Silver, simple and effective

Even as a savvy investor, you have been challenged over the last year. The biggest challenges are the rate of change in the world and the number of unresolved issues. The market doesn’t like uncertainties. We as humans are also at some point saturated with variable news items and overall data overload. Feeling safe requires simplicity. Being safe should be a core foundation for operating one’s daily life. When looking for safe havens for your wealth or investment opportunities, you get bombarded with a variety of opinions shoved into your face more than ever before. Silver, simple and effective.

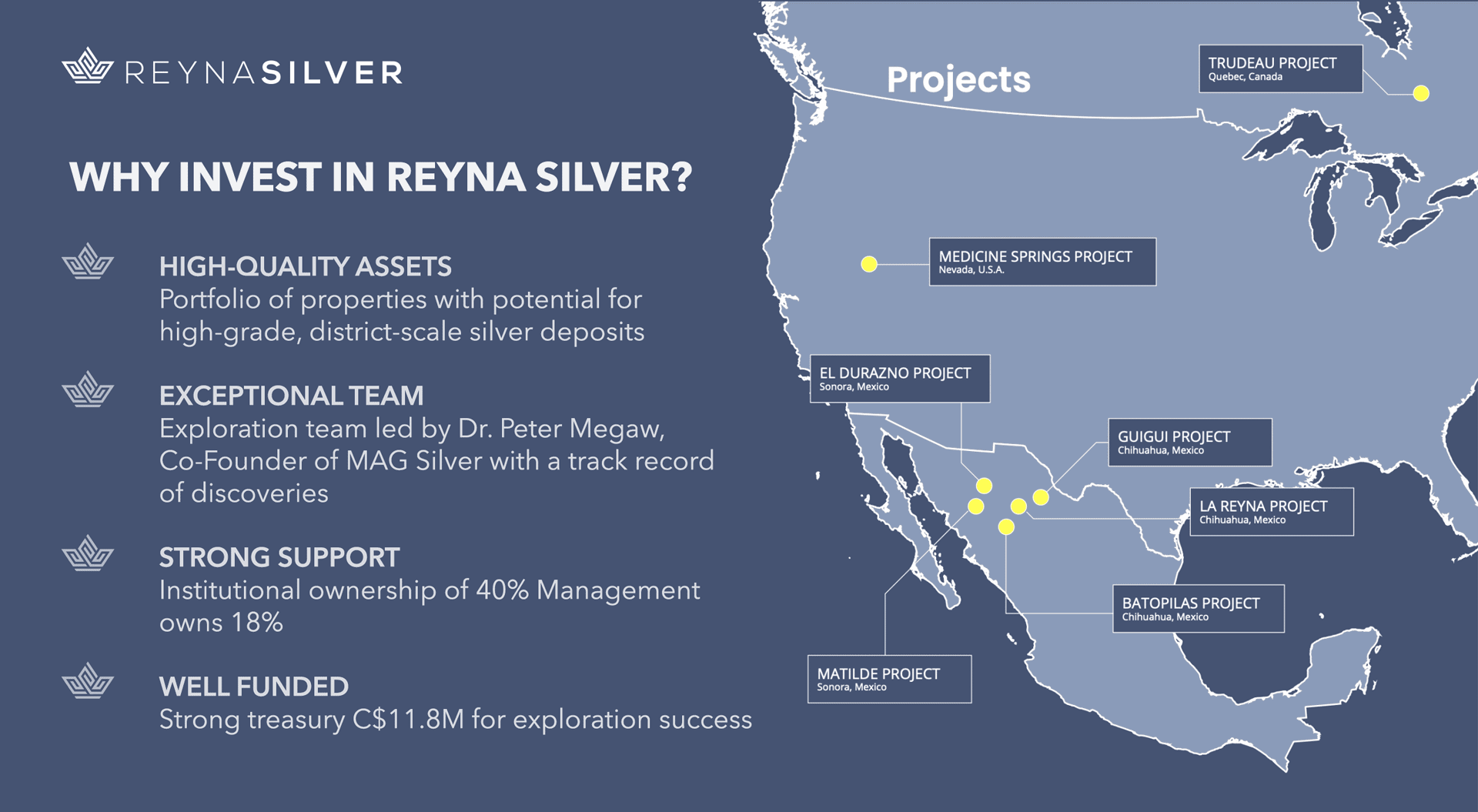

Why we find Silver to be the number one hedge towards an uncertain future, an excellent investment to make stellar returns, and a simple way to protect your wealth is as follows:

- Precious metals have a history of perfect risk mitigation of a portfolio

- Precious metals have an intrinsic tangible commodity value if held in physical form

- Silver is the underdog in its sector, needing to catch up with gold, providing for an additional edge

- Silver is trending (now in a consolidation period – and within this consolidation strong – after a potent first trend leg up)

- Fundamental facts point overwhelmingly towards a strong Silver demand

- Silver is in the public eye, the news, creating demand in various investor and consumer classes

- Actual proof of demand outweighing supply through the now consistently for a year divergence between spot and physical acquisition price for Silver (a 35% difference at the moment).

Monthly Chart of Gold/Silver-Ratio, The turbo edge:

Gold-Silver ratio, monthly chart as of March 18th, 2021.

A look at the monthly chart of the Gold/Silver-Ratio above shows that historically price violations of the 40 moving average result in a move much more closer towards a median zone. Imbalance, principle-based, returning to balance. This, even with the most moderate early area of a 43.50 level (our studies show a reasonable likelihood of a value of 18), provides a turbo stack-able edge for a Silver purchase. These additional boosters for a higher likelihood of success of your investment make all the difference.

Silver in US-Dollar, Weekly Chart, A healthy trend:

Silver in US-Dollar, weekly chart as of March 18th, 2021.

The weekly chart of Silver shows that even though the last six months were one of consolidation for Silver prices, within that consolidation, there was consistent follow-through of strength for direction. You can make this out by eyeballing price within this sideways period (after the stellar advance from March 2020 to August 2020) creeping upward on the blue midline for the linear regression channel. Strong volume node price support at US$25 is now substantiated by holding through the Fed announcement this week. Consequently providing good support and low risk for more physical Silver acquisition.

Weekly Chart, Silver in US-Dollar, Silver, simple and effective:

Silver in US-Dollar, monthly chart as of March 18th, 2021.

The last 50 years on a monthly Silver chart bring to light that Silver can move for substantial distances. These bull trends live above the 100 moving average. The bears have their upper hands below this average line. Silver jolted out of a six-year bear range cycle far above the 100 moving average. Consequently probability is now on the side for Silver investors. That with quite some upside potential for the long run. We feel confident that Silver sees new all-time highs in the not-so-distant future and most likely three-digit figures not too far out as well.

Silver, simple and effective:

A mistake here and there is human. If you miss an entry once in a while, that’s fine. But right now, we see a tendency of hope replacing sound wealth preservation strategy. A typical move of the subconscious when exposed for too long to a stressful situation. A hopeful mindset is not a good point of origin for investing. Emotional states aren’t the best investment advisors. The future is far from clear may this be fiscal or monetary, political or economical. A simple and effective way right now is what is needed to get grounded. Consequently finding oneself on an emotionally sound foundation to operate from.

Feel free to join us in our free Telegram channel for daily real time data and a great community.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.