The WHY is killing it

Trading is a complex endeavor because it has so many moving parts. The higher the degree of variability the more we feel the need to control things. Science as a good example shows, that each time when things have a high degree of variability, it needs to surrender. The reason behind this dilemma is that science aims at simplicity. It wants one-sentence answers that rationalize a whole process. When we start on a trading adventure we come with a strong belief of: “I can do this”. Quickly many answers are found but after a few years and money lost we try to harness the frustrations with a need to ask for why’s. This is when things start to go really wrong. A hope of a holy grail, a one-sentence answer, is futile. The WHY is killing it.

When reaching this moment of despair, go back to holding on to your belief. Do not aim to find rhyme or reason within markets with a scientific mind. Ask quality questions to find solutions but build upon a framework of trusting to solve the puzzle with an open mind and a belief of worthiness and an attitude: “whatever works”.

The next few weeks..

The next few weeks will be unusually “loud”. The ego will scream for answers. Who will be president? Will the election be contested? How much money will the government be printing? Will we have deflation, inflation, hyperinflation… And typically when overwhelm sets in, one just pics near randomly a scenario to shut this inner voice up – at least temporarily. Nothing like this can be conducive to proper trade planning and management.

You are not in the business to be right you are in the business to make money.

Charts include all of this data. All speculators make their bets and have an opinion projected with money on the line. Your job is only to keep risk at bay and look for scenarios matching your entry criteria. We need only to be looking at three possible scenarios: Are markets trading

- sideways?

- directional long?

- directional short?

If high volatility should set in, the most important aspect is stepping up in time frame to not get caught in day to day choppy price action.

Range trading (sideways) is less attractive since stop levels are often taken out. Consequently refraining from trading is wise and if one aims to participate you want to reduce the size and allow for more room on your stop levels.

