First moment of truth for Bitcoin since the crash!

My general thinking remains this: Bitcoin has been rising from 162 USD up to nearly 20,000 USD within 28 months and Ethereum went from 8 USD up to 1,400 USD in just 12 months. These types of spectacular moves are usually not digested with just one sharp seven week correction that took Bitcoin down 70%. If you look at former parabolic spikes in Bitcoin it is just realistic to expect more correction or at least more consolidation. So we could indeed be in a crypto winter for the next couple of months or even for a year or two… I guess especially many of the altcoins will have to justify their market-cap by proofing and improving their technology and user adaption during 2018.

1. Bitcoin

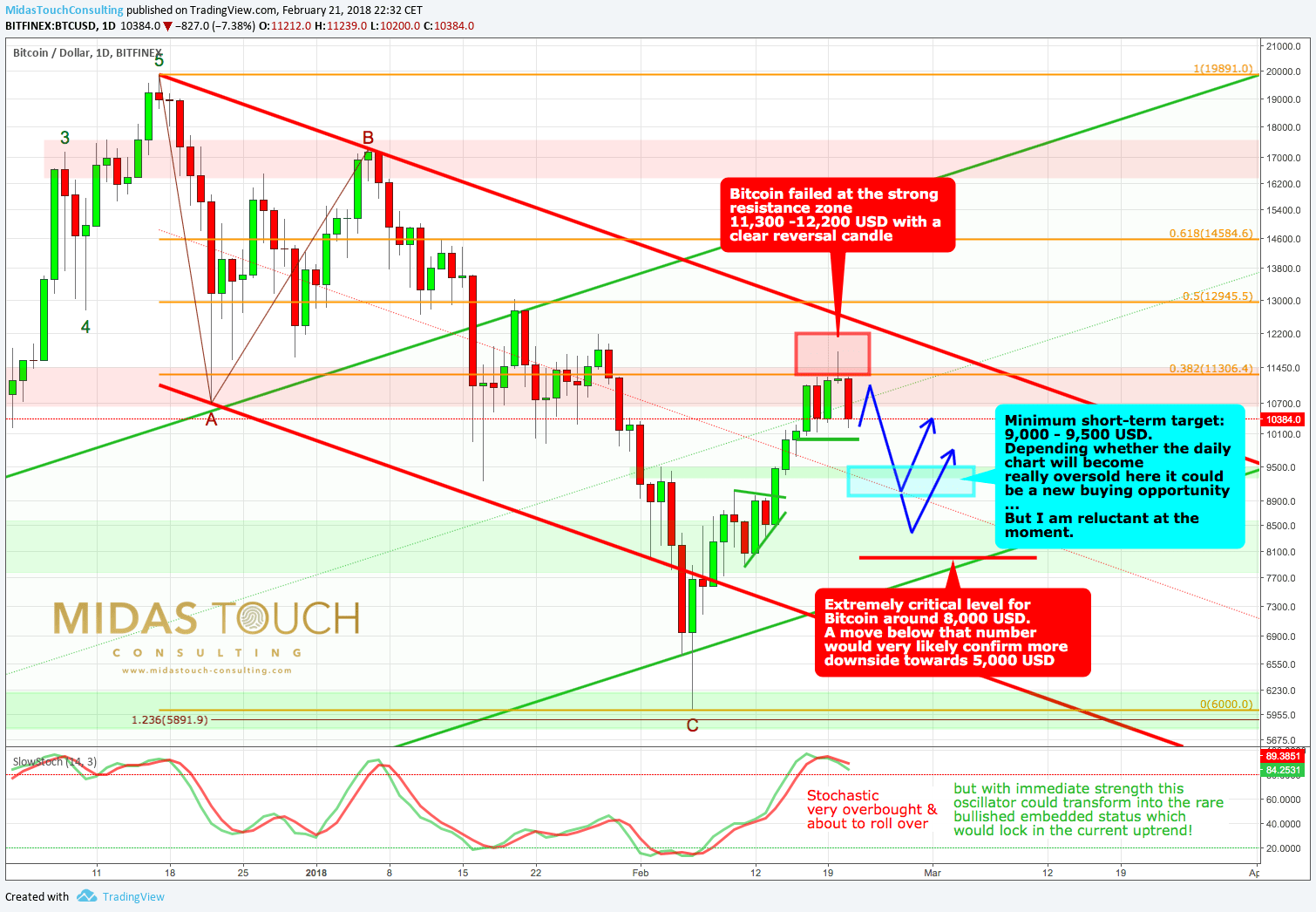

After a 100% bounce within just 15 days Bitcoin has failed at 11,800 USD and posted a pretty obvious reversal candle on the daily chart. The fact that Bitcoin could not take out the 38,2% Fibonacci level around 11,300 USD was to be expected and points towards internal weakness. Especially if you combine it with the lagging altcoins and the clearly overbought situation on the daily chart. Generally a bounce after a dramatic sell-off has to make it above the 38,2% rather sooner than later otherwise its a clear sign of weakness which points to more downside and a continuation of the correction in the larger timeframe. Most importantly I don’t want to see Bitcoin moving below 8,000 USD anymore otherwise lower prices towards 5,000 USD are getting more and more likely.

