The Silver island within CBDCs

CBDC (Central Bank Digital Currency) projects aren’t new. USA, China, Russia, Japan, Brazil, Thailand, Israel, Pakistan, Norway, Georgia, Kazakhstan, and the ECB (European Central Bank) are some of the players investigating into facilitation of centralized and decentralized options of digital currencies. The vastness of logistic problems must be overwhelming. How to implement from aspects of security to infrastructure? The sheer number of choices and their hurdles? Again, most often, there are simple answers to be found when examining from a principle-based view perspective. We want to know how a future that offers a new stream of various payment methods influences the price of Silver? The Silver island within CBDCs.

To us, the answer is quite simple. Money is personal. It feels inherently good to have cash in your wallet or under the mattress. It might be fun to some to have apple pay at a time of the iPhone craze, but do you want to give up on your privacy and a feeling of control over your savings at times of uncertainty. Change needs to be incentivized, and we do not see anything that typical card and payment systems haven’t done there already? In short, we know the stability of the inherent value and the historical proof of attraction of precious metals to outweigh any appeal central banks could try to entice us with. Our money is on Silver.

Silver in US-Dollar, Monthly Chart, Physical purchase opportunity:

Silver in US Dollar, monthly chart as of June 25th, 2021

Some countries already gave way to their cash due to hyperinflation. Even if you live under the rule of the mighty dollar, you can feel inflation with each grocery shop. Meaning there is a risk that the dollar isn’t so mighty after all anymore. Not everybody has that much wealth to invest in the housing market or real estate. Quickly your options diminish. With Gold being pricey and Bitcoin not being everybody’s cup of tea, our suggested bet on a physical Silver purchase is not so far-fetched.

The monthly chart of Silver reflects these assumptions showing a strong breakout from a multi-year sideways trading range. Recent behavior provides an investment opportunity since prices declined, and a low-risk entry scenario is unfolding.

A physical purchase transaction for a long-term play has its obstacles, you might say. There is a premium to be paid over the spot price, and as such, it doesn’t provide quite as much transaction speed as the click of a button on a trade.

Review our chart above one more time and enter anywhere between the red and green horizontal lines. You will find that you have an exceptionally favorable risk-reward ratio. More so if considering that we would only exit half of our position near the US$50 mark and expect the remainder to go much higher. The risk assumption is the unlikeliness for the price to penetrate much into the previous multi-year channel resistance (now support) of the US$20 mark.

