Silver, shrugging off attacks

The list is long of arguments why silver prices haven’t advanced further yet or might never take off. Market manipulation is one of them. While there is evidence that markets have always been manipulated, prices have eventually reached appropriate price levels. Another recent attack is a news item claiming bitcoin to replace gold as an inflationary hedge tool, which in turn would have a substantial effect on silver. The market cap of all digital currencies is at US$3 trillion, and the one of gold is US$11.7 trillion. In a US$615 trillion market cap world, gold and bitcoin are a tiny niche. They can coexist with their relatively small size and their intrinsically different usefulness, primarily through performing various functions. Silver, shrugging off attacks.

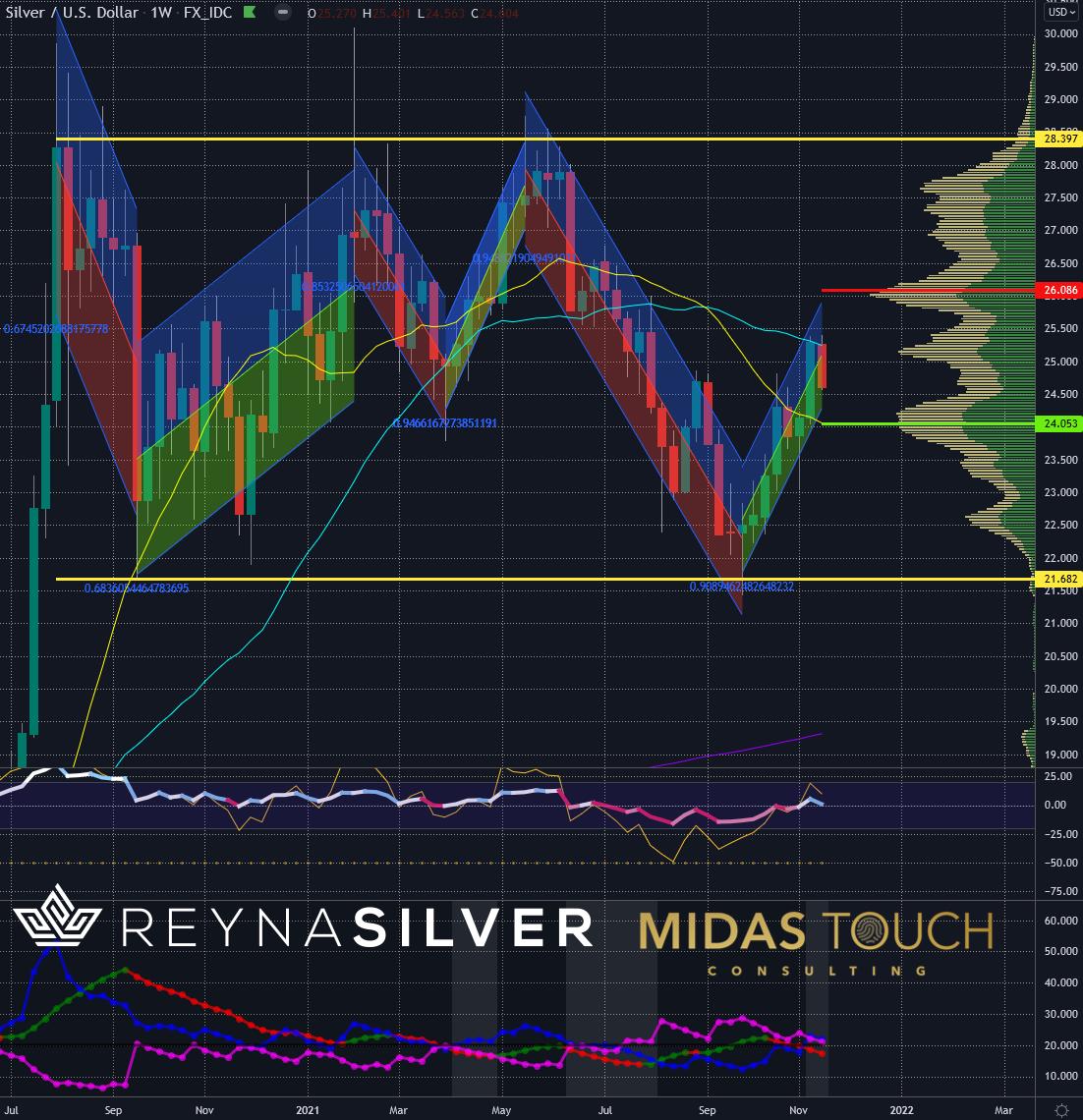

Weekly chart, Silver in US-Dollar, strong along gold:

Silver in US-Dollar, weekly chart as of November 20th, 2021.

The weekly chart illustrates price behavior over the last 15 months. Silver prices are trading near the center of the sideways range.

Gold in US-Dollar, weekly chart, rumors shrugged off:

Gold in US-Dollar, weekly chart as of November 20th, 2021.

