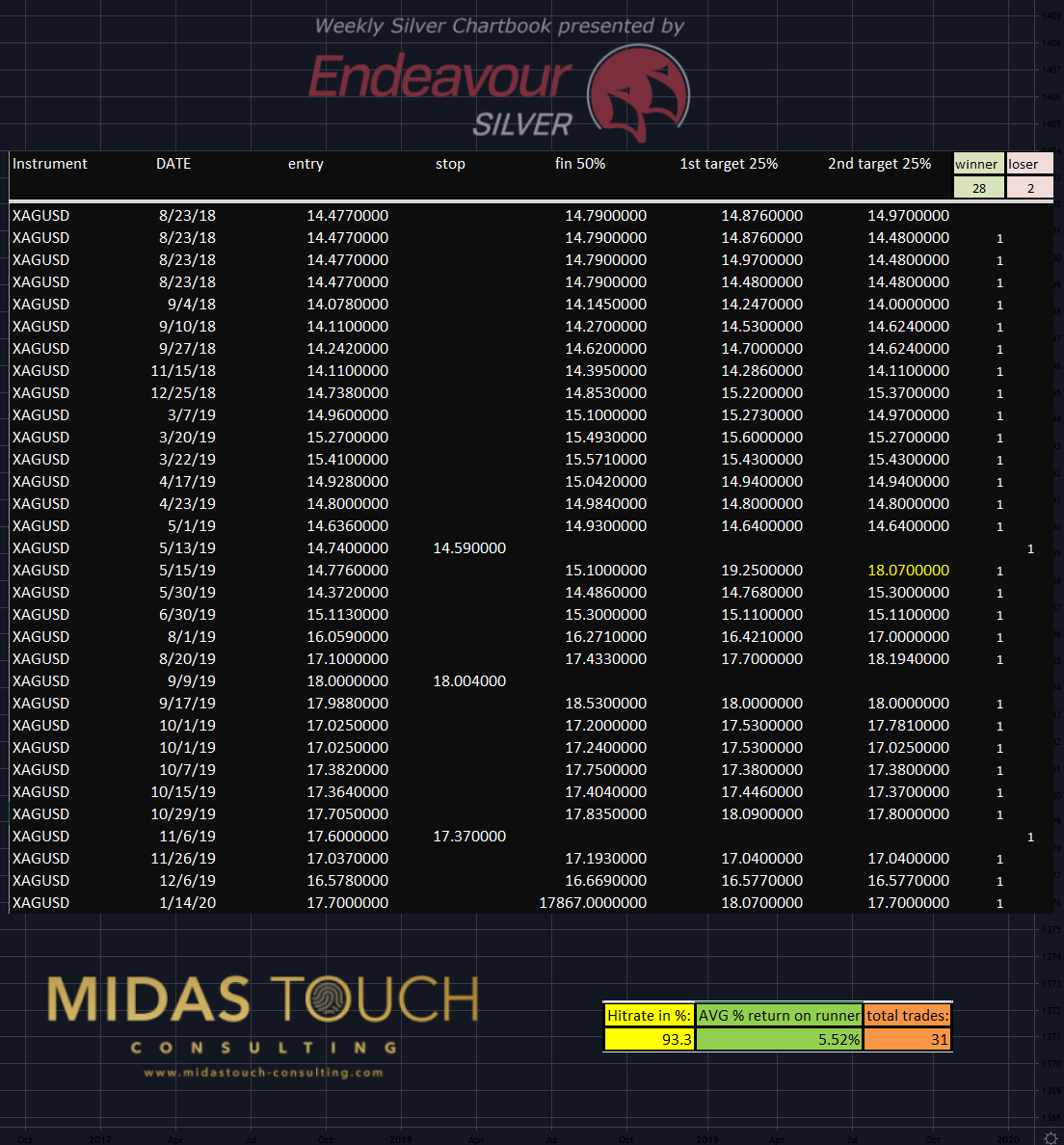

Build On Your Strength – Seventeen Months Of Silver Trading In Review:

Seventeen months of silver trading performance as of January 30th 2020

With a hit rate of 93.3%, one way to gain confidence is the knowing, that one doesn’t have to be fearful of taking additional trades even if a loosing trade should become part of the trade sequence. In addition the two loosing trades we experienced were small. The loss of -1.02% and -1.31% versus the average runner percentage return of 5.52% presents a low risk model that again allows to step aggressively into the market if warranted.

Gold in US-Dollar Weekly Chart – Gold Showing Directional Strength:

Gold is in a clear uptrend. We took another 3.17% profit on a reload runner, posted live in our telegram channel on January 27th.

Silver in US-Dollar Weekly Chart – Silver In A Sideways Range:

While gold broke to the upside, silver prices above US$18.50 get strongly rejected and pushes this precious metal into a sideways range.

Build on your strength

When confronted with a possible dilemma of internal debate of participating into a market situation or not, taking a step back is the first remedy. Emotions can flair up in situations like the presented diffluence between the gold and silver market. “When in doubt stay out” is certainly a rule of thumb that can help, but the more refined solution is to build on your strength. Looking back through ones trading history and building a case based on ones strength might provide the necessary fuel to be more clear minded whether to participate or stay on the sidelines.

Follow us in our telegram channel.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.