Silver, the loaded spring

The supply crunch might stretch as much as a seven-year event from now, but the spring is loaded already. It isn’t only a supply, demand scenario when talking about silver. Little accounted for is any surprise, and in our opinion, the slightest cough could set this spring off. The sum of fundamental facts is overwhelming on how the next large turning point could set silver into stellar motion. With this many accelerators, it makes this an incredible risk/reward-ratio play. Silver, the loaded spring.

Here are a few facts that we do not see accounted for in price and as that find to be accelerators for the next monthly time frame leg up:

- increase in demand for physical silver purchase during the previous eighteen months

- eleven trillion dollars pumped into the economy over the last eighteen months (inflation)

- electricity prices rising = demand for solar panels increasing (which contain silver)

- supply logistic constraints all over the world make large shipments of raw materials stuck in various ports (including silver)

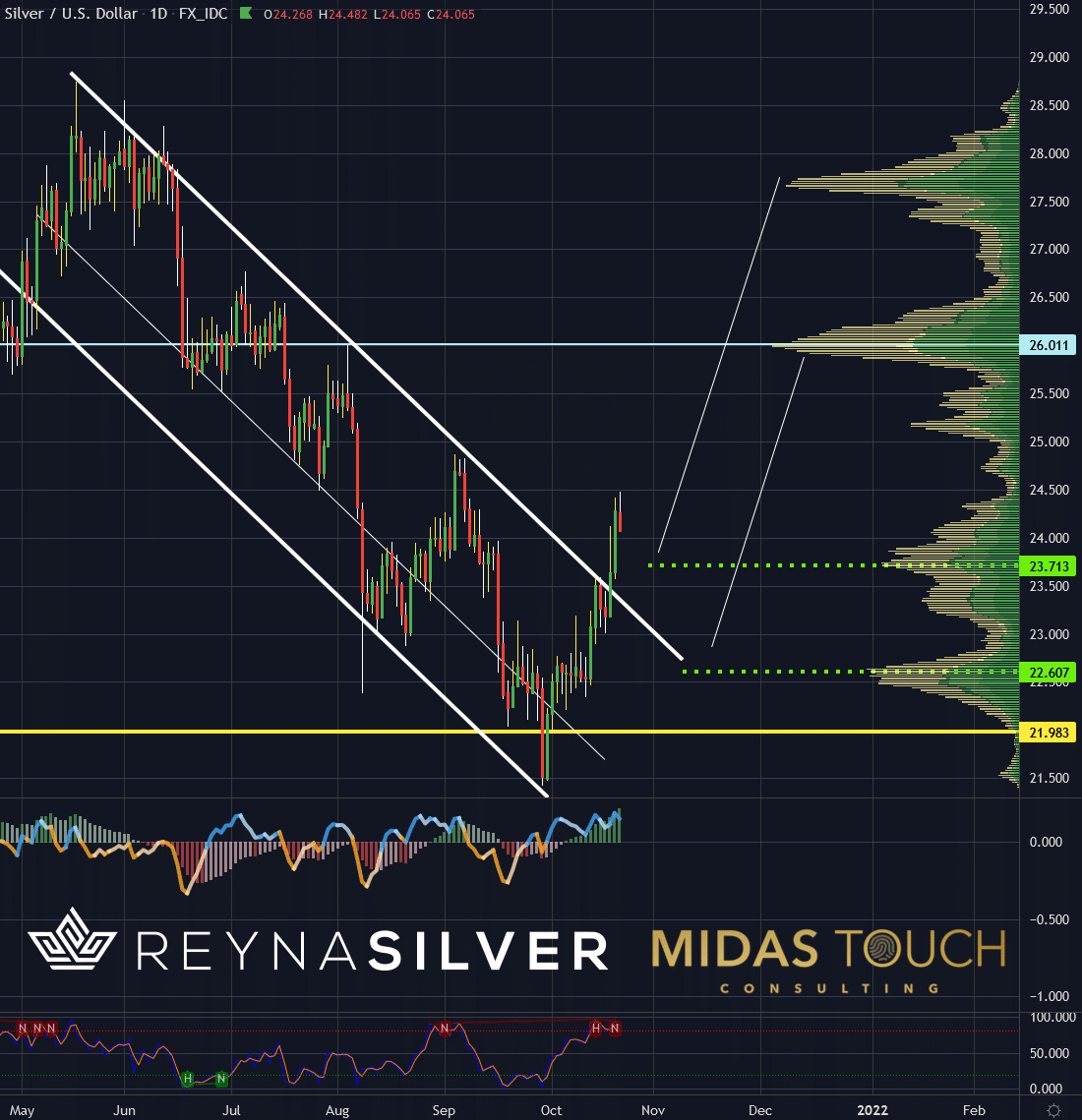

Silver in US-Dollar, daily chart, signs of life:

Silver in US-Dollar, daily chart as of October 22nd, 2021.

With the already present shortages of blanks for minting coins and a driver shortage for armored cars, why is silver trading at these low numbers? There is plenty of evidence that once demand for silver increases further, a short squeeze might be triggered. Consequently, silver prices might soar beyond typical trend steepness.

On the daily chart above, signs of life are already evident. The trend-down channel since June this year has recently been broken to the upside. The first indication of a reversal. We have a keen eye on the price levels near the green dotted horizontal lines for possible low-risk long entries.

