Bitcoin profits through quad exit strategy.

Within last weeks’ news rich environment, from a possible short squeeze in Silver to the Fed meeting, Bitcoin experienced much volatility. Thankfully, we were able to extract substantial profits. Let us share one of our core principle tools that allowed us to do so. Our Quad Exit Strategy. This useful tool is not just helpful in volatile sideways ranges like we experienced so far in 2021 but will come in handy especially when the trend reestablished itself soon again. Bitcoin profits through Quad exit strategy.

We use quad exits to honor the principle of “Choices.” Our approach is an “all in” system with a high expectancy of immediate profits based on the action-reaction principle. We are contrarians and are fading moves. As such, we exit half of the position shortly after entry for small gains to mitigate risk. Then we take another 25% off the position on our first target and another 25% on our 2nd final target.

Here are the significant advantages of the Quad Exit Strategy: It is typically getting more and more stressful for the mind through increased fear that gained profits might disappear. The quad exit supplements by making you emotionally an instant winner on your first exit.

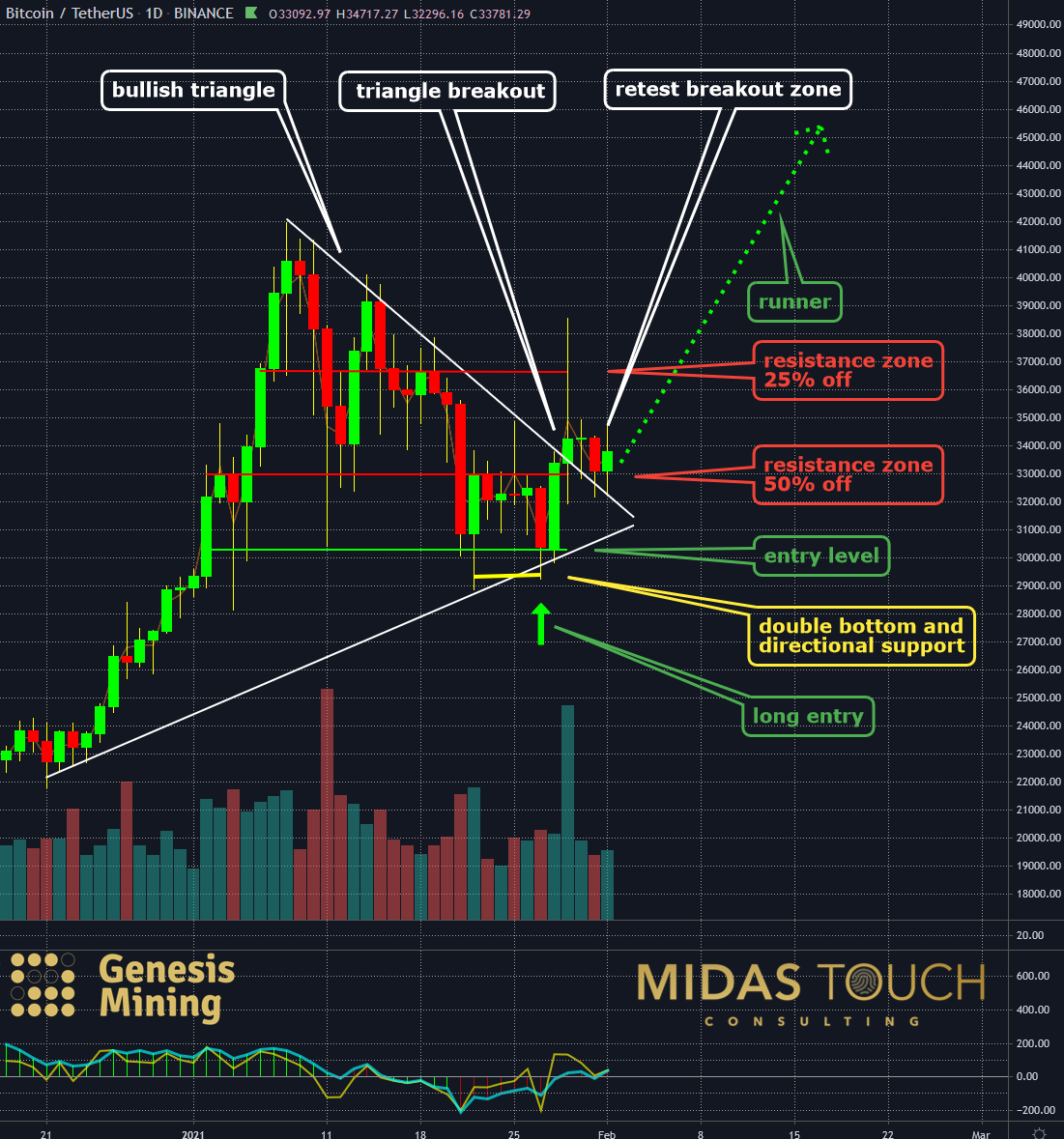

BTC-USDT, Daily Chart, Risk taken out before the breakout:

BTC-USDT, daily chart as of February 1st, 2021

The principle is that the more extended a move, the more extensive the possible snap back to the mean. Fear of missing out on profits tends for amateur traders to either make a tight stop, which takes them out or worse, they use a stop somewhat in the middle, taking quite big profits away and still getting stopped out. Principle-based though is to have either an extensive stop or take a profit target. However, both are very hard to do due to our human psychology. With the Quad Exit Strategy, you erase these hardships. You exit with half to mitigate risk and create a psychological balance following the instinct to cash in. Now you have two segments of each 25% of the total position size still left to be very flexible in maneuvering.

The daily chart above shows the various points of interest within a trade sequence.

BTC-USDT, Weekly Chart, Volume analysis supportive of runner success:

BTC-USDT, weekly chart as of February 1st, 2021

In our personal experience, after the second exit with yet another profit booked, one is very much at ease to let the runner (= the last 25% of the position size) do what it needs to do: RUN!

With price sitting right on a high volume analysis support node as seen on the weekly chart above, it’s survival has a good chance. Even if the trend continuation should fail it will get stopped out at break even entry levels and we still took profits on 75% of our original position size.

BTC-USDT, Weekly Chart, Bitcoin profits through Quad exit strategy:

BTC-USDT, weekly chart as of February 1st, 2021 b

The large time frame chart shows supportive of the trend. With a healthy Fibonacci retracement of .618%, the odds for trend continuation are in favor.

Of course, no one knows when a trend is over, but you don’t have to worry using the Quad Exit Strategy.

Bitcoin profits through Quad Exit Strategy:

Typically, one is glued to the screen when prices go into one’s favor with a biased emotional emphasis on up and downticks. With the Quad Exit Strategy however, you have an emotionally balanced mindset since 75% of the positions are successfully cashed in already. Now you can apply reliable technical analysis for the runner part. That means evaluating how much risk you are willing to take for this position part versus how likely the projections are for it to go further. You can do this unbiased and with a fresh mind. It also allows for wide and accurate stop placement and makes you see the market for what it truly is.

We post real time entries and exits for many cryptocurrencies in our free Telegram channel.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.