Silver – Pullback could bring another buying opportunity

After experiencing a 15.4% decline from USD 26.12 on May 5th, 2023, down to USD 22.09 on June 23rd, silver has made an impressive recovery over the past four weeks. Actually, prices managed to climb back up to USD 25.26 US dollars, effectively recuperating most of the previous losses in a relatively short period. Particularly impressive is the fact, that silver hit its low nearly a week before gold. Hence, silver has been taking the lead in the precious metals sector since the last week of June already. Although this development is somewhat surprising, it bodes well for the medium-term outlook for silver and the sector in general. Silver – Pullback could bring another buying opportunity.

Gold on the other hand, found its low on June 29th at USD 1,893, only slightly below our anticipated target zone of USD 1,900 to 1,920. In the meantime, gold rallied as well and hit a two month high at USD 1,987 last Thursday. However, in the short term, there are signs of a potential pullback after the rally of the past four weeks. In fact, gold and silver prices have retraced slightly since Thursday morning already, hinting at a potential breather. Nonetheless, we don’t expect a severe pullback. Rather a mild and shallow correction should be enough. And even though, gold and silver have lost their super bullish embedded stochastic on their daily charts last Friday, the technical uptrends remain undisturbed in place.

US-Dollar in a severe multi-months downtrend

Furthermore, the weak US dollar seems to slide deeper into its downtrend and hence boosting precious metals and commodity prices. The current downtrend of the greenback indicates an overarching downward trajectory, and such trends tend to persist for more than just a few weeks/months in currency markets. Don’t forget, in the big picture the US-Dollar has been in a uptrend against other fiat currencies like the Euro for a very long time. To be exact since March 2008! Consequently, our medium-term projection sees the EUR/USD exchange rate at around 1.20, which would translate into a DXY US-Dollar index at approx. 92. Of course, such a move is not a one-way street and heavy fluctuations are expected along the way. But ultimately, in such a scenario, we could expect a substantial rise in gold and silver prices, creating very favorable conditions for precious metals investors.

Silver in US-Dollar – Potential pullback towards USD 23 – USD 24

Silver in US-Dollar, daily chart as of July 24th, 2023. Source: Midas Touch Consulting

Four weeks ago, we were correctly focusing on the new opportunities in the silver market and explained in detail the possibility of an immediate trend reversal and turning point. However, in hindsight we could have demonstrate even more contrarian optimism…

After all, silver has since recovered very significantly by 14.35%. Initially, silver prices snaked around the slowly rising 200-day moving average (USD 22.86) for around two weeks. Starting on July 12th, two large green daily candles quickly took silver prices up. After the sharp recovery, however, the probability of a pullback is now increasing in the short term. Due to the seasonally favorable phase for precious metals, however, we are only assuming a short “cleansing thunderstorm”. This pullback should therefore ideally and at the latest catch itself between the 50-day moving average (USD 23.55) and the rapidly rising 200-day moving average (USD 22.86), or in the range between around USD 23 and USD 24.

