Gold did indeed continued its correction and reached a low at 1,260 USD on Friday the 6th of October. I hope you followed my advise and went long below 1,265 USD, cause since then a strong recovery is on its way and gold is already back above 1,300 USD.

Yet the big questions whether this current up-move is just a wave B type recovery or in deed the beginning of the next big up-leg towards 1,400 USD remains unanswered.

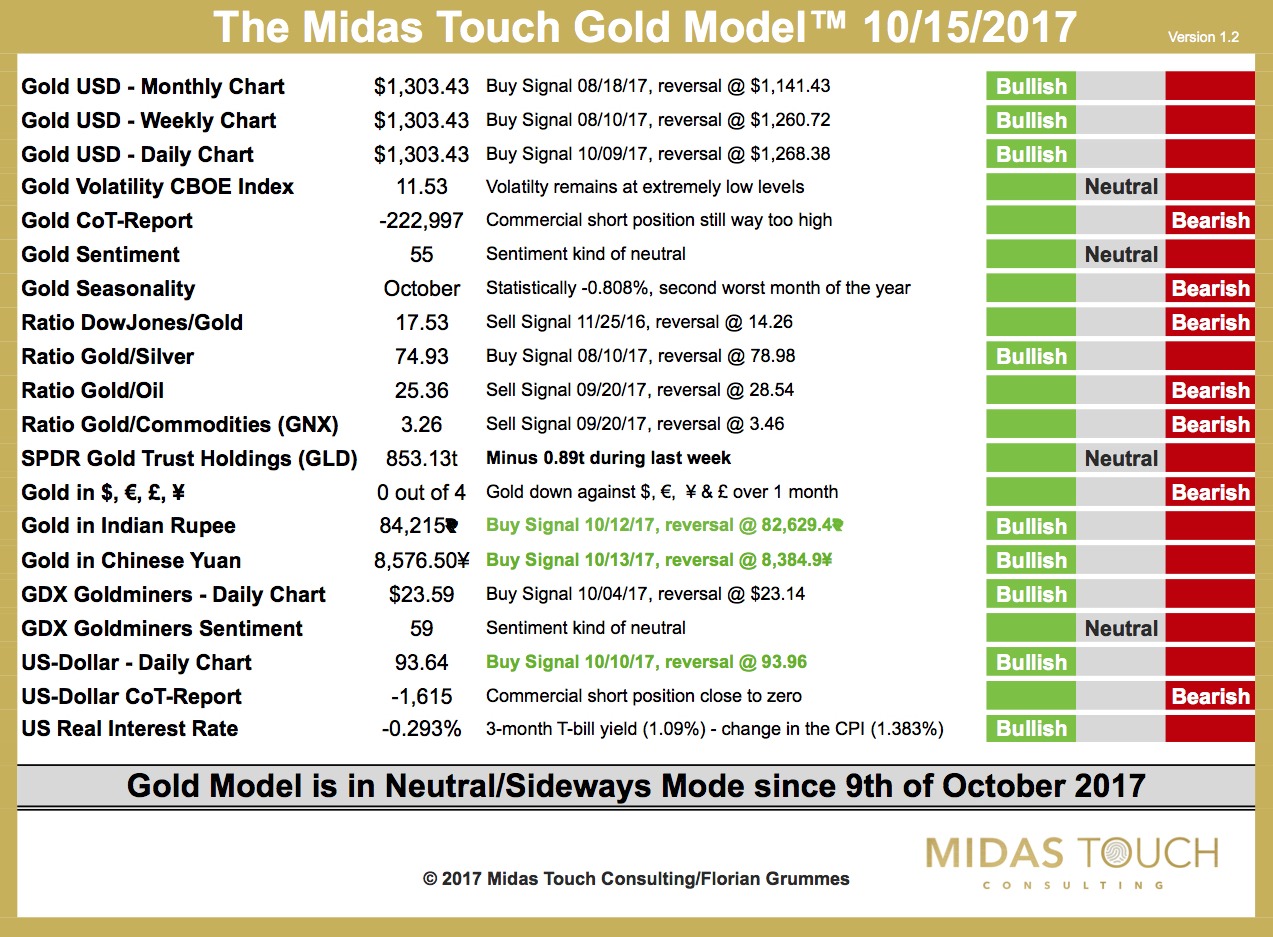

Our mechanical Midas Touch Gold Model™ has shifted to a neutral conclusion on October the 9th. Over the last couple of days a few new buy signals showed up. Besides the obvious ones for gold in Indian Rupee & in Chinese Yuan the US-Dollar has come back down enough to create a buy signal for gold six days ago. Especially positive is the fact, that gold in US-Dollar now has a buy signal one the daily, weekly and monthly chart.

Overall it therefore doesn’t take too much for a bullish conclusion of our model anymore. But looking at the CoT-Report its clear that the commercial are still holding a massive short-position in the gold futures-market. And you don’t want to bet against them. So besides any short-term recoveries the correction since early September seems not to be over yet. It would be a surprise if the bulls can force the professional players to raise their short positions once again.

Coming back to the technical outlook for gold the most likely outcome is that we are currently in wave B that will end somewhere between 1,315 and 1,345 USD. At 1,345 USD there is still an open gap waiting to be filled! The upper Bollinger Band currently sits at 1,316 USD. So we might see a temporary pullback from those levels before gold can find more strength to close the open gap. After that I expect another move down towards at least the rising 200MA currently sitting at 1,255 USD.

Only if gold can take out the September highs at 1,357 USD this outlook becomes invalid as it would mean that the correction since early September has already finished at 1,260 USD on October the 6th.