Extremes versus optimization

We all love to be inspired, want to feel something. We want to be special, feel meaningful, and have a story to tell. Extremes provide this story. Extremes make us feel something. It is one of the hardest things in trading to not go for extremes, that large winner. To not make that large sure bet. To not follow one’s instinct. Trading requires a true belief that averages and optimization are the way to riches. Extremes versus optimization are the daily inner fight a trader needs to win.

Optimization might not evoke the feelings sought after and it does not making you feel good. Nevertheless, it is the safest way to approach the market from a low-risk perspective.

Optimization is what brings systems alive. Moreover, sample size trading and acting in your own best interest based on thinking and acting on principles and laws of probabilities needs to be the true goal. This isn’t exciting. It certainly doesn’t make you stick out, but it makes you money.

In 2020 we had oil prices go negative. One out of six people in the US is now unemployed. We are struggling with pandemic and riots. We hear daily about conflicts in Iran and China and governments borrowing record amounts. Currency printing presses are overheating. To sum up, we live in extremes.

It takes the utmost discipline to stay balanced, trade humble, and execute optimization. In other words, hold the middle ground and don’t be tempted. Don’t let emotions get the better of You.

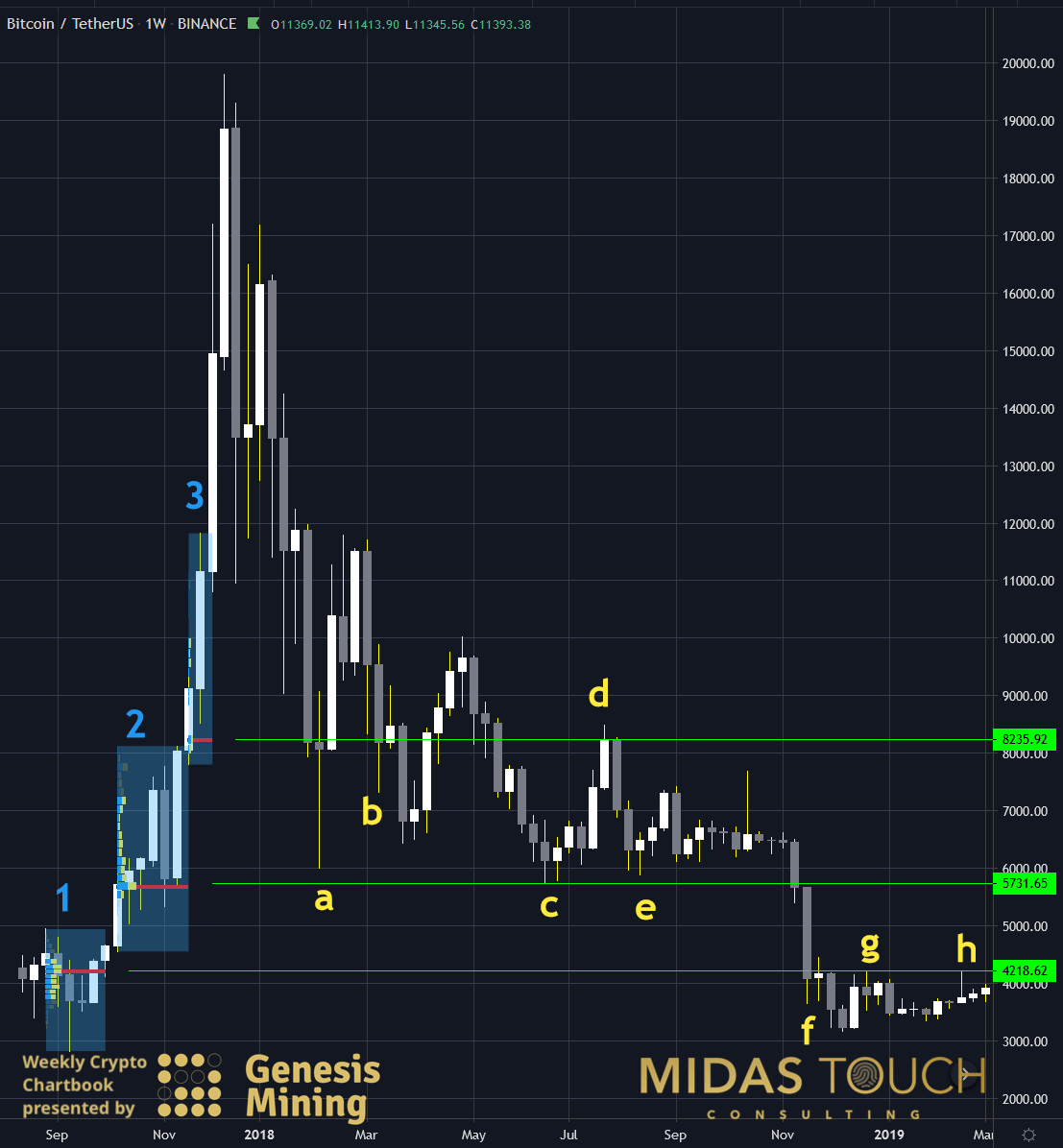

BTC-USDT, Weekly Chart, Knowing ahead of time:

BTC-USDT, weekly chart as of October 13th, 2020

One great way of optimized trading is extensive volume analysis. The weekly chart above depicts the time frame from August 2017 to May 2019. At that time, we identified three significant range fractals (blue boxes) at the end of 2017. The red horizontal lines within the fractal boxes in blue are the point of control (POC). They are the highest volume node within this time frame. Cunningly they predicted support resistance zones of the future (green horizontal lines). If you follow price along with points “a” to “h” (in yellow), the significance of this early established optimized data becomes evident.

