Gold – Consolidation before the next wave down

Since reaching a high of USD 2,067 on May 3rd, the bears have taken control of the gold market. In an initial wave down lasting about three and a half weeks, they pushed the price of gold down to USD 1,932. Since then, the bulls have been attempting a recovery. However, they have only managed a corrective bounce to USD 1,983 so far. Actually, gold prices have been trading sideways between roughly USD 1,980 and USD 1,940 since mid-May. Hence, gold is still about USD 110 or 5% away from a new all-time high. A break below the support level at USD 1,940 is likely to trigger a second wave down. Gold – Consolidation before the next wave down.

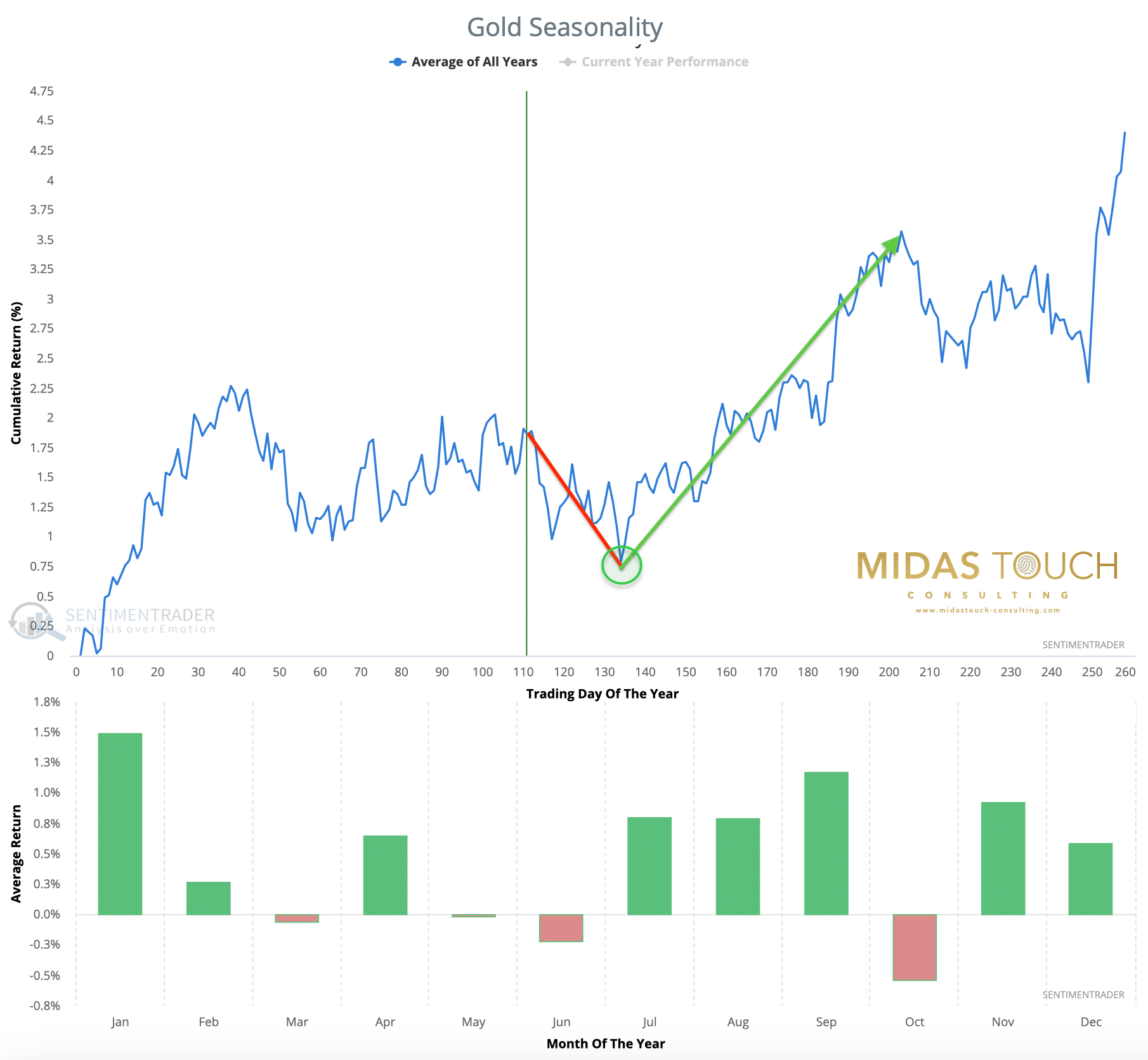

We anticipated the weakness in a timely manner and expect the correction/consolidation in the gold market to continue for a while. Particularly, the seasonal pattern advises caution and patience at the moment. Additionally, the technical situation has certainly worsened due to the price drop.

