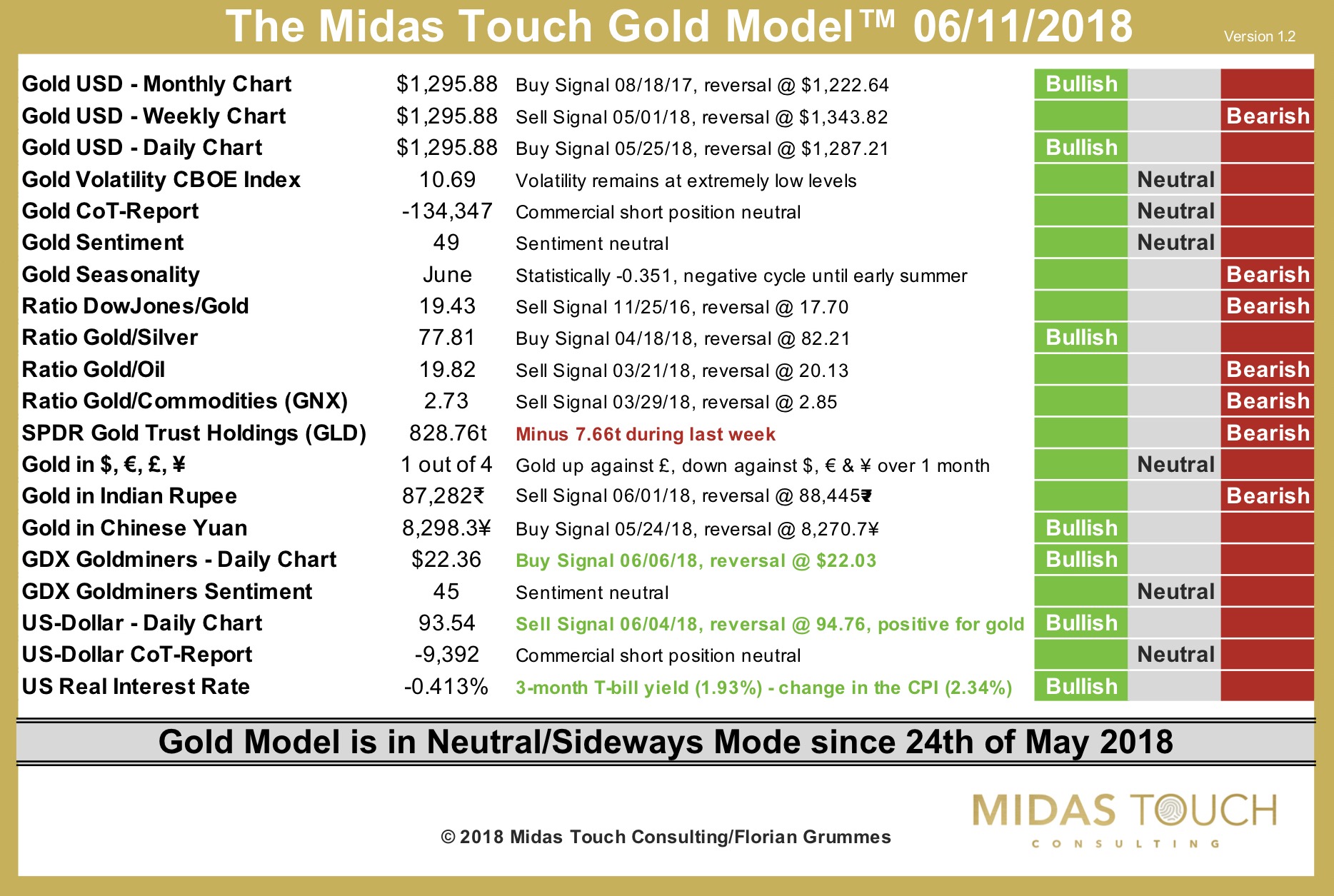

The Midas Touch Gold Model™ remains neutral!

The Midas Touch Gold Model™ continues to come up with a neutral conclusion. During last week´s quiet trading, gold barely moved at all. The trading range was 1,290 to 1,303 USD and volatility remains very low. But inside the model three positive developments have happened…

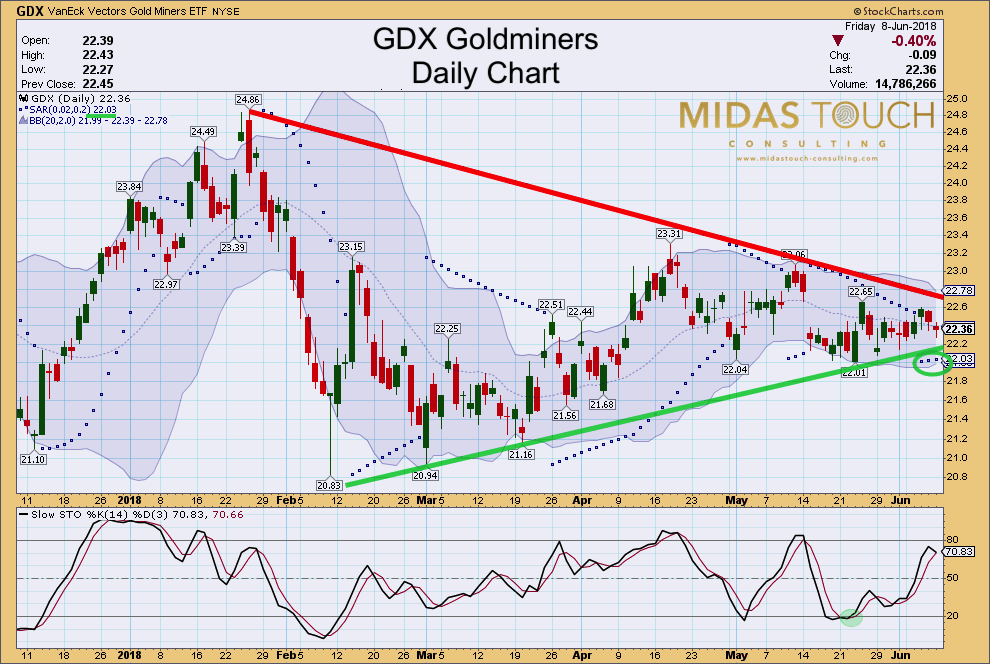

Most interestingly the GDX Goldminers daily chart is back to a buy signal. Since early February already the miners are in an uptrend. During the last six weeks they went sideways ignoring the sell signal from the parabolic sar indicator (in blue). Now this indicator has turned bullish as long as GDX stays above 22.03 USD.

Another new bullish signal comes from the US-Dollar. Here the daily chart for $USD has brought a bearish reversal for the US-Dollar, which of course should be bullish for gold. Finally the US real interest rate is moving back into deeper negative territory. This is mainly due to the rising consumer price index while the yield for US treasury bills remained unchanged. Should this trend of rising negative real interest rates continue, precious metals could respond with a furious and strong rally sooner or later…

On the negative side, once again the shrinking inventory (minus 7.66t last week) of the largest gold ETF (SPDR Gold = GLD) continues to send an ambiguous message. Weak ETF demand certainly is contributing to the current slackness in the sector. At the same time, when all those paper gold investors throwing in the towel, it is usually a good contrarian signal…

Over all, gold and our Midas Touch Gold Model™ remain neutral. Expect more back and forth around 1,300 USD..