Market Summary

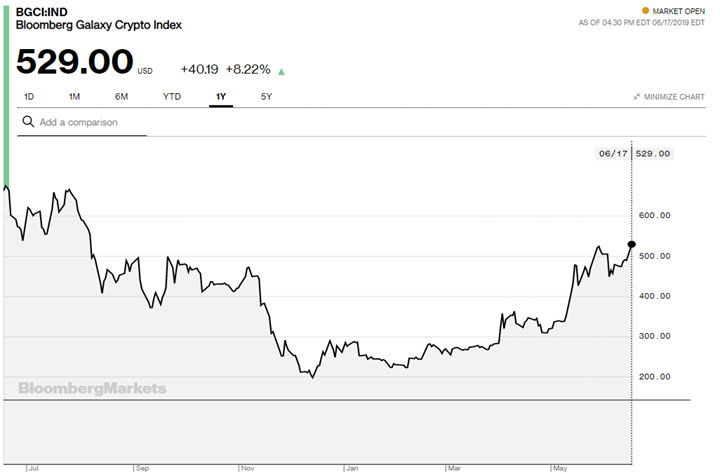

Cryptoassets started the year with three flat months followed by a strong uptrend for the last three months. Most major cryptoassets are up over 100% since mid-December. The obvious bull trend since the first of the year is easy to see just looking at Bloomberg’s Galaxy Crypto Index chart below.

Bloomberg tracks ten major cryptoassets in this index which started in May, 2018 at US$1,000. Thus, the index has been active for about a year and is now just under 50% of its starting level.

Just because BTC is a 1st generation crypto does not mean it is likely to die off and be survived by the later generation cryptos. It’s hard (impossible?) to predict which cryptoassets will thrive or even survive as we move forward as there are so many variables in play. Technology, use case, adoption, support, and multiple other factors come into play. For now, we monitor these five cryptos because they represent several relevant aspects: public ledger – BTC, smart contracts – ETH+NEO, scalable contracts at minimal cost – IOTA+SKY.

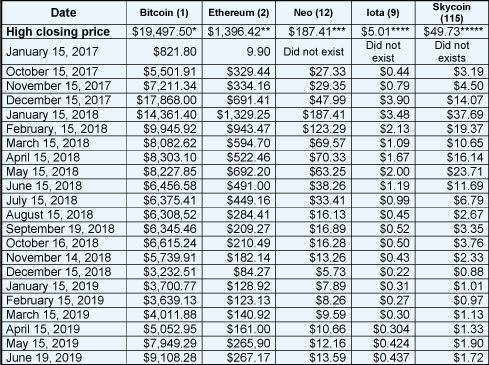

The All-Time High Closes

Date of the All-Time High Closes

*Dec 16, 2017 ** Jan 13, 2018 ***Jan 15, 2018 **** Dec 8, 2017 ***** Dec 29, 2017

All five of these cryptos are up significantly from mid-December. Most have at least doubled, and ETH is more than 200% higher than its mid-December price. Last month I said it was a low risk time to enter the market but I wasn’t sure yet if we had seen the bottom. Now it looks as if we’ve seen the bottom. The risk is less now but cryptos could still easily make a 100 times move up as widespread institutional adoption occurs over the next two years which could take the total market cap of cryptos into the trillions.

I’ve always said that you can only trade your beliefs about the market and I get to see that in action all the time. Right now, I follow five crypto newsletters simply to keep up in terms of information. One newsletter writer is an expert in cycles and since the start of this recent move, he’s been saying that BTC will have one more down cycle before the really big move starts. In addition, he sold the top two performers in his portfolio – Holo (HOT) and Binance Coin (BNB). He recently decided that the correction was only to US$7,300 and that the BTC bull market is on but he is (and his reader are) still only 27% invested. Perhaps he is unconvinced? He based all of that upon a belief that the market would have another major down cycle rather than watching what the market was actually doing.

I found it interesting that one cryptoasset newsletter said that the last thing you should buy is GBTC because it trades at a premium. I assume the writer believes that a BTC ETF will be available in 2019 with no premium.