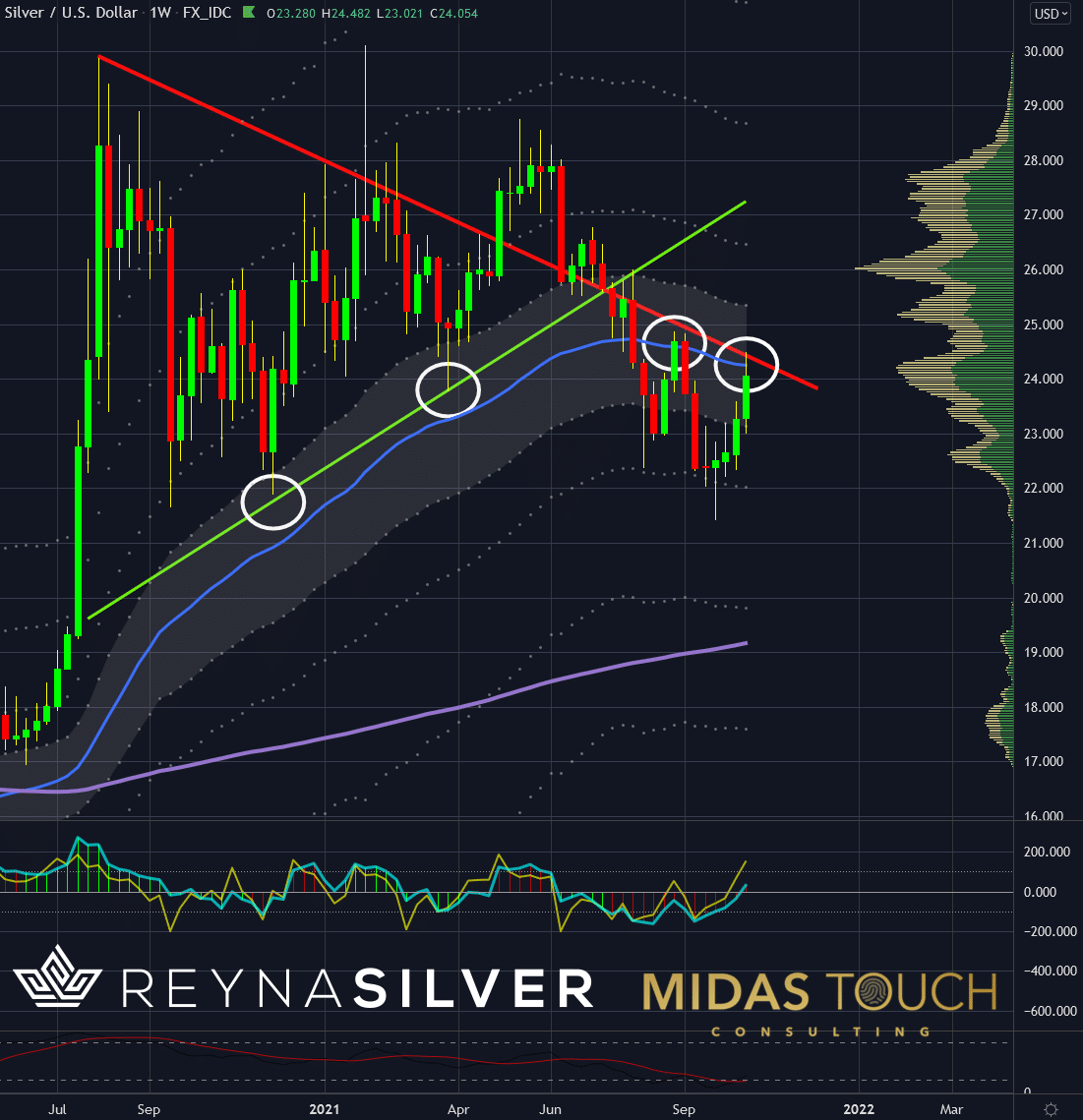

Silver in US-Dollar, weekly chart, on the verge:

Silver in US-Dollar, weekly chart as of October 22nd, 2021.

We have warned numerous times that the two most detrimental factors to market losses are intuition and emotions.

Intuition, while one of the most resourceful problem solvers, is worthless in the counterintuitive market environment. Emotions provide for a clouded perception of actual market behavior and a tendency to overwrite one’s rules and cause sabotage to disciplined behavior necessary for execution within one’s market play.

Emotions aren’t only fear and greed, or chasing trades and running stops. Over the last forty years, we were less worried about inflation. As a result, we might be a bit complacent now to validate early warning signals. Procrastination might be a consequence. Be advised that acquisition of physical purchase requires availability and even more knowledge. What to buy? Where to buy it?

The spring is loaded. There is no room for research once it’s sprung.

Prepare your actions in detail. Make a sample purchase for confidence and experience if you haven’t done so already. It is education that supports all subsequent steps and possible surprises to endure. Knowledge will give you the edge over the average citizen.

Spot price analysis is helpful as well to keep calm and prepared. The weekly chart above shows a pat situation. Bulls celebrated above the mean (blue line). Fourteen weeks ago, the directional green trend line was violated by price. Bears pushed since then prices to lower levels. Right now, we are right on the verge of price trading near the red resistance downtrend line. This makes not for a low-risk entry zone on this time frame but should price close above this line, it would indicate a possible long trend continuation.

Silver in US-Dollar, monthly chart, bullish engulfing pattern:

Silver in US-Dollar, monthly chart as of October 22nd, 2021.