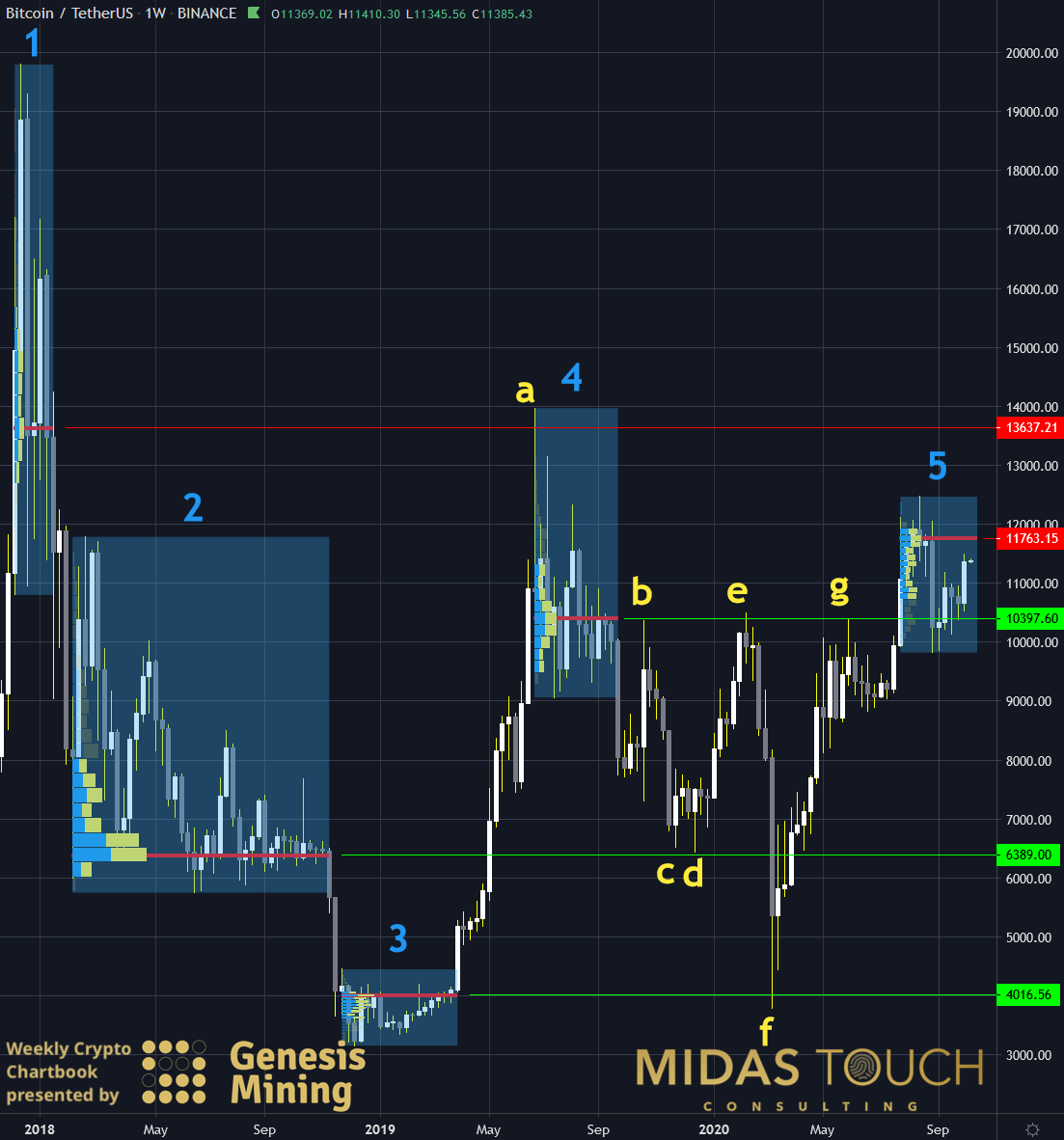

BTC-USDT, Weekly Chart, Target magnets:

BTC-USDT, weekly chart as of October 12th, 2020

The weekly chart of Bitcoin above starts now at the end of 2017 with Bitcoins all-time highs and ends with the current date. Five significant fractal zones were identified in sequence and consequently helped significantly to determine targets (yellow letters a to g) for our trades. The more Bitcoin has become a staple within the markets, the more precise has this optimized approach about high likely target prediction become. This approach is principle-based and can be applied to all time frames.