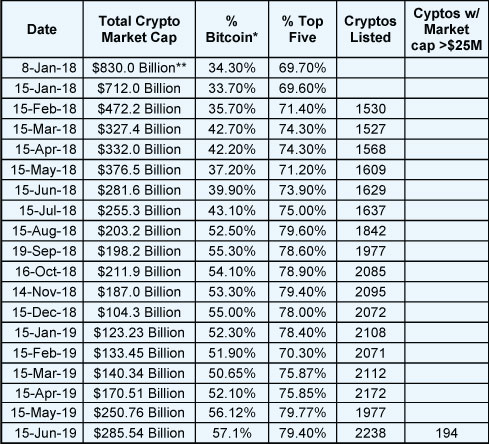

Total Market Cap, June 16th Cryptoassets Update

The market cap table below shows a similar pattern to the table above. The total market cap for cryptos is now the highest it has been since June, 2018.

Total Market Cap. as of June 16th 2019

* Bitcoin was as high as 90% of the market cap of all cryptos at the beginning of 2017 to as low as 32% at the top of the market. Part of the difference is that there are now nearly 2000 cryptocurrencies. So the number keeps going up even though the market cap goes down.

** This was the peak of the crypto market in terms of market cap. Data via Tama Churchouse, Asia West Investor email on 4/11/18

The data in both of these tables comes from coinmarketcap. Coinmarketcap publishes data for 2,238 coins but only 1,847 coins have a market cap listed. Only 1,307 coins have a market cap bigger than US$1 million, however, there is also some confusion about their data. They first list 1,245 coins with a market cap and then the remaining coins have a market cap shaded gray but I don’t know what that means. Here’s another interpretation of the numbers:

- 867 coins have a market cap over US$1M

- 354 coins have a market cap over US$10M

- 194 coins have a market cap over US$25M

- 75 coins have a market cap over US$100M

You definitely should ignore any coins below US$25 million in market cap.

Model Results, June 16th Cryptoassets Update

We are down to one spreadsheet that we plan to use to monitor cryptos and in it, we use price data from Tiingo (a paid data service). I will just be reporting from the results of that spreadsheet.

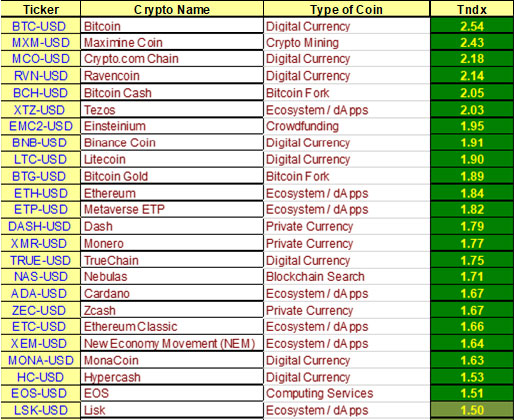

The top 15 are all now strong bull. And you’ll notice that Bitcoin now leads the pack with a Market SQN® score (100 days) of 2.54. In an early bull market, BTC usually leads for six months or so and then the other coins will tend to catch up and some will pass BTC. This month there are a number of coins in the top 15 that I don’t know about, especially #2 through #7 (MXM, MCO, RVN, XTZ, and EMC2 (Einsteinium?). I also have never heard of Metaverse, or Truechain. Plus BTG is probably not one that will stick around for a long time.

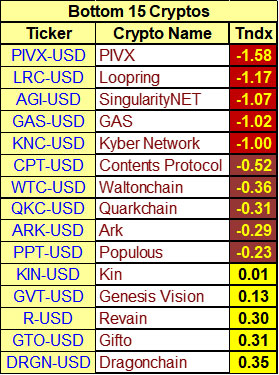

The next table shows the Bottom 15.

In the bottom list, we have four cryptoassets in strong bear territory and another five in bear territory. This means that we now have over 100 cryptos in our list that are neutral or better.

Gas and PIVX are fairly well known, so given the strength of the crypto market, this should be very telling.

The next chart shows all of the cryptos that have a Market SQN score of 1.50 or better (including the top 15) – with 1.51 being strong bull.

