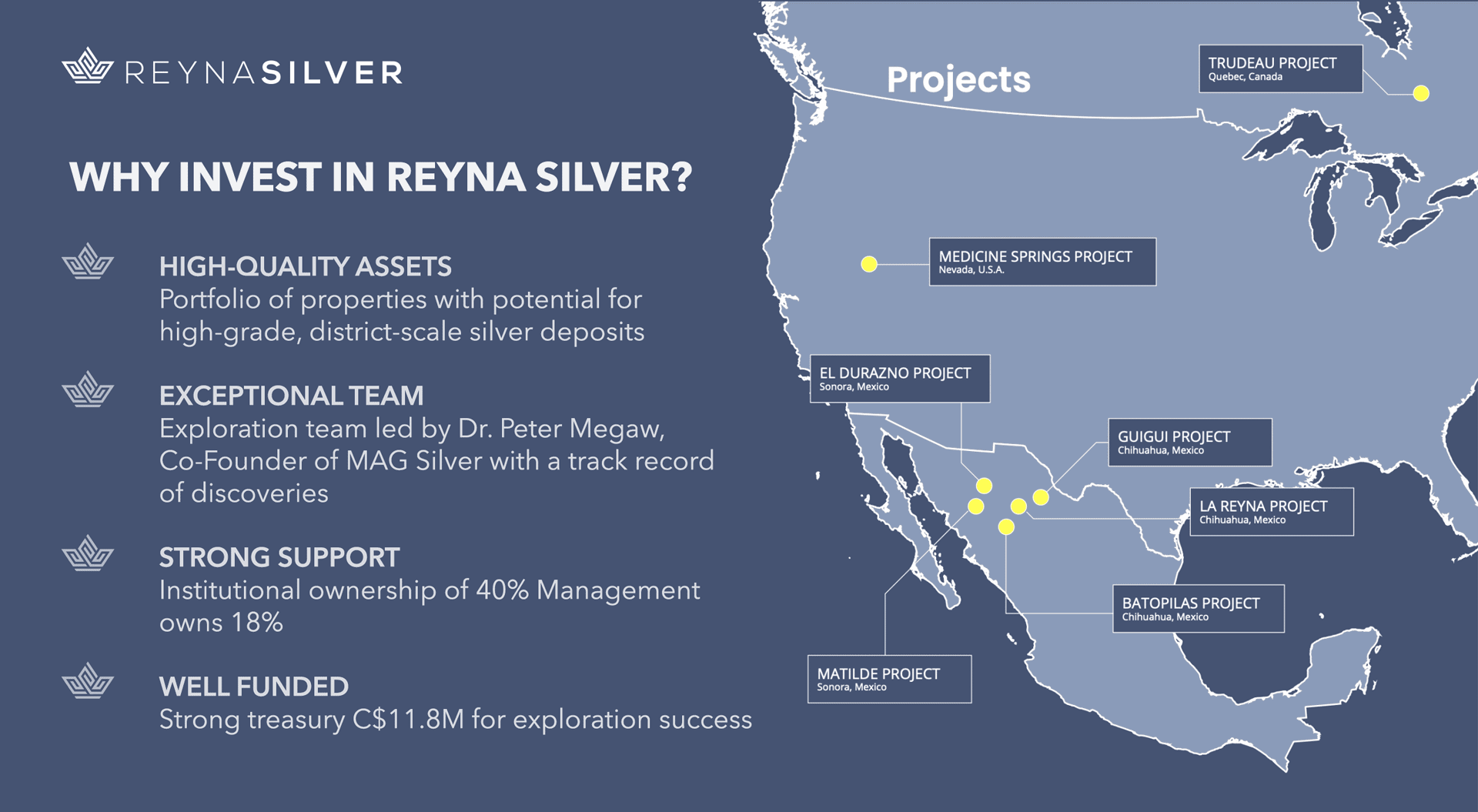

Silver, the value price spread

Emotions flew high when gold and silver markets opened this week with massive downward pressure and an avalanche of stops was hit. Shortly after, prices bounced significantly. Not to their previous level, but why would markets not continue to spiral down? Because nothing has changed. Fundamentally, we have not received any significant numbers that would bring the overall big picture into a different light. This shows how price moves can be extreme merely governed by extreme emotions. Silver, the value price spread.

The value regarding a concerning future is more represented in prices for gold and silver stocks, which weren’t as dramatically affected as they are in more meaningful sell-offs. We also encourage the reader to google 1-ounce coins or 100 oz bars of Silver on eBay to find physical acquisition prices not to be reduced as they should be. For 17 months, the spread between physical and spot price in Silver is now present. This means buyers are willing to purchase at an exuberantly higher premium than the paper price.

With no indications of fundamental reasoning that justifies paper prices going down, we find risk reduction to our physical holdings. Risk being our most dominant concern is as such more to the side this being a spread between value and price, and as such, we have added to our exposure on a physical level finding this to be a buying opportunity.

