Silver, Read the moves.

One way to gain certainty about the quality of a turning point is by examining the recent past. Looking at the daily chart watching price behavior over the last twenty sessions gives quite some insights into the actual strength of the weekly timeframe turning point and its quality. It is this habit of analyzing price behavior that dictates the aggressiveness of market participation (trade frequency) and money management (exposure size). Silver, Read the moves.

Not every price advance is the same in its validity. Let us have a look at why recent Silver price movements are so promising:

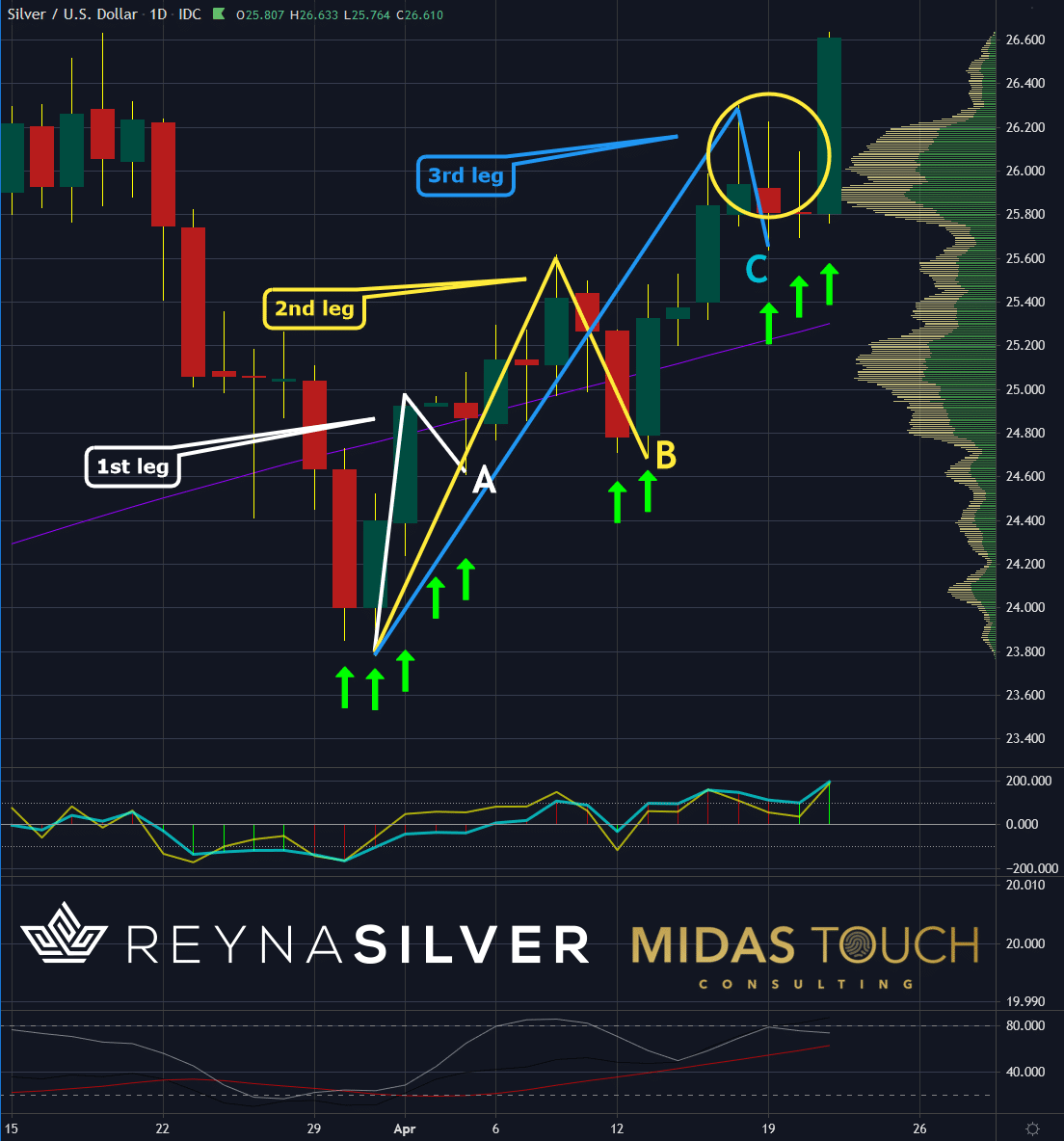

Silver in US-Dollar, Daily Chart, The giveaway:

Silver in US-Dollar, daily chart as of April 21st, 2021.

