Bitcoin, no exits necessary

It is common knowledge that it is exits where the rubber meets the road. If one has a sound exit methodology (like our quad exit), you’re in business. Exits are more important than entries. However, that doesn’t make it any easier to find these spots where to cash in. And here is where Bitcoin beats all other trading objects. Bitcoin, no exits necessary.

Well, maybe it isn’t quite that simple. If you want to have both, an income-producing approach and wealth preservation long-term investing strategy, you still need to take partial profits at times; you still need to use a tool like our quad exit. Generally speaking, though, you do not need to worry about exits regarding Bitcoin trading.

While bitcoin is consistently exploring new all-time highs since 11/30/2020, many wonder how high will this go. It is even harder to predict good exit points when price enters the uncharted territory of new all-time highs. Wall Street gurus speak of sell points with various six, seven, and eight-figure numbers of all sorts. But isn’t it evident that if Bitcoin reaches these higher echelons, you do not want to sell it? Sell it for what? What would be more interesting to own than Bitcoin if it trades at US$700,000 or US$7,000,000 or US$7,000,000,000? All you want is just to own Bitcoin. It will be the currency that will purchase you whatever you need. Being limited at twenty-one million, Bitcoin is a scarce “digital commodity”.

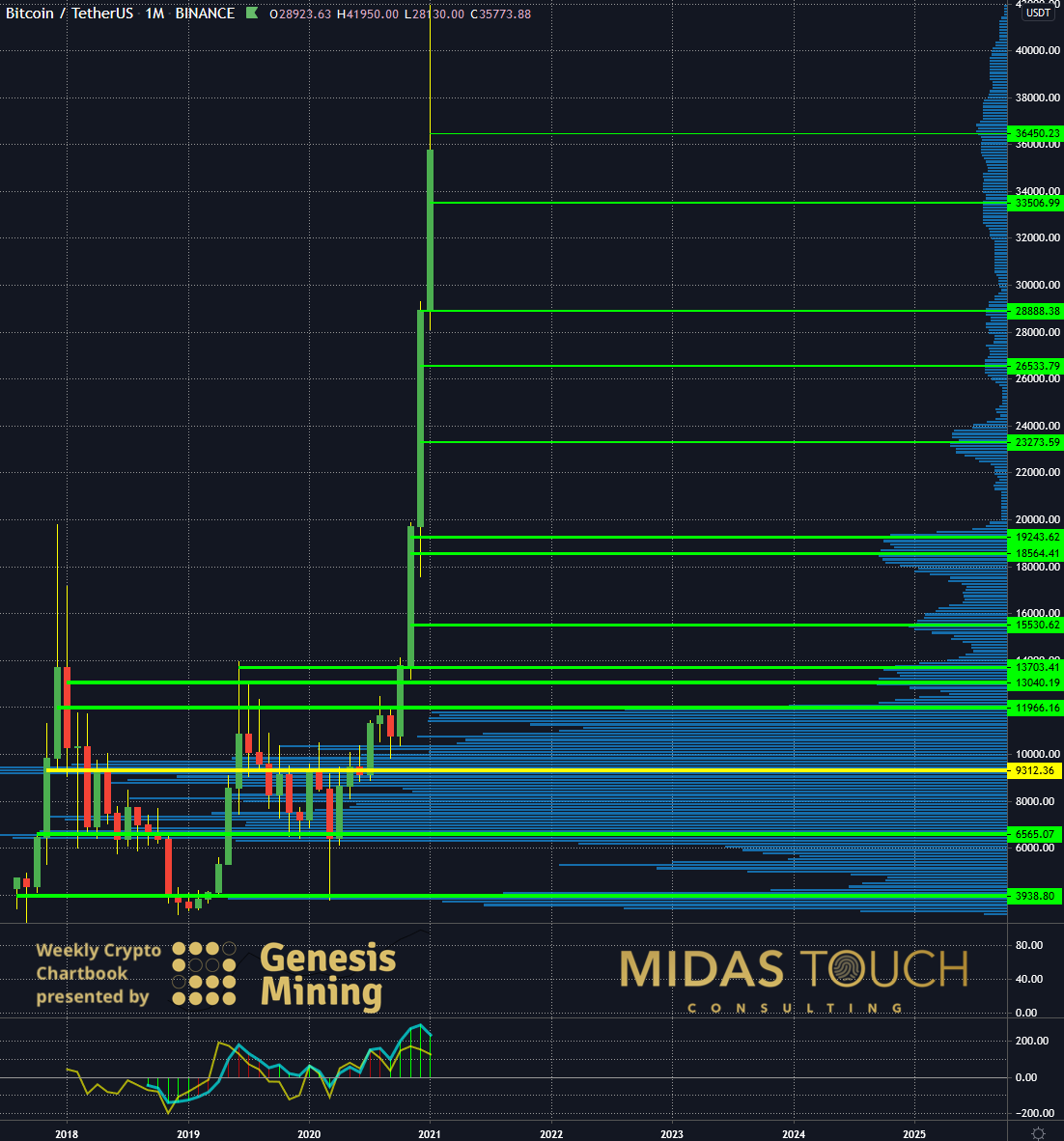

BTC-USDT, Monthly Chart, Roadmap overview:

BTC-USDT, monthly chart as of January 18th, 2021

The above chart shows in blue to the right in histogram style average volume traded on Bitcoin. We marked in green horizontal lines peak volume regions where bulls and bears had extended battles of buys and sells. Supply and distribution zones. The highest volume peak, called POC (point of control), is marked in a yellow horizontal line. Bitcoin prices will likely see much higher price levels than recent all-time highs, but we find a roadmap like this essential. A market crash in the stock market could temporarily drag Bitcoin along, but Bitcoin will recover with much vigor and quick speed. In such a scenario, these supply zones will provide an opportunity for reload entries to the runners which we are already holding as a core position.

