Silver – Banking crisis fuels breakout from triangle

Silver closed the month of march at 24.10 USD. But while gold has been trading clearly above its early February top (1.959 USD) for the lats two weeks, silver has not yet reached its February 2nd high at 24.69 USD. Silver – Banking crisis fuels breakout from triangle.

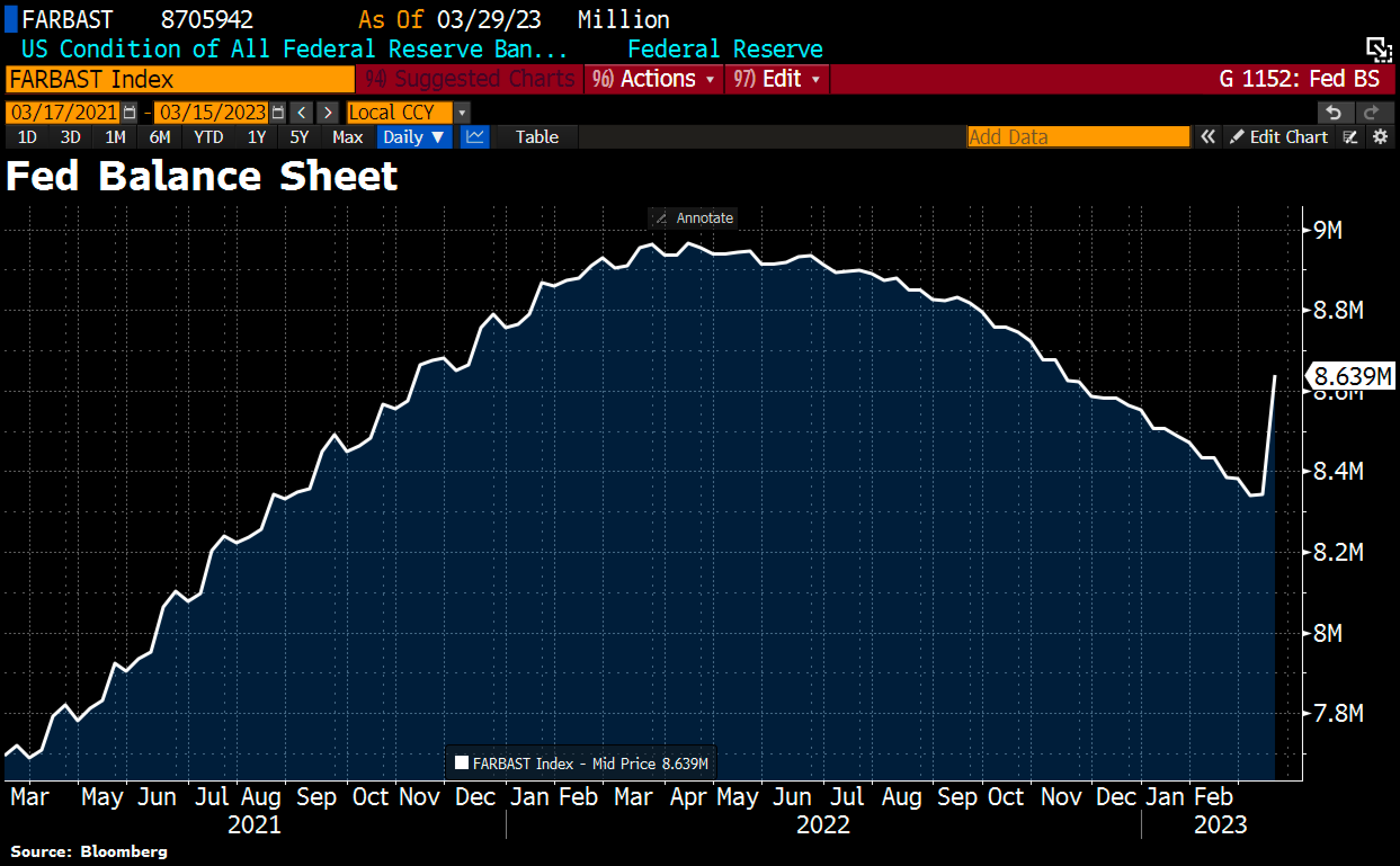

Over the past three and a half weeks, financial markets have experienced a tumultuous turn of events, with several banks in the USA collapsing or declaring bankruptcy in succession – including Silvergate Capital, Silicon Valley Bank, and Signature Bank. Social media platforms such as Twitter, combined with the convenience of online banking, resulted in a swift bank run. This banking crisis is new but systemic, and necessitated a sudden adjustment in U.S. monetary policy. To address the crisis of confidence and prevent potential domino effects, the Fed created an additional 390 billion USD out of thin air between March 8th and March 22nd. Presumably, the Fed will only be able to increase interest rates once more before needing to implement rate cuts as early as the beginning of summer as a support measure.

Fed balance sheet total as of March 29th, 2023. Source: Holger Zschaepitz