The weekly chart of gold isn’t much different from where prices stand. In short, there is no evidence that gold has lost its luster. Otherwise, we would see silver trading in a relationship much lower. Rumors are just that – rumors! Silver is shrugging them off.

Silver in US-Dollar, quarterly chart, room to go:

Silver in US-Dollar, quarterly chart as of November 20th, 2021.

A historical review with a quarterly chart over the last eighteen years reveals that silver prices can sustain extreme extensions from the mean (yellow line) for extended periods. Using the extreme of the second quarter in 2011 as a projective measurement (orange vertical line) for an upcoming target would provide for a price target more than 10% above all-time highs at US$56.

In addition, the chart shows that we find ourselves in a strong quarter so far, which is in alignment with cyclical probabilities.

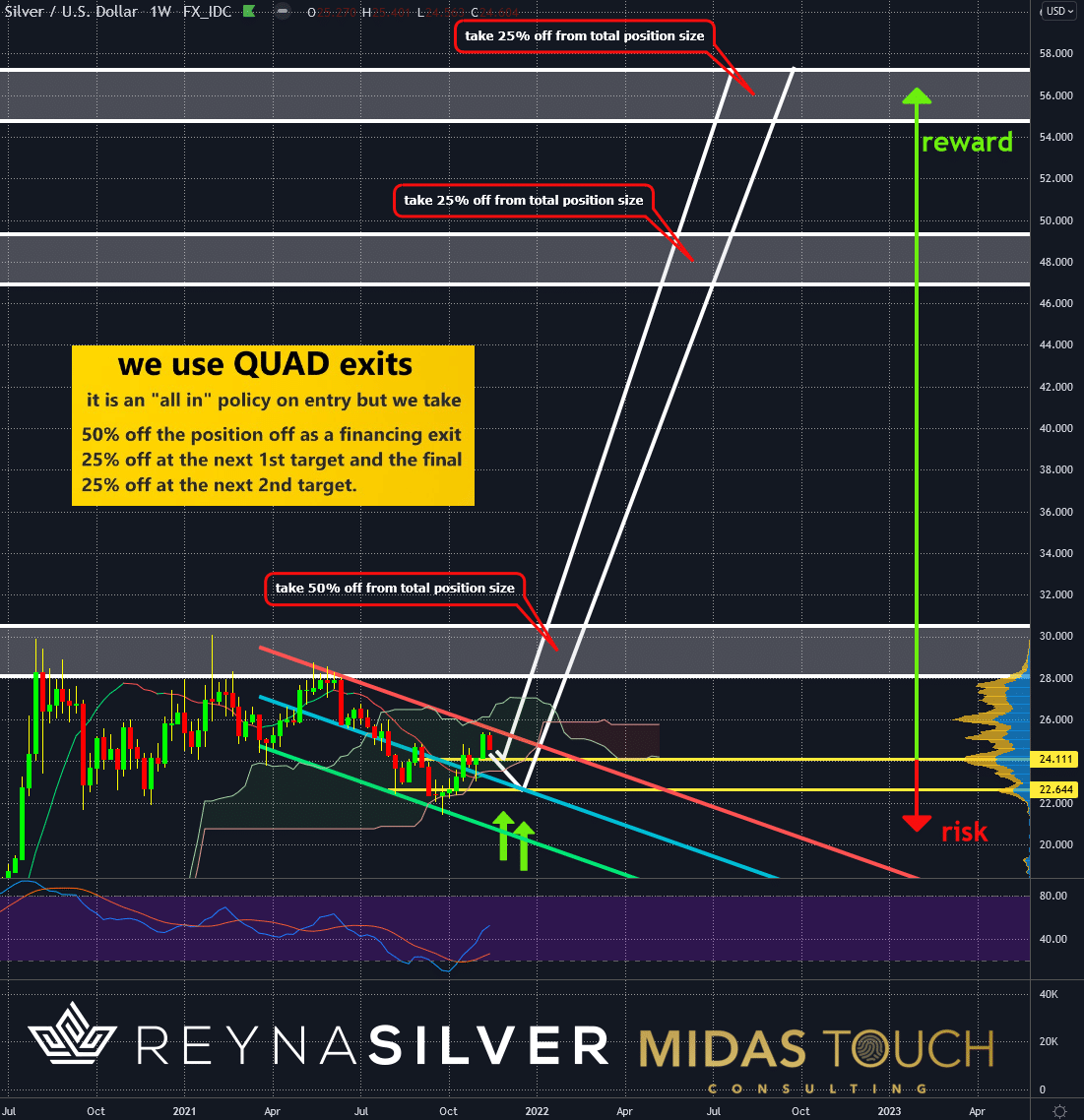

Silver in US-Dollar, weekly chart, prepping the play:

Silver in US-Dollar, weekly chart as of November 20th, 2021. Trade setup

Let us return to the weekly time frame for a possible low-risk entry scenario with this target in mind.

