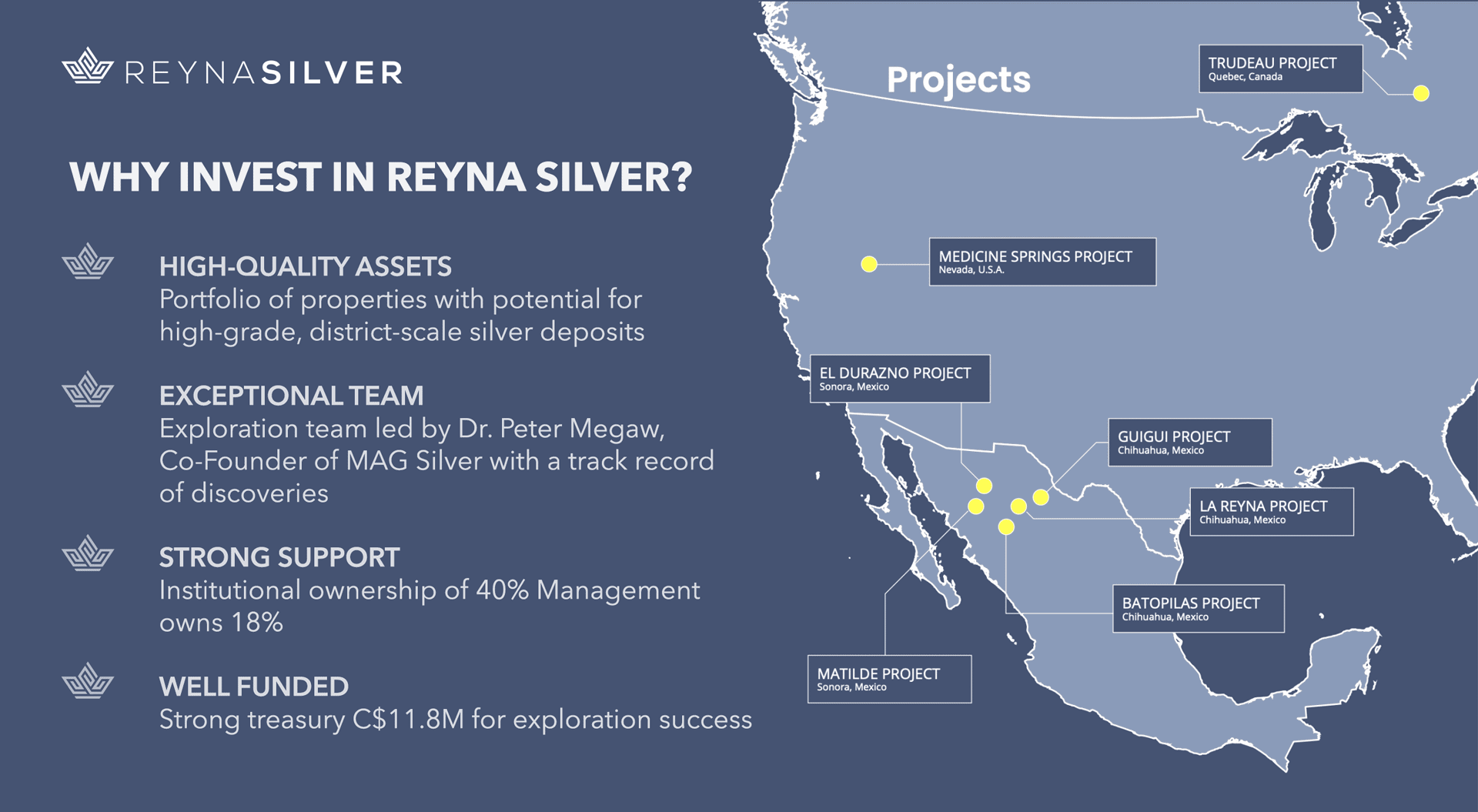

Silver, the exception

Martingale’s strategies are famous for getting broke quickly. Novices use this method of buying more when prices go down since it soothes psychology. Not having to admit one is wrong is a gambler’s tool. From a statistical money management point of view, it is high risk and serves brokers to get you to pay more commissions, while becoming over-leveraged. Hence, you will buy more shares than initially planned. But there are always exceptions to the rule. Silver, the exception.

