Market Summary

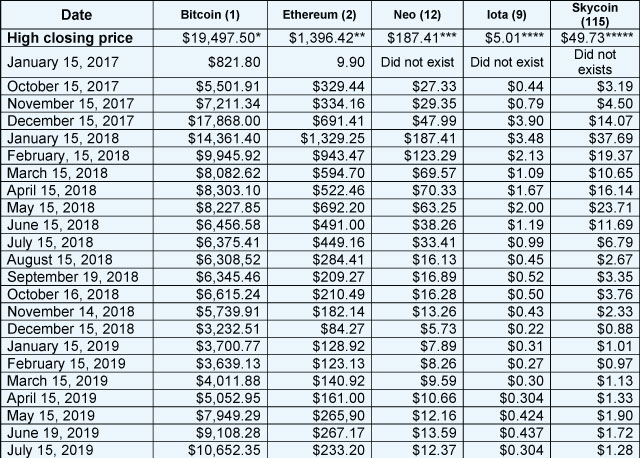

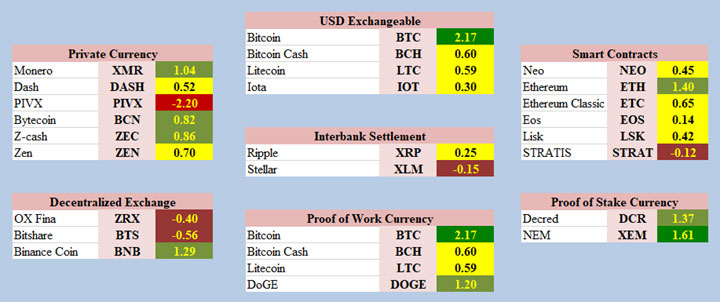

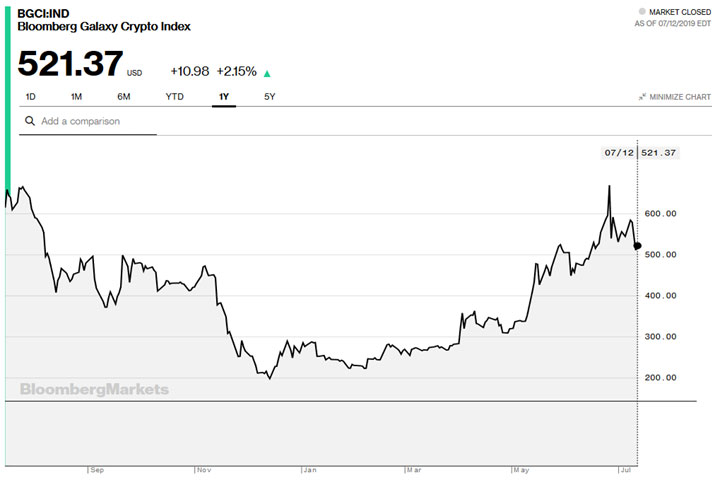

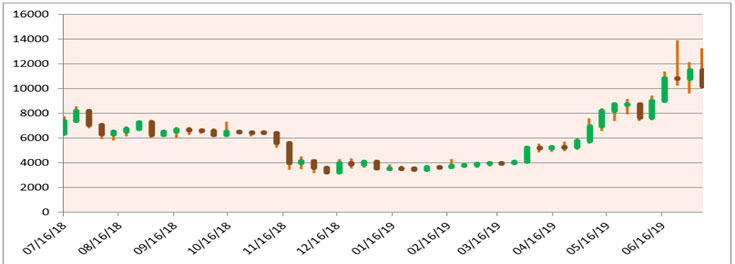

Cryptoassets started the year with three flat months followed by a strong uptrend for the last three months. Most major cryptoassets are up over 100% since mid-December. The obvious bull trend since the first of the year is easy to see just looking at Bloomberg’s Galaxy Crypto Index chart below.

Bloomberg’s Galaxy Crypto Index as of July 12th 2019

Bloomberg’s Index tracks ten major cryptoassets and Bloomberg started the index in May, 2018 at 1000. Thus, the index has been active for about a year and is now just under 50% of its starting level.

