Three ways to buy bitcoin

Bitcoin is a store of value. Holding it long-term in one’s portfolio is an intelligent investment. And yet, many shy away from this particular emerging asset class due to its specific trading behavior. High volatility, especially in the midterm trading arena and a consistent flow of dramatic news releases of all sorts, makes specifically conservative investors still hesitant to get their feet wet. Let us share three ways to buy bitcoin, to hopefully offer any market player a way to participate with low risk in this asset class, should they desire to do so.

With more than a trillion-dollar market cap, bitcoin is now in an echelon where regulation would be fearful to intervene harshly, since a bitcoin crash would affect other markets. In a way, the last pillar is cemented for there to be little risk to think of a world without bitcoin.

That being said, even if only minor, some bitcoin exposure is now widely accepted as a wise decision of portfolio management.

We share three ways of purchase that we find conservative. We aim to demystify the saga of bitcoins acquisition risk due to its volatility.

BTC in US-Dollar, Quarterly Chart, zooming out, away from the noise:

Bitcoin in US-Dollar, quarterly chart as of December 14th, 2021.

Risk is related to size. Suppose you buy a small enough amount alongside your overall market exposure, small enough that you can afford assets even to go to zero, then the risk is minimized. Would it be nice to have picked up a few thousand bitcoin when it was available at five dollars or a few hundred at fifty, certainly! Nevertheless, thinking long term and with volatility now being much less, the more bitcoin had settled in and is more widely accepted, even buying here now at US$47,000 is just fine. What we find less attractive is not owning any. And after that initial purchase, to add at price dips in bitcoin to grow a position size over time would be a possible extension of such a strategy.

The quarterly chart above shows how bitcoin has always reached new all-time highs again, and there is no fundamental or technical evidence that this behavior should change.

BTC in US-Dollar, Weekly Chart, buy low and hold:

Bitcoin in US-Dollar, weekly chart as of December 14th, 2021.

Another way to participate in the bitcoin market if you already have some exposure is buying in tiny increments when markets seem low. This means buying after one of bitcoin’s steep declines, and add this way to your long-term exposure.

The weekly chart above shows with a green box an approximated entry zone. We used ABC pattern recognition, volume profile, Fibonacci retracements, action-reaction models, and inter-market relationships along with other tools to zoom into such a low-risk and high success probability zone.

Once such a zone is established, we go a time frame lower. In this case, the daily time frame, to fine-tune entries. Therefore, it increases probabilities and reduce entry risk even further.

#WallStreetNinja is proud to announce the successful deployment of our groundbreaking Alpha release.

https://t.co/vpFVg3Z7PbPowered by @DeployOnStackOS @dfinity @BinanceChain

Read our medium article 📖 https://t.co/pOrszjh0FZ

#DeFi #alpha #Unstoppable #BinanceSmartChain— WallStreetNinja (@thewallstninja) December 2, 2021