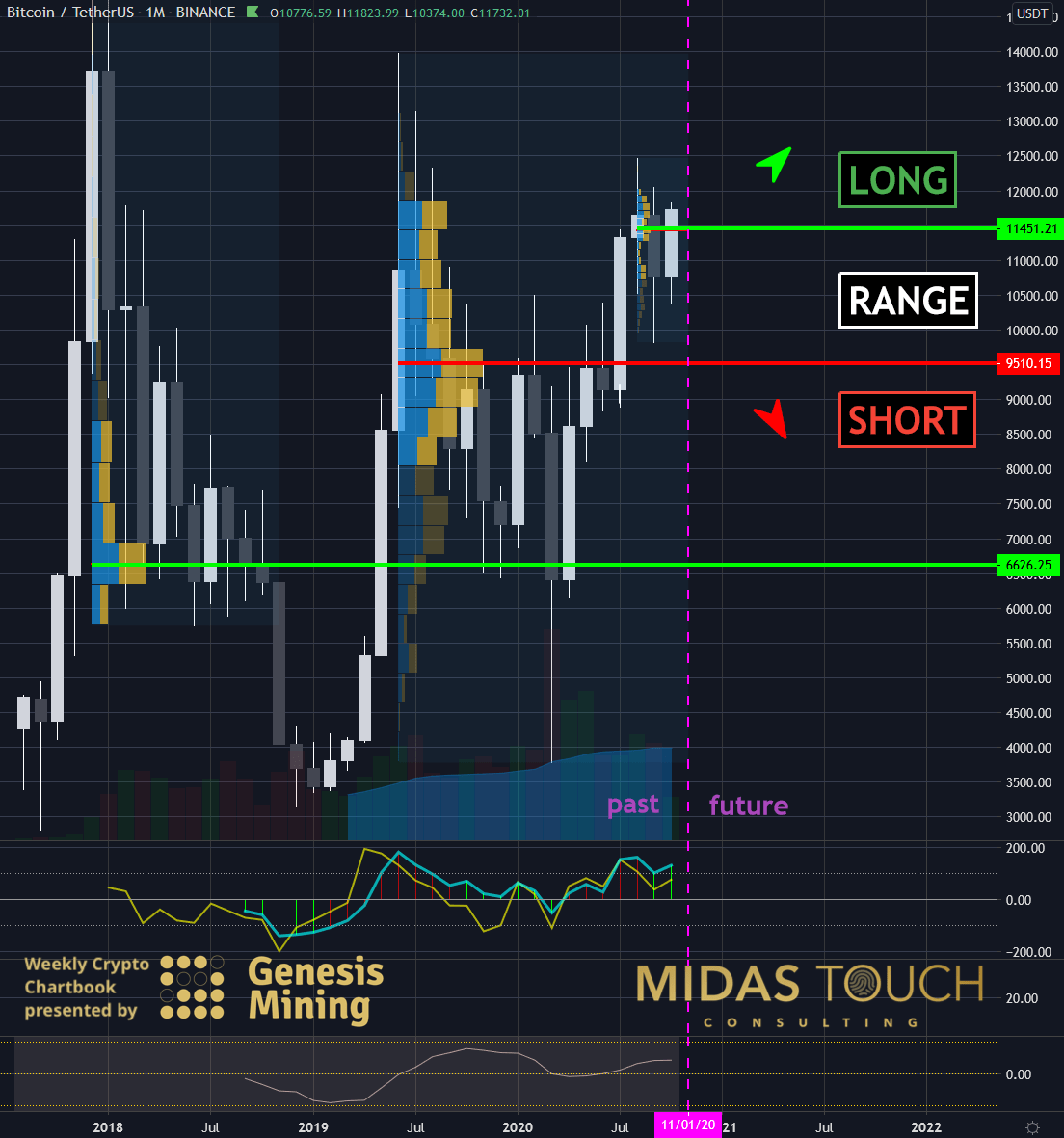

BTC-USDT, Monthly Chart, The WHY is killing it, plan ahead:

BTC-USDT, monthly chart as of October 20th, 2020

From a monthly trade frame volume analysis perspective, significant levels are US$11,451, US$9,510 and US$6,626. Above US$11,451 we consider markets to be long and we will hold our runners (see our quad exit strategy) from lower levels and take additional low-risk long entries. Below US$9,510 we will reduce exposed capital to the Bitcoin market and watch for a bottom building to initiate new larger long-term core positions. In the range in between these two levels we will stay put from a long term perspective in regards to opening new positions. Should we experience a temporary market crash that would drag the Bitcoin market alongside to more extreme lower levels due to margin calls, we would aggressively initiate long plays near the US$6,626 level.

