Has the sharp correction already been completed?

Silver had been sharply rising until mid of December, before drifting into a sideways consolidation for more than six weeks. Finally, this ended with an abrupt and steep sell-off. But despite this pullback, many investors continue to keeping a close eye on the silver market due to concerns about inflation, supply chain disruptions, and the increasing popularity of green technologies that require silver. Silver – Has the sharp correction already been completed?

On February 2nd, gold reached its highest level in nine and a half months at 1,959 USD. However, the joy over the strong recovery in prices since early November did not last long as bears mercilessly pushed gold prices lower for almost the entire month of February. It was only on Tuesday of this trading week that gold prices hit a low of 1,804 USD (-7.9%), from where a first bounce towards 1,845 USD has since emerged.

Silver ran ahead of gold

Silver, on the other hand, was the first to anticipate the strong recovery in precious metals prices last fall, rising by a robust 39.7% from its low on September 1st (17.55 USD). However, silver prices have been stuck around the downtrend line in the 24.50 USD range since mid-December. The expected breakout above this resistance did not occur. Accordingly, the anticipated final push (typical for silver at the end of a sector wide rally) was prevented by the sudden drop in gold prices starting in early February. Instead, there has been an unrelenting correction of over 17% in the last four weeks. Only since silver prices hit a low of 20.43 USD, more buyers than sellers started to show up in the silver market.

The sharp pullback in February has certainly dimmed the outlook for precious metals prices a bit, but it can still be considered a healthy correction. It is crucial now that Tuesday’s lows are not significantly undercut. If that is the case, there would be little in the way of a renewed wave of recovery, as daily charts are oversold and have been providing new buy signals for the past two days.

Very difficult macro setup

Fundamentally, two strongly negative factors continue hanging over the markets, namely the aggressive interest rate hikes as well as the announced balance sheet reductions by central banks in the US and the Eurozone. Although this central bank policy is known and currently somewhat priced in, dwindling liquidity in the financial system can still cause fresh disruptions at any time. Similarly, the ongoing drama in Ukraine remains a major burden, especially since the media on both sides still only give attention to warmongers and escalation. This geopolitical powder keg remains very difficult to calculate.

De-dollarization gathers momentum

However, the trend towards de-dollarization is gaining momentum worldwide, particularly in the Middle East, Asia, and Africa. Furthermore, the US Federal Reserve is already more than a big step ahead of the European Central Bank in the interest rate hike cycle, hence markets are likely to price in a pivot from restrictive interest rate and monetary policy for the US in the coming months. This would result in a depreciating US dollar against the Euro.

In addition, the bond markets are under pressure with yields of over 4.1% for 10-year US Treasuries. While new money can now be invested at rather attractive rates, all long-term bond purchases in the last 15 years are deeply underwater.

