Silver, by endurance, we conquer

“By endurance, we conquer” was Ernest Shackleton´s family motto. After a first leg up of a trending trade instrument, sitting through a consolidation period can be as taxing as an explorer’s challenging hurdles. It requires faith, patience, endurance, discipline, focus, and a strong will to overcome this waiting time to get moving at the right time. It is a low entry risk that should determine the striking point. Silver, by endurance, we conquer.

We consider wealth preservation the most important one right now. Unfortunately, this very long-term play has its tricky part since it encompasses large cycle thinking and planning. The principle being the longer the time frame, the harder to predict. As such, it is wise to give more weight typically to one’s fundamentals in addition to one’s technicals. We find one aspect specifically significant. We all know that money has been printed to a large extent throughout the world. Why aren’t we in hyperinflation yet? Yes, we get a lot less bang for the buck in the supermarket, but it seems modest in relation to the currency dilution. After all, from all dollar notes ever printed in more than a hundred years, half have been printed in the last 18 months.

The answer is that due to the unusual pairing with Covid, money hasn’t reached the market yet. It hasn’t circulated. It hasn’t diluted yet. People hoarded money, and the actual effects of inflation will manifest with this delay until people spend money again.

In other words, once public confidence is regained, it might fuel economic problems. Consequently, we are now positioning in Silver ahead of the storm.

Gold in US-Dollar, Weekly Chart, Watch out for Gold!

Gold in US-Dollar, weekly chart as of July 8th, 2021.

Over the last year, Gold was mostly outperformed within the precious metal sector (Silver, palladium, platinum). Consequently, we have a close look now at the sector leader. Once Gold gets going, it could easily be the last domino falling to cause a chain reaction for Silver running wild, fast, and furious.

Why with a vengeance? For every ounce of Gold mined, 7 to 9 ounces of Silver are dug out of the ground. The price between the metals isn’t 1:7 or 1:9, though. Current price is 1:70 between Gold and Silver.

This means Silver has some catching up to do, or at least when Gold starts to be moving, a stretch larger than 1:70 is not sustainable for an extended period.

The weekly chart above illustrates that long-term entries on the Gold market have a favorable setup regarding the risk/reward-ratio. It will come as no surprise if professionals are already in a silent accumulation phase.

