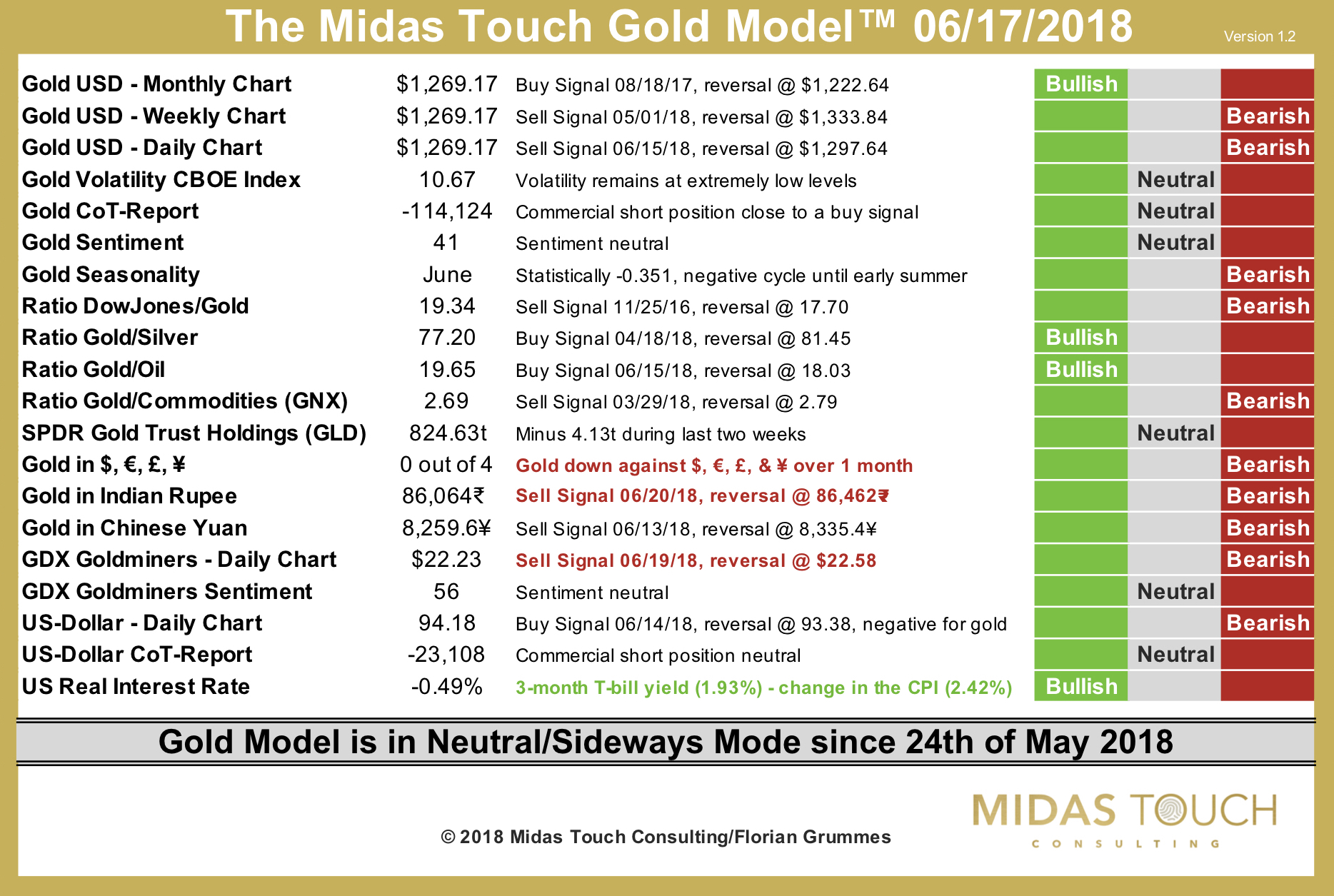

The Midas Touch Gold Model™ continues just neutral!

Again the Midas Touch Gold Model™ concludes this week with a neutral conclusion. Yet gold did move all the way down to 1,261 USD but posted a little reversal on Thursday. This could be the beginning of a turnaround. We will have to see how the next week unfolds.

For the last week there are three new bearish signals that are coming from:

- Gold in $, €, £ and ¥

- Gold in Indian Rupee

- GDX Daily Chart

In total, our Midas Touch Gold Model™ is already in neutral mode since end of May and actually most of the time since end of January too. But gold and precious metals seem to be very close to their bottom here. We might have even seen the low last Thursday at 1,261 USD. In any case, I think its time to get really bullish and start buying into gold, silver, platinum and selected mining stocks. I sense that there is quite some panic, disbelief and simply disinterest out there right now. I haven’t met any bullish gold guy over the last couple of days. Instead, all I can see is hesitation in the best case. A close above 1,294 USD will be the first confirmation, that the lows indeed are in. For the next two weeks seasonality isn’t favorable just yet. So we could still see gold testing the uptrend line around 1,250 USD.