Silver – Second leg down brings new opportunities.

As anticipated, gold and silver prices have been undergoing a correction for the past seven weeks. In this process, gold has been moving lower. Mainly in a sluggish and somewhat confused manner, but ultimately with a more or less determined direction. Today in the asian session, our initial target zone for the correction was reached with lows around USD 1,910. Silver – Second leg down brings new opportunities.

Bloodbath in the silvermarket

On the other hand, in the silver market, the bears have demonstrated significantly more momentum on the downside since the end of the three-week counter trend recovery. While the first leg of the correction pushed silver from USD 26.12 down to USD 22.68, the subsequent interim recovery clearly failed to overcome the now falling 50-day moving average (at USD 24.18) in the range around USD 24.50. In the current trading week, the bears are finally hitting their stride by pushing prices down by more than -8.5% to below USD 22.10, thus reaching a three-month low.

Overall, the correction phase does not come as a surprise to experienced goldbugs. After the gold price had increased from USD 1,615 to USD 2,067 by over USD 450 (+27.9%) between early November 2022 and May 4th, 2023, a breather was much needed. Silver, which mostly followed gold, experienced an even stronger surge (+47.6%) during the same period and was strongly overbought by early May.

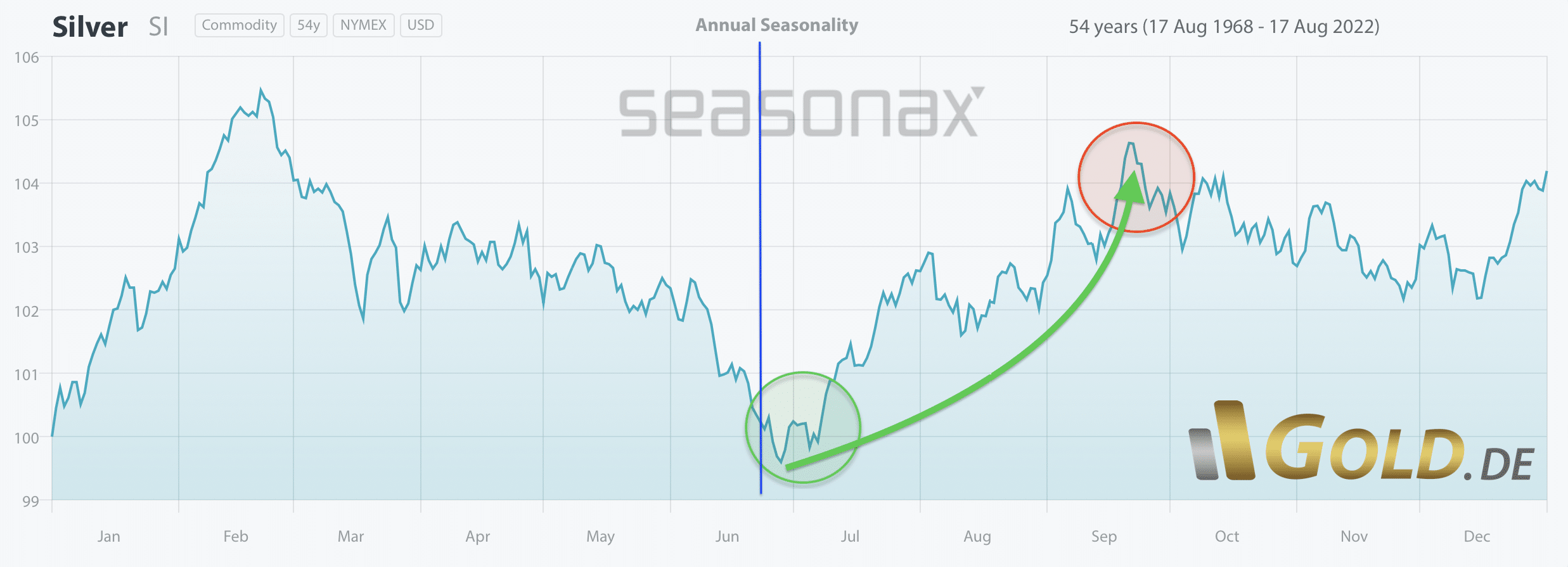

No green light from seasonality (yet)