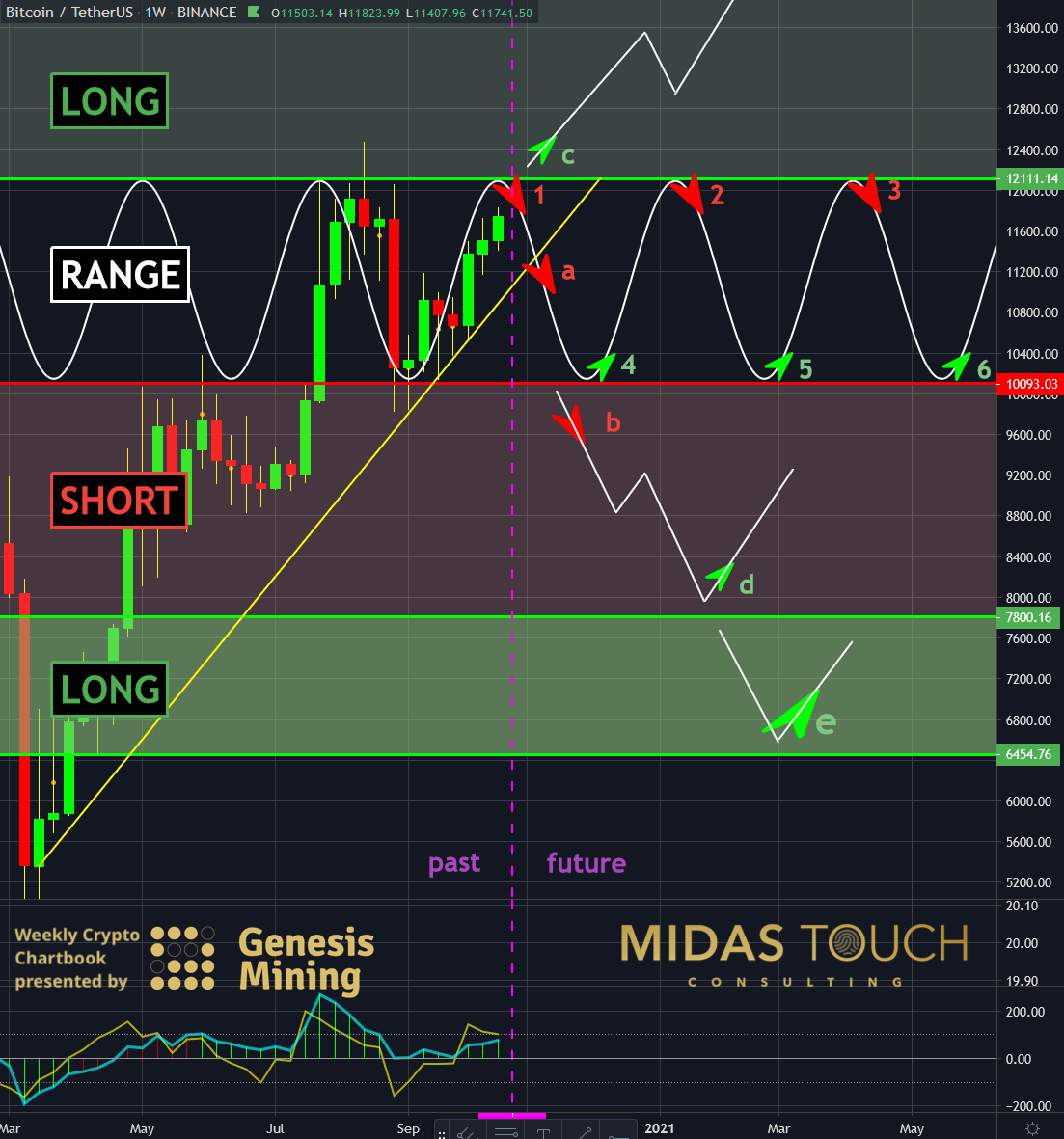

BTC-USDT, Weekly Chart, Sideways, long or short:

BTC-USDT, weekly chart as of October 20th, 2020

From a weekly perspective, meaningful levels are US$12,111, US$10,093, US$7,800 and US$6,455. Above US$12,111 we will add half-size low-risk long entries (c). Below US$10,093 (b) or a yellow directional trend line break (a) short positions are to be considered for a temporary market decline. If range plays are attempted, we would fade the range on its resistance line (1,2,3) and buy support (4,5,6). Bounce plays near US$7,800 (d) and US$6,455 (e) have a high probability profile.

In a way, larger time frame trading is similar to our daily call. that we post daily in our free telegram channel. One makes a clear distinction of possible scenarios the market might be unfolding towards and projects those into the future. Should one of the scenarios match actual market behavior at a future moment in time a call to action is initiated! Otherwise there is no market participation. This is especially valuable as an exercise since it avoids emotional decision making within the heat of the battle and emotions typically flair up more in higher volume and range and volatility markets. Planning protects one’s cool and leaves headroom to make quality decisions at a ta time when it matters most.

The WHY is killing it

When in trouble the ego will always step in and ask: “Why? I want to know!” Ideally in detail and precise.

But that is about the worst advice you can give yourself in the world of trading. While execution is counter-intuitive, the process of extracting edges and all other system development and trading psychology problems can be solved by merely trusting that quality questions will bring satisfactory answers and that there is no need for rhyme or reason. The core belief should be “whatever works” and not why, why, why.

We post real time entries and exits for many cryptocurrencies in our free Telegram channel.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.