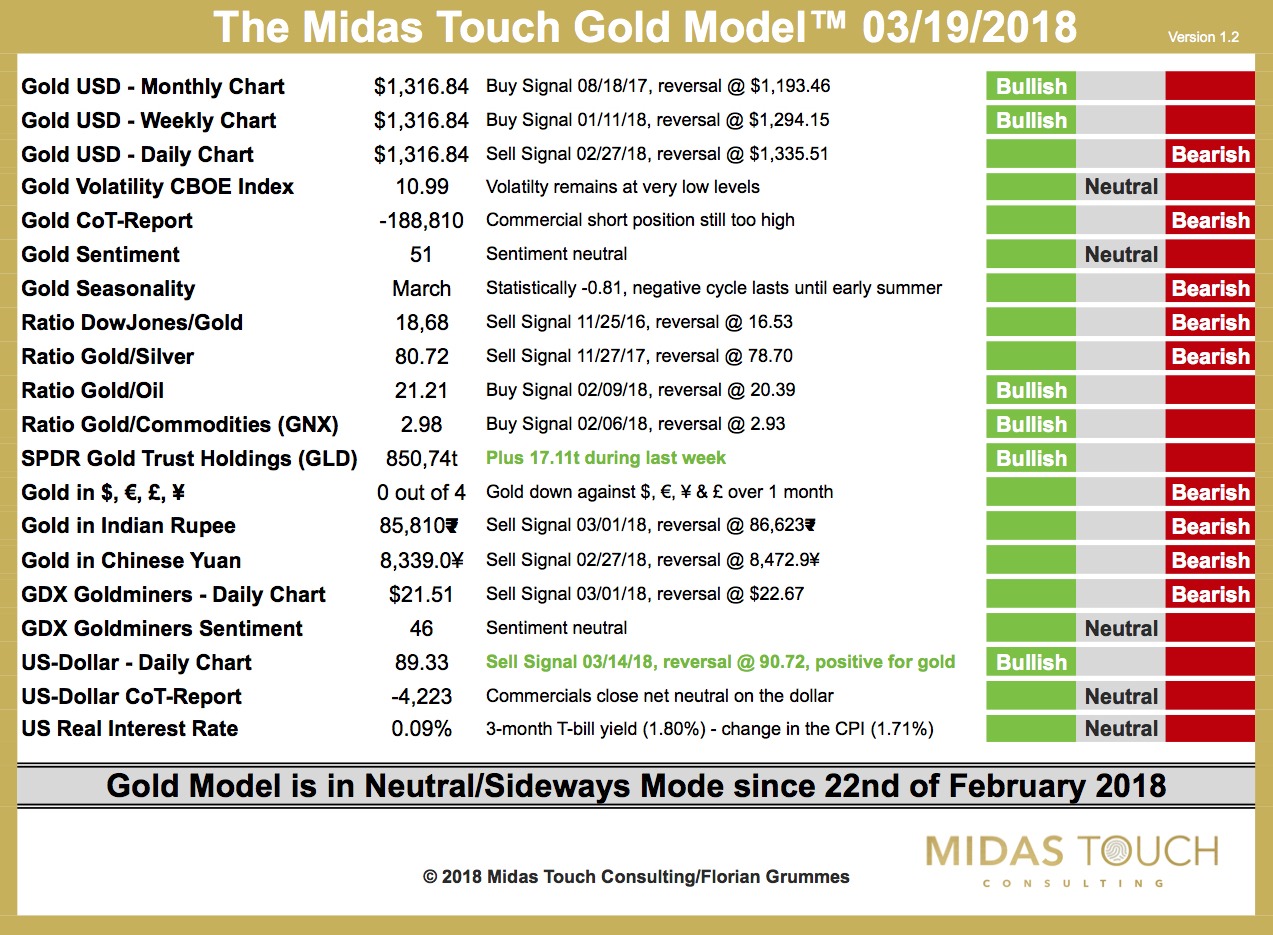

The Midas Touch Gold Model™ is in neutral mode since 22nd of February 2018!

While gold prices fell back into the important support zone between 1,300 USD and 1,310 USD over the last two trading sessions, the Midas Touch Gold Model™ remains in neutral mode. But contrary to recent price action two signals have improved since our last public update.

One new “green signal” comes from SPDR Gold Trust holdings ETF “GLD” which reported inflows of over 17 tones during last week. This without a doubt is a bullish number as the fund’s inventory has been hovering around 820t – 830t over the last two months. The second new bullish signal is due to renewed US-Dollar weakness.

All other parts of the Midas Touch Gold Model™ remain at the same outcome. Note that it now takes “only” a move below 1,295 USD to shift the weekly chart to a bearish reading. Our main expectation continues that gold will move below 1,300 USD soon or later over the next couple of weeks.

All in all the Midas Touch Gold Model™ remains in neutral/sideways mode, which fits very well to the typical stiff seasonal pattern in March and April.