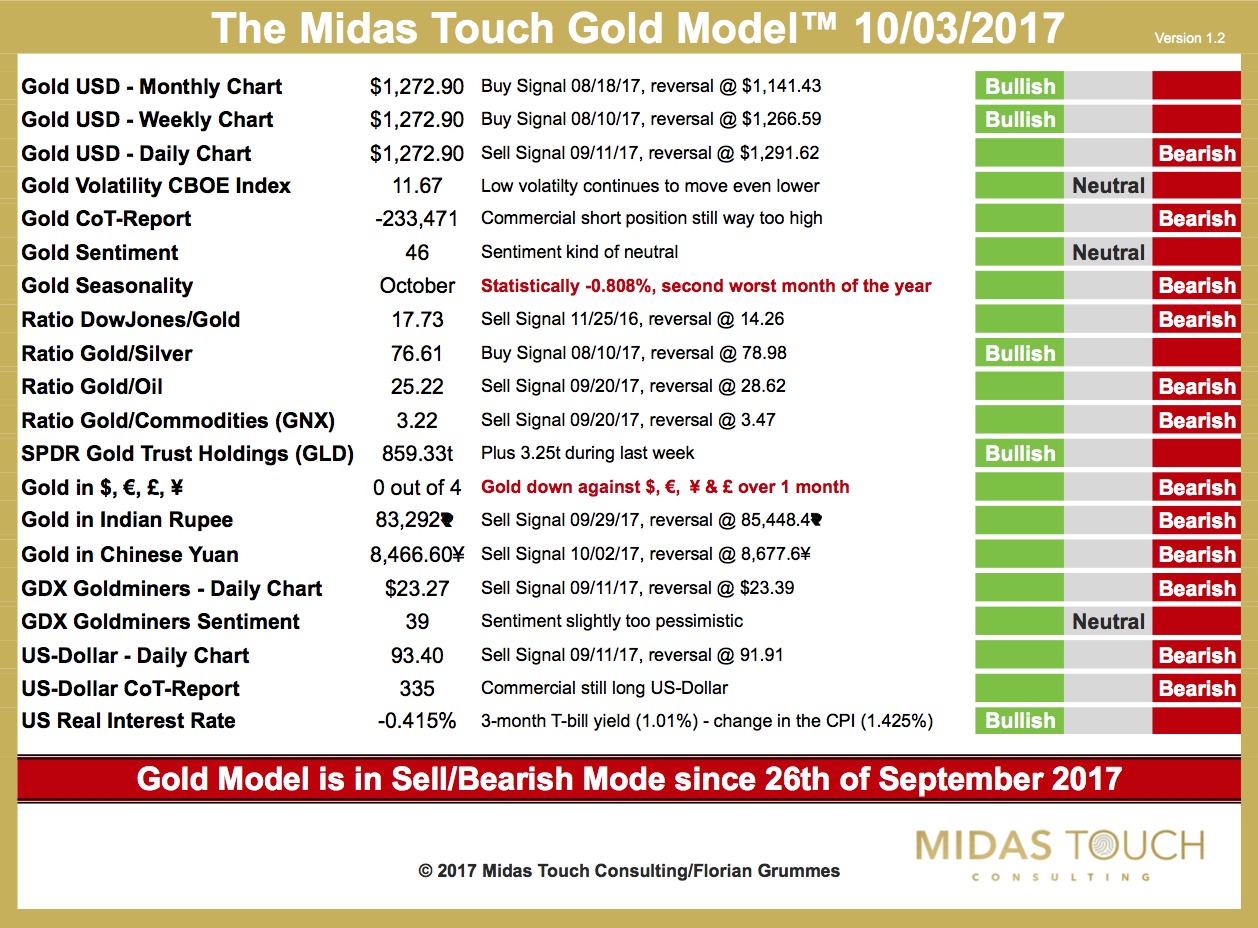

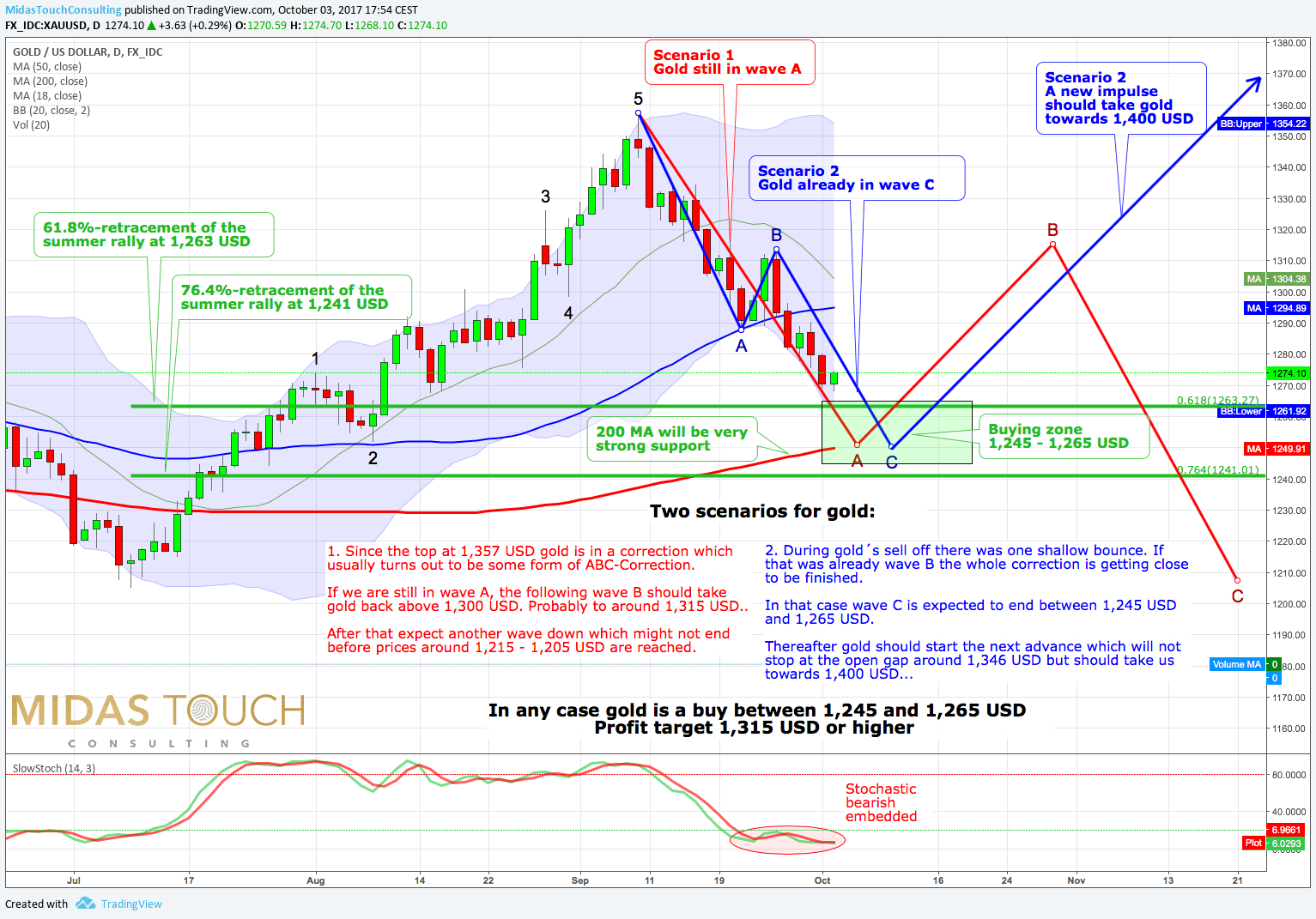

The Midas Touch Gold Model™ is in bear mode since 26th of September. Yet gold is getting very oversold while the stochastic is bearish embedded.

From our point of view there are two scenarios for gold with a buy between 1,245 and 1,265 USD:

1. Since the top at 1,357 USD gold is in a correction which usually turns out to be some form of ABC-Correction.

If we are still in wave A, the following wave B should take gold back above 1,300 USD. Probably to around 1,315 USD..

After that expect another wave down which might not end before prices around 1,215 – 1,205 USD are reached.

2. During gold´s sell off there was one shallow bounce. If that was already wave B the whole correction is getting close to be finished.

In that case wave C is expected to end between 1,245 USD and 1,265 USD.

Thereafter gold should start the next advance which will not stop at the open gap around 1,346 USD but should take us towards 1,400 USD…

In any case gold is a buy between 1,245 and 1,265 USD

Profit target 1,315 USD or higher

Stopp loss 1,235 USD