When to trade Bitcoin

Dealing with a 24/7 market requires a few extra steps to maintain good trade strategy results. One of them is choosing one’s spot to execute trades. In the night from Friday 3/12/21 to Saturday3/13/21, Bitcoin broke out to new all-time highs. It is quite typical that moves like this occur when the U.S. is asleep while Europe ain’t quite awake yet. Professionals drive markets on thinner volume. It is difficult enough to be bound by time zones and order entry regulations (not all crypto exchanges offer OCO orders). After all, even traders need to sleep. How can individuals participate best in Bitcoins bullish market? When to trade Bitcoin.

All markets are related. Looking for liquidity provides times when execution is guaranteed, and slippage minimized. Professionals tend to gravitate towards the futures and forex markets. These markets are leveraged and least regulated (no uptick rule for shorting the market).

What happened since our last weekly chartbook:

A glance at the daily chart above shows price progression since our last publication of this chart. (The split-screen shows to the left last week’s weekly chartbook publication). Prices have moved as anticipated through resistances above, which now have become support. We were able to take additional partial profits.

After the fake weekend breakout, we again added reload positions to our overall exposure and financed them based on our quad exit strategy principles to eliminate risk. All entries and exits were posted in real-time on our telegram channel. This small size ant system of adding reloads and immediately reducing their risk through partial profit-taking allows us to grow long-term positions in higher risk zones of extended moves.