Credit Suisse, the traditional Swiss bank, also became insolvent and required a swift rescue operation by the Swiss National Bank (SNB). Despite the SNB’s injection of 50 billion francs to restore confidence in Credit Suisse, this lifeline was not enough, and competitor UBS was compelled to take over the “bankrupt bank” two weeks ago for a ridiculous price of 0.76 francs per share. With this unprecedented step, not only Credit Suisse shareholders (including Saudi National Bank) were basically expropriated over a weekend. In addition, the Swiss Financial Market Supervisory Authority (FINMA) wrote off all of Credit Suisse’s 16 billion francs worth of “Additional Tier 1 Bonds” (AT-1 Bonds), igniting the fuse for the next multi-billion-dollar bomb in the market for contingent convertible bonds (CoCo bonds).

Are CoCo bonds the next multi-billion-dollar bomb?

These CoCo bonds were highly sought after during the low-interest phase, with banks investing over 260 billion euros in them. In the course of the Credit Suisse takeover, they have now created the novelty of ranking shareholders ahead of the holders of these bonds. Normally, shareholders would receive nothing, while bondholders would still receive some compensation. FINMA’s decision flouts standard financial regulations, drawing criticism from the European Central Bank (ECB) and the Bank of England. Several law firms are also preparing lawsuits over the treatment of these AT-1 bonds in Credit Suisse’s emergency bailout.

