All alone with bitcoin

The vast majority of market participants provide for the money inflow. The few who have mastered market play, extract it. While typically in other professions as challenging as trading, one works within a big team that supports your actions. In trading, you are all alone. Competing at such levels demands expertise, discipline, and skill in various fields to stay competitive. Again no coach, no support. Trades can easily be as devastating at the moment as losing a job. While you lose a job maximum of a few times in life, losing trades are the norm for a successful trader. In other words, the challenges are enormous. The support is absent. Responsibility is as high as securing a future for your family. Indeed, difficult to fess up to your spouse about how much you lost on your last losing trade. In other words, circumstances for market plays are extraordinary and require a unique talent to take self-responsibility to survive this game intact. All alone with bitcoin.

With this psychological burden, you want to stack your odds as good as possible to gain an edge for balance. Bitcoin provides such advantages. The inherent volatility allows for follow-through after an entry. In other words, one gets good risk/reward-ratios in midterm plays on bitcoin. Also, necessary for the long-term time frame player since hodling has another psychological hurdle that piled on top can be devastating. You won’t find many traders who bought a bundle of bitcoin when it traded at a dollar and are still holding it without ever having sold or rebought some.

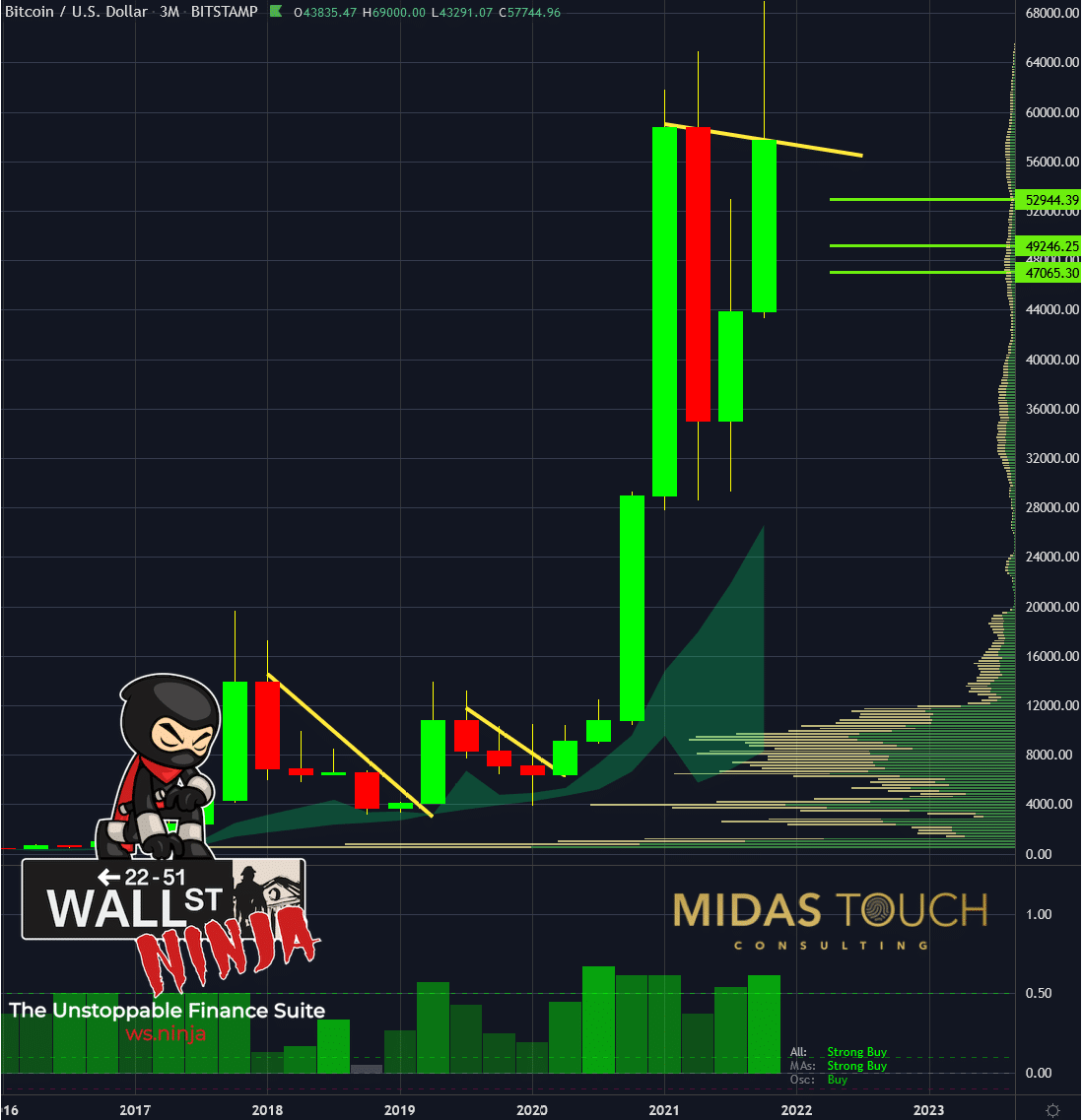

BTC in US-Dollar, Quarterly Chart, the Doji explosion:

Bitcoin in US-Dollar, Quarterly chart as of November 23rd, 2021.

The quarterly chart of bitcoin shows how explosive moves to the upside can be. If you look at the yellow lines, you will see that a small Doji builds after a retracement, and then prices explode within the next quarter like rockets. This trading behavior provides for sensational risk/reward-ratios.

The quarterly chart shows a bullish quarter. Even though all-time highs have been rejected, we see the year ending on a bullish note.

The great thing about this self-directed profession, on the other hand, is that you get all the credit. Work directly translates into money, without the typical step in between, selling a product or a service. If you are good at what you are doing in the trading/investing arena, rewards can be more than plentiful. No gift baskets need to be sent to a boss or coworker. True rewards for arduous work to yourself. A very self-fulfilling profession indeed.