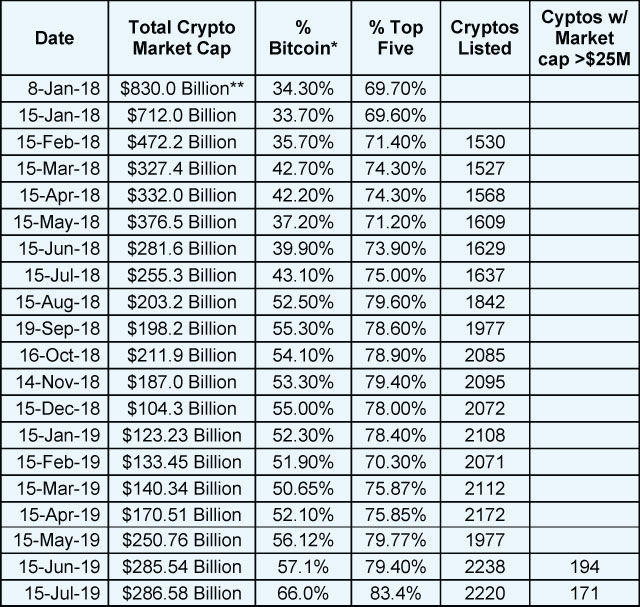

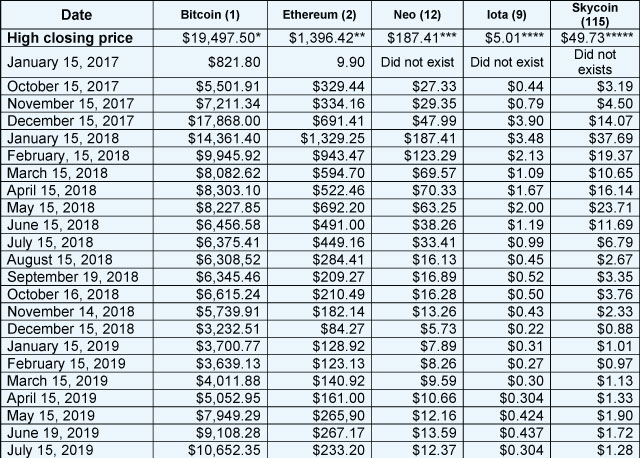

The table below tracks the price of five major cryptoassets across three generations of the technology:

Just because BTC is a 1st generation crypto does not mean it is likely to die off and be survived by the later generation cryptos. It’s hard (impossible?) to predict which cryptoassets will thrive or even survive as we move forward as there are so many variables in play. Technology, use case, adoption, support, and multiple other factors come into play. For now, we monitor these five cryptos because they represent several relevant aspects: public ledger – BTC, smart contracts – ETH+NEO, scalable contracts at minimal cost – IOTA+SKY.

The All-Time High Closes, July 15th Cryptoassets Update

Date of the All-Time High Closes

*Dec 16, 2017 ** Jan 13, 2018 ***Jan 15, 2018 **** Dec 8, 2017 ***** Dec 29, 2017

All five of these cryptos are up significantly from mid-December. Most have at least doubled, but IOTA and SKY are down since April.

I’m now running a regular Market SQN score (100 day period) on BTC just to keep track and here is what that study shows. First, BTC has been rated strong bull since April 30th 2019. That’s about 75 day ago. The current score is 1.85 but it did go as high as 3.17 on June 25th when BTC was $12,355.06. In addition, 100 days ago BTC was $5,057. Thus, BTC would have to fall below that value for the Market SQN to turn bearish. And even in the next 30 days, it would since have to drop below $5,700 for us to get a bear signal.

I have 1,711 data points for BTC right now going back to Oct 3, 2014. I calculate the 20 Day ATR% divided by the close as a percentage. The mean of our data 5.21 and the standard deviation is 2.9. The smallest number is 1.127635 and the largest number is 18.88. That date was the 1st date that suggested that BTC was now neutral after the huge bull market.

The highest volatility day was on Feb 2nd 2018 – when the big bear market of 2018 just got underway. The least volatility was Oct 5, 2016 – but most of the smallest numbers were in Oct 2016. October 2016 was a bear market for cryptos. Thus, we might have an unusually phenomenon in cryptos where we get the highest volatility close to market peaks.