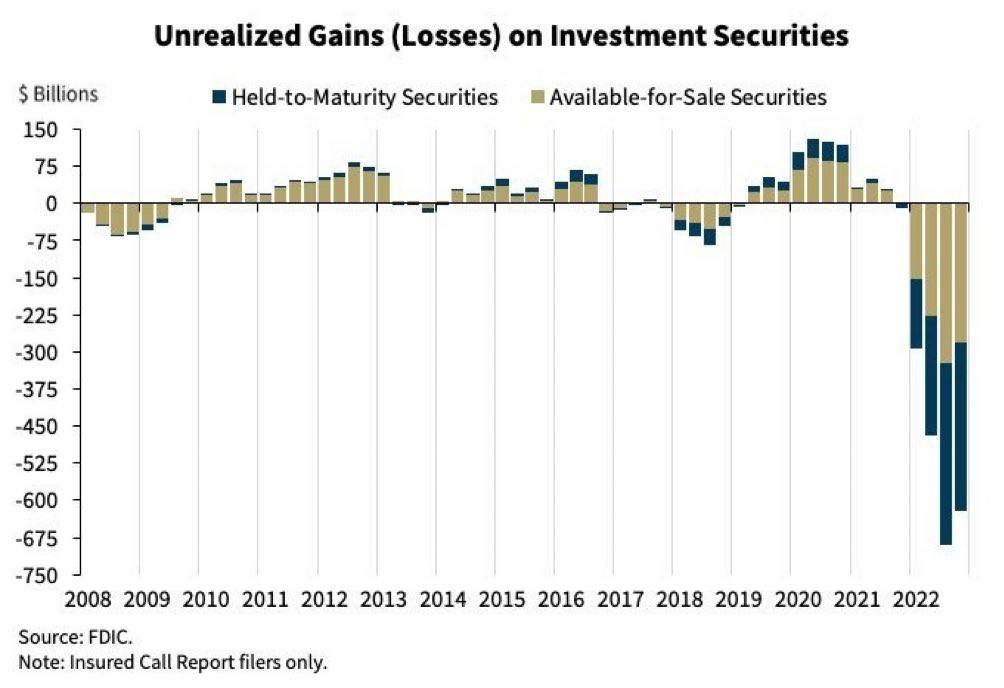

U.S. Bank’s unrealized gains (losses) on securities investment securities (2008-22) Source: FDIC

Above all, however, this Credit Suisse takeover, which was intended to stabilize the financial market “Switzerland”, is dangerous because it imposes further write-offs on an already extremely pressured banking world. The losses will be directly reflected on their balance sheets. According to Handelsblatt, the U.S. bond manager Pimco, a subsidiary of Allianz, will suffer losses of 340 million USD on Credit Suisse’s AT1 bonds alone. Although Deutsche Bank and Commerzbank claimed they were only marginally affected by the default, the prices for Deutsche Bank’s credit default swaps (CDS) skyrocketed. The situation has somewhat calmed down in the meantime, with the Deutsche Bank share price stabilizing above 9.00 euros after plummeting by 36% from its recent peak.

The banking crisis is far from over

With numerous bank failures and ongoing problems at First Republic Bank San Francisco, concerns arise whether further bank failures are imminent. Billions in losses lurk in bank balance sheets worldwide, while equity capitalization remains meager almost everywhere. The KBW Banking Index’s chart appears catastrophic! It’s strongly recommended not to heed politicians, central bankers, and bankers’ soothing words.

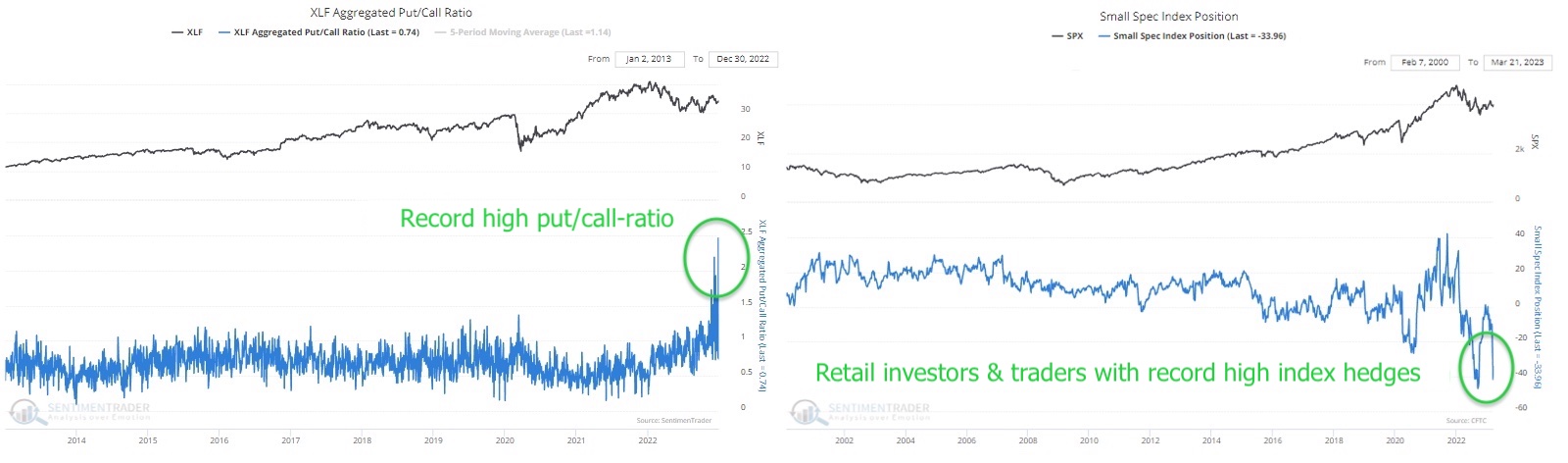

Small investors with big bearish bets, as of March 30th, 2023. Source: Sentimentrader