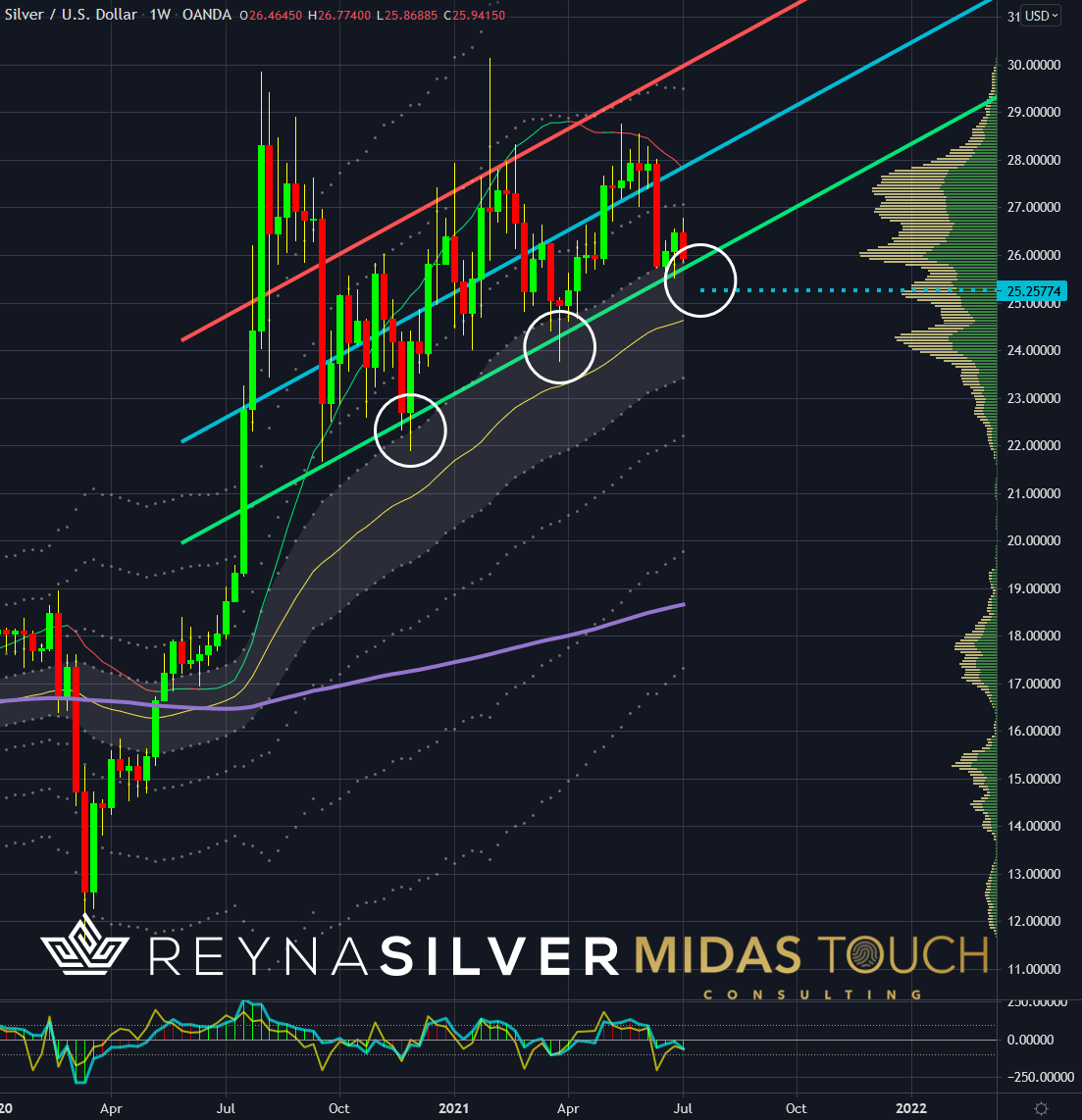

Weekly Chart, Silver in US-Dollar, A low-risk move lining up:

Silver in US-Dollar, weekly chart as of July 8th, 2021.

Timing, the trickiest part in investing, is favorable since we see Gold possibly moving over the short term due to Russia’s intent to buy 651 tons of the shiny metal within the next two quarters.

Since more than one year, physical silver for purchase is only available with a hefty premium. Supply might continue to diminish since a US-based movement called “Wallstreetsilver” advertises to buy physical Silver. And “Wallstreetsilver” has an impressive growth rate signing up new members.

The weekly chart of Silver above could unfold favorably in the sense that typically a brief overshoot through the linear regression line has led to a reversal in price direction (see white circles). With the additional fractal volume support slightly above US$25, we would not be surprised to find low-risk entry points within the next two-week time period. Recent swift up moves have also all started near the mean (yellow up sloping line).

