Silver, a new way to think

If you are a member of a small country that experienced hyperinflation, you were forced to this new way of thinking. If you are a member of the European Union or the United States, you need to adapt fast. What we are referring to is the fact that paper money is losing its value rapidly. This means it is also losing its benchmark quality. Consequently, we need to think differently when evaluating any and all things. Easier said than done. We are trained throughout our life to believe in our currency. Silver, a new way to think.

For example, let us assume grocery prices have increased by 33% within the last twelve months. This would mean that if you had US$150,000 in your bank account, they would now only be worth US$100,000. But you rarely think this way. Usually, you always take your currency as the base and instead think that grocery prices went up.

What is required is to compare values. This is especially essential when it comes to wealth preservation. Let us assume you have a 401k. What this means is you have your value stored in the stock market. The stock market is highly overvalued. And you get for your stocks and bonds dollars at maturity. Hence, you own something expensive, but you receive possibly little purchasing value in exchange. In other words, you are exposed to risk.

If you would like to add something to your long-term investment plan, you should look for value compared to what you already own. You should purchase cheap value. And Silver is a good bet.

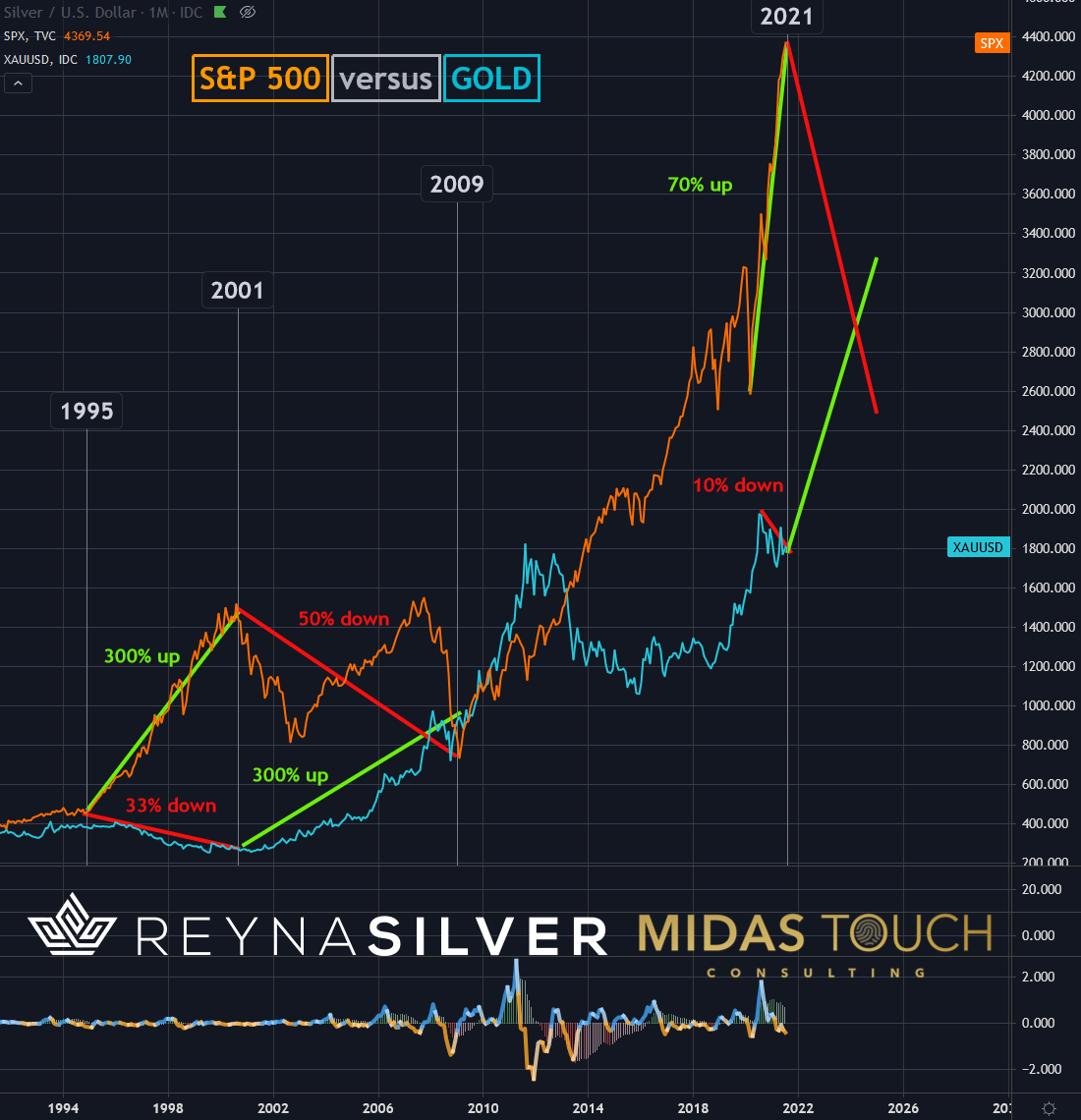

S&P 500 versus Gold in US-Dollar, Monthly Chart, History repeats itself:

S&P 500 versus Gold in US-Dollar, monthly chart as of July 15th, 2021.

Starting from the left on the above monthly chart comparing the S&P 500 versus Gold, the stock market began to explode in 1995. While the stock market had a bubble build up tripling in price in the following six years, Gold lost 33% of its luster. Eight years later, the picture was reversed. Now Gold had run up three hundred percent, and the stock market was cut in half.

As of late, we see a similar picture. While the Gold market is trading sideways to down, the stock market had another substantial seventy percent run-up. From a technical perspective view, this run-up has characteristics of a blow-off top. We expect a reversal and would not be surprised to see the stock market losing 40% or more and, in turn, Gold nearly doubling.

Weekly Chart, Silver in US-Dollar, Bet on the strong horse:

Silver versus Gold in US-Dollar, weekly chart as of July 15th, 2021.

Gold is the leader in the precious metal sector and enjoys popularity in wealth preservation, but we find Silver’s price development to be the more aggressive one. If you look at the weekly chart above, you will find Silver pushing stronger towards another leg up than Gold has over the last eleven months. Hence, we suspect Silver to outpace Gold by percentage in the next leg up.

Silver in US-Dollar, Monthly Chart, Fifty/fifty and rising:

Silver in US-Dollar, monthly chart as of July 15th, 2021.

We can make out that Silver broke out of a multi-year sideways range on the monthly chart above. It moved substantially, building the first leg last year and building a one-year-long bull flag, which is about to resolve itself.

As of right now, the odds are only 50/50 for Silver monthly prices to rise, but if prices hold current levels, these odds can change dramatically within the next two weeks. A price close above US$26.07 by the end of this monthly candle will make us an aggressive buyer in August.

Silver, a new way to think:

One way to illustrate how deep the thinking in currency reaches is the phenomenon of the 99cent store. The illusion that anything below a dollar is cheap created an empire (99only).

Another one is the abnormal behavior of the markets in the denomination units of the currency at 1, 5, 10, 20, 50 and 100 dollars, for example. Below each of these units, value is perceived cheap, and above these increments, value is expensive. Consequently, stops are placed closely near these figures. Meaning it shouldn’t be underestimated how deeply these behaviors in relationship to currency are rooted.

It requires proactive reconditioning, training, if you will, to think, in other units as a benchmark. You can use ounces of Gold or Silver and even Bitcoin. Practice this new way of translating cost and value to you, and you will have a heads-up to procrastinators who hang on to an old paradigm that does not actively reflect a measurement tool translating their wealth.

Feel free to join us in our free Telegram channel for daily real time data and a great community.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.