Bitcoin, be done with it

First, overwhelm originated from the rapid speed of technology, where one spent more time reading the manuals for the new gadgets versus using them. Then came endless lists for your passwords due to a security crisis. Now it is serious, though. After the housing crisis in 2008, working three jobs parallel and in Covid, the nerves are blank. Everybody wants to be done with endless lies from news, constant price increases, and on and on it goes. We see a desire for simplicity in a complex world in difficult times, but we fear that many lose their wealth trying to simplify in the wrong field. You can’t use a shortcut with money right now. Unfortunately, you can’t build a portfolio and “set it and forget it” for your wealth preservation. Ignoring bitcoin, to be done with it, would be a significant mistake.

What are your options for simplification? For one, follow the money trail. Everybody is telling you another story of the next best thing or tries to drag an investment idea down with criticism. Everybody tries to sell you something. What is going on behind the scenes? Few know, but everywhere where you can follow the money trail, you have the edge to gain some insight. Bitcoin provides just such a backdoor. It is transparent.

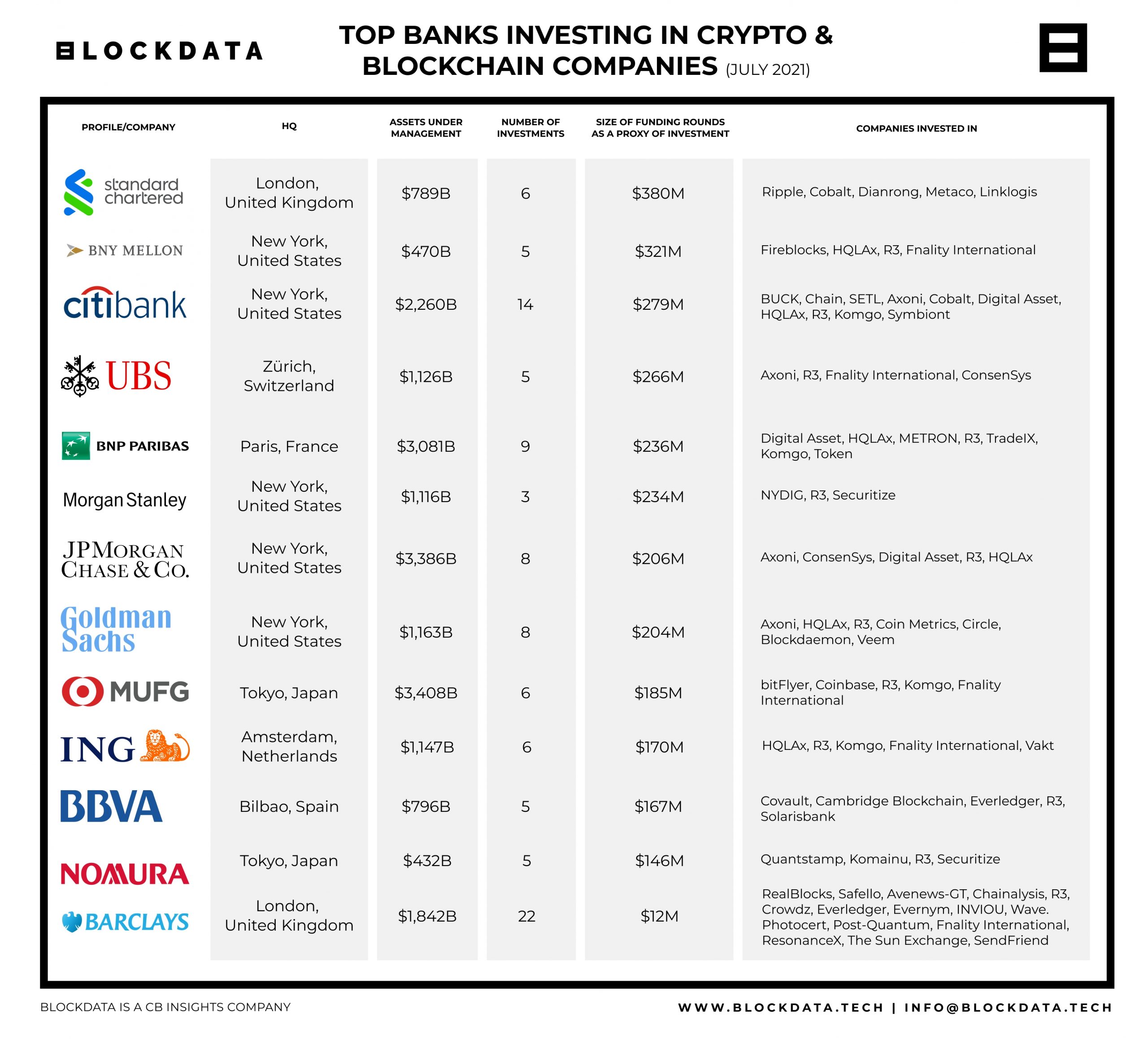

In the news, you hear nothing but banks despising bitcoin. The reality is that over half of the top one hundred banks are investing in crypto. And not just that. A quarter of those hundred banks are building custody solutions as well.

It is all about profits, and banks have learned that they can’t afford to miss out on substantial income streams.

Banks are invested in crypto:

Top banks investing in crypto and blockchain companies as of July 2021. Blockdata

This chart gives an overview that there are certainly intertwinings between banks and crypto/blockchain companies.

Look for data like this. Stay away from the hype and the “loud” news. Collect meaningful data that shows where money is flowing. Soon governments will forcefully deny their bitcoin participation, yet they also learned that they couldn’t avoid staying on the sidelines since they also want to collect.

BTC-USD, Daily Chart, Strong bounce from 30k support:

Bitcoin in US-Dollar, daily chart as of August 25th, 2021.

Looking at bitcoins’ recent up-move (one of many) indicates that it is unlikely that all the money flowing into bitcoin is merely amateur speculation.

Bitcoin is established now. It is here to stay. There are a few unanswered questions, and there is much speculation. We see that as an opportunity, not a risk. Risk in trading always needs to be managed, there are no sure bets, but this is about as good as it gets.

We find evidence, as shown in the daily chart above, that there is a higher probability than not that bitcoin will revisit and expand on its all-time highs within the next months.

