Basel 3 the Silver bull

Basel 3, a voluntary regulatory framework to stress test central banks worldwide, requires banks to hold a percentage of assets back to deleverage their lendings. On June 28th, a new regulation will be set in place that disvalues unallocated gold paper contracts held against lendings. At the same time, physical Gold changes its spot from a Tier 3 asset to a Tier 1 asset. It will count as a 100% reserve asset. This provides banks with an enormous opportunity to pay off debt and makes Gold highly attractive to accumulate before this event and exchange inflated dollars for bullion. Basel 3 the Silver bull.

Gold being the leader in the precious metal sector has a massive effect on Silver, and this is again another factor for our strongly bullish consensus.

Silver in US-Dollar, Daily Chart, Last weeks chart:

We published the green part of the daily chart above in our last week’s chartbook release pointing towards the consistency of the lower green regression channel line. With the additional transactional support supply line from our fractional volume analysis at US$26.85, odds were stacked. The astute reader took a low-risk entry below US$27 , the day after chartbook release. The right side of the chart illustrates the target near US$28.50. This has been the 4th trade in this upward move that allowed for these low-risk market engagements. A part of time closing in towards Basel 3. Typically more significant retracements would follow after such an extension, but we continue to advocate the lower green line to be one for low-risk entries. Only because the situation with Silver due to Basel 3 is unique.

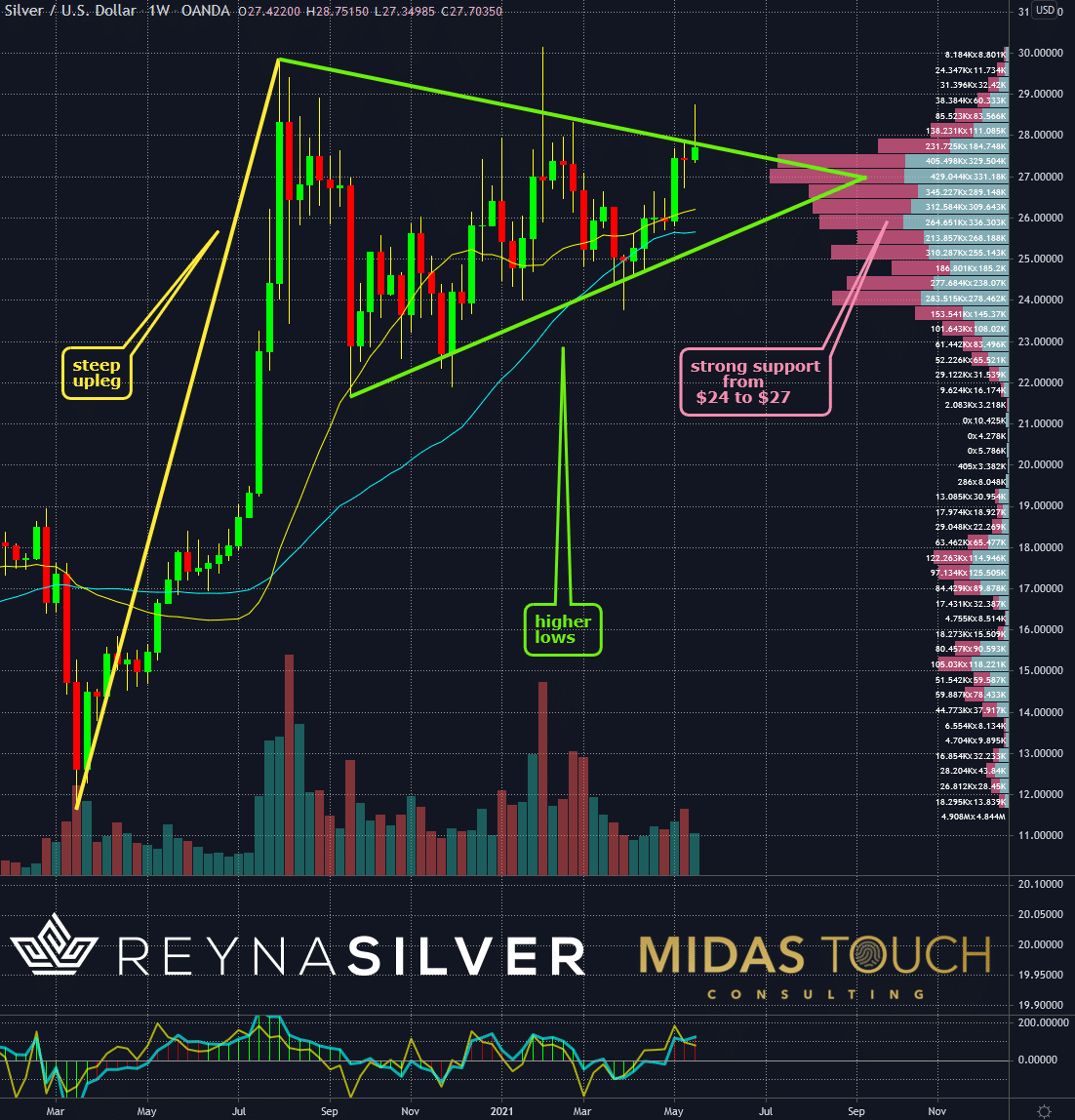

Silver in US-Dollar, Weekly Chart, Acquiring coins and bullion:

Silver in US-Dollar, weekly chart as of May 20th, 2021.

The weekly chart above shows how Silver’s strength doesn’t ease even after a significant up-leg from March 2020. A bullish continuation triangle shows a minor trend within. Transaction volume has cemented a carpet of support below the price. It is again the lower green line that we find most attractive for low-risk trades (acquisitions). Just do not be deterred by the price difference between the spot price and the actual physical acquisition price.

