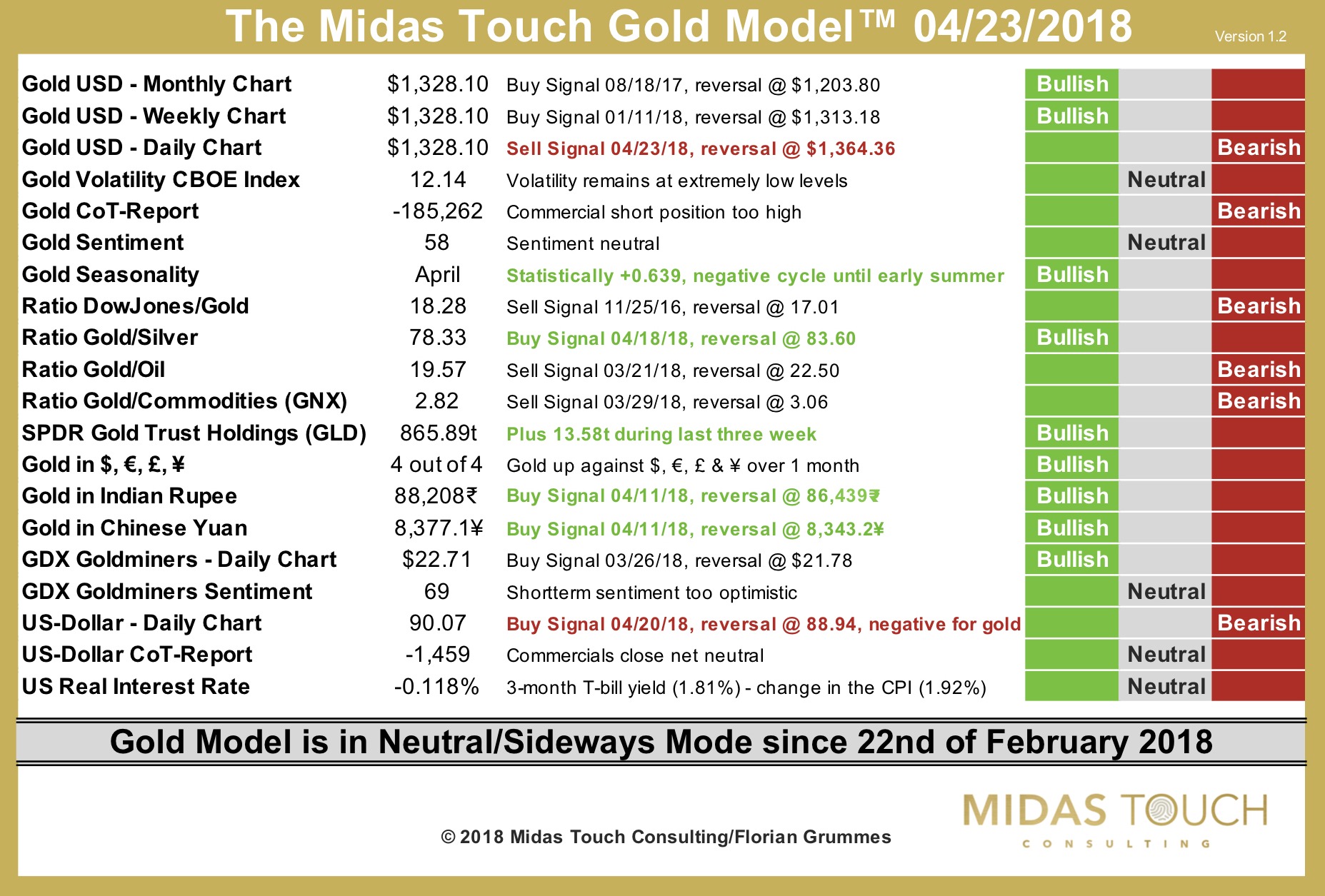

The Midas Touch Gold Model™ remains in neutral mode since 22nd of February 2018!

Although gold has been acting pretty strong over the last three months, it was not able to breakout through the massive resistance zone between 1,350 USD and 1,375 USD so far! Actually, all that did happen since the top in January was a tricky and confusing sideways consolidation. Investors and traders want to avoid such a challenging and trendless period in any market, as it usually creates too many misleading signals.

Fortunately, our Midas Touch Gold Model™ has done a great job to bring clarity into this consolidation. As well, I personally have been expressing my skepticism over the last couple of months as the seasonal cycle usually brings an important low somewhere in June or July. Hence, buying into strong gold prices in springtime has never been a promising strategy!

Since 22nd of February the Midas Touch Gold Model™ is in neutral/sideways mode. It doesn´t take too much to shift its conclusion to a bullish one but so far gold was not able to do that. Especially as the daily chart for gold in US-Dollar has flipped around to a bearish reading today, it is just prudent to expect more sideways action and probably one last pullback towards and maybe even below 1,300 USD. As well the US-Dollar has a new buy signal which transform into a bearish reading for gold of course.

Nevertheless, the Midas Touch Gold Model™ has a couple of new bull signals. Most importantly might be the bullish signal from the Gold/Silver-Ratio. Silver has been lagging for quite some time and just recently came back to life. According to the ratio silver is extremely undervalued and the ratio´s bullish signal is a promising development for the whole sector. Just understand that the ratio is not a short-term guide but more a mid- to longer-term proposition.

As ETF buying seems to be picking up, the SPDR Gold Trust indicator now is bullish again. And finally, both measurements for gold´s trend in Asia, Gold in Indian Rupee and Gold in Chinese Yuan, are still on a buy signal. With more weakness in gold especially the bullish signal in Chinese Yuan could change rather soon. In this case, the Midas Touch Gold Model™ would then move back into a more balanced neutral conclusion.