The Midas Touch Gold Model™ is back to neutral!

As gold was able to bounce off the strong support around 1,300 USD, the Midas Touch Gold Model™ shifted back to a neutral reading on May 10th. Unfortunately, the model had just turned bearish the week before. Such a bear trap can sometimes happen, especially as the model includes many trend following signals.

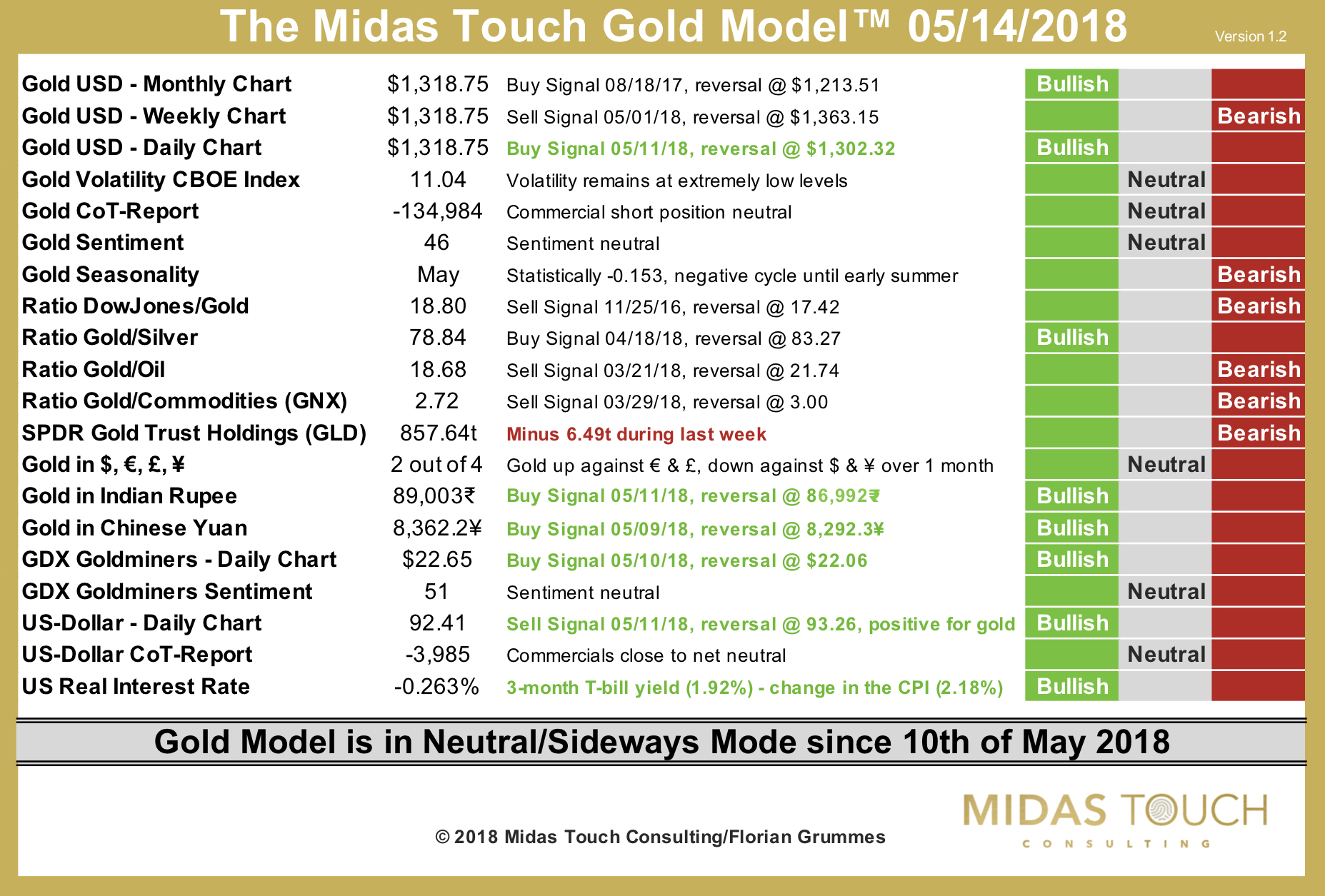

Interestingly enough, it was gold in Chinese yuan that was the first one to post a bullish reversal on May 9th. It was followed by new bullish signals from the GDX daily chart and another day later by gold in US-Dollar as well as Indian rupee. On Friday the US-Dollar itself issued a sell signal, which translates into a bullish signal for gold of course. Another new green light comes from the US real interest rate. With the lastest CPI numbers now at 2.45%, the real interest rate for the US is moving back into negative territory! Falling real interest rates are usually a strong driver for gold!

The only bearish changes comes from the SPDR Gold ETF (GLD). During last week 6.49t of gold have left its inventory.

All together the Midas Touch Gold Model™ is back to a neutral conclusion. Judging from the slow and unmotivated move that gold is currently showing I guess the sideways consolidation between 1,300 and 1,365 USD might continue for some more weeks. As well I still believe gold needs one final dip below 1,300 USD before a new up-leg can start. Especially the CoT numbers and seasonality are still signaling that gold is not yet ready to move higher.