The Midas Touch Gold Model™ is in neutral mode since 22nd of February 2018!

Generally speaking, Gold is acting pretty constructive and just posted a strong bounce from oversold levels around 1,322 USD towards 1,344 USD within just one trading day. But the Midas Touch Gold Model™ remains neutral. And this neutral conclusion of our systematic model hasn’t changed since late February! Neutral means sideways or no clear trend! In fact, Gold is moving between 1,305 USD and 1,365 USD since the beginning of the year…

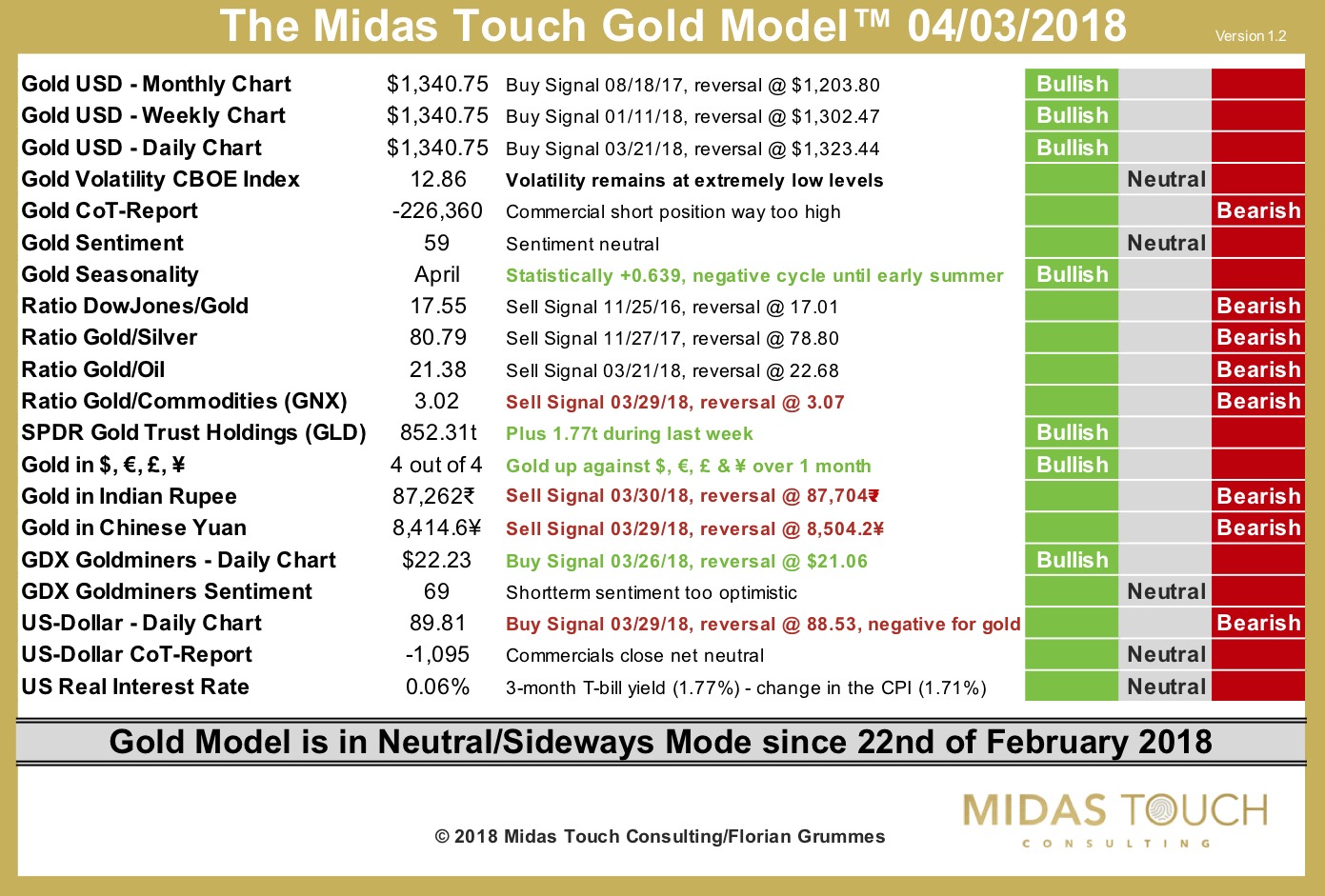

While the monthly, weekly and daily chart in USD all remain bullish, the extremely low volatility is back to a neutral reading as its upthrust did not continue over the last 6 trading days. Note that the daily chart for gold will now turn bearish below 1,323 USD!

But with the new months of April we temporarily have a green signal coming from the seasonal pattern. This changes rather soon but early April usually sees gold posting a little rally. As well we have a new but soft bullish signal coming from SPDR Gold Trust holdings ETF “GLD” which saw 1.77t of gold flowing into their inventories. Further more, Gold now is up against all four major currencies $, €, £ and ¥ over one month. Finally the Goldminers ETF “GDX” is now on a buy signal.

On the negative side the gold/commodities-ratio has flipped towards bearish. Interestingly and also worrisome are the new sell signals for Gold in Indian Rupee and Chinese Yuan. This clearly shows that the ongoing rally in Gold in USD is not really sustainable or was especially due to a weaker US-Dollar. But as the US-Dollar is back on a buy signal since last Thursday negative consequences for gold and the precious metals sector might just wait around the corner.

A pretty positive development, which is not yet visible in the model, is the continuing improvement in the DowJones/Gold-Ratio! It does not take much more strength in gold and weakness in the DowJones Index to finally (after a very long time!) flip the ratio in favor of gold and therefore against the general stockmarket. This of course would be a very positive development for gold.

All in all, our Midas Touch Gold Model™ remains at a neutral conclusion and in the light of the significantly worsened CoT-Report we continue to expect a rather muted or bearish development over the next two to three months. We are patiently waiting for gold to become oversold on its daily and weekly chart again to initiate aggressive long positions. This will probably become possible somewhere in June or July as the seasonal pattern usually provides an excellent contrarian buying opportunity in early summer. Until then we are not going to chase this market.