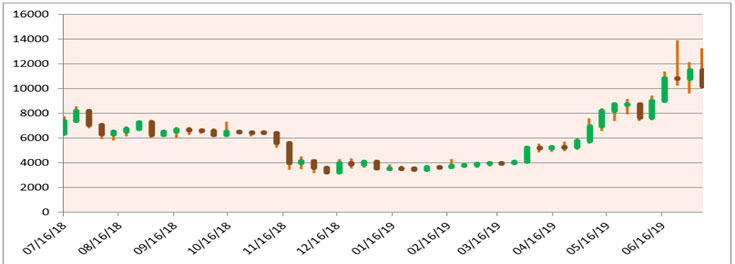

The following two graphs show BTC on a weekly basis and since 2014.

The more recent chart shows that BTC is in a trading range of about $4,000.

One of the crypto newsletters that I get says that BTC just had it’s biggest initial bull run in its history but that it’s now in a corrective phase that could take it down to as low as $7,000 – a 50% correction. If that’s right and BTC reaches that price, we still won’t get a bearish Market SQN score.

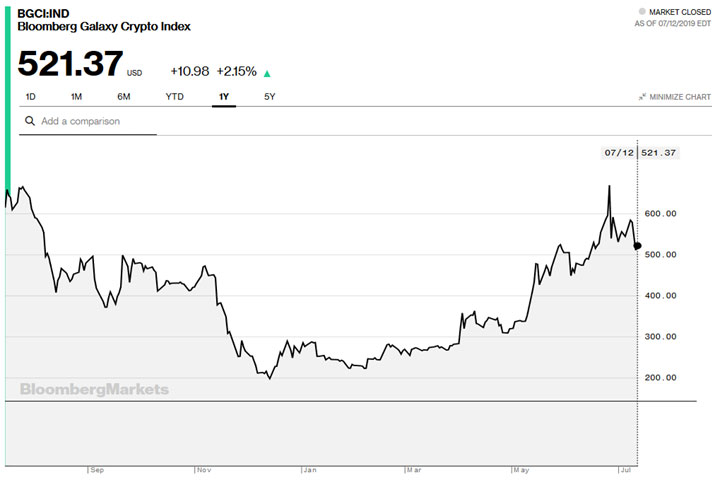

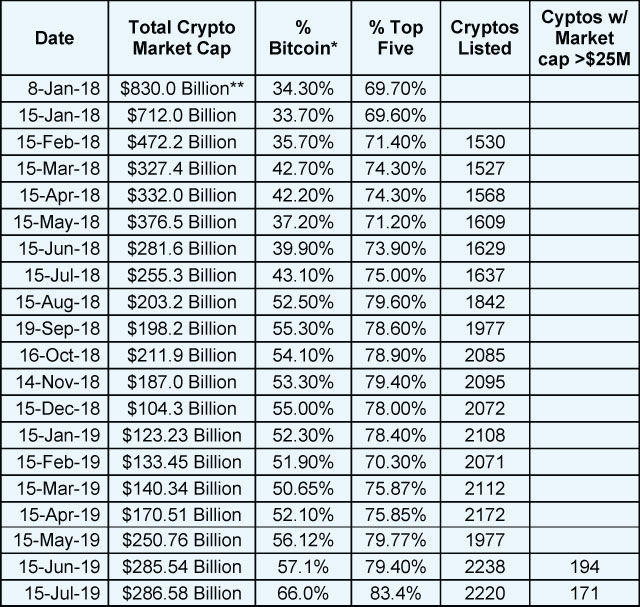

Total Market Cap, July 15th Cryptoassets Update

The market cap table below shows a similar pattern to the individual cryptos in the table above. The total market cap for cryptos is the highest it has been since June, 2018.

Total Market Cap. as of June 16th 2019 * Bitcoin was as high as 90% of the market cap of all cryptos at the beginning of 2017 to as low as 32% at the top of the market. Part of the difference is that there are now nearly 2000 cryptocurrencies. So the number keeps going up even though the market cap goes down. ** This was the peak of the crypto market in terms of market cap. Data via Tama Churchouse, Asia West Investor email on 4/11/18

The data in both of these tables comes from

coinmarketcap. Coinmarketcap.com publishes data for 2,220 coins but only 1,863 coins have a market cap listed but there is also some confusion about their data. They first list 1,1167 coins with a market cap and then the remaining coins have a market cap shaded gray but I don’t know what that means. If we look at the first group which is not shaded gray, then:

- 814 coins have a market cap over $1M

- 311 coins have a market cap over $10M

- 170 coins have a market cap over $25M

- 70 have a market cap over $100M

You definitely should ignore any coins below $25 million in market cap.