A glance at the daily chart above shows with green arrows our entry points on Silver over the last three weeks. We post all entries (and exits) in real-time in our free Telegram channel. The very first three entries (green arrows to the left) were based on momentum. We stepped up to the plate finding fractal volume support, and use the contrarian approach to step into momentum to take advantage of the action/reaction principle supporting our Quad exit strategy for quick risk mitigation of early partial profit-taking.

Another look shows that at points A, B, and C, the lows of each retracement (leg 1,2,3) are very modest in percentage. Meaning the bears didn’t get a foot in the door. Consequently, we built a more aggressive position size. We took advantage of low-risk entry points again.

The final giveaway that price might pierce through the central heart at US$26 of a previous congestion zone is marked with a yellow circle. For four days, price rejected this distribution zone, represented by the long wicks to the upside. But at no time was there a follow-through of price decline to the downside from bears attempting to short US$26.

We now find ourselves positioned well with ten runners left:

| Symbol | DATE | entry | fin 50% | 1st target 25% | 2nd target 25% |

| (= runner) | |||||

| XAGUSD | 3/30 | 23.7800000 | 23.8700000 | 23.9500000 | |

| XAGUSD | 3/31 | 24.3000000 | 24.3800000 | 24.8300000 | |

| XAGUSD | 4/1 | 24.2800000 | 24.7100000 | 24.8400000 | |

| XAGUSD | 4/4 | 24.5880000 | 24.6880000 | 24.8440000 | |

| XAGUSD | 4/5 | 24.7800000 | 25.0000000 | 25.1400000 | |

| XAGUSD | 4/12 | 24.6900000 | 24.9300000 | 25.3500000 | |

| XAGUSD | 4/13 | 25.3000000 | 25.4200000 | 25.9700000 | |

| XAGUSD | 4/19 | 25.7150000 | 25.8000000 | 26.0700000 | |

| XAGUSD | 4/20 | 25.7550000 | 25.9400000 | 26.5470000 | |

| XAGUSD | 4/20 | 25.9300000 | 26.0000000 | 26.0350000 |

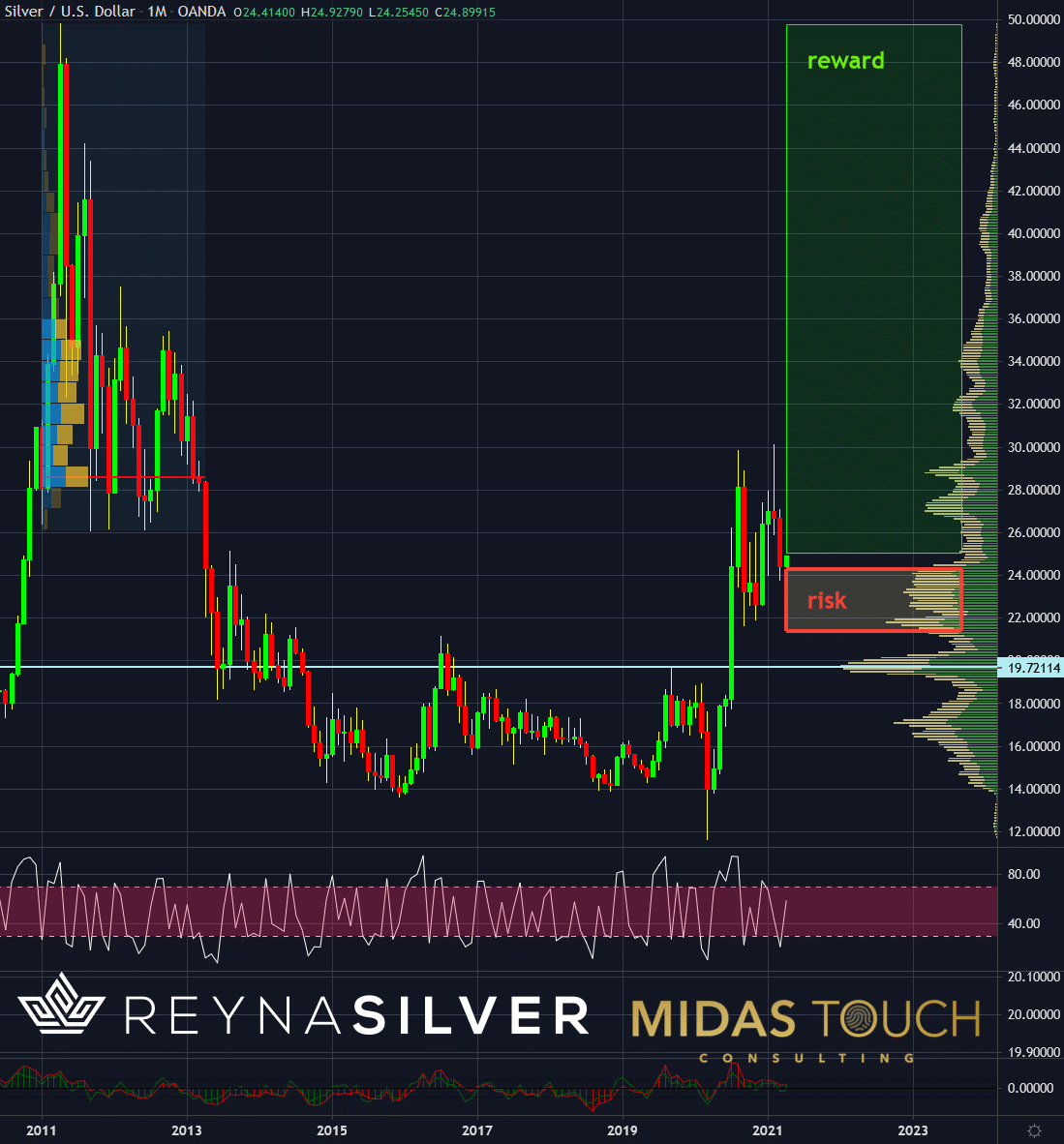

Silver in US-Dollar, Monthly Chart, The original plan and its risk:

Silver in US-Dollar, monthly chart as of April 1st, 2021.