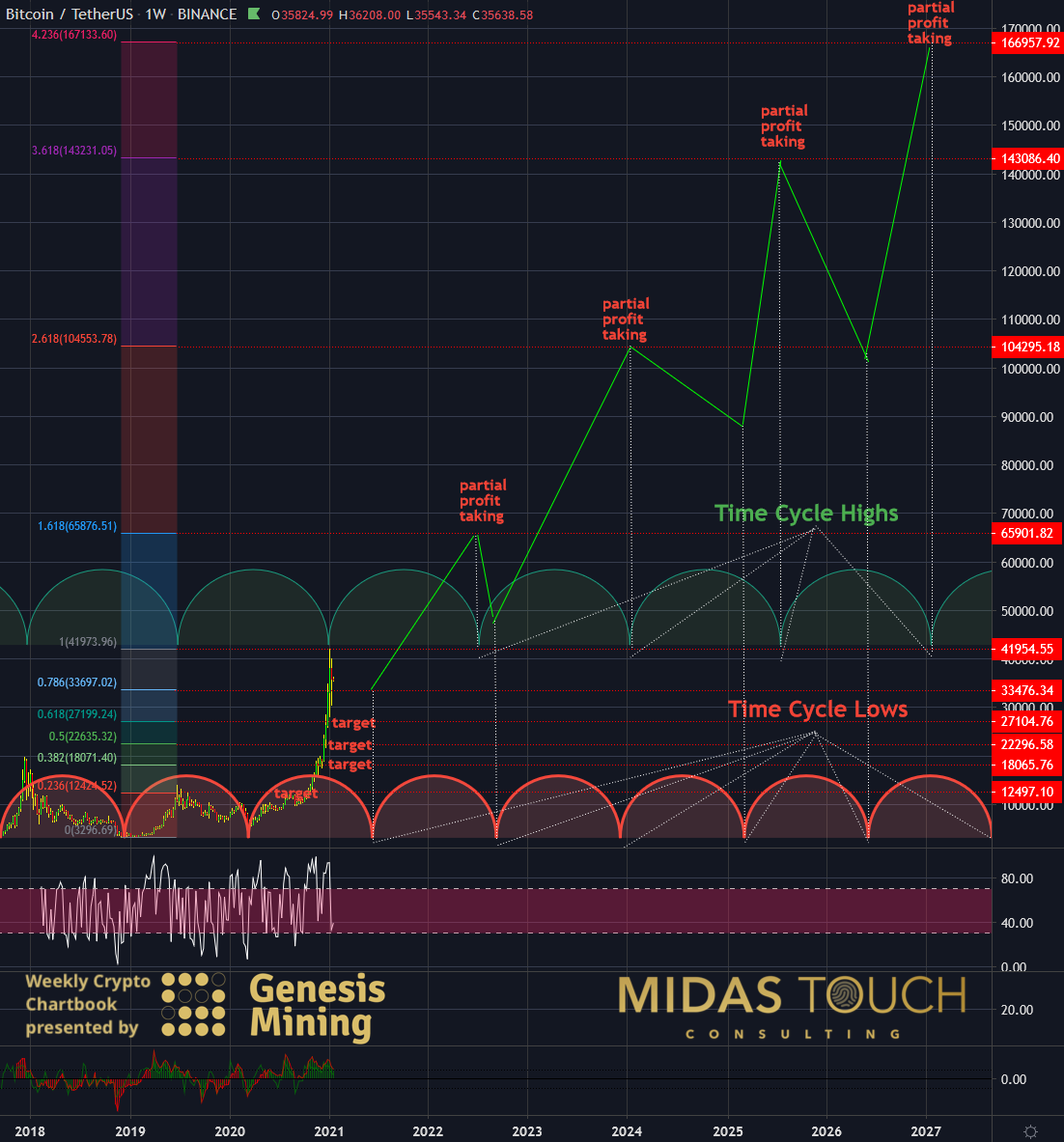

BTC-USDT, Weekly Chart, Time cycle and Fibonacci projections:

BTC-USDT, weekly chart as of January 18th, 2021

Bitcoin is consolidating right now and we see a bottom to be established soon. Afterwards Bitcoin might be heading towards the recent highs, followed by a breakthrough again. The weekly chart above tries to keep the bigger picture in check. We stacked exit odds projections by using a time cycle instrument and a Fibonacci extension tool. We shared the target numbers of where we find partial profit-taking sensible over the next six years marked in red to the chart’s right. But let the runners (the last 25% of each initial position) run! No exits are necessary for those.