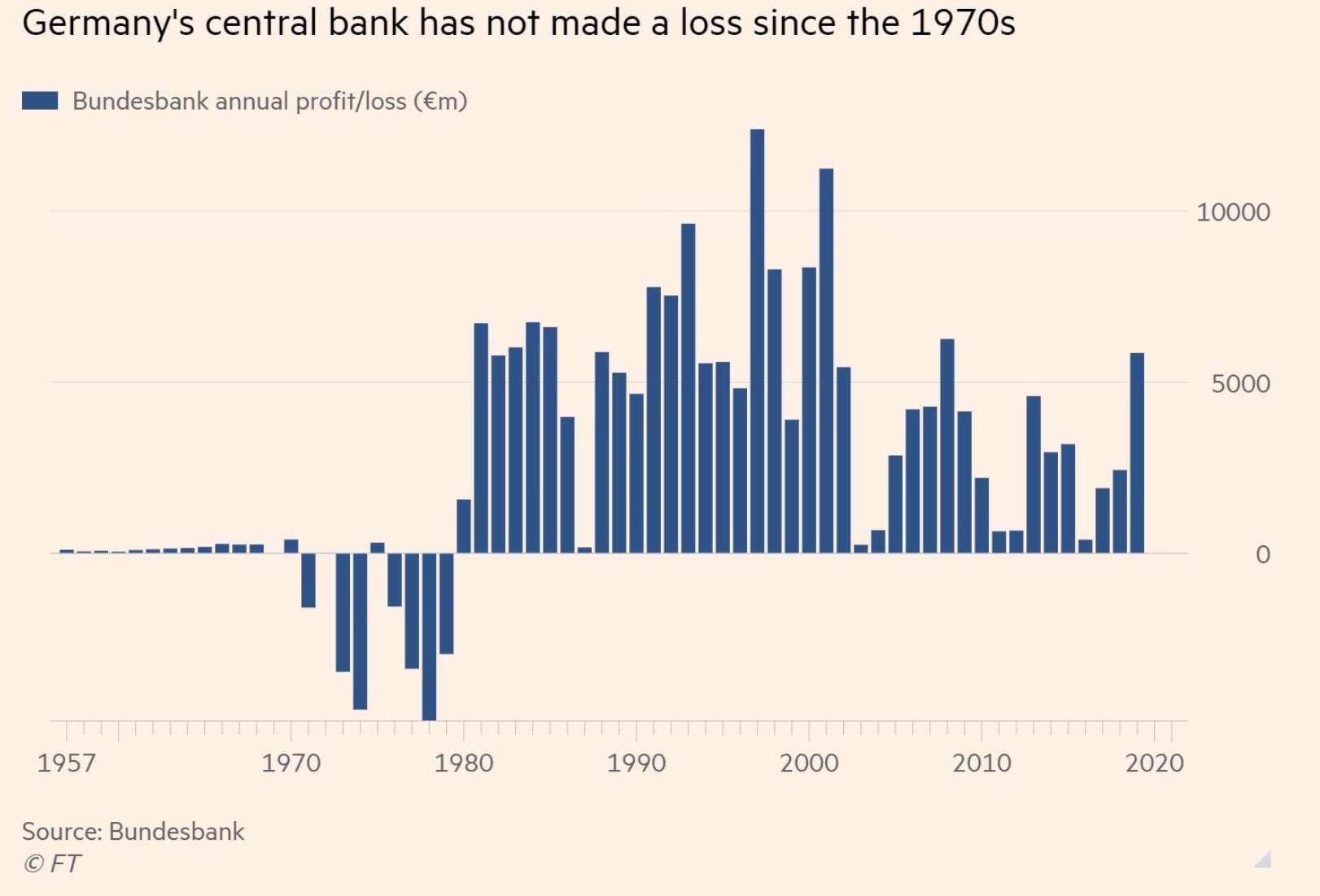

Bundesbank with operating loss

Germany’s central bank has not made a loss since the 1970s as of March 1st, 2023. Source: Holger Zschäpitz

It is not surprising that the German Bundesbank had to report an operating loss of 0.972 billion EUR for 2022. Only the release of reserves kept the overall result in the black. The interest rate shift and the sharp rise in US capital market interest rates caused “special financial burdens” last year, leading to a loss in value of the Bundesbank’s foreign exchange reserves. However, the growing gap between the rising interest rates the bank must pay for deposits and the lower yields from the 1 trillion EUR bond portfolio was primarily responsible for the first operating loss since the 1970s.

The results of the Bundesbank serve as a warning example. The mega-bubble in the bond markets has long burst, and trouble is looming. Just 1% of the institutional funds allocated there are enough to send the gold price soaring into the stratosphere. In addition to the weaker US dollar, the increasing stress in the bond markets is likely to be the second major driver for the next phase of the secular bull market in precious metals.

Silver US-Dollars: Stabilization around the 200-day moving average

Silver in US-Dollar, daily chart as of March 2nd, 2023. Source: Midas Touch Consulting

Four weeks ago, it looked as if silver was about to break out of its six-week consolidation and to follow its seasonal pattern with a final exaggeration until the start of spring. Instead, the Bollinger Band Squeeze started to move downwards, and silver quickly lost over 17% in the last few weeks. Finally, at 20.42 USD buyers found more footing just below the 200-day moving average (20.97 USD) since Tuesday.

Fortunately, this first “bounce” has dissolved the bearish embedded Stochastic and thus activated a buy signal. The oscillator is strongly overbought, while momentum has now turned up. This bodes well for at least a recovery towards the falling 50-day moving average (22.91 USD). The now-flat 200-day moving average could serve as a springboard. However, in the short term, silver is more likely to consolidate around this moving average, which could delay the start of a larger recovery wave.

Silver in Euros: Buying limit below 20.00 Euro activated

Our buying limit of 20 EUR has been triggered in recent days. The euro silver price has fallen by almost 16.8% since the beginning of February, providing an excellent buying opportunity. In particular, the weekly chart is clearly oversold! Generally, lower prices towards the September low (17.58 EUR) are possible until early summer, of course. In the medium- to long-term however, the potential reward strongly outweighs the short-term risks at current prices below 20 EUR.

Conclusion: Silver – Has the sharp correction already been completed?

Overall, the outlook for precious metal prices remains very favorable. However, we must expect the typical seasonal weakness and false signals until early summer. If the gold price wants to break out to new all-time highs in the third or fourth quarter of 2023, the pullback should already be over, and a new attempt towards 1,950 to 2,050 USD could follow in the coming weeks or months. In the short term, there could be some more confusion and consolidation while a bottom is forming.

As always, silver will follow gold and may only develop a life of its own in the later part of the bull market. The crucial hurdle in the form of the downward trend line is currently a good distance away. And the technical structure signals a consolidation between 19 USD and 23 USD until early summer.

Analysis initially published on March 2nd, 2023, by www.gold.de. Translated into English and partially updated on March 2nd, 2023.

Feel free to join us in our free Telegram channel for daily real time data and a great community. If you like to get regular updates on our gold model, precious metals and cryptocurrencies, you can also subscribe to our free newsletter.

Disclosure: This article and the content are for informational purposes only and do not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. The views, thoughts, and opinions expressed here are the author’s alone. They do not necessarily reflect or represent the views and opinions of Midas Touch Consulting.