Ready, set, silver, go

If you read our last weekly chart book publication, you will find our setup maturing right now, just as we planned. We spoke of this being an excellent, low-risk spot to add to your physical holdings. What is left is a detailed action plan and a proper execution of that plan. While timing has been most satisfactory anticipated, additional factors are essential to a winning strategy in motion. Ready, set, silver, go.

The most obvious first step is: “How much?” Depending on your time horizon and if your approach is purely diversification for your overall portfolio, a percentage of total investment capital needs to be set. This percentage should be higher on a more aggressive wealth preservation strategy and higher expected returns on beating inflation.

Another aspect is if silver is traded as the only hedge or alongside other precious metals. Silver already has a leverage factor in relationship to gold. For example, gold’s response to covid was a 37% up move, while silver moved up 80%. This volatility leverage works both ways, increasing the risk for silver if not purchased on low-risk entry points and traded with appropriate money management. We have pointed out various reasons why we find silver an extremely attractive play long term in this year’s chart book releases.

Monthly chart (a week ago), Silver in US-Dollar, ready:

Silver in US-Dollar, monthly chart as of November 26th, 2021.

The above chart was posted in our last week’s publication.

We wrote:” The monthly chart shows a high likelihood for November’s candle closing as an inverted hammer. Consequently, it provides for silver prices approaching the low end of the last 17-month sideways range near US$22.”

Monthly chart, Silver in US-Dollar, set:

Silver in US-Dollar, monthly chart as of December 3rd, 2021.

We were spot on. The anticipated entry zone has been reached. We added to our physical holdings and shared the trade live in our free Telegram channel.

Silver in US-Dollar, weekly chart, silver:

Silver in US-Dollar, weekly chart as of December 3rd, 2021.

We asked, “how much?” and in what diversification, which leaves us with the question of what denomination. The rule of thumb is that the smaller the weight amount is and the more recognizable the brand, the higher the cost. In addition, valuable numismatic collector’s coins have premiums as well. Generally, we find the added cost of brand items (Canadian maple leaf, American eagles, Austrian Philharmonic, and alike) to be of value since it adds to liquidity at a time of sale. While we would stay away from the added cost of numismatic collectible coins, we find there to be value to have a mix of coins and larger bars to arrive at a reasonably low-cost basis with a high degree of liquidity at the time of sale (larger bars are harder to sell than one-ounce coins).

The weekly chart above illustrates that as much as we have entered the “shopping zone” for silver, there is a probability that we might see a quick spike down as we have seen at the end of September.

As pointed out in the previous chart book, the goal of physical acquisition should not be the ultimate lowest price but availability and execution itself. We make a point of this, especially since we noticed that physical acquisition prices have in percentage retraced much less than the spot price right here, and once the turn is complete, could proportionally faster jolt up.