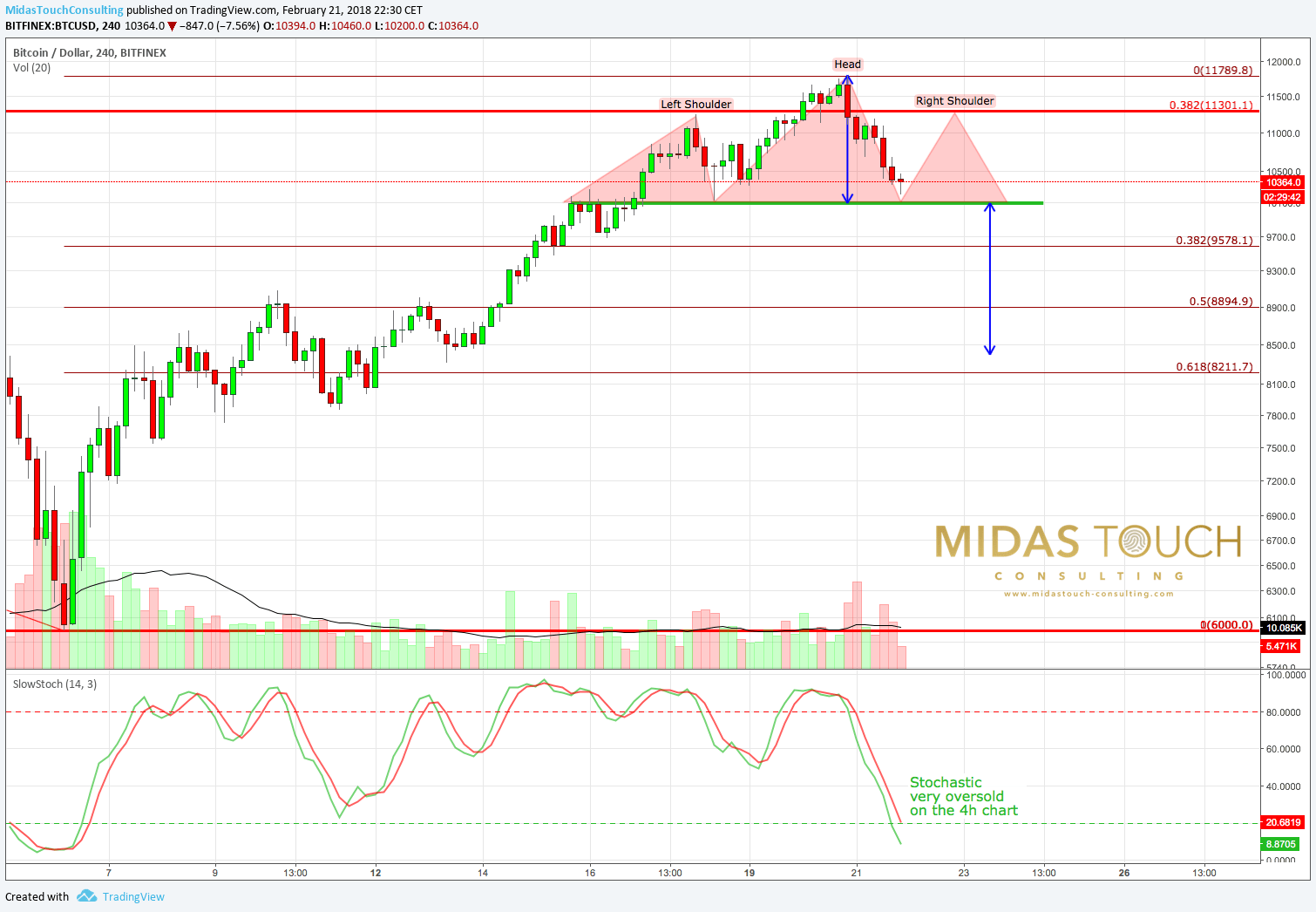

While the daily chart is clearly overbought, the 4h and 1h charts are pretty oversold which favors at least a shallow bounce from around 10,000 – 10,100 USD. Should this happen a potential HS-pattern might be in the making with the head at 11,800 USD and the shoulders around 11,300 USD and a potential target around 8,400 USD! The only caveat is that the volume does not really fit to this pattern. But we should keep this potential scenario in mind as a pullback towards 8,400 USD would certainly create a more oversold opportunity than a pullback towards 9,500 USD would do.