Model Results, July 15th Cryptoassets Update

We are down to one spreadsheet that we plan to use to monitor cryptos and in it, we use price data from Tiingo (a paid data service). I will just be reporting from the results of that spreadsheet.

Top 15 cryptoasset model by Van K. Tharp, Ph.D. as of July 15th 2019

Only the top 9 coins are strong bull . Of the top ten coins, I have never heard of MXM, Solve, ETP, CPT, and XEM. The next table shows the Bottom 15.

Bottom 15 cryptoasset model by Van K. Tharp, Ph.D. as of July 15th 2019

In the bottom list last month, we had four cryptoassets in strong bear territory and now 14 of the 15 have that rating.

I’m not sure what to make of the next two tables except that certainly look weaker than last month.

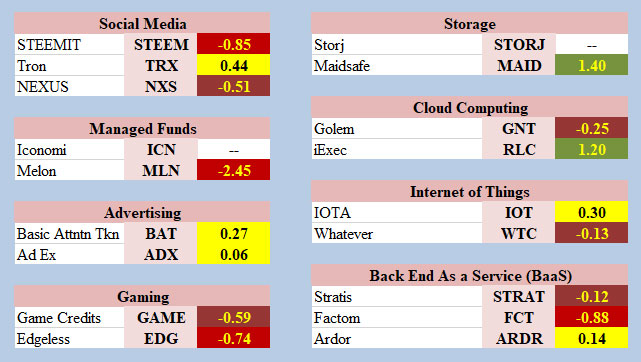

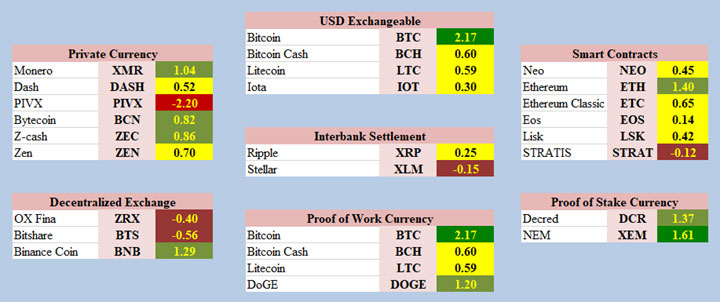

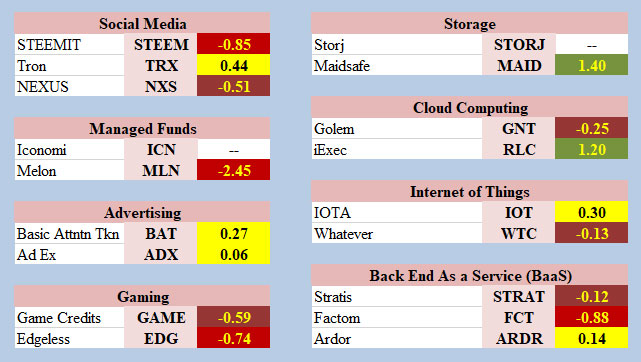

Crypto market model organized by major categories as of July 15th 2019

And here is the second table which looks even weaker.

Crypto market model organized by various other categories as of July 15th 2019

We are still working to perfect these tables so we apologize for the symbols that did not have a Market SQN score.

Institutional Involvement & Supply, July 15th Cryptoassets Update

This is the year that I expect significant institutional involvement in cryptoassets. Here is what’s going on right now and in the coming months:

- Fidelity is now selling cryptos to its best clients (although the typical retail client cannot buy through them yet.

- TD Ameritrade plans to offer the ability to buy crypto assets soon.

- The same goes for E-Trade.

- Bakkt — the ICE platform allowing institutions to trade cryptos safely was supposed to open in July. But now they say they will be testing its 1st product, physically delivered BTC futures on July 22nd.

