The Midas Touch Gold Model™ – in neutral mode!

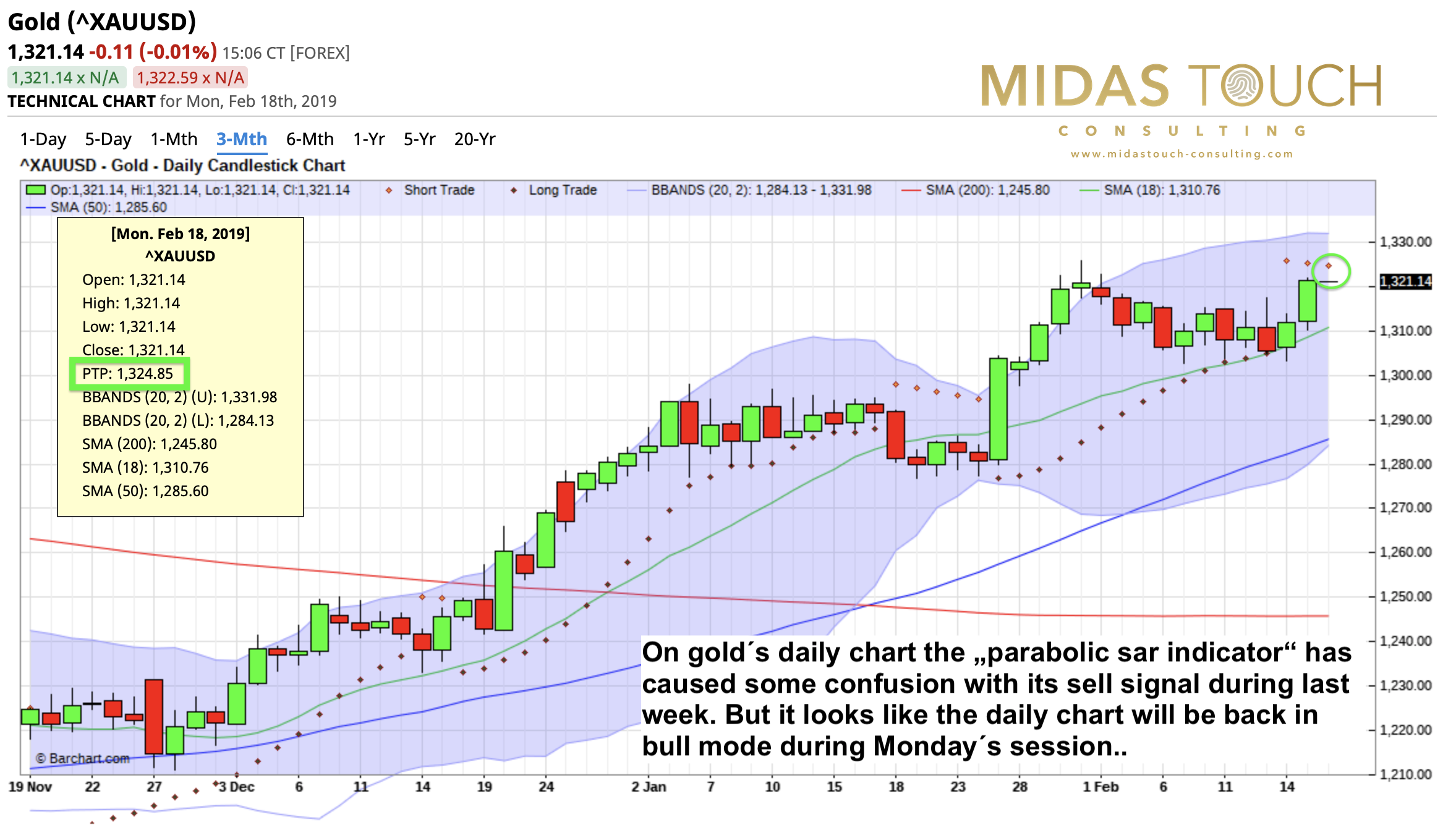

Gold finished the week with a bullish close above 1,320 USD. Bulls remain in control and the expected spike towards around 1,350 USD remains very realistic over the next few days or maybe weeks.