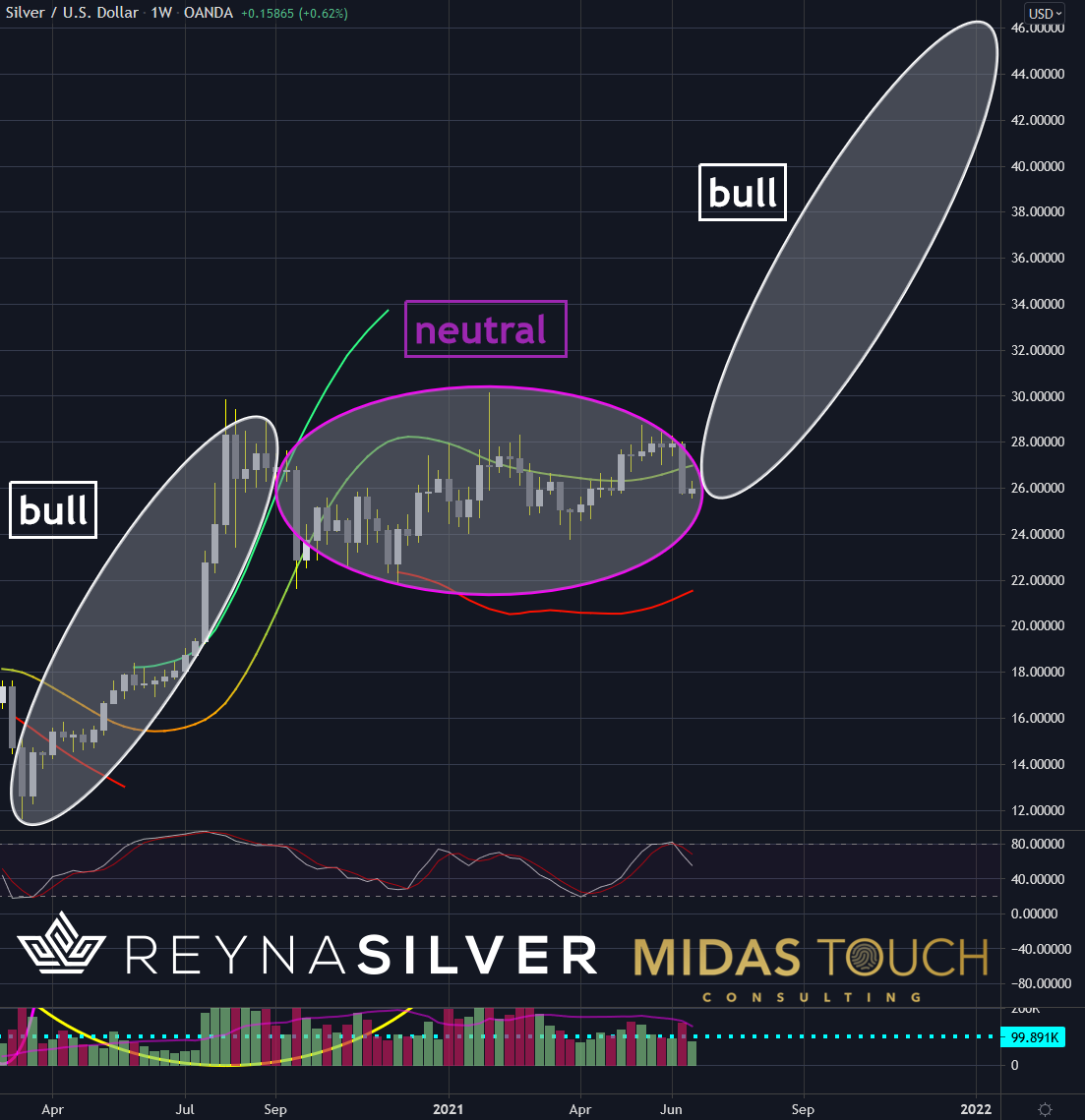

Weekly Chart, Silver in US-Dollar, Confirming the bull:

Silver in US Dollar, weekly chart as of June 25th, 2021

Let us zoom now into the smaller weekly time frame. We find that the chart shows nicely how the strength of the multi-year breakout last year persisted. When you look at the neutral sideways zone, you can tell that it entails inherent strength. Foremost, we didn’t see a dramatic decline. Secondly, this sideways trading zone nearly persisting now for a year will make the next breakout to higher price levels magnify in both price and time duration. Clearly, another part of the puzzle why we see the US$50 level not only be reached but also taken out at some point.

Silver in US-Dollar, Monthly Chart, Tricky but manageable:

Silver spot price trading is a bit trickier right here. Volatility is high around options and futures contract expiry time. Typically, we fade momentum as contrarians. In these scenarios, we prefer a late confirmed entry to avoid the increased risk volatility early entry. The daily chart above shows the various stacked odds of support. We are sitting on a supply support zone (green box). In addition, the price is also above the simple 200-day moving average. Most dominantly, we are trading right at directional support of the lower rim of a congesting triangle (yellow line).

The Silver island within CBDCs:

Some might argue the lack of long-distance transaction capability with precious metal payment options, and rightfully so. We are not opposed to say Bitcoin, for example, within your wealth preservation portfolio. We are highly confident that history has shown that the stability of money and payment methods are all about trust. In time of the information age and shaky economic grounds, we doubt that individuals blindly accept their greenbacks, even if exchanged over time, to be transferred into bits and bytes. Especially if this means that every purchase is documented, and privacy erased. It feels too natural and too safe to be able to either carry or store at home your true treasures without a ledger at the bank.

Feel free to join us in our free Telegram channel for daily real time data and a great community.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.