Silver – Questionable relative strength

The financial markets are firmly in the stranglehold of the bears. Obviously, precious metal prices can not escape this. While in midsummer a respectable sector-wide recovery succeeded, gold and silver prices came under severe pressure since August 15th, while stock markets started to tumble again. Silver – Questionable relative strength.

Starting from a new 20-month low at 17.55 USD on September 1st, however, silver has shown surprising “relative strength”. Thus, closing the week at 19.56 USD, just slightly below the round psychological level of 20 USD, a plus of nearly 11% since the beginning of the month is on the books. Yet, it is quite possible that this relative strength is only a temporary phenomenon. While the silver bulls are trying to break above the downward trend line established since April, gold has been breaking below its crucial support around 1,680 USD as expected. Should gold’s weakness continue, the relative strength in silver will probably evaporate again quickly.

Silver longterm sentiment as of September 15th, 2022. ©Midas Touch Consulting

In the big picture, silver has not been able to get on its feet for years. The last run towards the all-time high around 50 USD happened 11.5 years ago. And since the last high of just under 27 USD in early March, silver had lost almost 35% by the end of August. At the same time, the silver market is very oversold and the bombed-out market situation is basically providing a contrarian opportunity. Sentiment is down and most speculators have thrown in the towel. The remaining price risk on the downside should therefore be not too big. Hence, if bears will remain in control, their progress on the downside will only happen slowly and tenaciously.

Unfavorable outlook until the FED will pivot

Overall and in view of the current liquidity crisis in financial markets, the outlook for silver remains very unfavorable in the short to medium term. Everything now revolves around the question of how much more the U.S. Federal Reserve will raise interest rates and how great the resulting damage to the financial markets and the real economy will actually be.

As dollar liquidity dries up, so will markets, economies and lifestyles. Remember: All market crises are, at root, just liquidity crises.

The reversal/pivot of this restrictive central bank policy will only come once credit markets or a major financial institution start to falter. Depending on how quickly the situation worsens, the U.S. Federal Reserve will probably be forced to make a dramatic change of course within the next 6 to 12 months.. Then precious metal prices will be able to profit massively from the foreseeable new money printing orgy. Until then, patience, calmness and a high liquidity position (preferably in US dollars and Swiss francs) must be maintained. A contrarian but gradual physical accumulation into the falling precious metal prices is also highly reasonable.

Silver price in US-Dollar, daily chart – Just a flash in the pan or a bullish flag?

Silver in US-Dollar, daily chart as of September 19th, 2022. ©Midas Touch Consulting

From a fresh 20-month low at 17.55 USD, silver was able to recover by a significant 14% within just two weeks. Currently, this steep countermovement is potentially being consolidated in the form of a bullish flag right at the downtrend line of recent months. In view of the new sell signal by the stochastic oscillator as well as the strong resistance in the form of the upper Bollinger Band (20.01 USD), silver’s price action should, however, be better classified as a kind of flash in the pan for the time being. Only when the silver bulls sustainably recapture the 20 USD level, further targets on the upside will be unlocked. Those would be the next downtrend line around 21.10 USD as well as the falling 200-day moving average (22.11 USD).

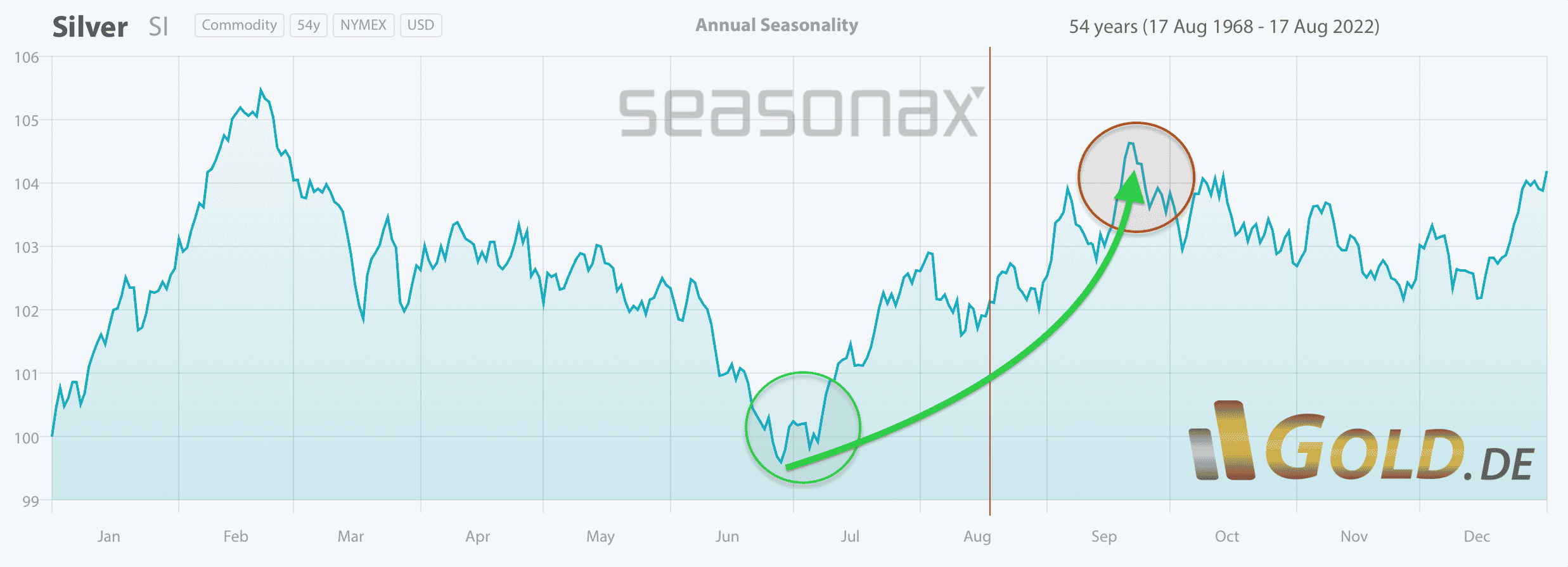

At the same time, the favorable seasonal window is now closing and statistically, silver should remain under pressure until mid-December.

In summary, silver has been surprising with some relative strength. In view of the difficult overall situation, its is questionable whether more can develop from this. Obviously, only time will tell, but sharp recovery moves are typical in a bear market. And without a firmer gold price, silver will certainly struggle again. In the long term, there is no way around the precious metals. Hence, weak prices provide further good entry opportunities. However, an overly aggressive positioning is currently not making any sense. For this, the financial markets and also the precious metal prices are too deep in a correction and bear market.

Next buying opportunity for Silver in Euro below 18,00 EUR

Our last buy limit of 18.75 EUR allowed us to catch silver at very favorable beaten down prices in August and early September. Currently, silver is trading at 19.40 USD. Given our analysis, we believe the next buy limit should be placed below 18.00 EUR.

Analysis initially published on September, 15th, 2022, by www.gold.de. Translated into English and partially updated on September, 19th, 2022.

Feel free to join us in our free Telegram channel for daily real time data and a great community. If you like to get regular updates on our gold model, precious metals and cryptocurrencies, you can also subscribe to our free newsletter.

Disclosure: This article and the content are for informational purposes only and do not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. The views, thoughts, and opinions expressed here are the author’s alone. They do not necessarily reflect or represent the views and opinions of Midas Touch Consulting.