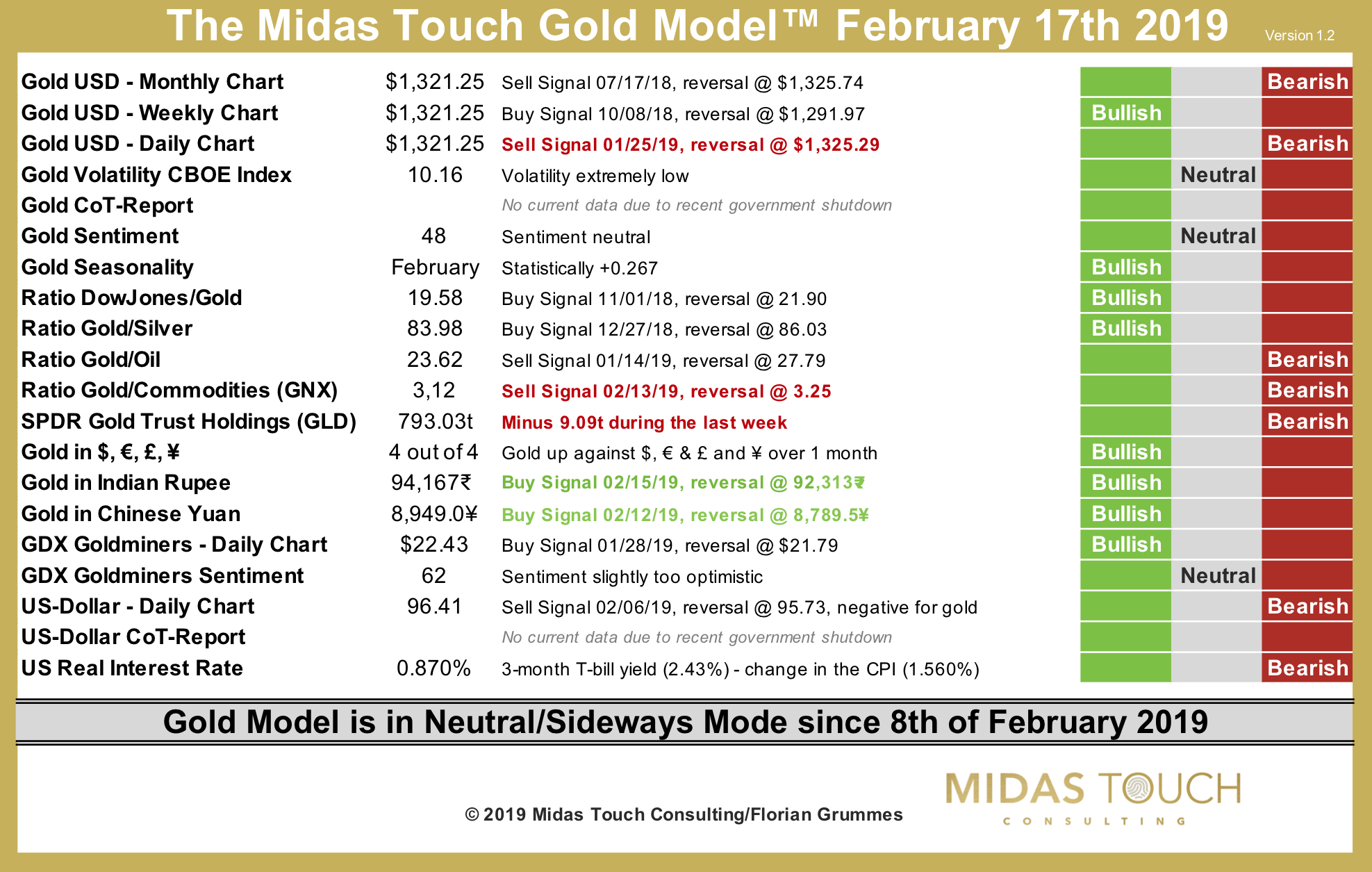

At the same time, our Midas Touch Gold Model™ is in neutral mode, indicating that the air is getting thiner and thiner for the bulls! Of course, general public perception is getting more and more bullish, pushing all the amateur traders into the slaughterhouse… Interestingly enough, the monthly chart for gold is just a few dollars away from a pro-cyclical buy signal. But these type of signals on the monthly chart usually come in very late and are basically just conforming the last six months of price action. Zooming into the daily chart for gold, the model added a new sell signal during the week when gold pulled back towards 1,302 USD. This is probably just irritating “short-term noise” as the daily chart only needs to move above 1,325.05 USD to flip this signal towards bullish again. Positive are in any case the new buy signals for gold in Indian Rupee and Chinese Yuan. The strong outflows (minus 9 tonnes) from the inventory of the largest gold ETF (GLD) on the other hand are a negative signal. They might imply that the last leg of this six-month up-wave is (as usual) only happening in the paper markets for gold! Note that exaggerations in the gold market are never backed by physical demand…