However, we do not see the increasingly proclaimed threat of a triple top (August 2020 = USD 2,075, March 2022 = USD 2,070, and May 2023 = USD 2,067). After the gold price rallied by around USD 450 or nearly 28% since early November 2022, a period of rest and digestion is certainly appropriate. Therefore, we continue to believe in a healthy and necessary correction that should set the stage for the next wave up and a breakout to new all-time highs. too.

Gold in US-Dollar – Sideways consolidation before the correction presumes

Gold in US-Dollar, daily chart as of June 9th, 2023. Source: Midas Touch Consulting

As anticipated, the rally in the gold market reached its peak in early May. Since then, gold prices initially corrected swiftly down to USD 1,932. However, the subsequent bounce has only managed to reach USD 1,983 and quickly got trapped in a sideways chop between USD 1,940 and USD 1,980. It is not yet clear whether this recovery has indeed concluded or if there is still some room for further upside potential. In the best-case scenario, the bulls could drive the gold price back to around USD 2,000 to USD 2,015 in the coming weeks.

Seasonality remains weak until mid-July, at least

However, the technical picture has deteriorated, and unless a sustained breakout above USD 1,983 is achieved, it is safer to assume a more or less direct continuation of the correction. Confirmation of the next wave down would likely occur with a break below the support level at USD 1,940. This zone has already been tested three times in recent weeks and may not withstand a fourth test. In that case, gold would likely target the 38.2% retracement of the entire rally since November, sitting around the USD 1,900 range. Therefore, our initial target for the correction remains unchanged at USD 1,900 to USD 1,920.

Considering that seasonality remains unfavorable until at least mid-July and that the gold market tends to ruthlessly shake off all weak hands before any major wave up, a precautionary “bloodbath phase” should be taken into account. This phase could be triggered by breaking the psychological level of USD 1,900, activating numerous stop-loss orders and then revisiting the rapidly rising 200-day moving average (USD 1,840) in the range of USD 1,850 to USD 1,875. This would likely deliver enough pain to cleanse the gold market and set the stage for the next leg up. Alternatively, a milder correction could occur, concluding above USD 1,900.

Gold in Euro – Buy limits at 1,800 Euro and 1,775 Euro

In euros, gold has been moving sideways between 1,855 and 1,795 Euro since reaching a new all-time high (1,885 euro on March 20th, 2023). Ideally, there will also be a revisit of the rapidly rising 200-day moving average (1,749 Euro) by mid-summer. We are adjusting our buying limits slightly to 1,800 Euro and 1,775 Euro.

Conclusion: Gold – Consolidation before the next wave down

Gold has experienced the expected pullback over the past five weeks. Currently, the remaining bulls are striving for a recovery. But thus far, it has only resulted in a minimum bounce and a sideways phase without a clear trend. As long as the resistance around and above USD 1,980 cannot be overcome, the situation remains corrective, and a second wave down is likely just a matter of time. Our realistic target price remains the range between USD 1,900 and USD 1,920. Alternatively, the correction could go one level deeper, reaching USD 1,850 to USD 1,875.

Ideally, the correction should deliver the typical summer low between mid-July and mid-August. From there, we expect the next attack on the all-time high and, in the 3rd or 4th quarter, a breakout above USD 2,075, leading to gold prices heading towards USD 2,250 and USD 2,500. Hence, patience is still required in the short term, but favorable gold prices in early and mid-summer should provide a last promising buying opportunity.

Analysis initially published on June 9th, 2023, by www.gold.de. Translated into English and partially updated on June 9th, 2023.

Feel free to join us in our free Telegram channel for daily real time data and a great community. If you like to get regular updates on our gold model, precious metals and cryptocurrencies, you can also subscribe to our free newsletter.

Disclosure: This article and the content are for informational purposes only and do not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. The views, thoughts, and opinions expressed here are the author’s alone. They do not necessarily reflect or represent the views and opinions of Midas Touch Consulting.