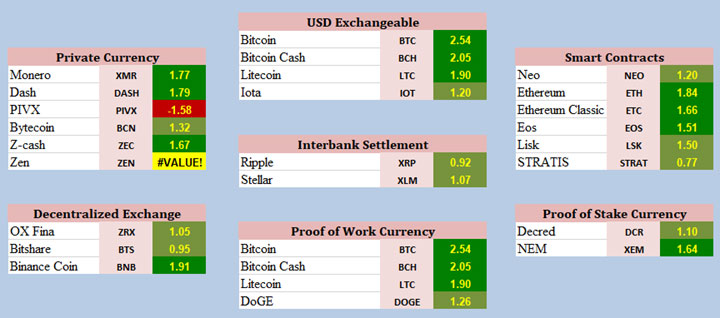

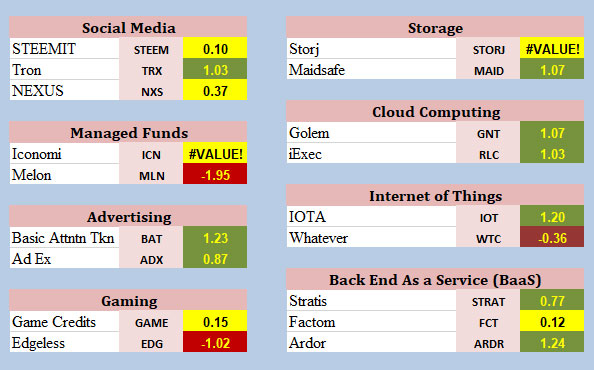

The next tables show the different coins according to their types. Only PIVX, under the category of privacy coins is weak.

And here is the second table that shows categories that are not quite as strong.

We are still working to perfect these tables so we apologize for the three cells that did not compute their symbols’ Market SQN scores.

Below is a weekly bar chart for BTC —

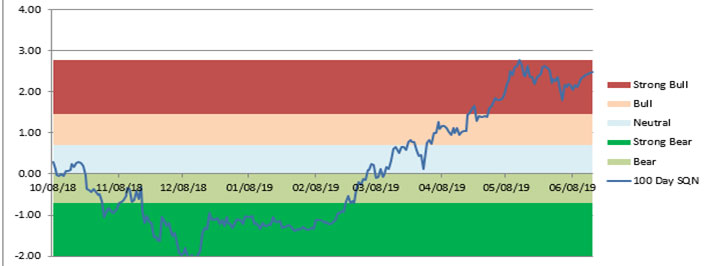

We also have a market type chart for BTC that is similar to the one we use for the S&P 500. It’s strong bull as shown in the chart below.

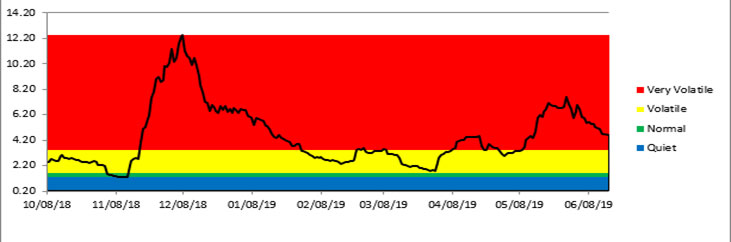

And finally, from the last chart you can see how much volatility BTC has. This chart only covers from Oct. 2018 to the present and you can see how much of it is red. So, as is normal for BTC, we can except a very volatile bull market.

Institutional Involvement & Supply

This is the year that I expect significant institutional involvement in cryptoassets. Here is what’s going on right now and in the coming months.

- Fidelity is now selling cryptos to its best clients (although the typical retail client cannot buy through them yet.

- TD Ameritrade plans to offer the ability to buy crypto assets soon.

- The same goes for E-Trade.

- BAKKT – the ICE platform allowing institutions to trade cryptos safely is supposed to open in July.

Facebook just introduced their new crypto token which it is calling Libra. eBay plans to introduce its crypto coin soon that will allow users to transact purchases and sales on its site. Neither of these, however, fit the criteria of a decentralized coin because they are controlled by one company. Nevertheless, these companies will make millions of new people a little bit more familiar with cryptos though broader usage probably won’t happen until 2020.

And finally, I was told that you could use BTC to pay for your Starbucks coffee now. Starbucks is a partner in the BAKKT exchange so I’d expect that to start operations soon. Buying coffee with BTC is a taxable transaction so would you really want to do that?

In May of 2020, the BTC protocol will only allow half as many new coins produced in each cycle. The average block generation time is 10 minutes (actually about 9 min and 20 seconds). Right now 12.5 BTC are mined in each cycle, but on May 27, 2020, that will drop to 6.25 coins per cycle. This means the supply of new coins will drop just at the time when institutions will be wanting them more.

BTC usually rises about 200% in the year prior to a halving, however, I would expect the rise to be much greater in a roaring bull market which is possible for 2019-2020.

Trading Genius Crypto System

In the Trading Genius workshop, I presented a simple system that profits from runups in BTC. We are in the process of turning Trading Genius into an e-learning course. If you are interested and want to know when it’s available CLICK HERE.

