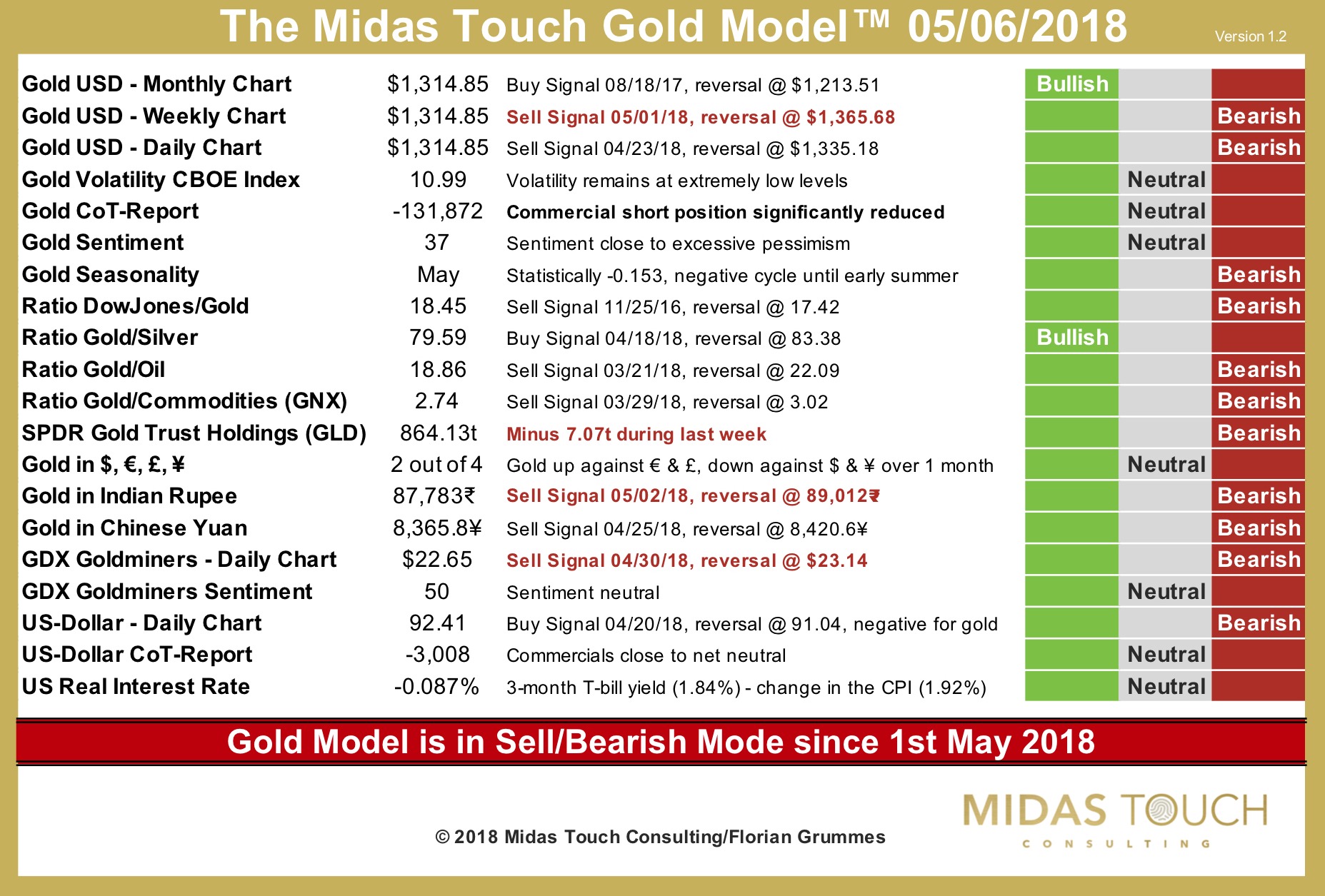

The Midas Touch Gold Model™ is now bearish!

After more than three months in neutral mode our Midas Touch Gold Model™has finally shifted to a bearish conclusion last week on May 1st, when gold dipped towards 1,301 USD on Tuesday.

Due to the sell off and new low the weekly chart is now bearish and needs a gold price above 1,365 USD to return into bull mode. Another new bearish signal comes from the SPDR Gold ETF (GLD). Its inventory has seen outflows of 7.07t of gold during last week. Pretty late the daily gold chart in Indian Rupee has now joined the bears too. And finally already last Monday the daily chart for the goldminers (GDX) had turned bearish. Fortunately, this ETF does not have to rise dramatically to become bullish again.

