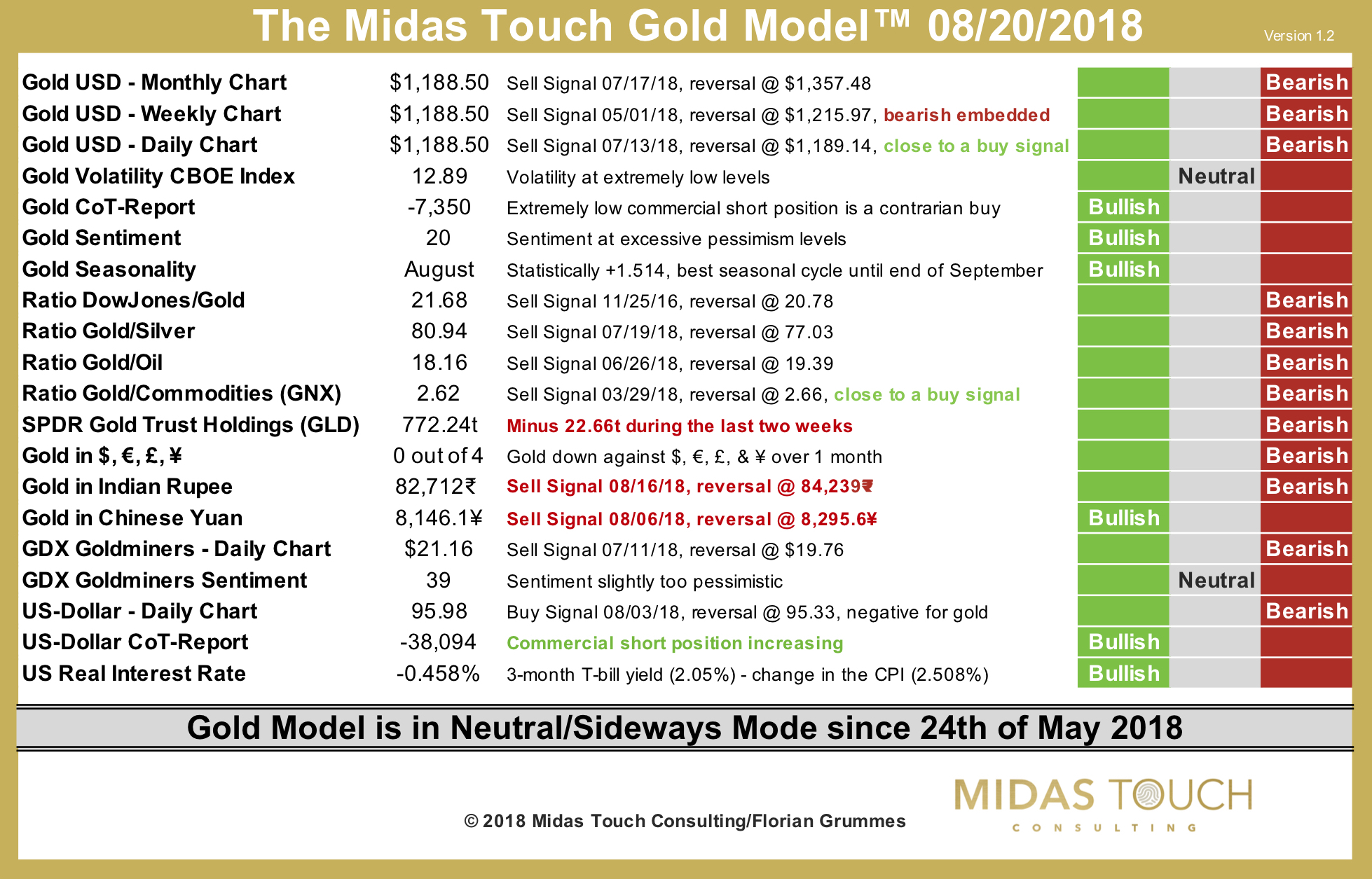

The Midas Touch Gold Model™ remains neutral!

After trending lower since mid of April already, the precious metals sector experienced a nasty (and probably final) wash out last week. Gold fell from 1,210 USD down to 1,160 USD in just three days. Typically these kind of moves are the final exhaustion and create a trend change. On the daily chart gold posted a nice reversal candle and already recovered towards 1,190 USD.