Overall right now there is no need to chase Bitcoin for a long position that you plan to hold for days and weeks or even months. The risk/reward is simply not good. Remember nobody knows the future but the only way to make money in the markets is to BUY LOW AND SELL HIGH. I personally have used prices above 10,500 USD and above 11,300 USD to lighten up on my portfolio and build a larger cash position again.

2. Ethereum

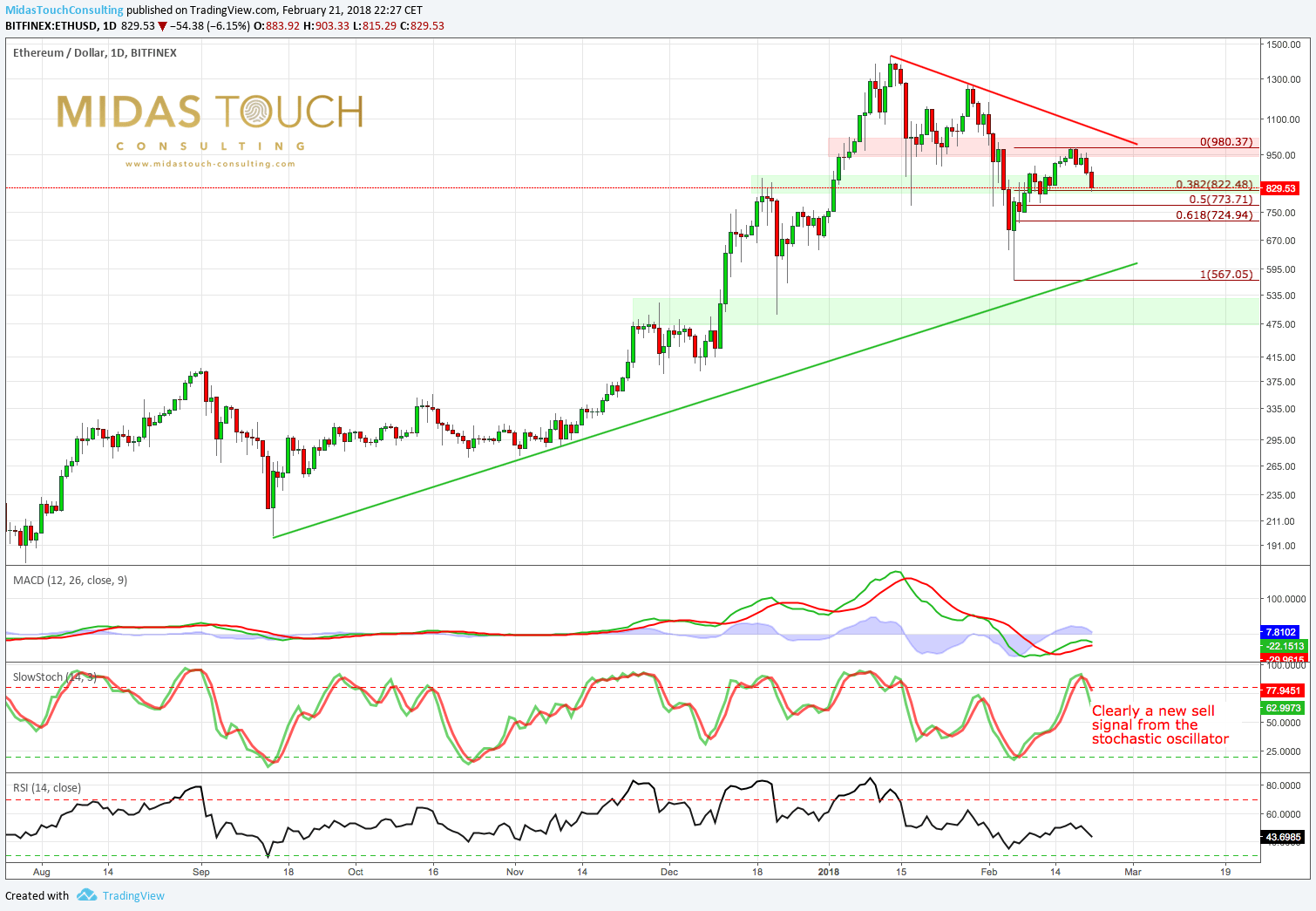

Ethereum does not look very persuasive at the moment. It seems that the correction is not yet done as we have a clear series of lower highs. The recent bounce from the crash lows at 567 USD brought Ethereum prices back up to 980 USD which is just below the psychological level of 1,000 USD. Today Ethereum came down to 815 USD giving back a third of its recovery. Judging from the new stochastic sell signal further downside towards 725 USD is at least to be expected. But the next stronger support sits around 670 USD. Therefore no need to chase Ethereum at current levels! My recommendation is to patiently wait for lower prices and an oversold situation again.