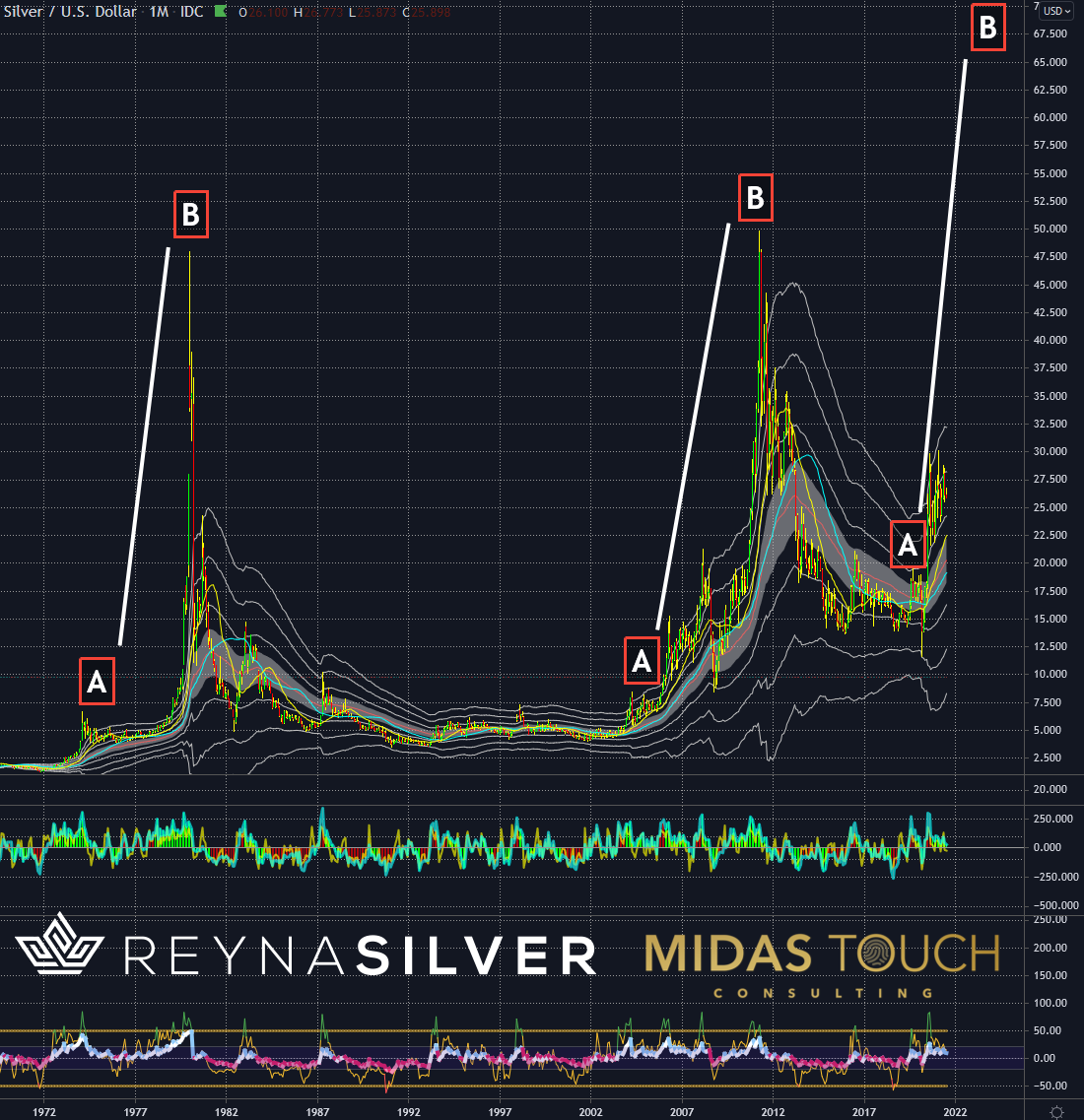

Silver in US-Dollar, Monthly Chart, When it moves, it moves:

Silver in US-Dollar, monthly chart as of July 8th, 2021.

To us, the question is always one of risk. Do we have a risk to the downside or the upside? Typically, this involves a pretty lengthy debate and evaluation. Rarely do point so many fundamental and technical data towards one side. We find not to be exposed to the physical holding of Silver (and other raw materials) the part of the risk. Holding fiat currencies without this counterpart insurance is, in our humble opinion, quite a risky business.

The monthly chart above shows that Silver has a history that once prices are in motion, they excel explosively. We find the anticipatory accumulation of physical Silver to be less risk involved versus sitting it out. The US mint already had shortages, and we anticipate a more severe Silver shortage to be on the horizon.

Silver, by endurance, we conquer:

This isn’t the only time trading feels challenging, like exploring the antarctic pole. It is in principle aligned, constantly stepping into the unknown and dealing with terrain unfamiliar. Market participation requires a unique mindset and isn’t for the faint-hearted. Taking risks isn’t anyone’s game and needs special preparation as well. What is striking is that we are dealing with an occurrence that happens, maybe two or three times in a century. An inflection point, one could say, for wealth preservation. It is hard to make money, but preserving it is now an additional challenge. We find it no understatement when headlines state a “transfer of wealth.” Being aware of the magnitude of one’s action for the long-term effects of ones’ financial affairs is key to maneuver ones’ ship through the tricky waters.

Feel free to join us in our free Telegram channel for daily real time data and a great community.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.