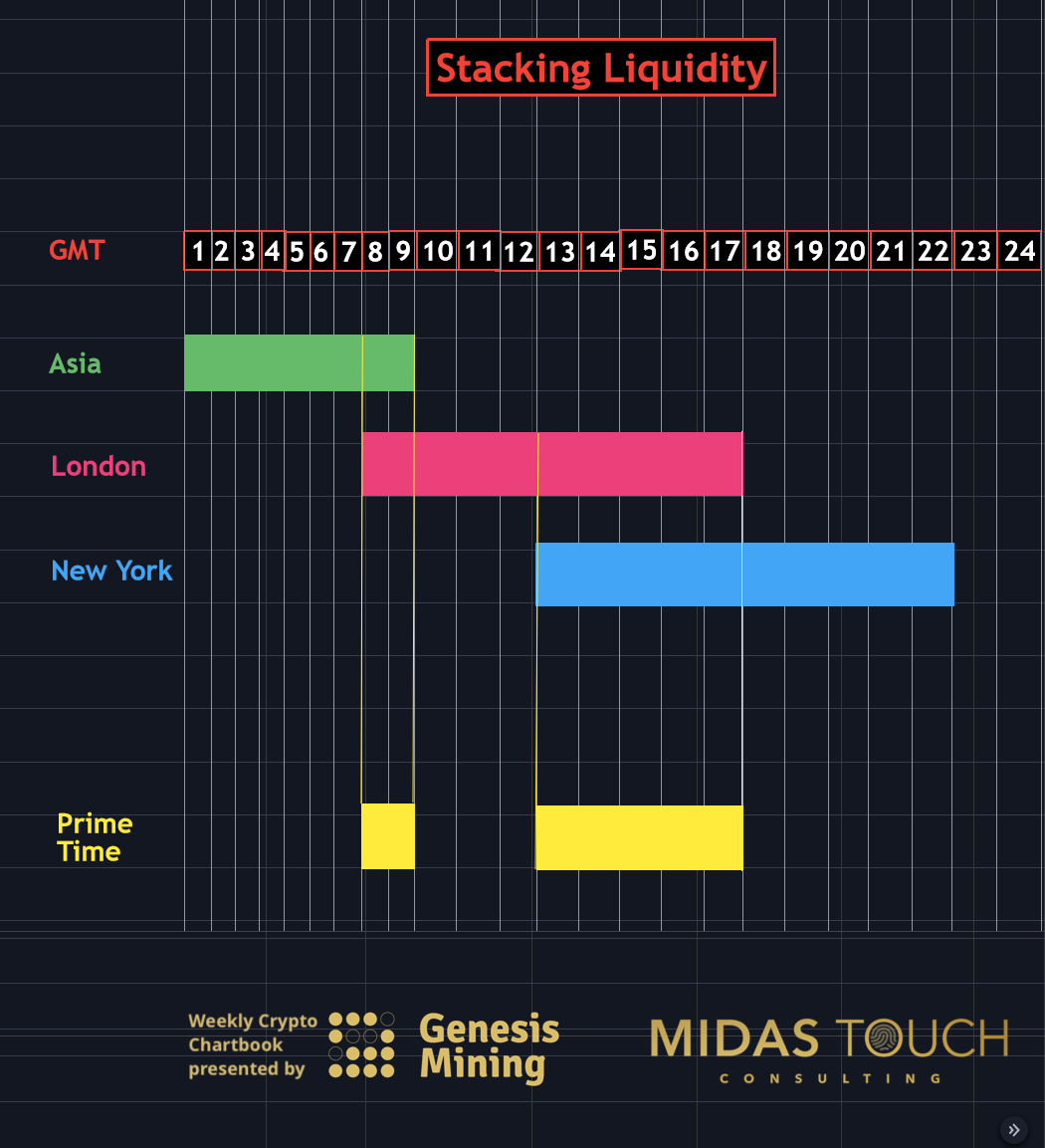

Stacking Liquidity, When to trade Bitcoin:

Stacking Liquidity, GMT daily chart as of March 15th, 2021

The chart above tries to show when these prime times occur daily to place one’s trades. For the long-term investor, these times guarantee good fills and good times to get in and out of their positions. For short- to mid-term trades, these times represent in addition opportunities to find themselves in transactions at the right time. To clarify, whenever a market opens around the globe, it means an abnormality, a possible imbalance. These imbalances can be the seed to a directional move more significant than at other times.

If you visit Wall Street, you will find market makers on typical days trade the market open for about ninety minutes, then handing over operations to their assistants while enjoying elaborate lunches and returning for the last 90 minutes of the trading session. You want to focus alongside this more meaningful time in the market rather than being caught in the noise.

It is stacking one’s odds that provide for a consistent outcome of profitable trading. In this case, we minimize risk by entering and exiting the market at Prime Time. Prime Time being liquidity stacked session overlaps (Asia+London and London+New York).

BTC-USDT, Daily Chart, The weekend fake:

BTC-USDT, daily chart as of March 15th, 2021

That leaves us with weekend moves that have a lower probability of follow-through. Last weekend’s move to all-time new highs is a good example. Old highs got penetrated, but actual price behavior reveals once the Asia session starts on Monday.

Short-term trading as such is directionally neutral for now. For the midterm, we plotted possible reentry zones in the daily chart above.

BTC-USDT, Weekly Chart, A bright future:

BTC-USDT, weekly chart as of March 15th, 2021

We find the long-term price expansion of Bitcoin still in place as long as prices do not runaway towards the upside exuberantly in fast motion.

Even if you have high time frame entries or exits, it is wise to pick market times of a high degree of liquidity and strong participation.

When to trade Bitcoin:

It is essential to look at one’s desired trading instrument for abnormalities like the weekend night moves on Bitcoin. Position yourself before breakouts to such moves to avoid traps and volatility that requires larger stops, representing larger risk.

Bitcoin has a relationship with the precious metal sector. Gold leading this sector typically shows price moves at the London session open (4:00 am EST), and as such, these are times to have an eye out for Bitcoin as well. Gold also is known to move at the U.S. premarket hours (8:30 am EST), and the actual NYSE opens at 9:30 am EST.

Picking one’s battles timed to suggested hours in the first chart of this publication allows for risk minimization. Consequently, it provides a scheduled trading routine versus the risk of struggling to pay 24/7 attention and deal with a lot of price noise and fatigue risk.

Feel free to join us in our free Telegram channel for daily real time data and a great community.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.