Silver leading Gold

Having isolated Silver, Gold, and Bitcoin as the most reliable wealth preservation vehicles for a looming hyperinflation scenario, we consistently look for each of these three instruments’ advantages and disadvantages over their counterparties. One abnormality stands out, which lets us to believe that Silver might be outperforming Gold and providing for extra bang for your buck. Silver leading Gold.

We are not after maximizing profits when talking about wealth preservation where risk is the dominant factor of focus. Nevertheless, it might be fundamental reasons why Silver is gaining this momentum for this newly found abnormality in relative strength behavior that warrants stacking up on more physical holdings. And no one will be disappointed if wealth isn’t just preserved and stored properly but also see some potential massive gains as well.

Silver and Gold in US-Dollar, Monthly Chart, Smooth alignment:

Silver and Gold in US-Dollar, monthly chart as of April 8th, 2021.

If you follow the vertical lines along with over the last fifty years on the monthly chart above with the comparison of highs and lows in the Silver markets compared to the Gold market, you will find great alignment. Both metals have been for thousands of years a good store of value in coins, bars, and jewelry.

Silver and Gold in US-Dollar, Weekly Chart, Silver gaining momentum over Gold:

Silver and Gold in US-Dollar, weekly chart as of April 8th, 2021.

Zooming in on last year’s Gold and Silver behavior on a weekly percentage chart shows a divergence in this comparison of the precious metals. While highs and lows from last year’s March to August were still in unison, something changed beginning in November 2020. Silver is clearly showing strength over Gold.

The fundamental reasons supporting this strength can only be speculated on. The fact is that Silver is in high demand for solar cells, 5G cellular technology, electric vehicles, Semi-conductors, photography, anti-bacterial, and medicines, to only name a few.

Daily Chart, Silver in US-Dollar, Clearly directional:

Silver in US-Dollar, daily chart as of April 8th, 2021.

A glance at the daily chart of Silver over the last year, we can clearly identify through a linear regression channel that Silver is in directional motion. This provides a high probability of the continuation of these price advancements. We find physical ownership to be the preferred method to hedge your wealth against a monetary debasement.

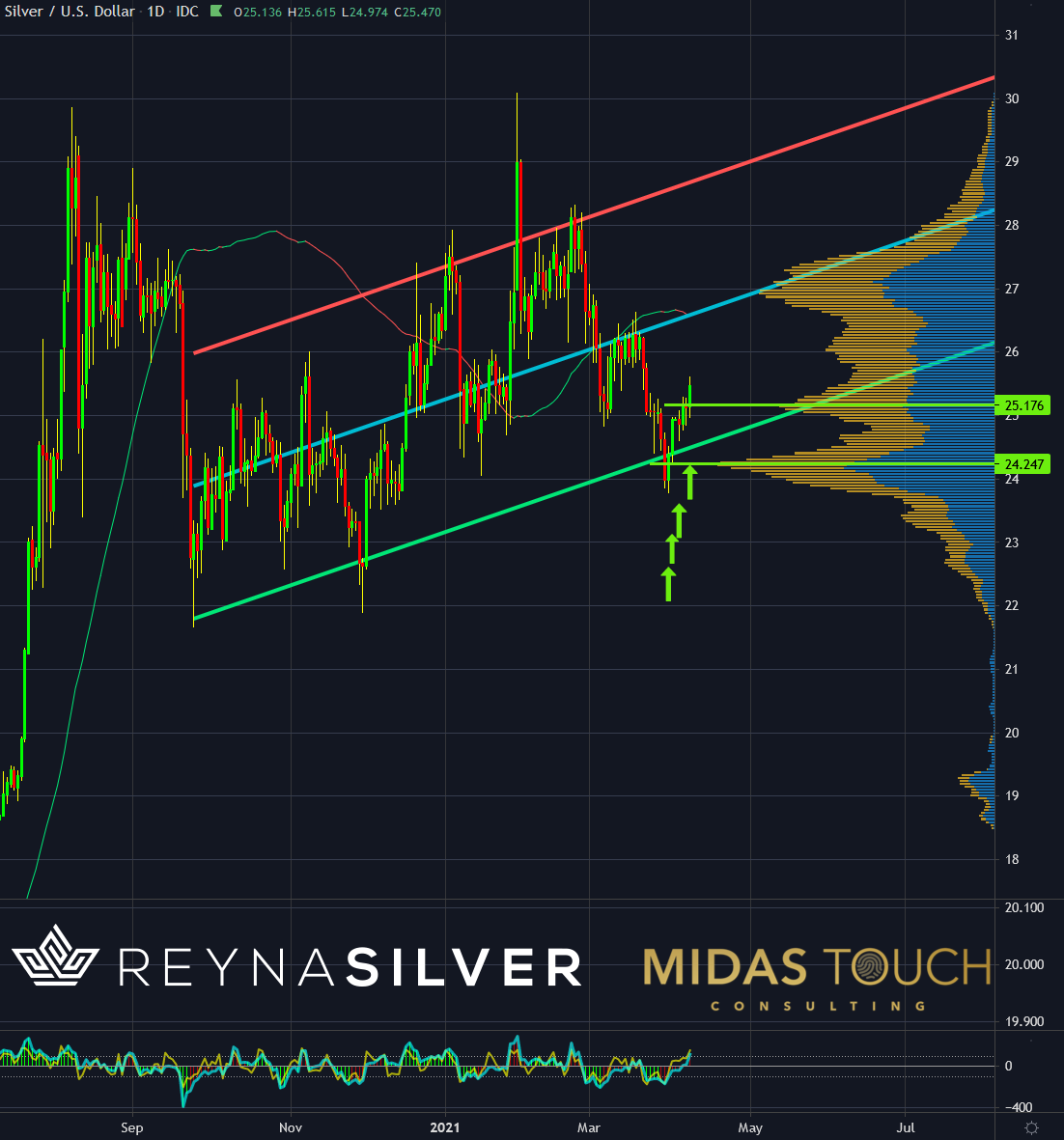

Silver in US-Dollar, Daily Chart, Multiple long entries with support:

Silver in US-Dollar, daily chart as of April 8th, 2021.

Let us now zoom further in on the daily chart of Silver over the last seven months. One can see that direction is also evident in the recent period of an overall sideways zone for Silver. A string of higher lows made us aggressively take entries within the last eight trading sessions. We use a Quad exit strategy and, as such, took partial profits already to eliminate risk. All trade entries and exits were posted in real-time in our free Telegram channel. The last bottom on Silver is now confirmed. Strong support at US$24.25 and US$25.18 based on transaction volume analysis is present. We find this to be a solid point in time to add to physical Silver holdings.

Let the gap between the spot price and the actual physical acquisition price not discourage you. This gap has been persistent for twelve months already. This is only another confirmation of how much the metal is sought after.

Silver leading Gold:

It is hard to say why Silver is coming so much to the forefront. Two facts are very attractive in our mind. One is divisibility. A Gold coin, if advancing vastly, will be a hard item to barter with since the smallest units are still very expensive. Gold as such is impracticable for making smaller size purchases. Silver is priced much lower. Secondly, Gold has a history of confiscation from private hands in turmoiled times. The likelihood of Silver being declared illegal is much lower due to its various daily applications. Should, as we expect, Silver outperform Gold in this bull market, you might just find yourself in a scenario of “have your cake and eat it too.”

Feel free to join us in our free Telegram channel for daily real time data and a great community.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.