We find a supply zone based on fractal transactional volume analysis near the price of US$24.11 and US$22.65. Both attractive entry zones for excellent risk/reward-ratio plays.

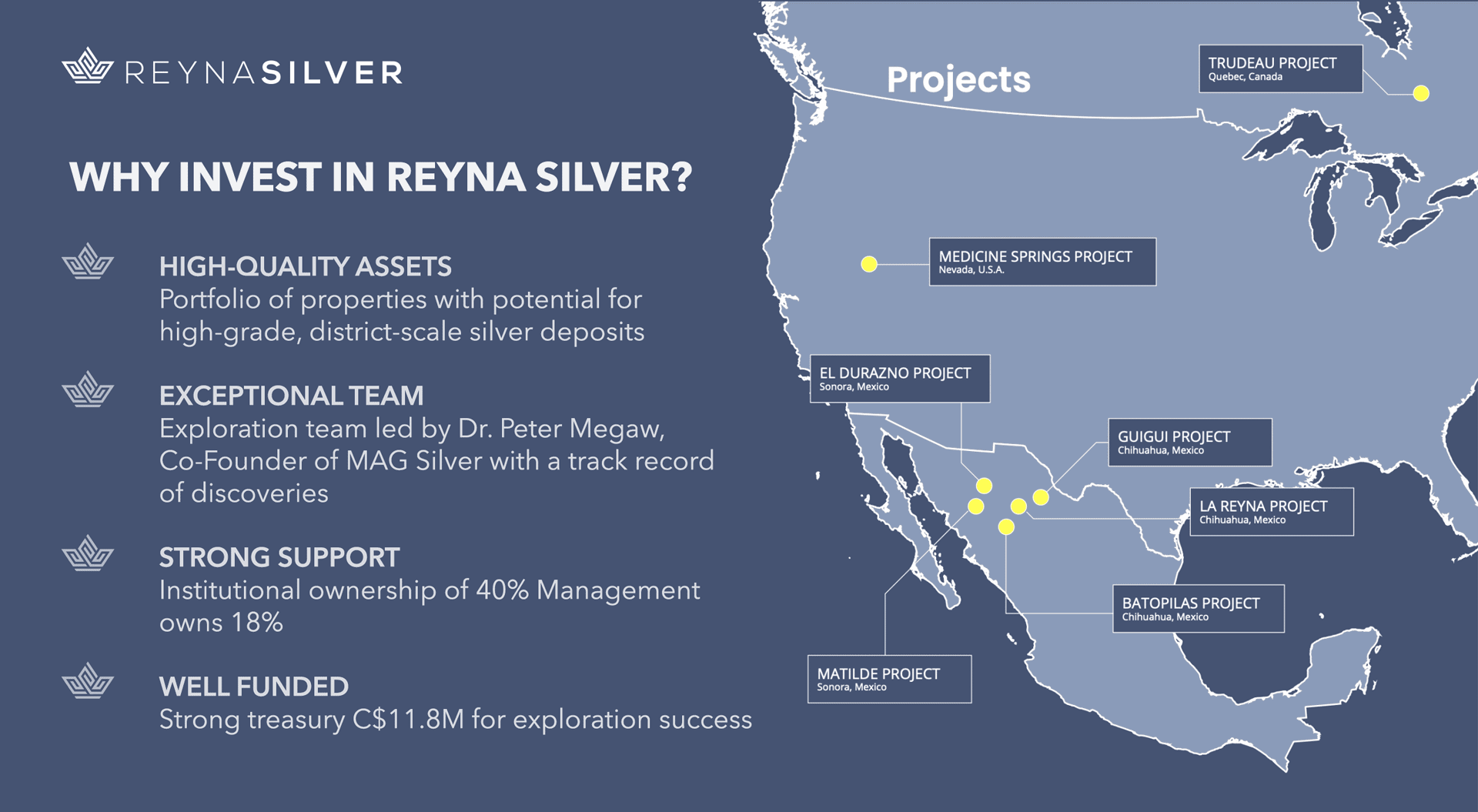

Phase 1 drilling program at Guigui discovered not only the largest intrusive ever found in the district, but it’s the first mineralized skarn ever seen in Guigui!

Silver, shrugging off attacks:

It will not be rumors, doubts, and speculations that will be the catalyst for silvers’ success or failure. It isn’t a question of “if,” but just a question of “when” we will see the next massive price advance in this precious metal. The odds are stacked too much in favor of a continued price movement up that the long-term investor should let doubts allow for diverging from a splendid opportunity to partake in wealth preservation and a very profitable way to participate in a chance rarely presented this prominent.

Feel free to join us in our free Telegram channel for daily real time data and a great community. If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can also subscribe to our free newsletter.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. The views, thoughts and opinions expressed here are the author’s alone. They do not necessarily reflect or represent the views and opinions of Midas Touch Consulting.