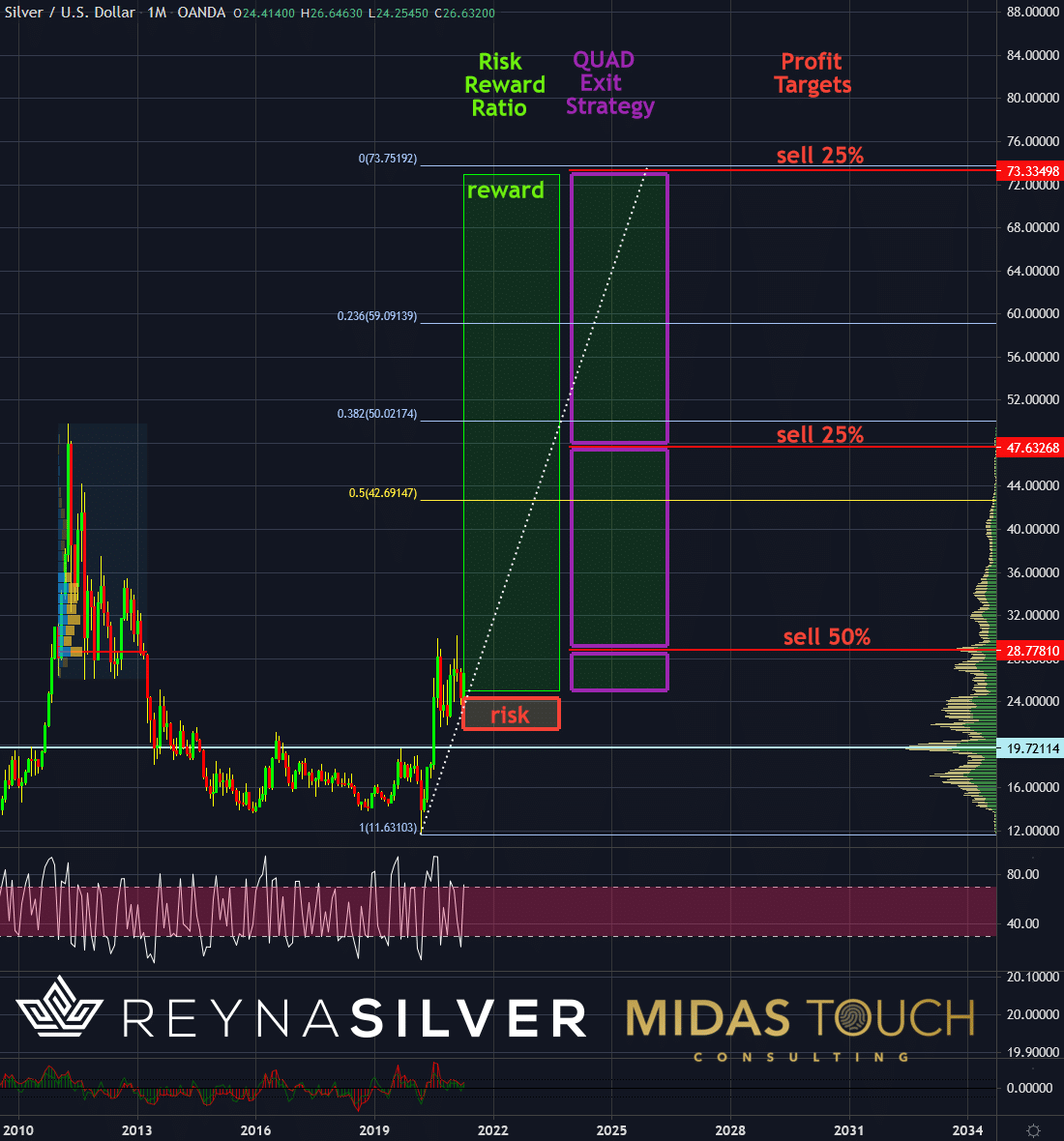

We posted this monthly chart three weeks ago in our weekly chartbook. Our long-term plan is in motion just as strategized. It is necessary now that we have eliminated the risk to expand our projections and set target zones for our ten runners. We consider them as one whole position unit. We visualize this progression in the following chart.

Silver in US-Dollar, Monthly Chart, Silver, Read the moves:

Silver in US-Dollar, monthly chart as of April 21st, 2021.

We find ourselves not only in a risk-free position but have pocketed some substantial profits. We also carry a 2.5 typical position size in runners (10x 25% of standard size).

This allows for opening up to a more significant risk/reward-ratio. We changed our original target near all-time highs to a runner target now at US$73.33 (based on Fibonacci number sequencing). The financing target for half of the position size is set to US$28.77. We will exit another 25% position size as well at US$47.63. These targets are based on fractal volume analysis of distribution zones.

Silver, Read the moves:

When dealing with more complex methods of risk elimination, position building, transfer time frames, and money management, it is essential to read the market right. While most follow hunches, leverage, or simplified money management and are at most times not even aware of the risk they are taking on, we scrutinize the market in its development of turning points to not arrive at unrecoverable risk positions. Trading isn’t about maximizing profits. It is a constant evaluation of probabilities and market behavior to ride market cycles like surfer ocean waves.

Feel free to join us in our free Telegram channel for daily real time data and a great community.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.