Tried and true

This phrase describes something that has proved effective or reliable before. A principle of classical technical analysis in trading. Still, it eludes us. Why not take the good looking trades? Why not just grab the grapes from the vines? The need to push ourselves is in our DNA. It is DNA rooted since it is what allows us to evolve in the story of life. It is in part what makes us question each trade. Tried and true.

As a trader, you can’t hand select your trades. If you doubt that fourth trade after three losing ones in a row and skip it you skew the system. This might be the trade with the high expectancy that would have squared with your previous three small losing trades and got you back in the green.

When you go to your favorite breakfast place where you always order the same item that you love, you don’t ask yourself: “Maybe they screw it up today, maybe I should order something different.” There you believe in tried and true.

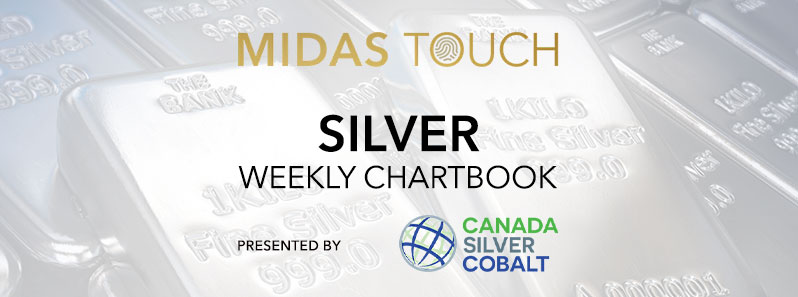

Silver, Daily Chart, High probability entry edges for weekly time frame trading:

Silver in US Dollar, daily chart as of October 15th, 2020 a

In short, you need to have your bread and butter trades. You can’t question those and need to execute them flawlessly. In the case of Silver, the trend-line breaks both horizontal and directional work like a charm.

Looking at the daily chart above of just this year alone the success probability is stunning. This solid probability entry method is a great way to stack one’s odds for the weekly time frame market plays as an entry tool.

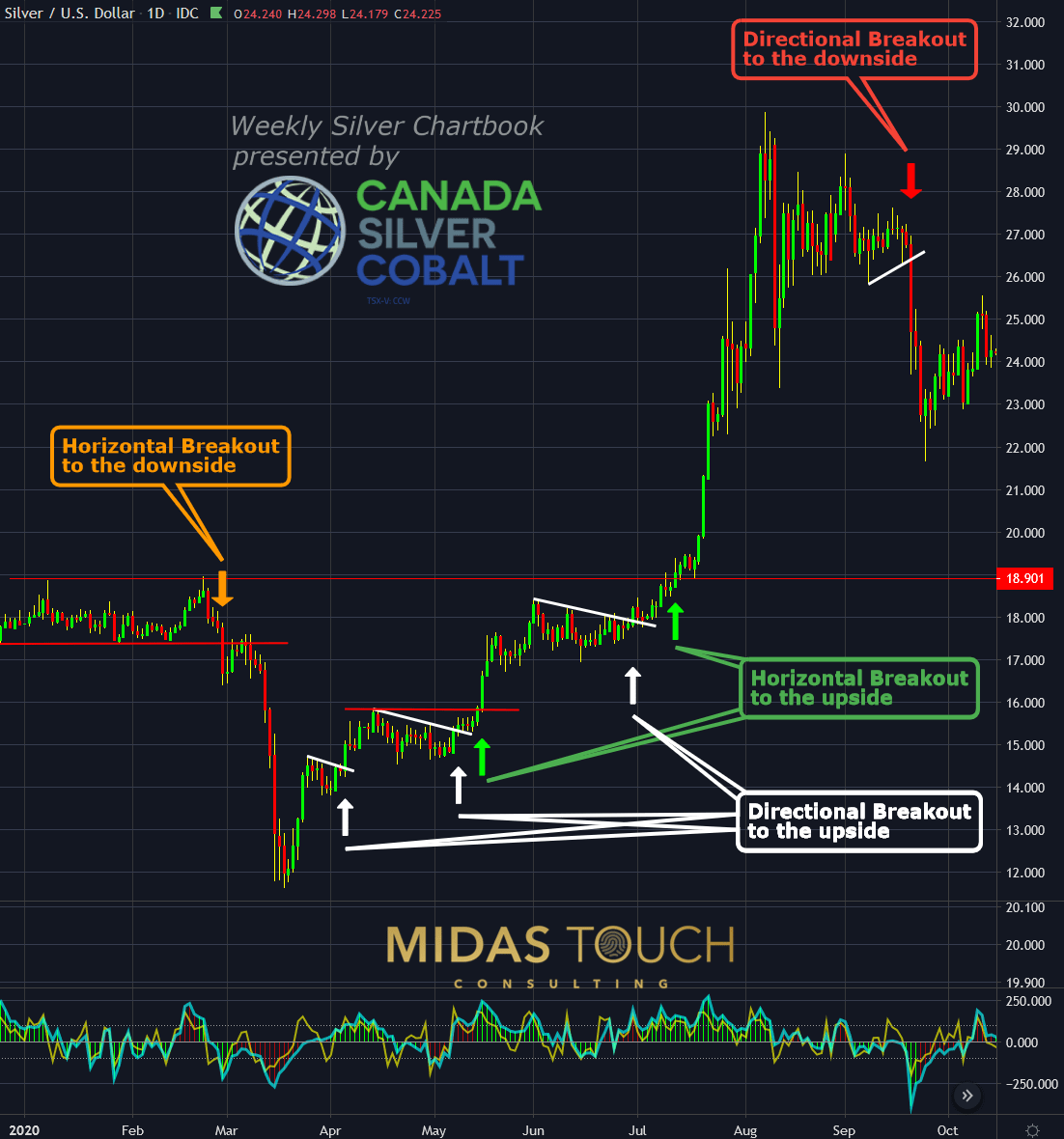

Silver, Daily Chart, Silver channel plays, a high probability game:

Silver in US Dollar, daily chart as of October 15th, 2020 b

Another solid edge in trading Silver is directional channel plays. With great risk/reward-ratios, these precision entries help to minimize risk. A glance at the chart above shows that Silver trades very precise at the rims of a directional channel. This provides for entries and exit targets. In addition, we use our quad exit strategy to maximize profits and minimize initial risk.