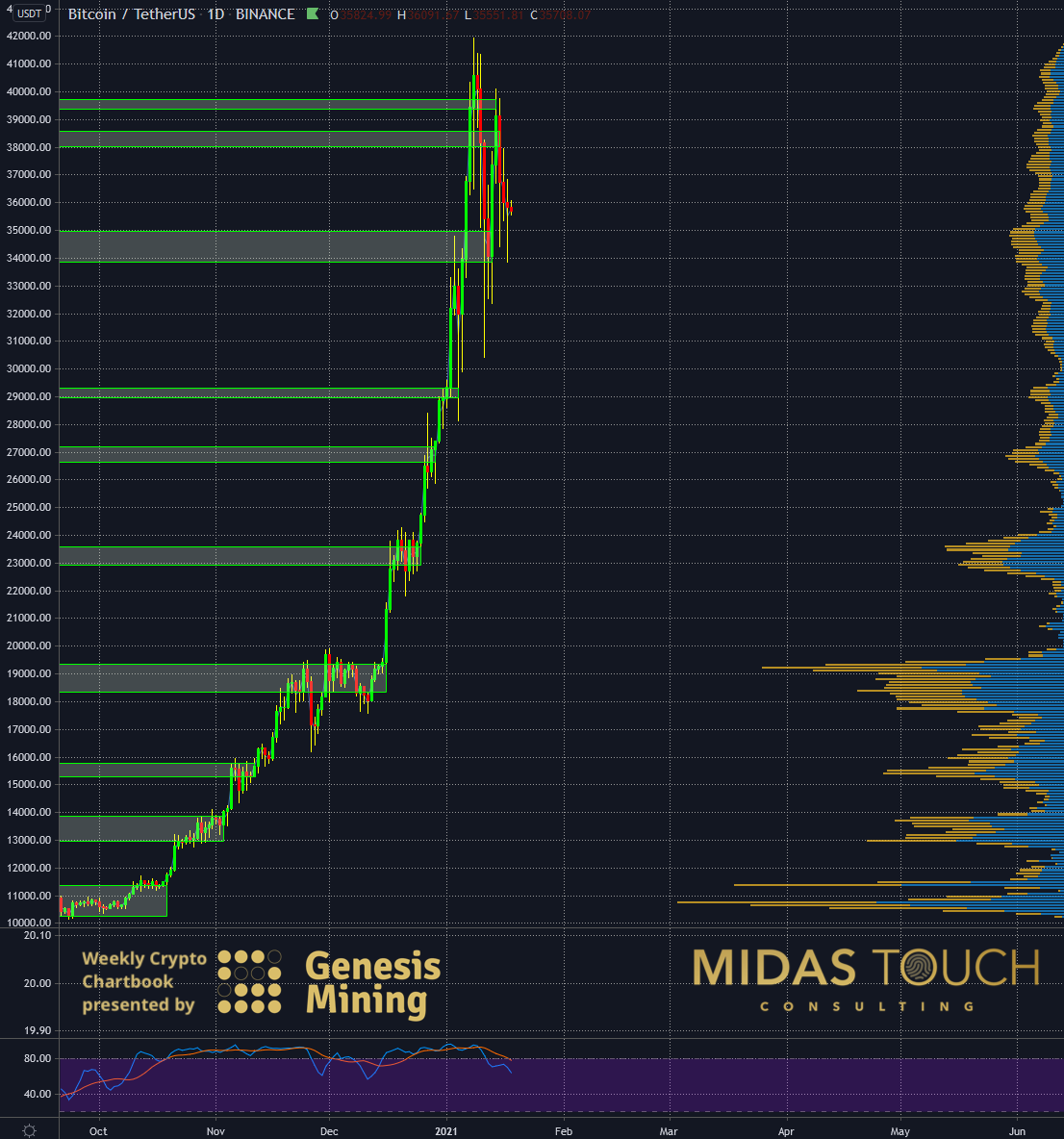

BTC-USDT, Daily Chart, Real-time partial profit prediction zones:

BTC-USDT, daily chart as of January 18th, 2021

Zooming now into a smaller time frame, we are trying to illustrate on this daily chart how these volume measurement tools (available in almost all charting software packages) can also help to predict partial profit-taking zones. To the right, we plotted volume again, to the left mirrored green box zones show sensible profit taking zones should bitcoin prices retrace. After smart entry places those zones are needed to take some profit off the table.

But that isn’t all. With a volume histogram open like this, you can see distribution zones establishing in real-time. Establish meaningfulness by comparing the volume peak levels with prior peaks. This volume analysis approach is advantageous when bitcoin should be extending in new all-time high territory again.

Bitcoin, no exits necessary

At Midas Touch, we advise our clients to hold a portion of their wealth in Bitcoin. We use the quad exit strategy as a risk reduction tool for entries. We do recommend taking partial profits if income-producing profit-taking fits your investment style.

But in general, we are holding on to what we call runners, the last 25 % of a trading position, and while we have in any other commodity exit targets for those as well when it comes to Bitcoin, we just let them run add infinity.

In other words, while one was thinking in the last hundred years of one’s wealth and profits measured in fiat currencies, it might be sensible to now instead think of one’s net worth in Bitcoin!

We post real time entries and exits for many cryptocurrencies in our free Telegram channel.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.