Silver protection against exuberance

We don’t know how you feel, but when car companies make more money in a few weeks of Bitcoin speculation than in over a decade of car sales, something seems off. When you read these kinds of news for weeks and months out over a year, it doesn’t only get exhausting, it gets frightening. As if the constant threat of covid wouldn’t be enough. Now the fear for Your financial security also heads towards a climax. What to do when things become overbearing? Keep it simple, keep it safe! Silver is in a bull trend. It has real value! Silver protection against exuberance.

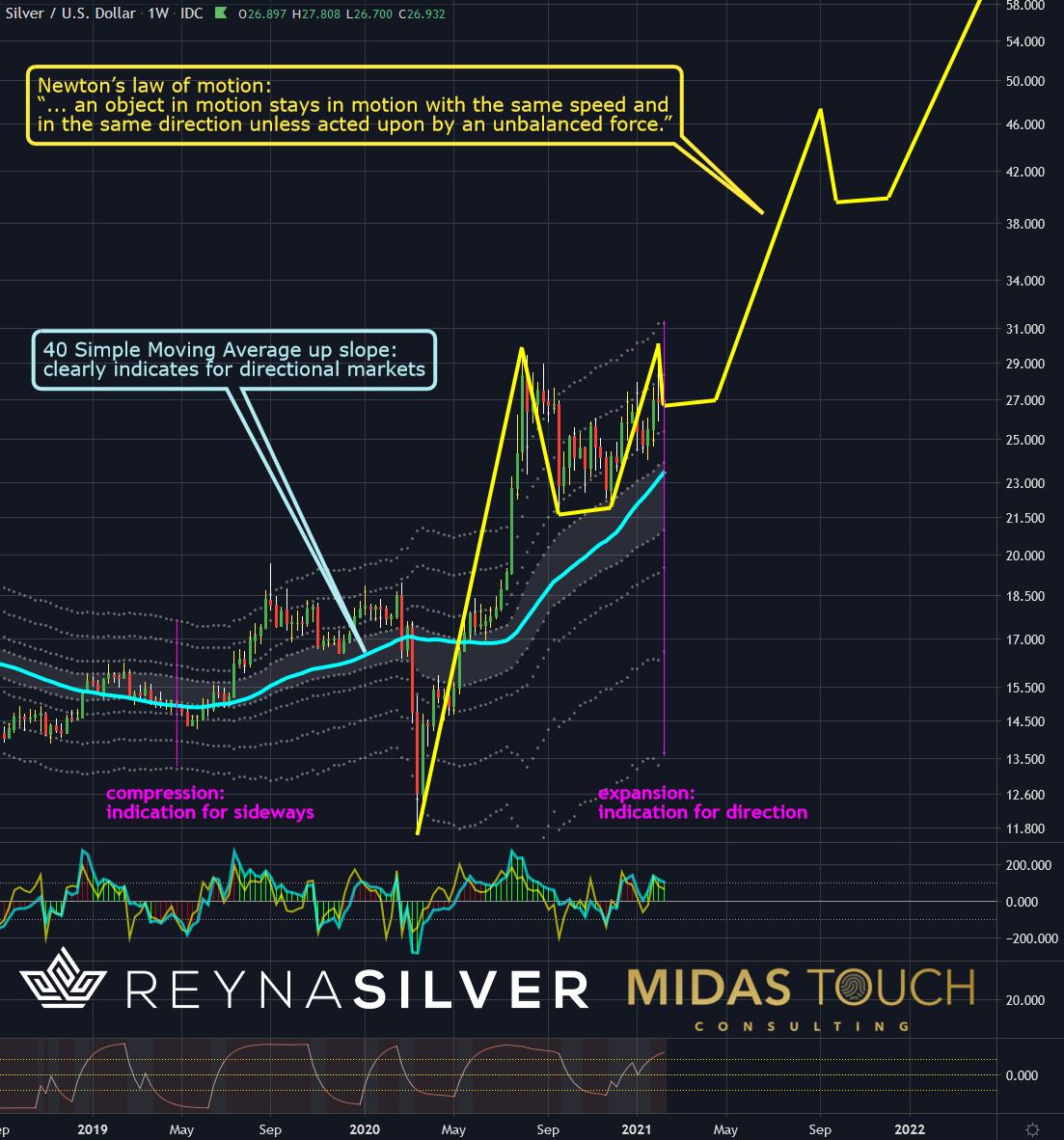

Weekly Chart of Silver, The trend is your friend:

Silver in US Dollar, weekly chart as of February 11th, 2021.

First and foremost, remove yourself from the noise. There is no need to read every news item. Turn those notifications on your phone off to not let media frequently trigger fear and uncertainty emotions within. Make a longer-term plan that excludes short-term uncertainties and, as such, escapes temporary exuberance hype. Once your mind has settled down, approach the market with a simple but sound wealth preservation strategy first and wealth creation second. It is much harder to make back what you already earned once lost.

Looking at the chart above, you find silver in an uptrend. Trend-following strategies are the most common and quite powerful.

Daily Chart of Silver, Silver protection against exuberance :

Silver in US Dollar, daily chart as of February 11th, 2021.