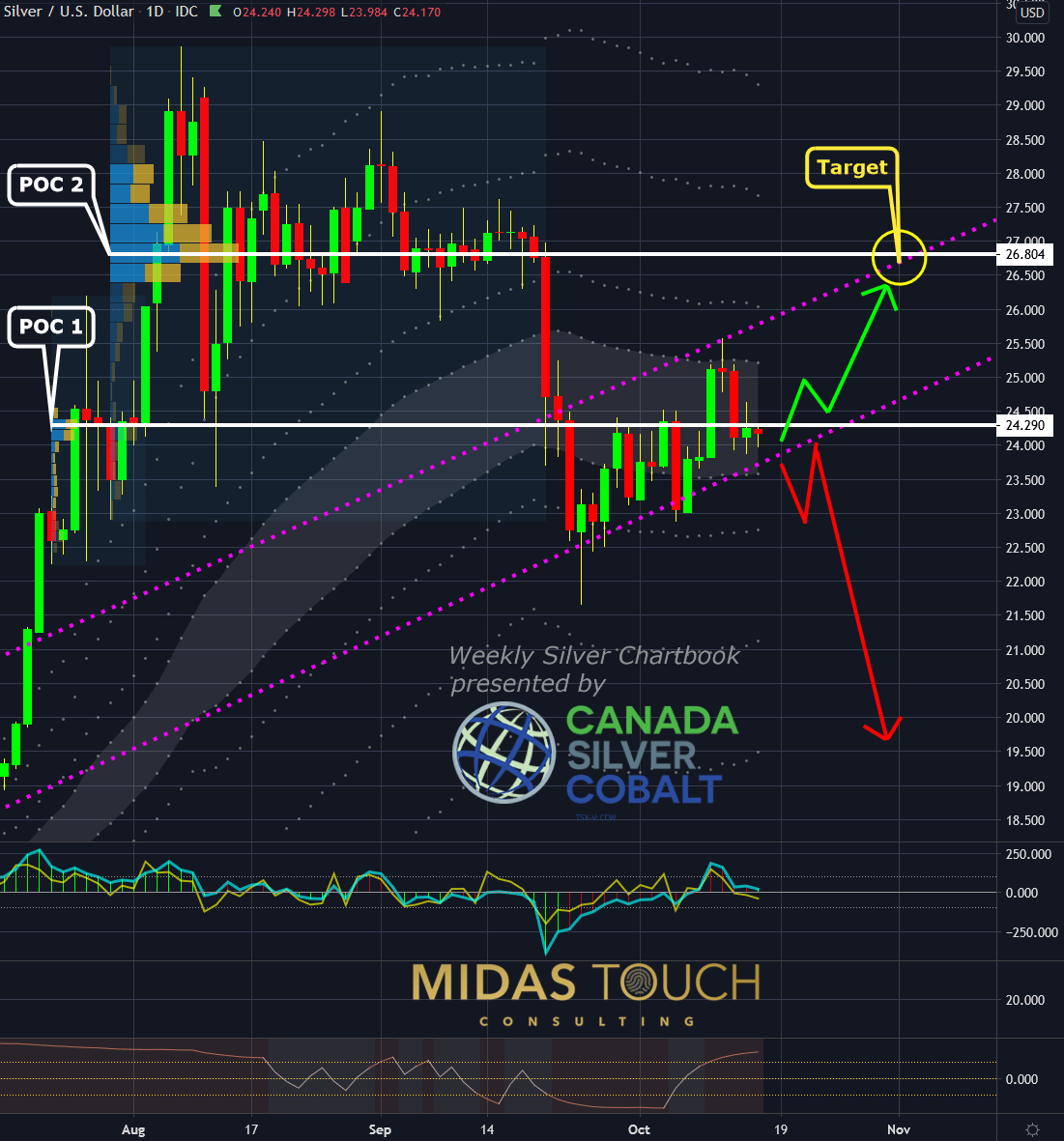

Silver, Daily Chart, Whats next? Tried and true:

Silver in US Dollar, daily chart as of October 15th, 2020 d

With the analysis of the prior charts as a tried and true statistic (take our word for it this isn’t just true for the data of 2020 but Silvers history as a whole), let us project forward.

Any confirmation either to enter long into a channel play (green arrow up) or a trend line break to the downside (red arrow down), is another opportunity in the making right now. We employ our quad exit strategy to further reduce risk and maximize profits. In addition, we give our free Telegram channel members a daily heads up through our daily call feature.

Tried and true

So why do you trust your breakfast eggs prepared by someone else more than your trading ability? The answer is: risk. The more risk is involved the more we try to gain certainty and scrutinize the answers. One of the best ways to eliminate this is by trading a smaller size. Risk less and take the easy trades! Grow your risk appetite slowly and gradually. You will find it a lot easier to take the trades that fit your trading criteria when the risk of the individual trade is less meaningful to you.

We post real time entries and exits for the silver market in our free Telegram channel.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.