We highly advocate to never throw good money after bad money and only use Anti-Martingale strategies. However, the rare situation that Silver finds itself in right this moment allows for adding paper plays to your physical Silver holdings. The reasons are as following: While the spot price dipped below US$25, physical acquisition prices held relatively steady. This stretch between spot and actual Silver purchase prices shows an imbalance that works like a rubber band effect. As such, we would even be as confident to say this is still a physical acquisition of Silver opportunity.

First and foremost, recent Silver price drops shouldn’t cause you to sell your physical holding. Secondly, it is worth considering taking on small position-sized spot Silver trades to leverage one’s physical holdings.

Fundamentally thinking: Has anything changed?

- Are supply chain discrepancies fixed?

- Is the economy on solid grounds?

- Has money printing stopped, as the FED Balance sheet hits a new all-time high?

FED balance sheet as of July 21st, 2021. The balance sheet of the Federal Reserve (US central bank) has hit another all-time high as FED president Jerome Powell keeps the printing press rumbling despite spiraling inflation. Just last week alone, total assets rose by another US$39billion to US$8,240.5billion. This is equal to around 37% of US’s GDP.

Do not be deterred by temporary price imbalances, but look at the larger picture and the necessity of some wealth preservation insurance.

Gold/Silver-Ratio in US-Dollar, Daily Chart, Stretched and ready to snap back:

Gold/Silver-Ratio, daily chart as of July 22nd, 2021.

It isn’t only the “stretch play” between spot and actual physical silver acquisition price that is an edge on Silver entries right now. The Gold/Silver-ratio also has had a recent run-up in price, where Silver eventually will have to catch up to its big brother Gold. The daily chart above shows how the “stretch” between the two precious metals rose from a level of 62 to 73 over the last six months. An imbalance extreme that will have to return to its mean (and beyond) at some point.

Weekly Chart, Silver in US-Dollar, Silver, the exception, Buying zone opportunity:

Silver in US-Dollar, weekly chart as of July 22nd, 2021.

If you give the up sloping green buying channel a look at the weekly chart above, you will find that each time price penetrated this zone, a sturdy leg up followed. You will find a histogram of fractal volume analysis to the right of the chart. It illustrates extended bars, meaning good support, at price levels between US$24 and US$25. You can also find an indicator divergence on the “turbo” (thin yellow line) on the Commodity Channel Index oscillator (indicator below the volume bars).

With the round number of US$25 showing good previous support for price reversals, we are confident in a longer-term play to be engaged at these levels. As contrarians, we take entries at the lower part of this up sloping bull flag. Consequently, possibilities open up to finance trades at higher levels. In addition, we are already positioned if prices break through the upper resistance line (red horizontal line).

Silver in US-Dollar, Daily Chart, Good timing for risk reduction:

Silver in US-Dollar, daily chart as of July 22nd, 2021.

The daily chart provides the opportunity to fine-tune one’s entry. Consequently, we stack our odds one more time and reduce risk. Silver prices already reversed from US$24.80 levels to the upside, and we posted real-time entries for this trade in our free Telegram channel. We use our quad exit strategy to reduce/eliminate risk early on.

A closer look at the chart above shows that this first attempt might not be successful right away for follow-through. We have strong resistance above us (red horizontal box). In addition, the yellow line represents the simple 200-moving average. Probably the most observed moving average, and as such significant in technical analysis.

Consequently, we expect prices to decline from there and providing a low-risk double bottom entry near the US$25 levels. This would allow the reader ample time to compare their findings. Compare your charts and trading system with our approach to plan a possible trade setup. We are fully transparent and as such, feel free to ask questions in our free Telegram channel.

Silver, the exception:

Things that are hard to do are most of the time the right actions in trading. Doubling up at a time when the hard thing was to honor your stop does not reduce your cost average. Even though, your broker makes it sound so alluring, instead it increases your risk massively. And yet, this 100-year cycle has dealt us right now an unusual card. Times require us to pay extra attention to making the right moves not to get train wrecked.

The stern action right now is to be a contrarian early enough to hold cards or, better said, physical Silver before it will be unattainable. This allows for exceptional moves, but not by adding more risk. Instead, by identifying unusual opportunities in alignment with timing and not insisting on old paradigms. There is no shame in easing into this with prudence and small position size. Ignoring exceptional circumstances and procrastinating might become a costly path of action. We invite you to our free Telegram channel to ask questions of any kind to form a self-directed opinion to take care of your financial future actively.

Feel free to join us in our free Telegram channel for daily real time data and a great community.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.