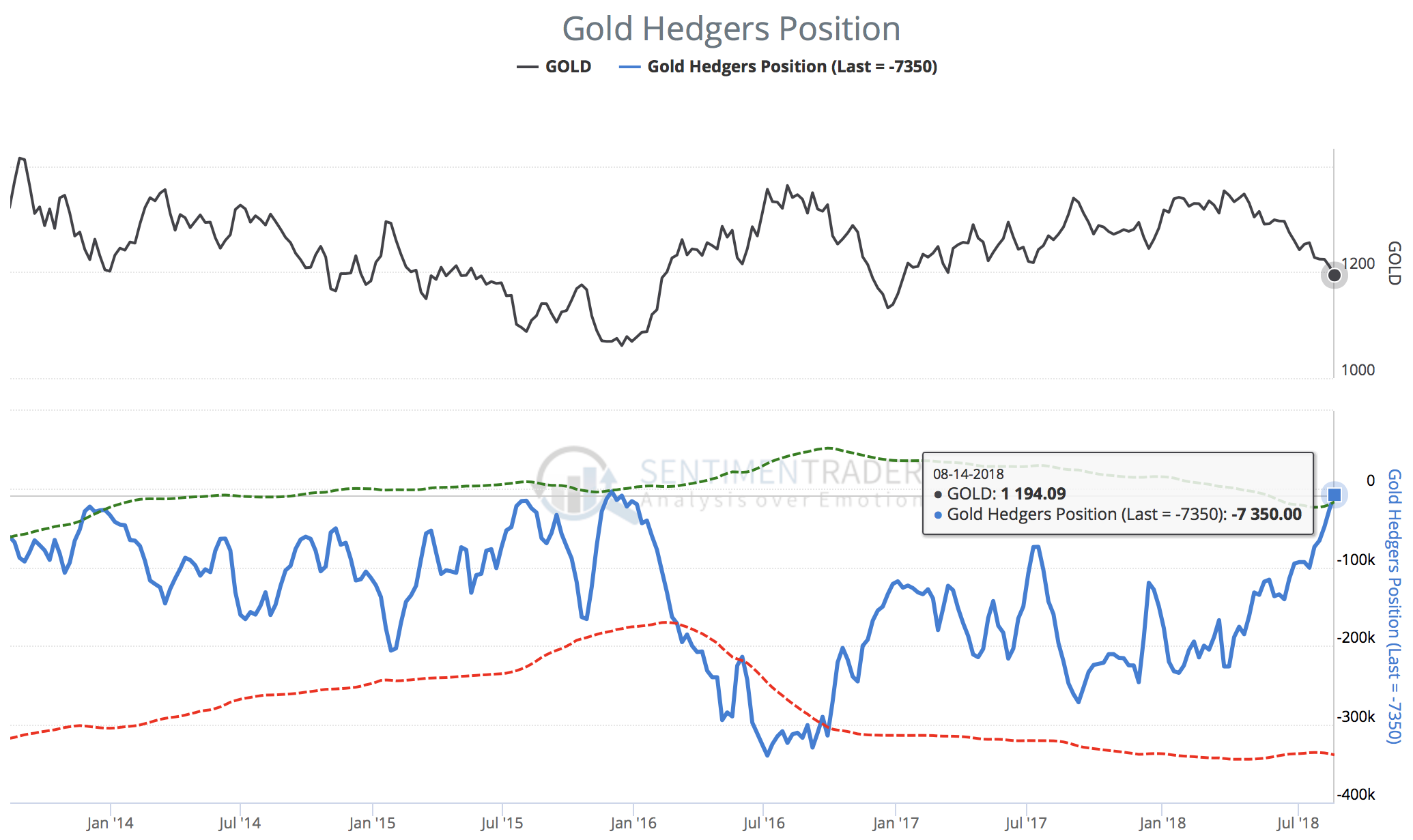

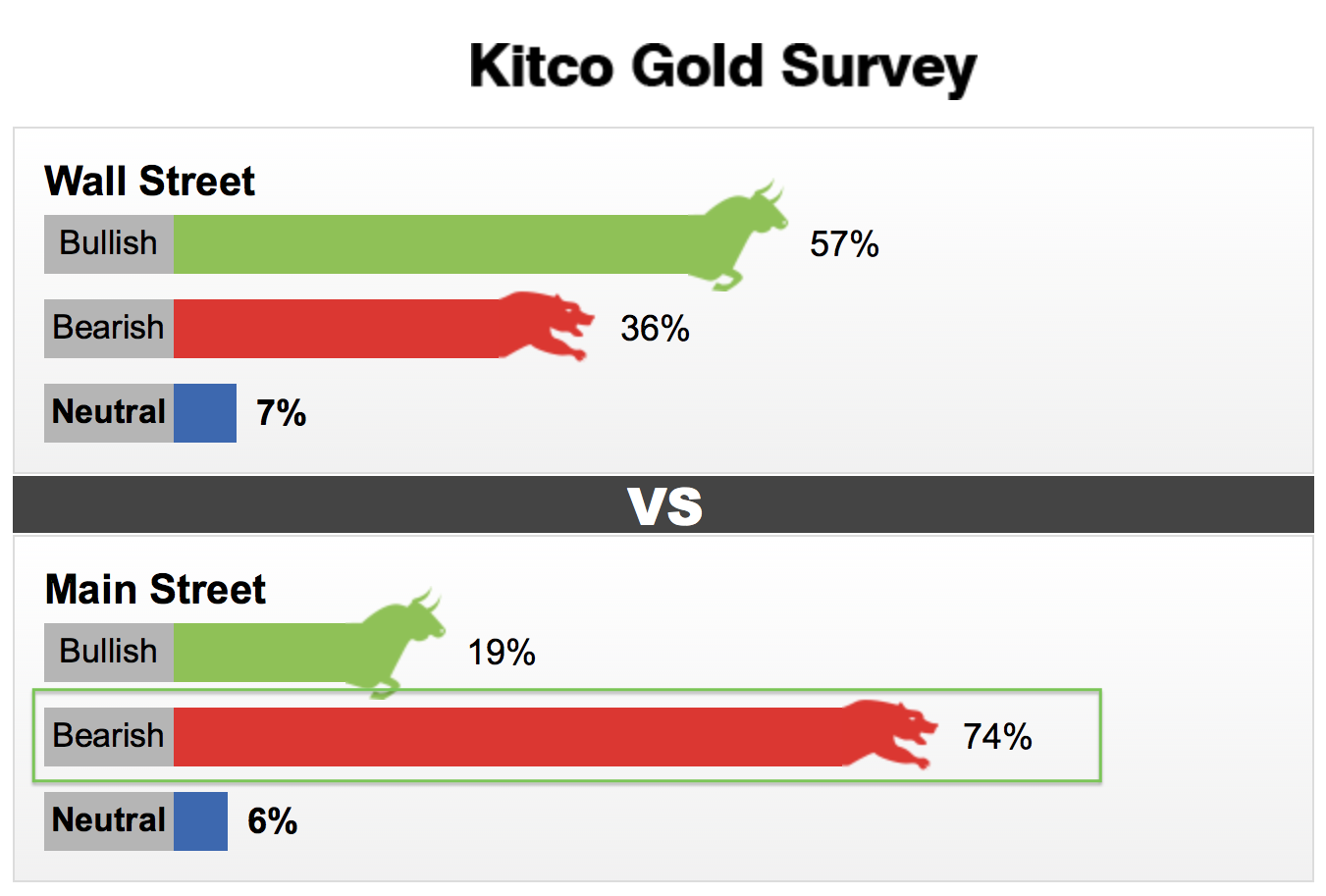

Our Midas Touch Gold Model™ still remains neutral and currently needs quite a lot of new positive signals, before it can come up with a bullish conclusion. But at least the daily chart is very close to a new buy signal. As well sentiment and Cot-Data are heavily flashing contrarian buy signals.

Kitco Gold Survey from 17th of August 2018. Bearish sentiment among retail investors & traders is at extreme levels. A classic contrarian setup.

Overall gold´s last high from mid of January is more than 7 months away and it seems that the downtrend is about to end. According to the latest CFTC data, speculators are now net short for the first time since December 2001. Back then gold was trading at 275 USD an ounce and about to start its 11 year bull run towards 1,920 USD.

Fundamentally, we assume that the emerging market turmoil (Turkey.. etc.) will probably spread to other markets. The Fed will therefore be forced to stop their tightening policy. If it does, gold will rebound strongly and rather quickly. If the Fed continues its way, this inaction introduces the prospect of a complete liquidation of the financial system, including the Fed itself.

As it looks right now, gold has started a bounce, that could take it at least towards 1,240 – 1,260 USD over the coming weeks and months.

Should gold move below 1,173 USD again, it is very likely that downtrend is still not over. In that unlikely case the sell off will continue towards 1,120 – 1,140 USD.