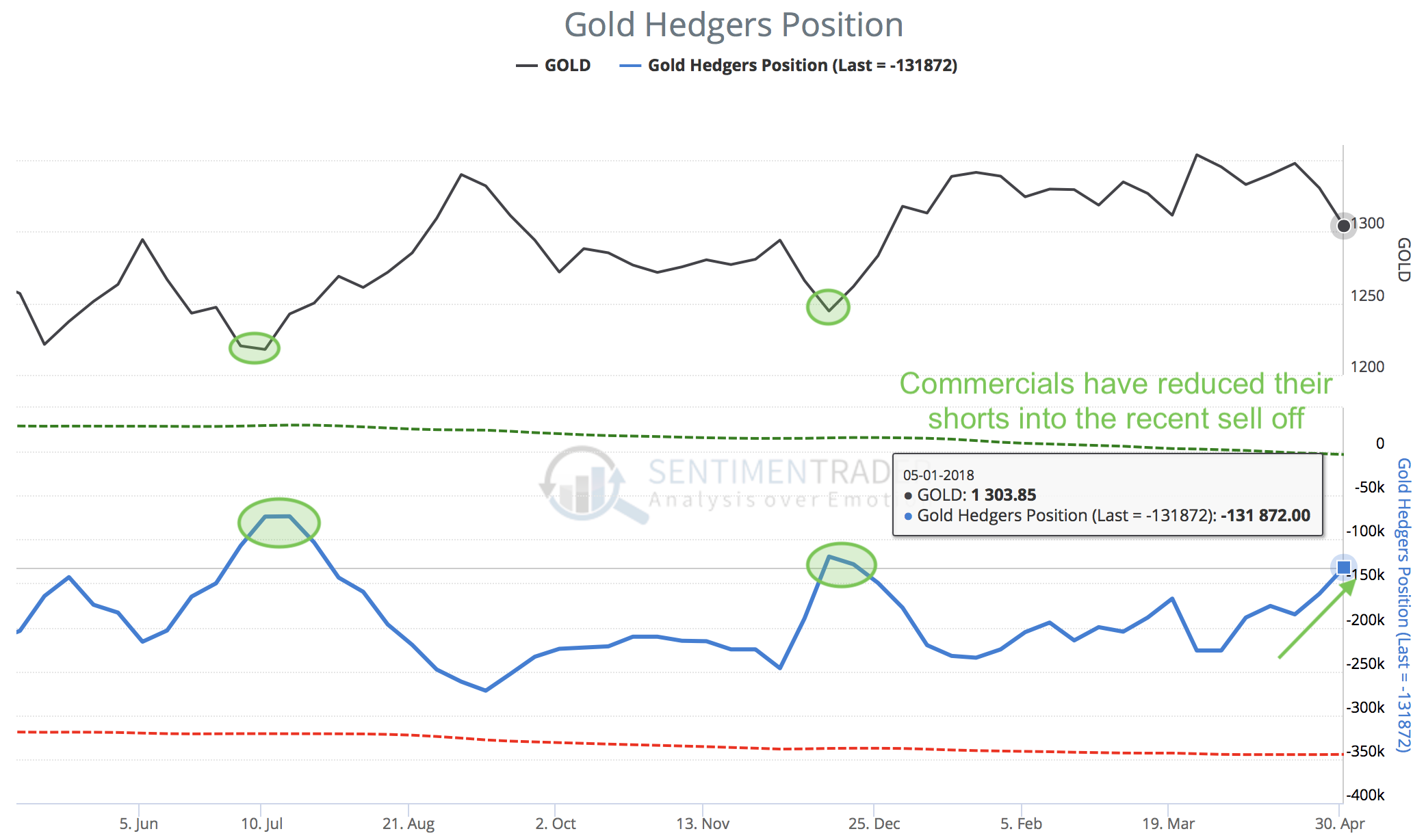

The only improvement in comparison to last week comes from the latest CoT-report. We have been praying for weeks and months now that any commercial short position above 100k is not a promising setup. Instead with the recent pullback the professionals are finally starting to cover their shorts. The CoT-report for gold is now neutral and it looks like gold does not have to dramatically move lower anymore. Probably another 20-30 USD should already be enough for a new contrarian buy signal from golds futures market. Also note that a similar constellation was enough in mid of last December for the trend change and a significant rally in the gold market.

Overall, the Midas Touch Gold Model™ is now bearish and urges you to be careful with any bullish positions in the precious metals sector. Although being pretty oversold the daily chart for gold in USD has a “bearish embedded stochastic” activated. This means that the downtrend is locked in and any bounce will be shallow and short-lived until the stochastic oscillator can free himself out of this bearish clutch.

The expected final pullback towards and very likely below 1,300 USD has started. Remain patient. An outstanding new buying opportunity into this sector is coming probably within the next two to ten weeks.