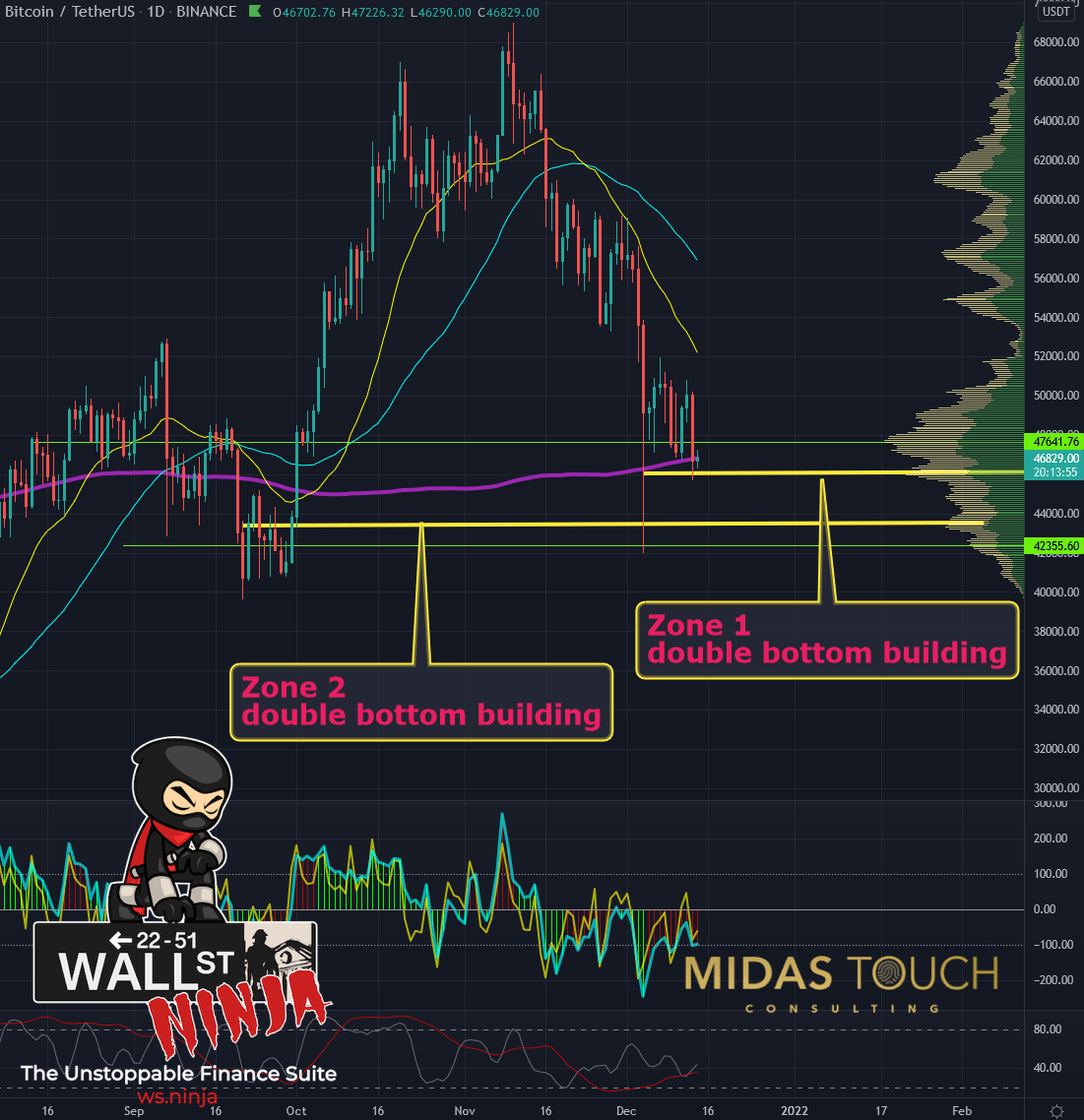

BTC in US-Dollar, Daily Chart, low-risk entries with quad exit:

Bitcoin in US-Dollar, daily chart as of December 14th, 2021.

Our third option presented is a more active way in market participation. It is refined in its form to suit more experienced traders to soothe trading psychology. In addition, it keeps entry risk to a minimum and maximizes profits.

We openly share the underlying principles in our free Telegram channel. Alongside, we post real-time entries and exits for educational purposes.

This approach has a sophisticated exit strategy (quad exits). It allows for partial profit-taking and expansive position size building over time to maximize one’s bitcoin exposure without added risks.

The daily chart above focuses on two supply zones (yellow horizontal lines).

The zones got identified by volume profile analysis (green histogram to the right side of the chart).

We want the price to build a double bottom price pattern at one of these levels to enter a long position.

We have already retraced from recent all-time highs in a typical percentage fashion for bitcoins trading behavior. Consequently, a turning point here is highly likely.

Why join the #WallStreetNinja ecosystem?🥷

Here are some reasons 🔥

Provide decentralized product users Unstoppable access via the WallStreetNinja Ecosystem.$WSN #DeFi #Web3 #gaming #NFT #WSNecosystem pic.twitter.com/lEvhqKzOLR

— WallStreetNinja (@thewallstninja) December 13, 2021

Three ways to buy bitcoin:

Overwhelm often stems from a lack of choices. After reading this chart book, we hope that those readers who feel intimidated experience a sigh of relief. Like gold, bitcoin is a store of value. We find a good likelihood that bitcoin might surpass the ten trillion gold market cap. Consequently, your investment right now has a fair chance to grow by a factor of ten or more.

After acquiring bitcoin, you can store your purchase in a small cold wallet, the size of a USB stick. Tuck it away, just like you do your precious metal coins. Buying now for the long term is still stepping in front of most market players which have succumbed to their doubts and procrastination. Consequently, it allows for this investment to be early, anticipating a likely change of the future regarding payment methods and store of value vehicles. Therefore, an asset with significant growth potential (=attractive risk/reward-ratio).

Feel free to join us in our free Telegram channel for daily real time data and a great community. If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. The views, thoughts and opinions expressed here are the author’s alone. They do not necessarily reflect or represent the views and opinions of Midas Touch Consulting.