If you had started with US$2,000 in BTC on July 9, 2015 and had followed this system’s rules, you would have a position of US$34,973 today. You would have made five trades which resulted in one loss and four gains. You would also be long BTC right now.

We can’t go back into the past but we can start monitoring the performance of the system now. The most recent long entry signal from this system was on March 23, 2019 but we will assume starting with a US$5,000 investment on June 13th, the day after I presented the Trading Genius workshop.

You would only be able to trade BTC in such a manner, however, if you agree with my beliefs which are as follows:

- Cryptocurrencies are an uncorrelated asset class and institutions really want to get involved. Thus, if about 2% of the money currently in stocks and bonds (i.e., about US$160 trillion worldwide) flows into the crypto market, then this asset class will move from a market cap of US$285 billion currently to about US$3.2 trillion.

- If BTC continues to be at least 40% of the total crypto market cap, then its price will go up to more than US$500,000.

- On its way to that level, however, BTC will continue to have drawdowns in the range of 75%. You want to participate in the upside but you also want to avoid the worst part of the drawdowns.

- You would risk only an amount you can comfortably afford to lose completely. You also need to be able to tolerate large volatility swings in your holdings.

- If these assumptions/beliefs are not valid for the future, then the system may generate very poor results and could even lose money.

- Any investment in cryptos should be limited to low single digit percentages. For a US$100,000 portfolio, a US$5,000 BTC position could grow to be worth more than US$50,000. If the rest of the portfolio was relatively static, then the BTC position would be about 33% of the total portfolio. A long term volatile position with a 33% size is a bad position sizing strategy (poor risk management). Further, assuming BTC’s very volatile nature continued, youwill have to tolerate very large daily swings in your entire portfolio value because of your BTC position.

- The context in which these beliefs are true could change entirely and then all bets would be off, i.e. you could lose most or all of the money in your crypto position. For example, the development of a quantum computer would change everything about cryptocurrencies because 1) a single quantum computer could dominate all BTC production and 2) most cryptos would be subject to a 51% attack on their network by a quantum computer. Right now, that kind of threat with current technology is way too expensive for anyone to consider pursuing.

Super Trader Crypto Workshop Systems

Here are the performance results for several crypto trading systems presented at the Super Trader Crypto Workshop earlier this month –

- Our buy and hold system, written about in the March 15th 2019 newsletter turned US$3,700 into US$87,292 by May 2019. That’s a gain of 23.6 times in value.

- The Trading Genius system cited above taking positions in multiple coins did better than that with nearly a 35 fold gain. If someone could have somehow sold all of the coins at their all-time high prices (an impossibility!!!) that would have produced a gain of 257 fold.

- The best system presented at the Super Trader Crypto Workshop this month actually outperformed that with a 295 fold gain in about 4 years.

Remembering that you can only trade your beliefs, let’s look at the last system’s assumptions. And if these beliefs no longer work in the future, then the system will be unable to approach its previous performance.

- Cryptocurrencies are an uncorrelated asset class and institutions really want to get involved. Thus, if about 2% of the money currently in stocks and bonds (i.e., about US$160 trillion worldwide) flows into the crypto market, then this asset class will move from a current market cap of US$285 billion to about US$3.2 trillion. (Same as the first belief in the list above.)

- During the next crypto price runup, some coins will increase by 100 to more than 1,000 fold – similar to the kinds of gains for some coins in the last four years.

- We can capture the gains from coins with gains from 100 to 1,000 fold.

- To identify those kind of coins requires knowing only the past performance and the market cap while eliminating obvious Ponzi schemes and stable coins.

- There is no bias against privacy coins as they have been great performers in the past.

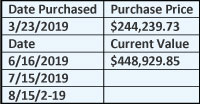

This system entered positions again on March 23rd with an investment of US$244,239. That money came from the last exit of positions on March 14, 2018, The new March 23 positions are now worth US$448,929. For reference —

- the original investment was US$2,000 on 7/9/15,

- the portfolio value does not reflect subtractions for paying taxes which would dramatically impact the performance.

I will follow the monthly values of our portfolio just to see if our assumptions continue to hold true and the system is able to capture huge returns over the next four years. If BTC begins a bear market, however, we will close out the portfolio.

Remember that the purpose of this update is not meant to give investment recommendations or to be predictive in any way. It is meant only to give you a status quo of the cryptoassets markets. Until July 15th, this is Van Tharp.