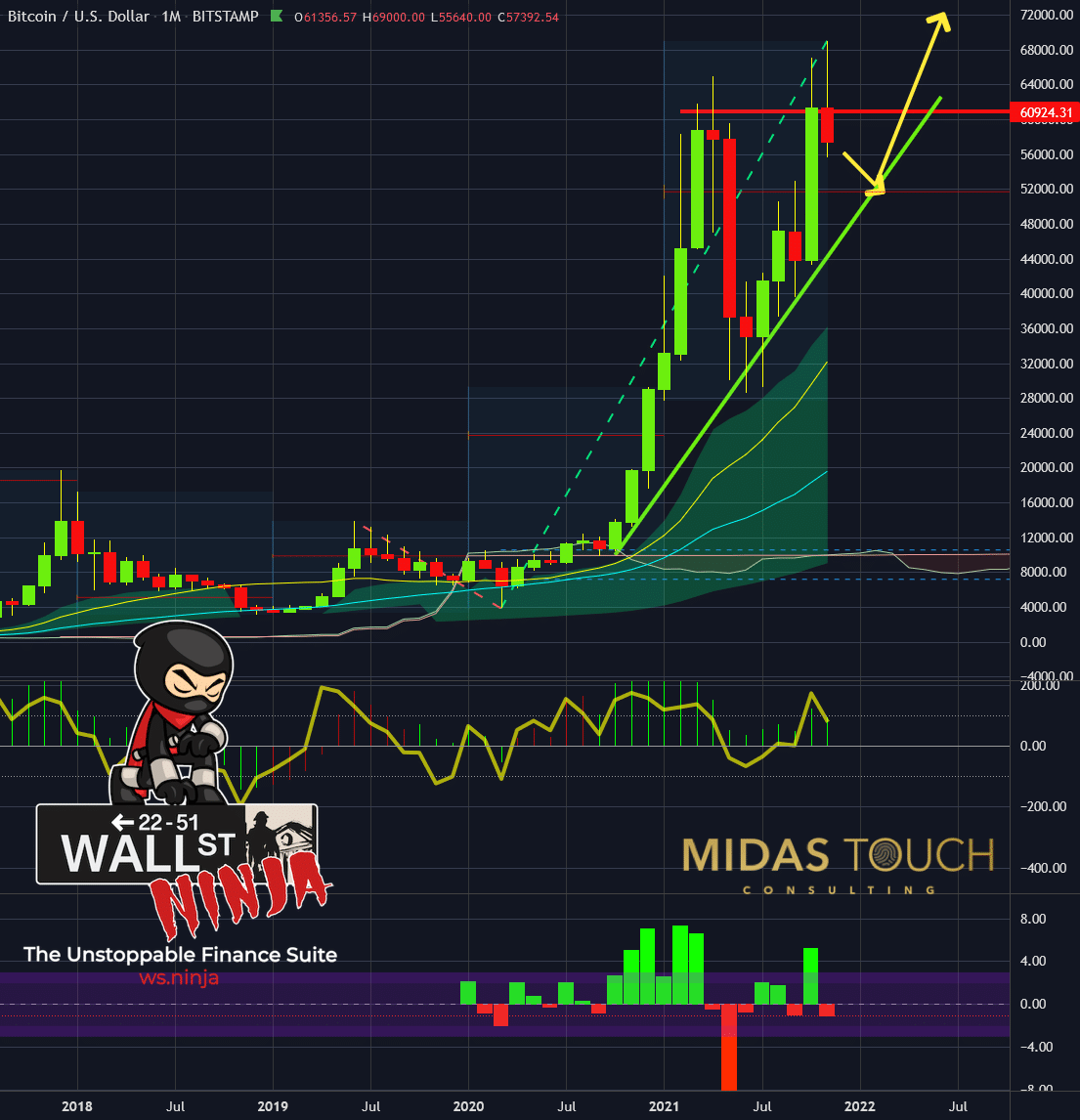

BTC in US-Dollar, Monthly Chart, most often trending:

Bitcoin in US-Dollar, Monthly chart as of November 23rd, 2021.

The monthly chart illustrates the steepness of the trend, and yellow lines provide a possible long reload opportunity, which will take all-time highs out next year.

Another benefit for individual traders choosing to trade bitcoin is its unique personality of trending much more than most trading instruments. This unique feature adds a massive edge to a trader’s trading arsenal.

BTC in US-Dollar, Weekly Chart, freeing investment capital fast:

Bitcoin in US-Dollar, weekly chart as of November 23rd, 2021.

But this isn’t all. From a trading perspective, bitcoin supports the unsupported individual in comparison to gold or silver as alternate wealth preservation tools due to its speed. Risk is the most defining aspect for a trader, and consequently, capital exposure time is the most crucial aspect. After all, the longer money is in the market, the more exposed it is, let’s say, to unexpected news and six sigma events. Market money parked cannot produce elsewhere and is also emotionally draining. No such thing in bitcoin.

A look at the weekly time frame illustrates what we mean by this. It took less than eight weeks for bitcoin to gain staggering percentage moves within the first and second leg in this steep regression channel up. We also just entered a low-risk entry zone again for a third leg to mature.

In short, you are all alone with bitcoin, but at least you picked the most ideal alliance with this trading vehicle to stack the odds in your favor.

All alone with bitcoin:

The business of market play is unique. You’re not learning this skill in school, mentors are hard to come by, and it isn’t a group sport. It is advisable to seek out a community of like-minded traders like our free telegram channel, since spouses rarely can comprehend the steepness of the learning curve and the challenges of constant self-reflection and pain until the consistency is mastered.

While one typically can team up and is supported within a group at the mastery level required, it’s a solo sport in trading.

Statistics support that the likeliest reason for failure in this business is underestimating the time required to acquire all the important skills necessary for success. New traders run either out of money or patience.

The press makes it look so easy, and the fact that all one needs to do is press a button doesn’t help towards a more respectful attitude. Yet, the mere truth is that it is one of the most demanding businesses to find oneself into.

Feel free to join us in our free Telegram channel for daily real time data and a great community. If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. The views, thoughts and opinions expressed here are the author’s alone. They do not necessarily reflect or represent the views and opinions of Midas Touch Consulting.