Reading mass psychology

We posted in our telegram channel on August 20th 2019 a long entry for silver. One of our astute long term followers asked consequently a wise question.”Why do you consider this entry to be low risk?” We responded in depth but found it worth while to revisit this particular scenario one more time. Especially as this illustrates a principle that can be beneficial to all traders and investors alike. Reading mass psychology.

The following is neither the classical interpretation of sentiment nor the one for candle stick formations. It is a view to guesstimate a possible mass psychology at a specific point in time. The first step is to ask oneself, while not being committed to the market yet, the question.

“How does it feel if I would have a long position here?”

Consequently one also needs to play devils advocate right after answering this question for oneself, by asking:”How does it feel if I would have a short position here?”

In answering these questions the dominant tool of evaluation should be “assumed crowd sentiment”. Here our long entry in silver as an example for what we mean:

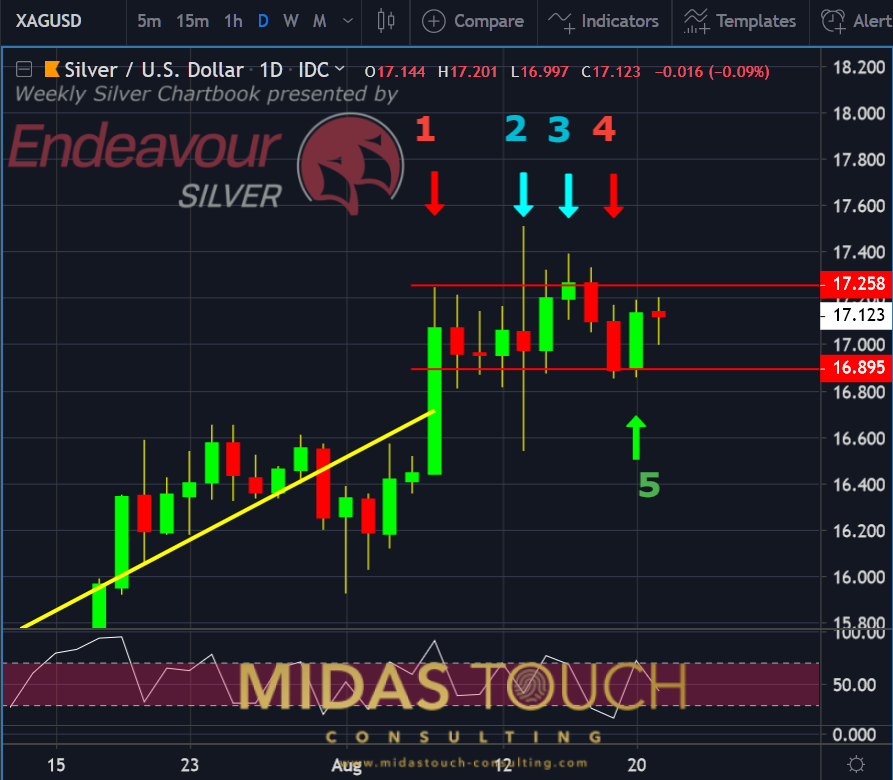

Daily chart Silver/US Dollar 8/20/2019, confirmed entry long:

Silver in US-Dollar, daily chart as of Aug 20th, 2019

The daily chart above shows the day of entry with a green arrow. Entry price was US$17.10 . The previous days open was US$17.099. Now let us answer the question: “How does it feel if we would have a long position here?”

Looking a bit in the past we know that silver markets advanced strongly and we aggressively exited a daily long position at resistance on August 7th 2019 (see our chart book from August 10th 2019):

Reading mass psychology, daily chart, silver in US Dollar – August 7th 2019, target exit:

Silver in US-Dollar, daily chart as of Aug 7th, 2019

The idea here is not to sit through the anticipated sideways phase, especially when there is no clarity if after the temporary break of price direction prices will either climb or fall. Capital exposure in uncertainty phases presents always extra risk.

Now let’s pretend we are still long and evaluate sentiment from this standpoint.

Silver in US Dollar – August 21st 2019, daily chart, “pretending we are long”:

Silver in US-Dollar, daily chart as of Aug 21st, 2019

- starting at point 1: happy to have taken profits at highs of a move, if we still would be holding the next few tight range sideways days, it would create a feeling of uncertainty

- at point 2: hopeful while prices break the range upwards and disappointed when a strong reaction pushes prices much lower – possibly stopped out if a stop would be set tight

- than at point 3: second breakout attempt of range rejected and confirmed in follow through days by further declining prices

- at point 4: fearful that a range break is to be followed with the bears in control at low end of range

- finally at point 5: conviction for possible range break in the future to the upside and as a result commitment to long entry on small size – but why?

Reading mass psychology

In eight trading days prices have traded sideways with no significant retracement. This is a bullish sign. As much as the bears have temporarily stopped further prices advances, they have not managed to break the lower range supply and demand zone. Quite the contrary, if you think of it, at the time we entered at US$17.10 with the prior days open being US$17.099, each market participant that has entered the market in a short position on the 19th of August 2019 at the open or below, is now in a loosing position or already stopped out at a loss.

This is an aggressive entry since the stop is fairly large. Position size should be accordingly. This is also not a spot to initiate a position but only for reload purposes with a larger time frame position already in the green.

This is an ideal spot to commit more money to the market if one would like to aggressively expand ones longer term position.

Professional large size players not uncommonly play a similar game by exposing small test trades to the market before they commit size. They want to feel the market. They watch how orders get absorbed and literally feel how money exposure to the market makes them react emotionally. Once they get their emotional confirmation they commit larger size.

We encourage the reader to ask themselves the question in this example from point 1 to 5 “how it would feel to be short”…

Follow us in our telegram channel.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.