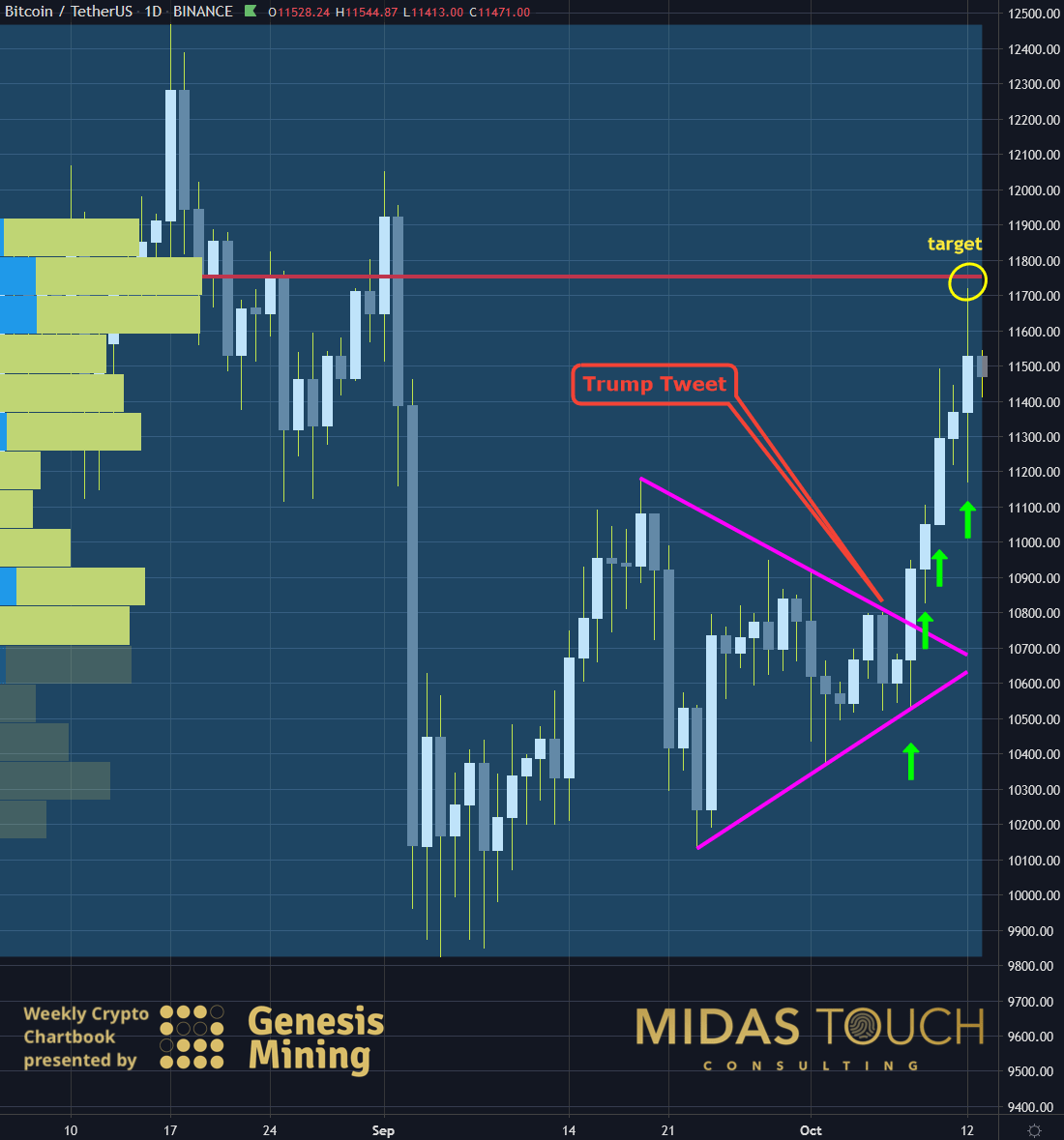

BTC-USDT, Daily Chart, Extremes versus optimization:

BTC-USDT, daily chart as of October 13th, 2020

A closer look in the last (5th) fractal range of the previous weekly chart shows, that over the last three weeks a contracting price range providing a great risk/reward-ratio. The POC of the optimized volume analysis (horizontal red line) provides the assumed target.

We initially attempted an anticipated long breakout on October 6th, 2020. Only 25 minutes after our low-risk entry the President’s tweet resulted in a steep price decline for the day. An extreme had taken us out of the market. We were able to cut the trade at our usual optimized half percent risk mark. Already two days later another opportunity arose (green up arrow). This time the upper resistance line of the triangle gave way to a breakout.

We were able to follow with three more winning trades in trend direction. Our quad exit strategy allowed for immediate risk reduction and as usual we shared our trading in our free telegram channel, with a heads up as well through our daily call.

Extremes versus optimization

Optimization is the key desired outcome. A well rounded always functioning, smoothly running versa-teller.

The work of a trader is emotionally very average. If there aren’t any kicks it means you are doing great. As soon as your heart rate goes up it is clear something isn’t right. You either trade to large or break other rules.

Befriend the optimization process! What you focus on expands. The emotional highs we all crave can be satisfied when spending the money… earned through an optimized approach.

We post real time entries and exits for many cryptocurrencies in our free Telegram channel.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.