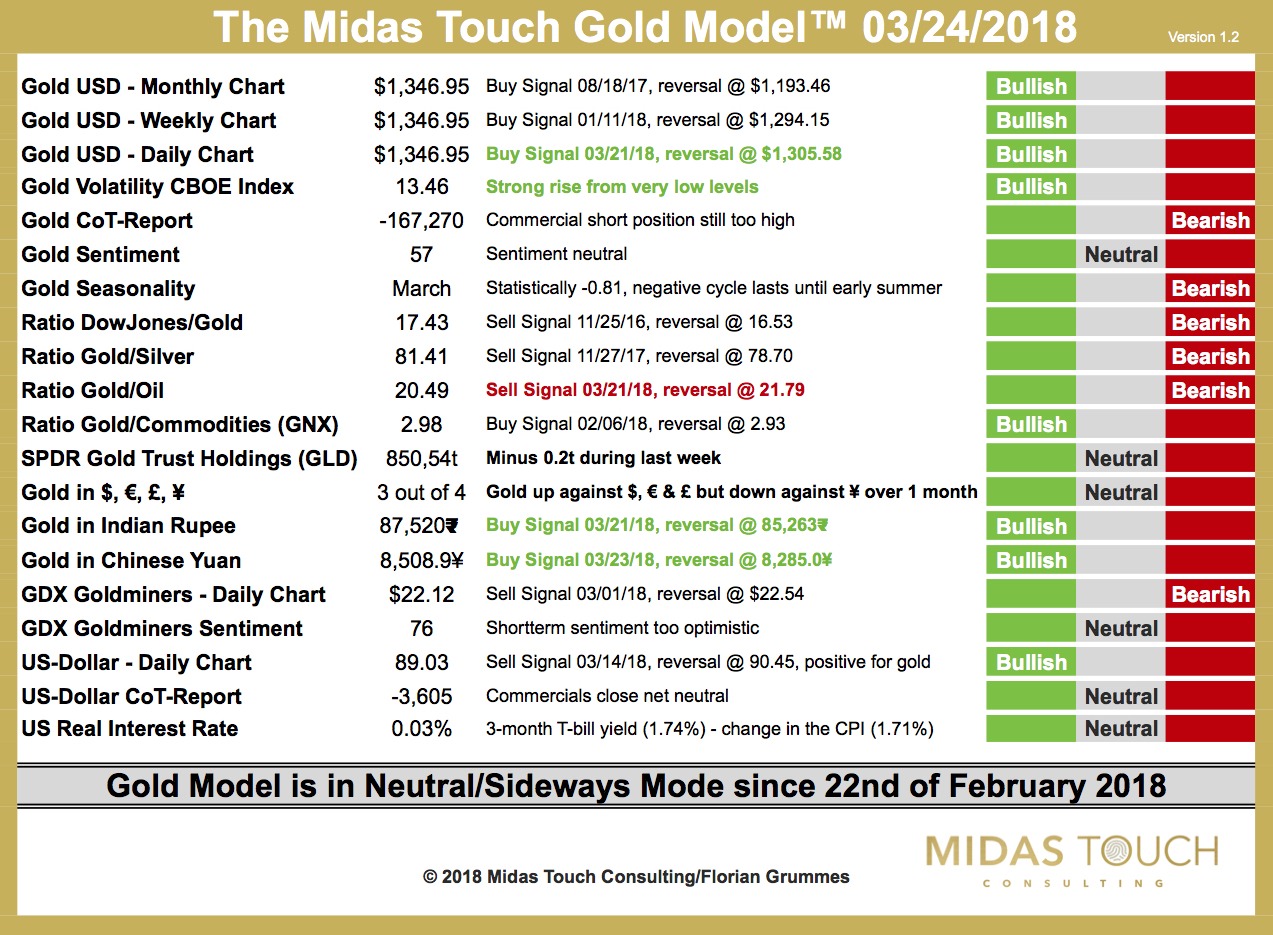

The Midas Touch Gold Model™ is in neutral mode since 22nd of February 2018!

Gold had a very strong week and was able to rally up to 1,350 USD. The weekly close came in at 1,346.95 USD. Most commentators think that a potential trade war between the U.S. and China is the reason for gold´s strength. If that´s the case, the trade war issue won’t be solved anytime soon and could, therefore, push gold prices against the seasonal cycle much higher.

During last week our Midas Touch Gold Model™ registered a couple of significant signal changes but its conclusion remains the same! Of course, the strong rally led to a new buy signal on the daily chart for gold. As well, the exploding volatility in direction of the price move is bullish. Two more new buy signals are coming from gold in Indian Rupee and Chinese Yuan.

The SPDR Gold Trust holdings ETF “GLD” and an indicator that tracks the gold price against the four major currencies $, €, £ and ¥ have both moved to neutral readings. The only new bearish signal comes from the ratio gold against oil!

All in all, our Midas Touch Gold Model™ remains still at a neutral conclusion. On top, you will find gold being overbought on the daily, the 4hour and the 1hour chart. So for anybody who is afraid to miss the gold train, our strong advice is to wait at least for some form of a pullback!

The technical picture certainly has improved and gold is already showing strength since a couple of weeks as prices did not want to retreat below the strong support at 1,305 USD. As well, in the bigger picture gold is now testing the neckline of its multi-month ascending triangle. A clear breakout above the massive resistance around 1,350 – 1,375 USD would certainly be very bullish and would activate a rally towards 1,500 – 1,530 USD. But should gold fail at current levels in the next one or two weeks we finally might get the typical pullback in spring.