Do you really want to be on the sidelines when something this big is about to start?

Facebook just introduced their new crypto token which it is calling Libra and Fed Chairman Powell said he had serious concerns about privacy, money laundering, consumer protection, and financial stability. But why shouldn’t he have serious concerns? Facebook will be printing it’s own form of money — something that only the Fed and other central banks have had the power to do until now.

Libra has generated some interesting comments from notable people. Mark Cuban said, “There’s going to be some despot in some African country that really gets upset that they can’t control their currency anymore, and that’s where the real problems start occurring.”

Donald Trump said, “I’m not a fan of Bitcoin and other Cryptocurrencies, which are not money, and whose value is highly volatile and based upon thin air. Unregulated crypto assets can facilitate unlawful behavior, including drug trade and other illegal activity.’… if Facebook and other companies want to become a bank, they must seek a new Banking Charter and become subject to all Banking Regulations.

On the other hand, Libra has the financial and infrastructure support from Visa, PayPal, eBay, Lyft, Uber, and Spotify.

To me, all of this shows the potential of cryptos to change everything – including existing power structures. The powers that be, however, are not willing to give up their power easily.

In May of 2020, the BTC protocol will only allow half as many new coins produced in each cycle. This means the supply of new coins will drop just at the time when institutions will be wanting them more. BTC usually rises about 200% in the year prior to a halving, however, I would expect the rise to be much greater in a roaring bull market which is possible for 2019-2020.

The SEC stance that cryptocurrencies are a security has basically isolated the US and US citizens from most of the crypto world. Binance is now closed to new US investors but they will open a US branch and conjunction with BAM trading. Binance is the largest crypto exchange in the world and it originally started out in China. When the regulatory atmosphere there became too difficult, it moved to Japan. Japan started to crack down and it then announced in March that it was moving to Malta. I don’t know the official opening date but they are definitely in Malta now. Malta is a crypto friendly island and it doesn’t tax the profits from crypto trading. The Malta exchange will close to current US citizens in December. We are not yet sure of what will happen with crypto assets that US investors own already but will not be allowed to own at that point.

As you can tell, the crypto regulatory environment is a mess. For example, all around the world, when a new ICO starts, it is typically offered on exchanges that are not open to US Citizens. Why? Crypto start-up companies don’t want to battle with the US SEC so they just keep American investors out. Within the US, start-up companies that want to issue coins/tokens are now doing so under REG A+ — which allows non-accredited investors to participate in startup companies. The first two ICOs were recently approved by the SEC were Blockstack and to YouNow. One advantage of these tokens is that they will probably be stronger than most of the coins in coinmarketmap.

Grayscale has openings in its various cryptocurrency trusts, including GBTC, for accredited investors. The advantage of participating is that the shares always sell at a huge premium. GBTC now has about a 30% premium which has been as high as 100%. Their new trust for Ethereum, ETHE, has been open less than two weeks. The value of the Ethereum holdings in one share of ETHE right now is about $21, however, its price was as high as $600 in the first few days. Currently, it’s still trading about more than 100% premium at $55. It probably should sell at perhaps a 25% premium which would make it about $25-$27. This just shows how stupid some people can behave when they purchase something at a 1,000% premium.

The disadvantage of investing in the new Grayscale issue is that you cannot sell your position for a year. That’s a huge risk because who knows what will happen in a year?

Trading Genius Crypto System

In the Trading Genius workshop, I presented a simple system that profits from run-ups in BTC. The Trading Genius material will soon be available as an e-course if you missed it in June. If you are interested and want to know when it’s available

click here.

If you had started with US$2,000 in BTC on July 9, 2015 and had followed this system’s rules, you would have a profit of US$34,973 today. You would have made five trades which resulted in one loss and four gains. You would also be long BTC again right now.

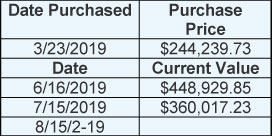

We can’t go back into the past but we can start monitoring the performance of the system now. The most recent long entry signal from this system was on March 23, 2019 but we will assume we started with a $5,000 investment on June 13, the day after I presented the Trading Genius workshop.