Silver in US-Dollar, seasonality as of August 17th, 2022. Source: Midas Touch Consulting & Gold.de

The current correction does not change anything about the anticipated medium-term breakout to new all-time highs in the gold market. On the contrary, this healthy pullback could provide a good entry or buying opportunity in these days and the coming weeks. However, the seasonal pattern is still urging patience. Typically, the early summer low is found somewhere between mid-July and mid-August. Since the precious metal prices reached their highs this year rather late in early May, the seasonal trend reversal could potentially be pushed back a bit. Patience, as almost always, is your best guide!

Silver in US-Dollar – Correction target between approx. USD 20.80 and USD 22.00

Silver in US-Dollar, daily chart as of June 23rd, 2023. Source: Midas Touch Consulting

After the brutal bloodbath in this trading week, silver has reached its rapidly rising 200-day moving average (USD 22.44) on Thursday. Given the short-term highly oversold daily Stochastic, this widely observed moving average could initially stabilize the trading activity and possibly initiate a recovery. In this scenario, a retracement up to the broken trend-line in gray, in the range of approximately USD 23 US dollars, is conceivable.

However, silver has been sliding southwards below its lower Bollinger Band (USD 22.37) for the past three days. Statistically, experiencing five to six consecutive trading days outside the lower Bollinger Band is the maximum expected. By the third trading day below the Bollinger Band, the probabilities increasingly shift against the bears, although they still firmly hold the momentum due to the clearly established downtrend.

Weekly stochastic still far away from oversold levels

Silver in US-Dollar, weekly chart as of June 23rd, 2023. Source: Midas Touch Consulting

In the best case, today’s low in Asian trading at USD 22.10 could already be the final bottom. However, it doesn’t align with the weekly chart. Here, the Stochastic oscillator still has plenty of room to move downward before reaching its oversold zone. Therefore, additional weeks of declining or sideways prices would be necessary to reach the oversold zone. Based on experience, we know that before the greatest advances in precious metals, all weak hands must be shaken off radically.

As well, our target zone for the silver price has not yet been reached. Ideally, silver will test the green uptrend line in the range between approximately USD 20.80 and USD 22.00 US dollars in the coming weeks. At the same time, the downside potential has become quite limited after the sell-off this week, and a stubborn bottoming process has a higher probability.

Silver in Euro – Buy limit activated below EUR 21.00

Silver in Euro, daily chart as of June 23rd, 2023. Source: Midas Touch Consulting

In euros, silver has been trading sideways for three years, roughly between EUR 18.75 and EUR 23.50. The rising 200-day moving average (EUR 21.26) did not halt the bears on Tuesday. It appears that the correction is not yet complete in this market as well. There remains a residual downside risk of approximately 5% until reaching the ideal target around EUR 19.50 to EUR 19.75.

However, the highly oversold condition on the daily chart already provides a buying opportunity. Our purchase limit at EUR 21 has been triggered. We are buying at the current levels!

Conclusion: Silver – Second leg down brings new opportunities.

The timely announced correction in precious metals continues in the recent trading days, presenting new entry opportunities, especially in the silver market. From a seasonal perspective, however, the trend reversal might still be a bit premature, indicating that the sluggish market activity could persist for several more weeks. Hence, it is possible that a multi-week bottoming process could lead to occasional confusing spikes in both directions.

The bloodbath in the silver market suggests an oversold condition, which is not yet evident in gold. Gold prices have been moving slowly and sluggishly lower. The 200-day moving average (USD 1,852) is still a significant distance away. Therefore, there is no reason to aggressively position oneself on the long side at the moment.

Analysis initially published on June 23rd, 2023, by www.gold.de. Translated into English and partially updated on June 23rd, 2023.

Feel free to join us in our free Telegram channel for daily real time data and a great community. If you like to get regular updates on our gold model, precious metals and cryptocurrencies, you can also subscribe to our free newsletter.

Disclosure: This article and the content are for informational purposes only and do not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. The views, thoughts, and opinions expressed here are the author’s alone. They do not necessarily reflect or represent the views and opinions of Midas Touch Consulting.