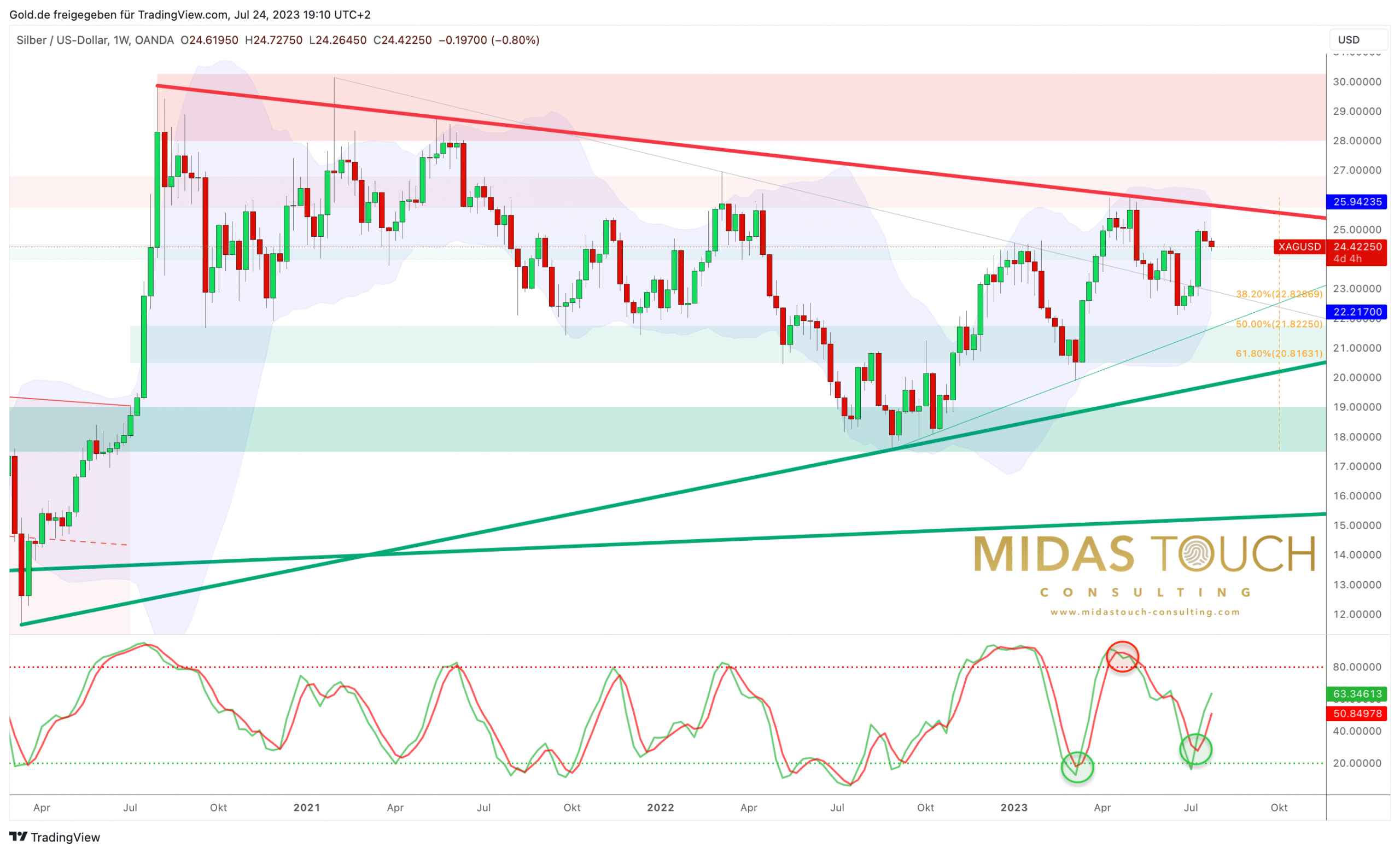

Weekly chart still in a three-year consolidation triangle

Silver in US-Dollar, weekly chart as of July 24th, 2023. Source: Midas Touch Consulting

In the big picture, silver continues to trade well below the key resistance zone at USD 30. There is still a lot of work to do for the silver bulls before silver is even getting close to this big hurdle. However, given the new buy signal on the weekly chart, there is a good chance that silver prices can break through the downtrend-line at around USD 25.90 and and then also surpassing May’s high of USD 26.12 in the coming weeks. This would not only have finally ended the series of lower highs, but would also mean the promising breakout from the three-year consolidation triangle. Subsequently, silver should then be able to target the resistance zone around USD 30 in the 4th quarter at the latest.

Silver in Euro – New buy limit below 21.75 euros

On a euro basis, silver prices have been able to recover significantly in July, too. However, due to the weaker US-Dollar and the stronger Euro, the recovery of 11.44% was not quite as strong as on a US-Dollar basis. In any case, our buy signals from four and eight weeks ago came at exactly the right time, so that favorable prices below the 200-day moving average between EUR 20.20 and EUR 21.00 could be bought perfectly.

Currently, silver has already made a strong move, hence we are not going to chase it. However, should the suspected pullback to around the 50-day moving average (EUR 21.64) or the 200-day moving average (EUR 21.42) occur, there would be another good entry opportunity for latecomers. Hence, we are setting a new buy limit of EUR 21.75 and will execute patience.

Conclusion: Silver – Pullback could bring another buying opportunity.

The correctly anticipated correction in the silver market ended on June 23rd with a low of USD 22.11 and six days later in the gold market with a low of USD 1,893. Since then, a first recovery has already provided a foretaste of the best phase of the year. Statistically, signs for the precious metals sector are dark green between mid-July and the end of September.

We therefore assume that there is a high probability that gold will not only attack its resistance zone around USD 2,075 again, but that it will ultimately break out to new all-time highs. This would resolve a 12 year pattern of consolidation and compression and should unleash a corresponding energetic explosion. We therefore consider gold prices around USD 2,525 by the end of the year to be quite realistic.

Even though, silver was the first one to turn around at the end of June, we suspect that gold’s little brother will initially only follow a rising gold price. However, an attack on the resistance zone around USD 30 should at least succeed in the course of the year.

In the short term it is important to treat every pullback as a buying opportunity, because the train has basically already left the station.

Analysis initially published on July 21st, 2023, by www.gold.de. Translated into English and partially updated on July 24th, 2023.

Feel free to join us in our free Telegram channel for daily real time data and a great community. If you like to get regular updates on our gold model, precious metals and cryptocurrencies, you can also subscribe to our free newsletter.

Disclosure: This article and the content are for informational purposes only and do not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. The views, thoughts, and opinions expressed here are the author’s alone. They do not necessarily reflect or represent the views and opinions of Midas Touch Consulting.