Trading Genius Crypto System Performance as of July 15th, 2019.

You would only be able to trade BTC in such a manner, however, if you agree with my beliefs which are as follows:

- Cryptocurrencies are an uncorrelated asset class and institutions really want to get involved. Thus, if about 2% of the money currently in stocks and bonds (i.e., about US$160 trillion worldwide) flows into the crypto market, then this asset class will move from a market cap of US$285 billion currently to about US$3.2 trillion.

- If BTC continues to be at least 40% of the total crypto market cap, then its price will go up to more than US$500,000.

- On its way to that level, however, BTC will continue to have drawdowns in the range of 75%. You want to participate in the upside but you also want to avoid the worst part of the drawdowns.

- You would risk only an amount you can comfortably afford to lose completely. You also need to be able to tolerate large volatility swings in your holdings.

- If these assumptions/beliefs are not valid for the future, then the system may generate very poor results and could even lose money.

- Any investment in cryptos should be limited to low single digit percentages. For a US$100,000 portfolio, a US$5,000 BTC position could grow to be worth more than US$50,000. If the rest of the portfolio was relatively static, then the BTC position would be about 33% of the total portfolio. A long term volatile position with a 33% size is a bad position sizing strategy (poor risk management). Further, assuming BTC’s very volatile nature continued, youwill have to tolerate very large daily swings in your entire portfolio value because of your BTC position.

- The context in which these beliefs are true could change entirely and then all bets would be off, i.e. you could lose most or all of the money in your crypto position. For example, the development of a quantum computer would change everything about cryptocurrencies because 1) a single quantum computer could dominate all BTC production and 2) most cryptos would be subject to a 51% attack on their network by a quantum computer. Right now, that kind of threat with current technology is way too expensive for anyone to consider pursuing.

Super Trader Crypto Workshop Systems

Here are the performance results for several crypto trading systems presented at the Super Trader Crypto Workshop earlier this month –

- Our buy and hold system, written about in the March 15th 2019 newsletter turned US$3,700 into US$87,292 by May 2019. That’s a gain of 23.6 times in value.

- The Trading Genius system cited above taking positions in multiple coins did better than that with nearly a 35 fold gain. If someone could have somehow sold all of the coins at their all-time high prices (an impossibility!!!) that would have produced a gain of 257 fold.

- The best system presented at the Super Trader Crypto Workshop this month actually outperformed that with a 295 fold gain in about 4 years.

Remembering that you can only trade your beliefs, let’s look at the last system’s assumptions. And if these beliefs no longer work in the future, then the system will be unable to approach its previous performance.

- Cryptocurrencies are an uncorrelated asset class and institutions really want to get involved. Thus, if about 2% of the money currently in stocks and bonds (i.e., about US$160 trillion worldwide) flows into the crypto market, then this asset class will move from a current market cap of US$285 billion to about US$3.2 trillion. (Same as the first belief in the list above.)

- During the next crypto price runup, some coins will increase by 100 to more than 1,000 fold – similar to the kinds of gains for some coins in the last four years.

- We can capture the gains from coins with gains from 100 to 1,000 fold.

- To identify those kind of coins requires knowing only the past performance and the market cap while eliminating obvious Ponzi schemes and stable coins.

- There is no bias against privacy coins as they have been great performers in the past.

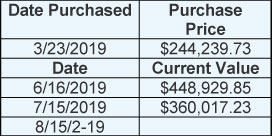

This system entered positions again on March 23rd with an investment of US$244,239. That money came from the last exit of positions on March 14, 2018, The new March 23 positions are now worth US$448,929. For reference:

- the original investment was US$2,000 on 7/9/15,

- the portfolio value does not reflect subtractions for paying taxes which would dramatically impact the performance.

I will follow the monthly values of our portfolios to see if our assumptions continue to work and the system is able to capture huge returns over the next four years. If BTC begins a bear market, however, we will close out the portfolio. As I said earlier, it would have to drop into the low US$5,000 range.

Super Trader Crypto Workshop Systems as of July 15th, 2019

Remember that the purpose of this report is not meant to give investment recommendations or to be predictive in any way. It is meant only to give you a status quo of the cryptoassets markets.

Until August 15th, my birthday, this is

Van Tharp.