3. IOTA

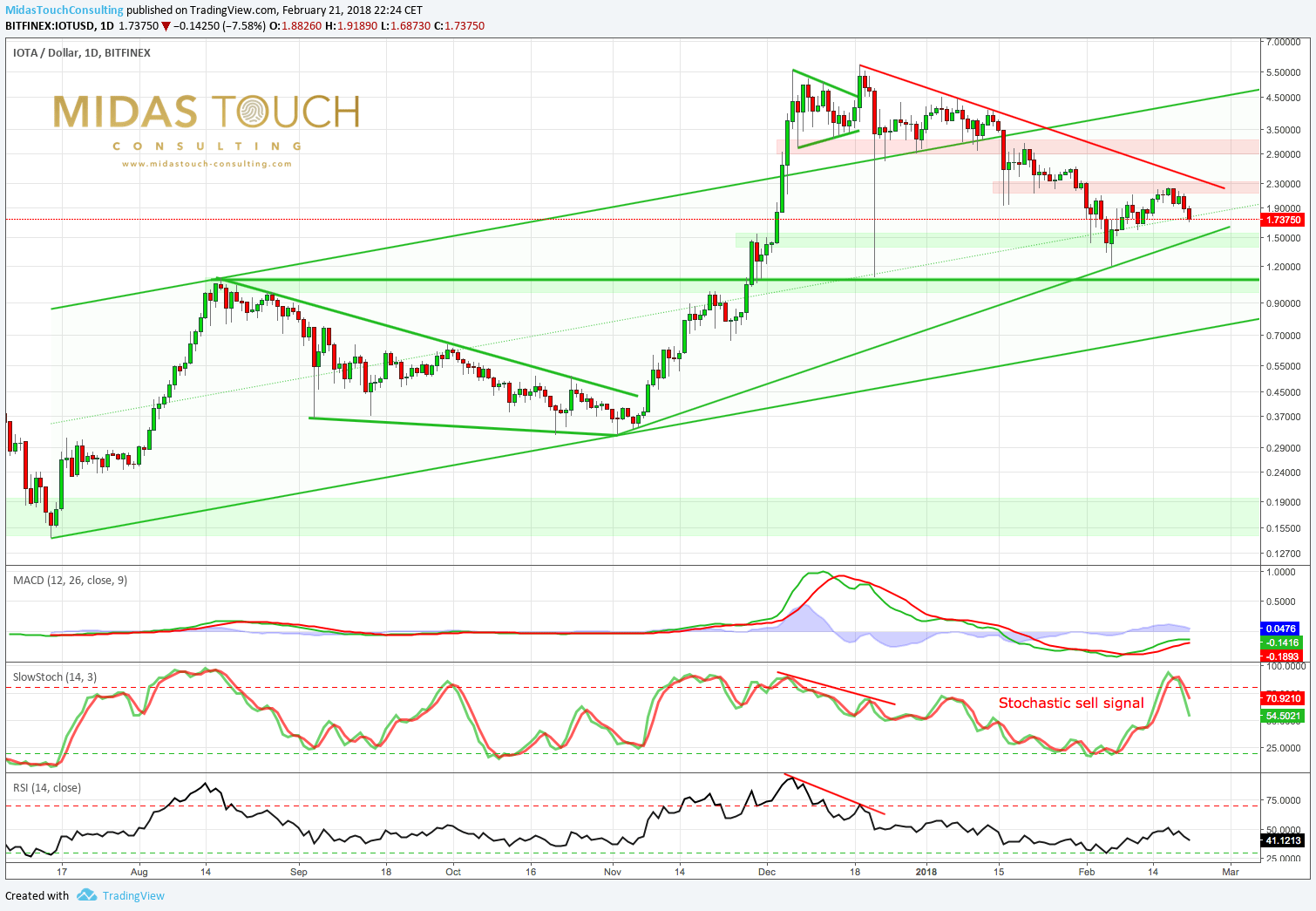

Regarding IOTA I have been extremely bullish last November below 0.45 USD but at this stage I am not so enthusiastic anymore as I personally think that the technical situation is very poorly managed and it takes a lot more development before IOTA can justify current pricing. The chart is not looking very exciting neither. IOTA remains a hold as long as you are comfortable with your position size. Otherwise I recommend to reduce long positions as IOTA could easily move back towards 1,50 USD and even 1,20 USD.