It would also come as no surprise if a triangle break would already manifest soon. Especially since US$27 has built itself out to be the significant volume analysis support zone for price.

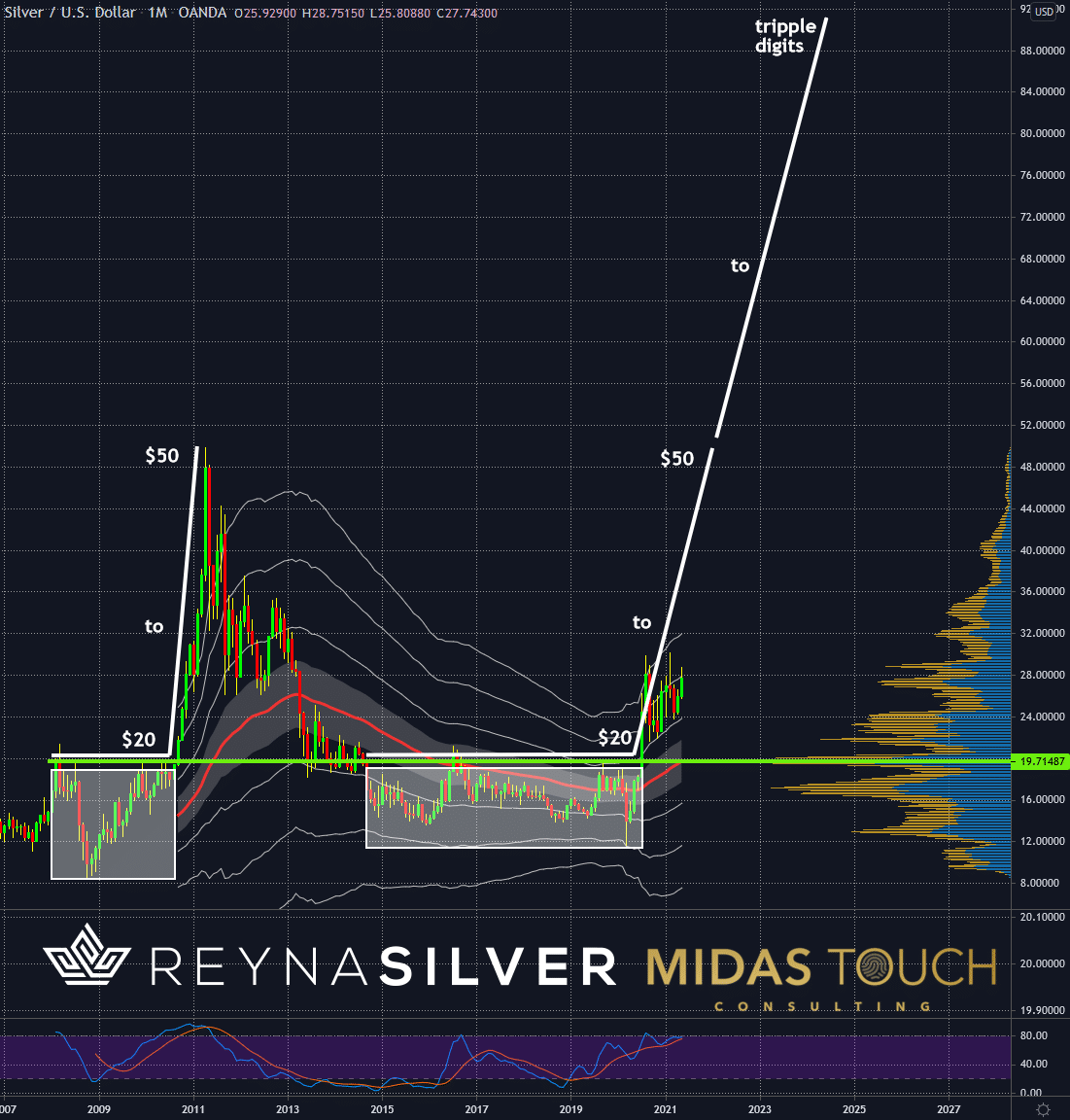

Silver in US-Dollar, Monthly Chart, Easily underestimated:

Silver in US-Dollar, monthly chart as of May 20th, 2021.

The monthly time frame shows how significant moves can get once the US$20 mark gets penetrated by price. We expect this time around for the price to exceed the US$50 mark. This because, typically, the length of the congestion zone before a range expansion directly influences the size of the following move.

We would not be surprised to see a bull trend for many years to come. Doubters that find prices right now to be expensive will look back with agony why they didn’t grab some physical Silver when it was cheap.

Basel 3 the Silver bull:

A word of advice. Abnormalities like this bring with them changed market behavior. If you came late to the party or weren’t otherwise able yet to take advantage of low-risk entries, do not be discouraged. We mentioned market manipulation in our last two chartbooks. Banks have the resources to participate with an edge towards the market to get their desired physical acquisitions at a price that makes trading bumpy for the individual investor. Don’t bet the farm. Trade small size. Precision trading isn’t required for physical acquisitions since you do not aim to sell a week later.

And do not use times like these to change your approach to the market. Generally speaking, you should not change your system when you struggle but either before or after market abnormalities. Confidence is the most crucial part of trading and investing. You do not want to jeopardize this confidence by altering your trading approach if your system might not have produced the desired results yet.

Simplify if you feel you have to alter your approach with the toolset that you are familiar with. We are confident that even very small physical Silver acquisitions will make you smile down the road.

Feel free to join us in our free Telegram channel for daily real time data and a great community.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.