BTC-USD, Weekly Chart, Clean trading:

Bitcoin in US-Dollar, weekly chart as of August 25th, 2021.

Charts do not only tell statistical evidence or technical analysis patterns. To a professional, they reveal much more. They show the character of an investment tool. One can see a lack of liquidity without a volume indicator. An overall picture gives insights if something is off or choppy or otherwise alarming.

The weekly chart of bitcoin above could just as well be a Dow component or a top ten chart in the Nasdaq. Trading is clean and orderly. Professionals entered this trading arena a while ago, and when watching the tape, large block trading is common now. The hype and overbearing news are more fabricated than real. Bitcoin has been demystified, but is dealt with in public as an outcast to keep prices low and let professionals take huge bites at modest prices.

BTC-USD, Monthly Chart, Up and up and up:

Bitcoin in US-Dollar, monthly chart as of August 25th, 2021.

When Bitcoin reached nearly US$20,000 in 2017, the newspapers could hardly believe it, and doubters were relieved when prices declined to almost US$3,000 a year later. Now three years later, looking again at the monthly chart from a perspective of harmony, we can find no fault that would let us believe that bitcoin might not find its way into the six figures in another three years.

News is loud when El Salvador adopts Bitcoin into its core financial operation. And relatively quiet when the EU aims to implement an asset register, a precursor to possibly controlling personal gold ownership. One needs to filter data instead of relying upon the headlines of prominent newspapers. Filtering is also necessary due to the sheer amount of negativity one exposes oneself if trying to take it all in, a sure way of wanting to be done with it and procrastinating.

Bitcoin, be done with it:

We understand the desire for clarity and simplicity, the desire for a Covid free world, and time to be with the family and travel the world. Unfortunately, it is the desires that get us in trouble when it comes to money management. Typically, that means when playing the stock market intuitively; you lose some bets. This time, you’re not just risking the next bet; you can lose it all. It sounds dramatic, but it is the truth. We live from the perspective of money in a significant time period where procrastination could cost you your nest egg. Be done with everything else, but focus now on how You can create a process that makes a monthly (weekly) review mandatory to ensure your family’s financial future.

Feel free to join us in our free Telegram channel for daily real time data and a great community.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.