Not surprisingly, retail investors are reacting in panic in this tumultuous environment, leading to record levels of put options being purchased to hedge their portfolios. However, this behavior could prevent a major stock market crash and instead contribute to a strong recovery rally similar to last October. Nonetheless, the market remains unpredictable, but until early summer, the potential for a surprise surge in prices outweighs the downside risks.

Precious metals in pole position

In these uncertain times, investing in precious metals is a safe haven. The gold price had rebounded strongly from its recent double low at 1,805 and 1,809 USD. Pretty quickly, gold has tested the psychological threshold of 2,000 USD three times already. A rise towards 2,025 to 2,050 USD is possible in the short term. However, seasonal weakness and a (temporary) relief in the stock markets could still lead to a pullback towards 1,900 to 1,920 USD by early summer. This could offer the last good buying opportunity before the break out to new all-time highs.

Silver in US-Dollar – At the major downtrend line

Silver in US-Dollar, daily chart as of April 2nd, 2023. Source: Midas Touch Consulting

Four weeks ago, we predicted the end of the correction and while gold followed our scenario perfectly, silver wavered and even dropped 50 cents below its low from February 28th. However, the silver bears ultimately gave up at 19.90 USD and silver has since risen by over 20%. Closing the week at 24.10 USD, silver is once again at its major downtrend-line of the past two and a half year years. Given gold’s surge and the bullish embedded daily stochastic, a breakout from this large triangle should occur in the coming days. This would unleash upward potential towards around 30 USD in the medium-term. Nonetheless, another pullback until early summer should not be surprising either.

Overall, silver appears promising as the breakout from its large triangle appears to be underway. A rise towards 25 USD could happen swiftly, and a direct move towards 27 USD is also possible. However, a rally directly towards 30 USD remains uncertain at present and would be a rather extreme and rare scenario.

Silver in Euro – Currently, no contrarian buying opportunity

Our buy limits, set below 20 euros and 19 euros, have proven to be quite successful! Silver on a euro basis has surged by more than 17% since hitting the low at 18.79 euros. Currently, euro silver is hovering just around a significant downtrend line, while the daily stochastic indicates a bullish trend. This suggests that a breakout above 22 euros is on the horizon. Although we do not see any opportunities for contrarian buying following the recent strong surge, those who still do not possess enough physical precious metals (at least 10-15% of total assets) should consider purchasing more immediately.

Conclusion: Silver – Banking crisis fuels breakout from triangle

Closing at 1,969 USD, gold just set its best monthly performance since July of last year. Gold has clearly been driven by fears of a banking crisis which led investors rushing into safe haven assets. Silver’s speculative nature on the other hand does not immediately make it a safe haven. However, it gained more than 21% in March and is about to breakout from its multi-year triangle pattern. In the big picture, silver is lagging significantly too, but we remember a similar behavior from the last bull market (2001-2011) and expect silver to catch up at some point in the future.

Analysis initially published on March 31st, 2023, by www.gold.de. Translated into English and partially updated on April 2nd, 2023.

Feel free to join us in our free Telegram channel for daily real time data and a great community. If you like to get regular updates on our gold model, precious metals and cryptocurrencies, you can also subscribe to our free newsletter.

Disclosure: This article and the content are for informational purposes only and do not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. The views, thoughts, and opinions expressed here are the author’s alone. They do not necessarily reflect or represent the views and opinions of Midas Touch Consulting.