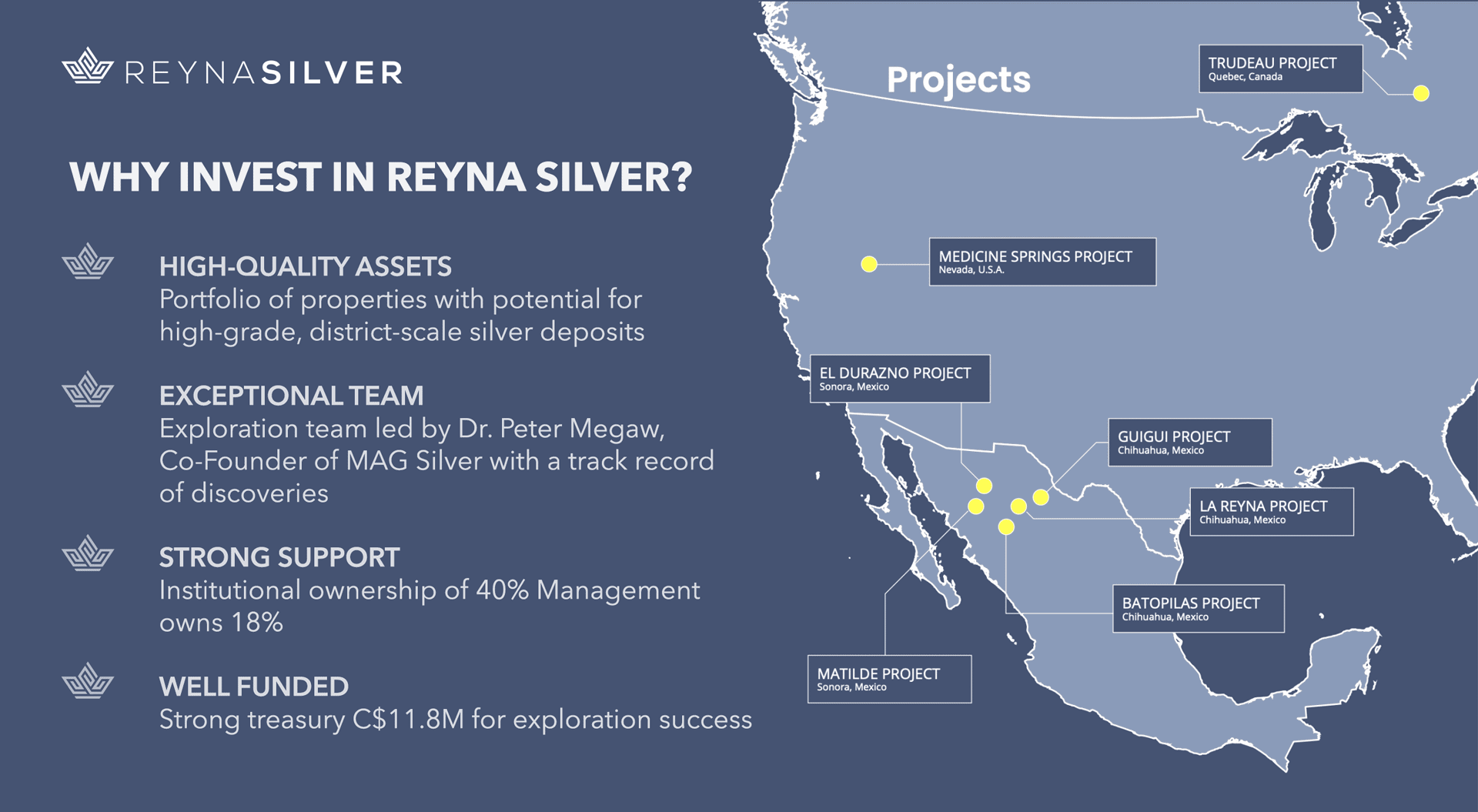

Next, we find physical silver holdings a lot more attractive than any other Silver investment derivatives. Yes, the physical Silver purchase’s actual price is much higher, as indicated in this chart versus the spot price. Since this phenomenon has persisted already for nearly a year and as such is a trend, it should only be interpreted that physical Silver is in higher demand than any holdings where your rewards are paid out in a fiat currency. After all, you want to have wealth preservation against fiat currencies since money printing is also in exuberance. So do not shy away from this factor in regards to the acquisition.

Weekly Chart of Silver, Price projection:

Silver in US Dollar, weekly chart as of February 11th, 2021.

We find there to be a fair chance that Silver spot prices might advance to the mid fifty range within this year. We would not be surprised for this trend to have a total of five legs reaching just short below three-digit numbers within the upcoming years.

Silver protection against exuberance

There are other ways to protect yourself, like Gold, for example. As much as we find Silver to be very attractive here, the most we care about is illustrating that a proactive stand with a quiet mind is an opportunity right now. Finding yourself shell shocked in hopes the overwhelm might settle and circumstances return to a familiar previous point in time is a dangerous one. We see multiple confirmations in the market that point towards a different future to unfold. Acting on a longer time frame to buy “insurance” for possible hyperinflation and other monetary threats could be a wise decision to ensure your nest egg.

Feel free to join us in our free Telegram channel for daily real time data and a great community.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.