Bitcoin and the beauty principle

One of Bitcoin’s fundamental values is its simplicity of both, idea and code; it reflects beauty. Nature shows us daily how such reductions tend to have longevity and attract observers. At Midas Touch Consulting, we developed a technical analysis tool that we named “The Beauty Principle”. It follows the same line of nature’s inspiration and aims to look at the market from a beauty perspective. For attractive returns, high hit rates, and most of all, low-risk money exposure, it is necessary to have expansive knowledge about the markets from the aspects of psychology, trade execution, fundamental and technical market analysis, and money management. Moreover, to sustain the up and downs of consistent market exposure, it is essential to create new edges. You need to extract new principles, and look at the market from an angle others haven’t. Bitcoin and the beauty principle.

Expansions of the “golden mean” in the form of the Fibonacci ratio have found their stronghold in technical analysis as a long used edge for predicting retracement levels and future distribution zones as exit targets. We have extracted edges in the often underestimated trading aspect, time.

If you want to learn more about “The Beauty Principle”, we recommend to take a look at some our past chart-books:

BTC-USD, Daily Chart, Time as support:

Bitcoin in US-Dollar, daily chart as of August 25th, 2021.

We posted the above chart on August 25th in our weekly chart book publication at that time. If you compare to the recent chart below, you will find a progression of price stunningly adhering to the predictive value of the white time arcs.

BTC-USD, Daily Chart, Stacking edges for low-risk entries:

Bitcoin in US-Dollar, daily chart as of September 14th, 2021.

You can make out that price made a double bottom (yellow horizontal line) precisely at the time when arc two was reached from a time perspective. The time element served as an extra edge for low-risk entry points. Price adhered to the rising arc and again found support when arc three was reached. Using lesser known edges like these helps for low-risk entry timing.

BTC-USD, Daily Chart, Time and price:

Bitcoin in US-Dollar, daily chart as of September 14th, 2021.

Another edge tailored to bitcoin is a combination of both, price and time. You will find in the chart above that bitcoin, when trading near the statistical mean (red line), has substantial advances after building a double bottom. This fact is advantageous, since many mathematical edges cease when the price is near the mean. If prices originated from a previous up-leg, we find these times to be sensible looking for additional edges to low-risk entry points.

BTC-USD, Daily Chart, early warning signals:

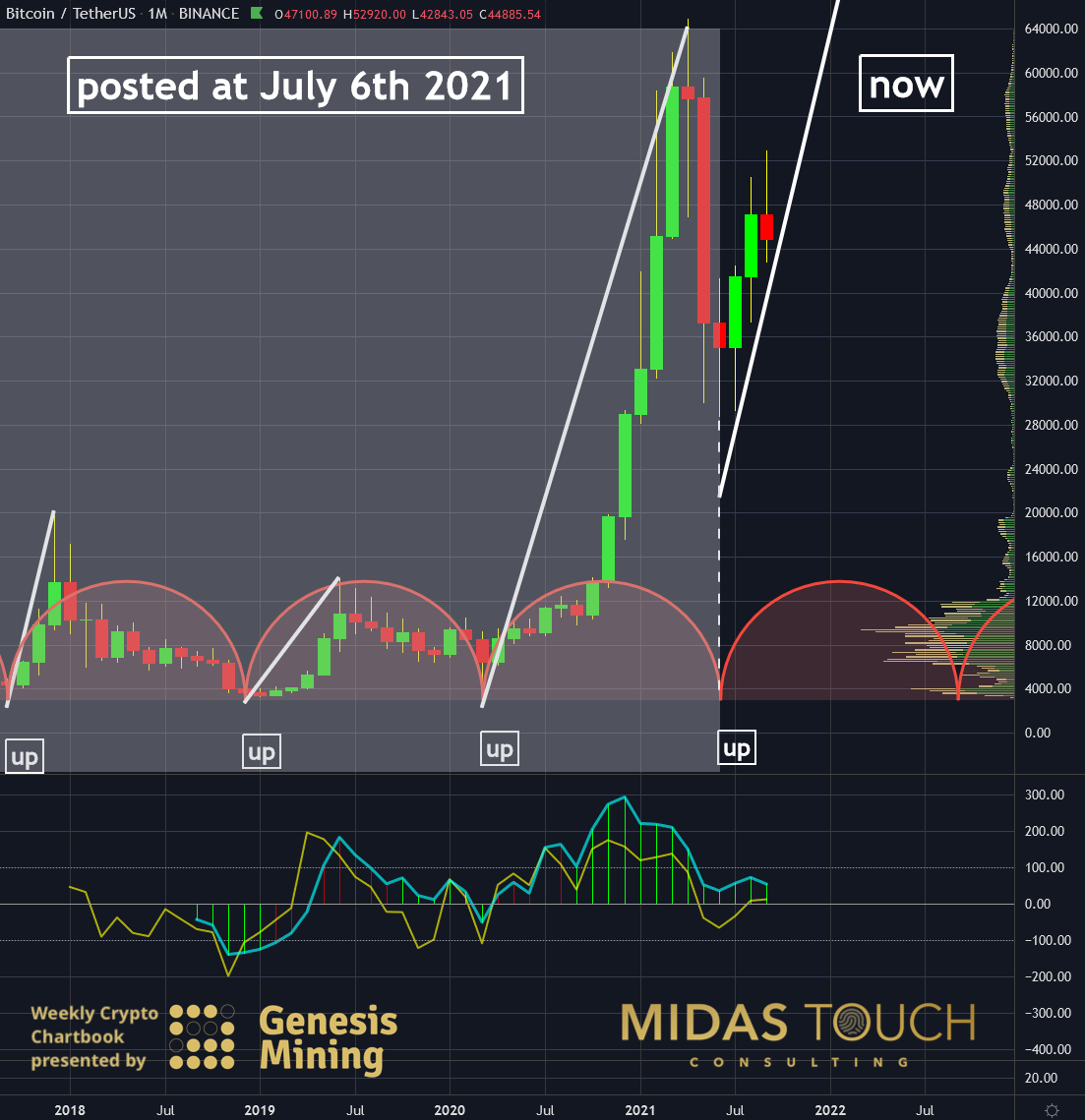

Bitcoin in US-Dollar, monthly chart as of September 14th, 2021.

On July sixth, we posted another chart that involved time analysis under our beauty principle edge structure, and projections came true. If you followed us at the time with the entries we posted live in our free Telegram channel, you were able to nearly double your money. Now we have taken substantial profits off the table. Should the monthly candle to the very right, representing September, close as a bearish red candle, a second down leg could be in store for bitcoin.

From a fundamental beauty perspective, bitcoin has found itself transcended from a practical philosophical idea and inspired bodies collecting it at the time. Now it is already a store of value of over a trillion-dollar value. While not yet a unit of account, we see more and more significant cases where bitcoin is used as a medium of exchange. There is still a lack of understanding of bitcoin and its beauty at present. But nature shows that beauty typically persists, and mass adoption is undoubtedly a highly likely possibility.

Bitcoin and the beauty principle:

Due to the high degree of variables in the market present, it provides a vast field of possibilities of interpretation. Consequently, it allows generous room for new edges to be extracted. Critics of technical analysis often claim that technical analysis is nothing but a self-fulfilling prophecy, which is only partially true. By definition of a principle being a fundamental truth or proposition that serves as the foundation for a system of belief or behavior or a chain of reasoning, it is an ultimate truth with inherent high value. We find the laborious effort to search for new ways to define market behavior as essential. After all, a significant edge is only the one known by a few.

Feel free to join us in our free Telegram channel for daily real time data and a great community. If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. The views, thoughts and opinions expressed here are the author’s alone. They do not necessarily reflect or represent the views and opinions of Midas Touch Consulting.