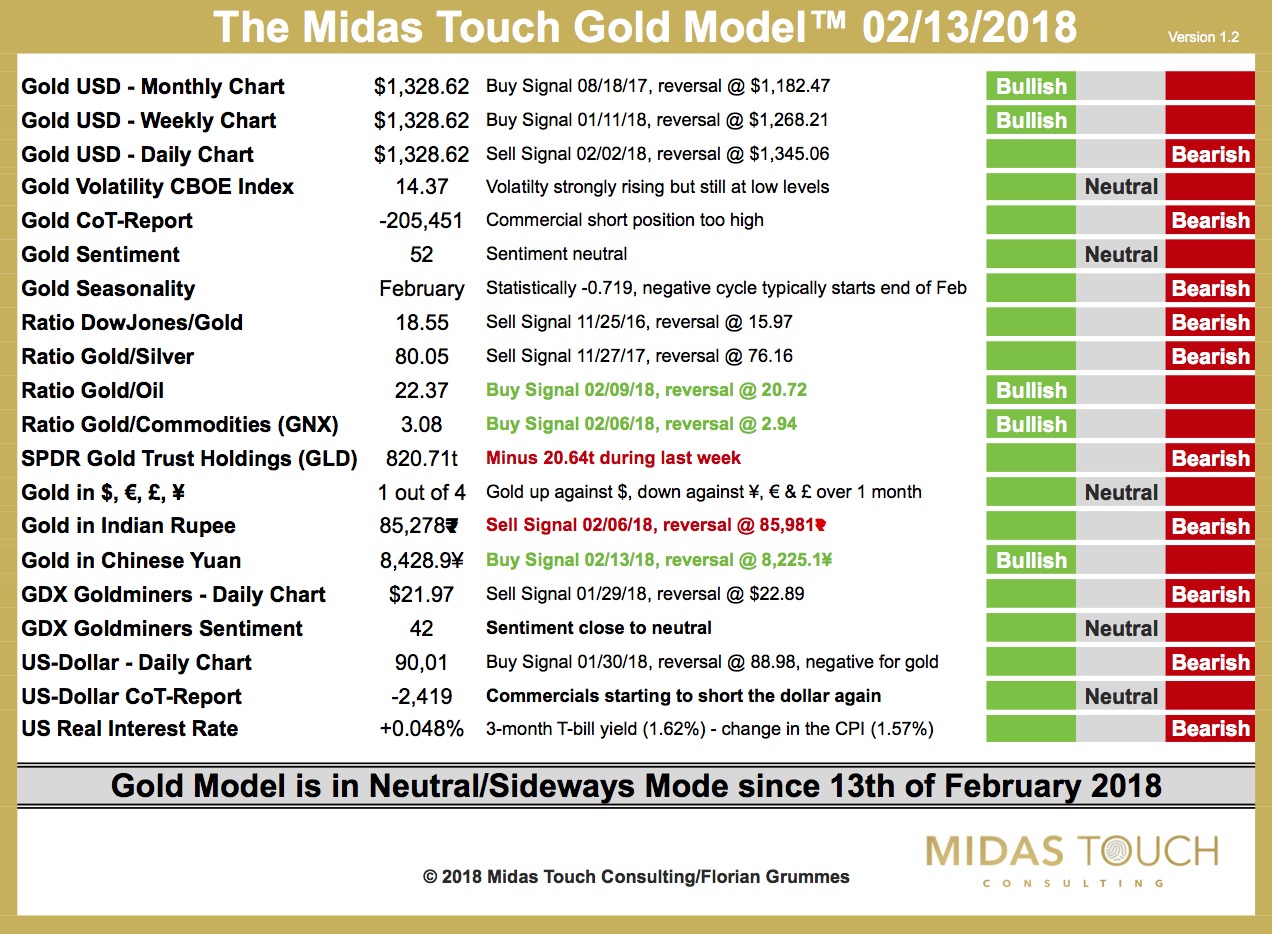

The Midas Touch Gold Model™ is back to a neutral conclusion!

Today our Midas Touch Gold Model™ moved back to a neutral conclusion as Gold in Chinese Yuan gave a new buy signal! This without a doubt is a positive development and a first confirmation that gold indeed made an important low last week at 1,305 USD.

One thing that is more and more irritating however is the fact that Gold in Chinese Yuan and Gold in Indian Rupee do not walk in the same direction together anymore.. This has been nearly always the case since the introduction of our model more than three years ago. It still needs to be seen what this means or whether it means anything at all..

Another very positive news are the two new buy signals from the Ratio Gold/Oil and the Ratio Gold/Commodities. They both have been on a sell signal since last September. Generally all four ratios that we are tracking in our model can become the backbone of a strong trend in the gold-market. Now already two of them pointing to higher gold prices. The Ratio Gold/Oil also gives us some indication that inflation might be picking up while the green Ratio Gold/Commodities clearly states that gold has its “safe haven” character activated which should be no surprise since last week´s nasty plunge in worldwide stock markets…

Overall the Midas Touch Gold Model™ is back to a neutral conclusion and therefore pointing towards the end of gold´s recent pullback from 1,366 USD down to 1,305 USD. As you can see gold needs a close above 1,345 USD to switch the Gold USD daily chart back to a buy signal. Therefore bulls still have some work to do before gold can become a trending and therefore bullish market again.