading the word to friends and colleagues since typical learning curve time frames are somewhere between 3 to 7 years, and the additional stress to defend ones venture is not helpful. This behavior also supports the necessary feature later as a trader to be highly flexible in changing one’s mind about the market’s price direction. Something outsiders might find foolish.

We are live https://t.co/e9riY1L2wE

— The Standard (@thestandard_io) January 14, 2022

Now zooming into a lower time frame, the weekly chart shows a similar picture of opportunity. Prices are trading at the mean. A mathematical “neutral zone.” As the white ellipse in the past shows, for bitcoin, this is a support zone of prices where bitcoin turned after a temporary sideways trading period. Similar trading behavior is unfolding right now, supporting our bullish tone.

BTC in US-Dollar, Daily Chart, possible entry zone:

Bitcoin in US-Dollar, daily chart as of January 18th, 2022.

If you are already a consistently winning trader, setting the tally to zero at the beginning of the year like this can be very helpful. You start fresh. Consequently, you trade a bit smaller and are very focused and diligent in building a new winnings nest egg that provides for free market play at the beginning of the year. Starting the beginning of the new year supports confidence that no matter what might be faced, if somewhere an exchange is open, you can make a living even after hardships and, as such, refreshes the confidence needed for proper execution throughout the year. Not resting on one’s laurels this way keeps trading exciting and the moral up to par towards the required skill set.

The above daily chart tries to identify low-risk entry zones with our typical top-down approach, now zooming even closer. We aim further to stack the odds for a possible low-risk entry spot.

After four swing legs down, prices are trading in a congestion zone (green square). We find this an area worthwhile to be on the lookout for a possible low-risk entry. This daily time frame entry could mature to a higher time frame turning point. Our quad exit strategy can capture profits for a more significant developing trend.

We uploaded the recording of our Community Update & AMA with Joshua and Laurin from the 14th January!

Let us know your feedback! #TST #thestandard https://t.co/sm8kX3HlUL

— The Standard (@thestandard_io) January 17, 2022

Bitcoins New Year’s resolution:

Trading needs to be treated like a business. A high percentage of businesses fail due to a lack of a business plan. In trading, a clear set of rules is even more critical due to the counterintuitive nature of the markets. In short, one can’t shoot from the hip in this profession. You get nowhere with your gut feeling.

The biggest obstacle in trading is that traders underestimate how long it takes before success settles in. Consequently, backup plans are an excellent way to extend one’s learning curve. We also find a great way to overcome obstacles and accept when things go wrong consistently that a new rule is possibly missing.

The business of trading has many components, and as such, it is helpful to seek the outside counsel of a professional when needed. You find good support through the learning process in our free telegram channel within a community of professionals and newbies alike who provide answers to your questions.

In memory of a great economist and thinker.#Rothbard pic.twitter.com/5xoVWrJpOH

— The Standard (@thestandard_io) January 7, 2022

Feel free to join us in our free Telegram channel for daily real time data and a great community. If you like to get regular updates on precious metals and cryptocurrencies, you can also subscribe to our free newsletter.