Looking at trading “paper precious metals prices”, either exuberant emotions of traders and/or price manipulation I present. Hence, we still see a pretty risky environment. While we see a possibility of even lower price levels, such trading behavior is temporary. Typically, extreme states are short-lived.

Silver in US-Dollar, Daily Chart, Don’t get rattled:

Silver in US-Dollar, daily chart as of August 13th, 2021.

The debate about the possibility of market manipulation in the precious metal sector is exhausting, to say the least. While we understand a possible frustration of market participants this to be the cause for losses, it is yet another reason for emotional behavior in market participation which we extremely discourage no matter the reason for triggering. Emotional behavior does principle-based find no place in market play. It clouds the mind and limits the ability for proper trade execution.

Gold is the big brother to Silver and is used as a barometer for the health of a nation. It makes Gold political and should be reason enough to find possible strong forces to influence such a barometer. But this should still be irrelevant to the principles on how one allocates money in speculative spot price plays.

Keeping one’s emotions in check is one of the best ways to ensure a chance of a positive outcome on a series of one’s bets.

The daily chart shows that last Friday’s price action was the precursor setup for the exuberant move when Asian markets opened for the week. Friday’s close (see 1) at the day’s lows, after a strong down trending day near a significant supply zone (see2), weakened this support. It took little pressure to open the flood gates for a self-perpetuating motion. A chain of stops got triggered when markets opened for the week. Once the rubber band was stretched, we had a quick V-shaped bounce for most of the previous down move.

This down move was followed by the typical small range indecision sideways day. Prices advanced modestly on Wednesday and again sold on Thursday. It is now the focal point to follow price behavior for a possible retest near the week’s lows zone.

We are looking for a possible aggressive entry on a half-size position size. But we will only expose capital if a supply zone is hit with speed to take advantage of an action/reaction principle. Should the price steadily but slowly decline, we will not engage in the markets from a long perspective.

Daily Chart, Gold in US-Dollar, Silver relatively weak:

Gold in US-Dollar, daily chart as of August 13th, 2021.

Another reason why we are relatively conservative in taking a long position right now in Silver is its relative weakness towards Gold.

A look at the daily chart of Gold above reveals that the price bounce within this week was nearly double as strong as the one of Silver (see 1/2). Gold’s price decline on Thursday was also a lot more modest. As such, we are not in a hurry to expose capital. We rather trade a possible turning point reactionary after price confirmation.

Silver in US-Dollar, Weekly Chart, Silver, the value price spread:

Silver in US-Dollar, weekly chart as of August 13th, 2021.

But it isn’t our concern at this point, where speculative short-term entries on spot price trading in Silver are to be determined. What we want to point out is the value stretch. An extreme example would be the fact, that one ounce of silver is enough to feed a family of five for 38 days in Venezuela right now (equaling 3.8 million Bolivars). It is foolish and extreme to argue, “oh well, this is in Venezuela, and something like this could never happen where I live.” Moderate, which in our opinion is the way to go, is thinking in insurance terms and low-risk opportunities to purchase such an insurance, Silver.

The larger weekly time frame already indicates that we might be at an entry opportunity for just such a positioning of physical Silver for a long-term wealth preservation perspective.

Prices have held a bit above the 0.618 Fibonacci retracement level. Recent price low extremes are within the last thirteen months’ sideways range extremes from US$21.66 to US$30.14. With the relative weakness divergence to Gold, a decline towards a 50% retracement level would spell “opportunity” to us. In general, from a large time frame perspective of a multi-year hold, physical silver acquisitions at spot price levels here, irrespective of the premium to be paid, seem decent to us in the entry range between US$20.70 to $23.75.

Silver in US-Dollar, Monthly Chart, The big picture counts:

Silver in US-Dollar, monthly chart as of August 13th, 2021.

Where clarity cements itself is on the monthly timeframe. One can make out how substantial the move up from last year’s lows at US$11.64 was. On top, the price retracement from this year’s highs is proportionally harmonious. Most likely it’s nothing, but just taking a breath before the possibility of a trend continuation.

Supportive to this bullish picture are two significant fractal volume analysis support zones (1,2), right below current price levels (see histogram to the right of the chart).

Silver, the value price spread:

It is essential to differentiate market speculation and wealth preservation regarding engagement into the Silver markets.

We do not claim to have a crystal ball to see clearly into the future. Still, when joggling with numbers, it is hard to believe a statement that all is honky dory. That the economy is sound, and that Federal Reserve policy and money printing aren’t having any adverse effect.

We have seen irrational trader behavior over and over again. With the ego’s domain on insisting on being right and a lack of accepting responsibility for losing trades, emotions get out of hand pretty quickly. Minds cannot find reasons for prices declining. Promptly a dam can break, and a self-fulfilling prophecy is in motion.

We urge you not to participate in further confusing, more emotion triggering mental debates. Avoid letting rage run rapidly. Value price spread opportunities cease to exist for those individuals tied in emotional frictions and frustrations. Take a step back and examine sound fundamental reasoning for your longer-term holdings and extended multiple-decade wealth preservation opportunities.

Feel free to join us in our free Telegram channel for daily real time data and a great community.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.