It seems the crowd is complacent about all monthly bills and especially food prices going through the roof. Many billionaires, including Stanley Druckenmiller, Paul Tudor-Jones, Bill Ackman and Warren Buffett, have stated that Americans aren’t paying enough attention to the fact that we will face consequences of the eleven trillion dollars pumped into the economy over the last eighteen months.

The monthly chart reflects these market uncertainties to a certain degree. Silver prices have seen a substantial move up. Even though trading within a sideways range for over a year now, October is exceptionally strong so far. Representing a bullish engulfing pattern from a Japanese candlestick perspective, the majority of sellers in September got stopped out or are underwater. Should prices close above US$ 24 for this month, we would be very bullish on silver. We have already taken nine trades on small timeframes this month, of which seven were successful winning trades. Our quad exit strategy allows the remaining partial positions (the last 25% which we call “runner”) to be exposed at no risk within the markets. All these trades are posted in real-time in our free Telegram channel.

Silver, the loaded spring:

There seems to be much confusion regarding the math on silver demand in the news. Boiling it down to a simple equation, we are mining an average of about 800 to 850 million ounces a year. In opposition to this mine supply, industrial demand is about 600 million ounces. With a speculated growth to about a billion ounces of industrial demand, it isn’t so challenging to feel safe on a long-term bet holding physical silver. And we are only talking about one sector of silver demand here… The real kicker will be the investment demand.

Feel free to join us in our free Telegram channel for daily real time data and a great community. If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can also subscribe to our free newsletter.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. The views, thoughts and opinions expressed here are the author’s alone. They do not necessarily reflect or represent the views and opinions of Midas Touch Consulting.