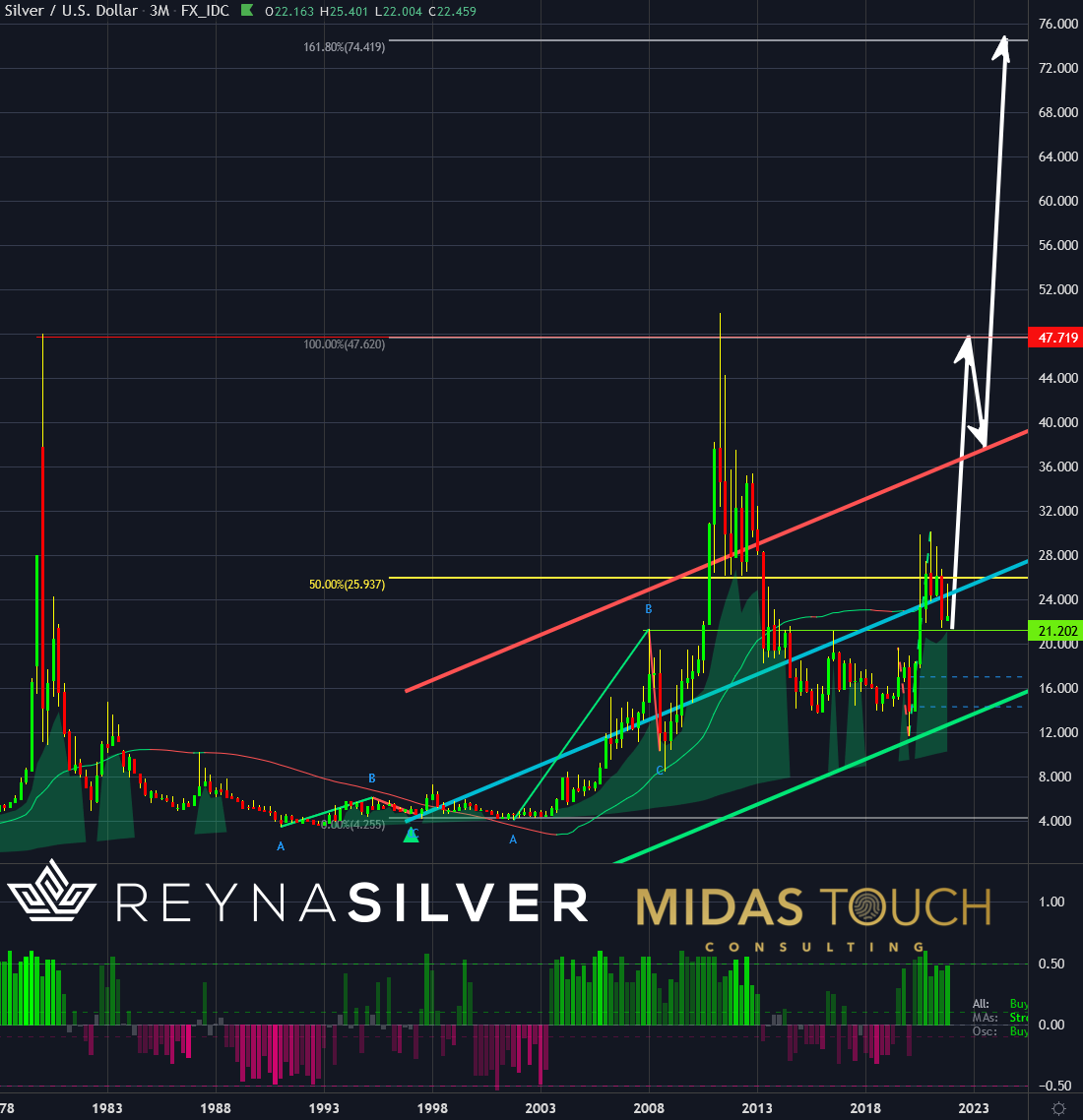

Silver in US-Dollar, quarterly chart, go:

Silver in US-Dollar, quarterly chart as of December 3rd, 2021.

It is essential to have an exit strategy in place before entry. These exit projections are necessary to measure risk/reward-ratios. Moreover, with the entire plan clear, there will be no debate while in the trade. This part of exit psychology is often overlooked, but a low-risk entry point alone does not provide a good strategy.

We expect a price advance on silver within the next six to eight quarters to a price target of US$74.40! Significant profits allowing for an outstanding risk/reward-ratio.

Ready, set, silver, go:

Last week, we anticipated the market’s direction correctly and find ourselves now at the desired low-risk entry zone. With possible additional questions about physical acquisition answered today, we might have reduced doubt. The devil is in the details, and due to the various countries, their taxation law, and the wide variety of official precious metal dealers, we did not dive into the details on where to take possession of your possibly desired purchase.

Nevertheless, our multinational membership in our free Telegram channel might provide helpful information to your specific situation. We hope we have provided enough knowledge to erase doubt. We encourage participation since we see procrastination towards a wealth preservation strategy as the poorest choice in this challenging time for your hard-earned money.

Feel free to join us in our free Telegram channel for daily real time data and a great community. If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can also subscribe to our free newsletter.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. The views, thoughts and opinions expressed here are the author’s alone. They do not necessarily reflect or represent the views and opinions of Midas Touch Consulting.